Life insurance is a contractual agreement between an individual and an insurance company where, in exchange for regular premium payments, the insurance company provides a lump sum, known as a death benefit, to beneficiaries upon the death of the policyholder. The primary purpose of life insurance is to provide financial security to surviving dependents or beneficiaries after the policyholder's death. Life insurance policies have profound implications for readers as they directly impact financial planning, ensuring stability and support for loved ones in case of untimely death. The context of life insurance is wide-ranging, covering different types like term life, whole life, and universal life insurance, each catering to diverse financial needs and circumstances. Choosing the right life insurance depends on various factors, including financial situation, coverage length needed, and potential for cash value accumulation. Beneficiaries are the individuals or entities designated by the policyholder to receive the life insurance payout upon their death. This payout, known as the death benefit, can be used for various purposes, including paying off debts, covering funeral expenses, or providing financial stability for the future. Life insurance payouts are generally tax-free. However, some situations, like if the death benefit is paid in installments instead of a lump sum, could result in a portion of the payout being subject to taxes. Beneficiaries can typically choose between receiving the death benefit as a lump sum or in installments. The landscape of life insurance includes a variety of plans to cater to different financial needs, coverage durations, and investment components. Below are the common types of life insurance, each with distinct features and benefits. Term life insurance provides coverage for a specific period, typically ranging from 1 to 30 years. If the policyholder dies within the term, the death benefit is paid out to the beneficiaries. There are several subcategories of term life insurance: Level Term Life Insurance: The death benefit and premiums remain constant throughout the term of the policy. It's ideal for those looking for substantial coverage at a relatively lower cost. Decreasing Term Life Insurance: The death benefit decreases over the term, usually annually, while premiums typically remain level. This type of insurance is often used to cover a debt that reduces over time, like a mortgage. Increasing Term Life Insurance: The death benefit increases over the term while premiums typically remain level. This can be beneficial for those expecting their financial responsibilities to grow over time. Convertible Term Life Insurance: This policy allows the policyholder to convert their term policy to a permanent policy without requiring a medical examination. Whole life insurance provides lifetime coverage with the added benefit of a cash value component. The two main types are: Non-participating Whole Life Insurance: The cash value and death benefits are determined at the policy's inception and do not change. There are no dividends paid out in a non-participating policy. Participating Whole Life Insurance: These policies pay dividends that can be taken as cash, used to reduce premiums or purchase additional insurance. Universal life insurance offers both a death benefit and a cash value component. The policyholder can adjust the premium and death benefit amounts without obtaining a new policy. The types of universal life insurance include: Indexed Universal Life Insurance: This policy links the cash value component to a stock market index, allowing the potential for higher returns. Guaranteed Universal Life Insurance: It guarantees the death benefit up to a specified age, regardless of the cash value. Variable Universal Life Insurance: This policy allows policyholders to invest the cash value in various investment options, leading to potentially higher returns or losses. Endowment policies pay out a lump sum after a specific term or on the policyholder's death. It combines insurance and investment by paying the full policy amount if the policyholder is alive at the policy's maturity date or to the beneficiary if the insured dies before the term ends. This insurance pays benefits if the policyholder dies or is seriously injured in an accident. It's often a rider to a larger life insurance policy, but it can be standalone coverage. Choosing the right life insurance policy depends on a variety of factors: Policyholder's Financial Situation: Some policies may be more expensive than others. It's essential to choose a policy that fits within your budget while providing adequate coverage. Length of Time Coverage Is Needed: If you only need coverage for a certain period, term life might be the best fit. If you need lifelong coverage, consider whole or universal life. Potential for Cash Value Accumulation: Whole and universal life insurance offers a cash value component that can grow over time. Cost and Affordability: The premiums for whole and universal life are typically higher than for term life. Flexibility of the Policy: Some policies, like universal life, offer more flexibility in terms of premium payments and death benefit amounts. Each type of life insurance comes with its own set of features and benefits: Term Life Insurance: Provides a simple, affordable way to secure a substantial death benefit. It is ideal for individuals who need coverage for a specific period, for instance, until children graduate from college or a mortgage is paid off. Whole Life Insurance: Offers lifelong coverage with a guaranteed death benefit and a cash value component that grows over time. It can be a good option for individuals seeking coverage plus an investment component, regardless of market conditions. Universal Life Insurance: Offers flexible premiums and death benefits, plus a cash value component that can earn interest. Endowment Life Insurance: Provide insurance coverage, and if the policyholder survives the policy term, it pays out a lump sum. This dual functionality makes it a valuable tool for both financial protection and financial planning. Accidental Death & Dismemberment Insurance: Provides extra protection in case of serious injury or death due to an accident. While life insurance provides valuable protection, it's also important to understand its limitations: Term Life Insurance: Provides coverage for a specific period only. If the policyholder outlives the term, coverage ends unless the policy is renewed or converted to permanent coverage. Furthermore, it does not have a cash value component. Whole Life Insurance: Tends to be more expensive than term life insurance. Additionally, the investment component might not offer as high a return as other investment options. Universal Life Insurance: This can be complex and might not be suitable for individuals seeking a simple insurance product. Plus, the cash value component is subject to market risk. Endowment Life Insurance: They tend to be more expensive due to their dual nature of providing a maturity benefit and a death benefit. Additionally, the returns may not be as high as other investment options. Accidental Death & Dismemberment Insurance: Only pay out under specific circumstances, making it less comprehensive than other life insurance types. Life insurance is a crucial tool for financial planning, offering varying types to cater to diverse needs. Term Life Insurance provides affordable, time-bound coverage, while Whole Life Insurance offers lifelong coverage plus a cash value component. Universal Life Insurance grants the flexibility of adjusting premiums and death benefits, and Endowment Life Insurance combines insurance with an investment element. For additional protection against accidents, there's Accidental Death & Dismemberment Insurance. Each type comes with unique benefits and potential drawbacks, so understanding these is essential when choosing a policy that best fits individual needs and financial situations. Payouts from these policies, known as death benefits, provide financial security to beneficiaries. Considering the right type of life insurance is an investment in the future, securing your loved ones' financial stability in the face of unforeseen circumstances.Life Insurance Overview

How Life Insurance Payouts Work

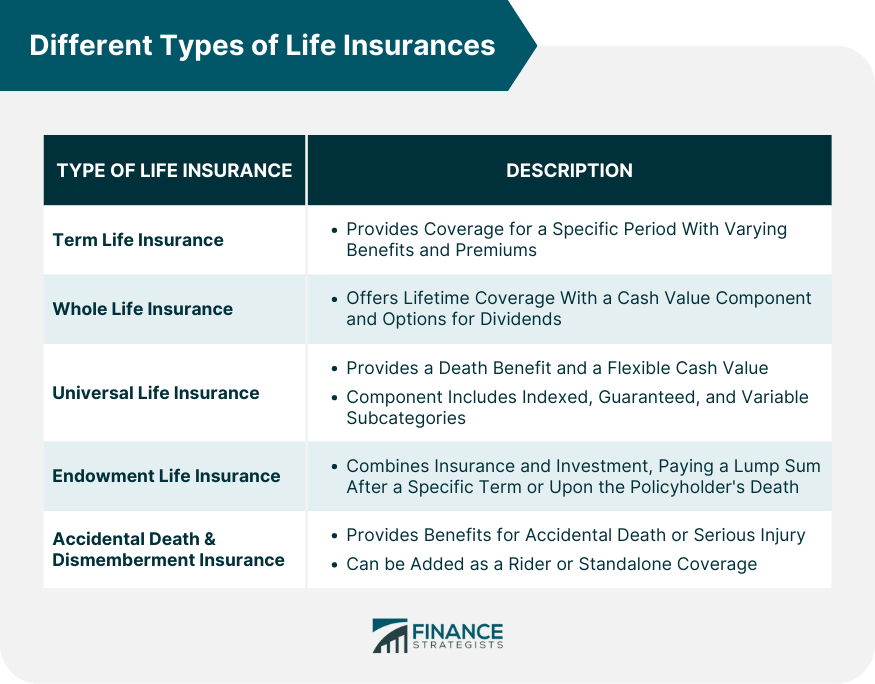

Different Types of Life Insurances

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Endowment Life Insurance

Accidental Death & Dismemberment Insurance

Factors to Consider When Choosing a Type of Life Insurances

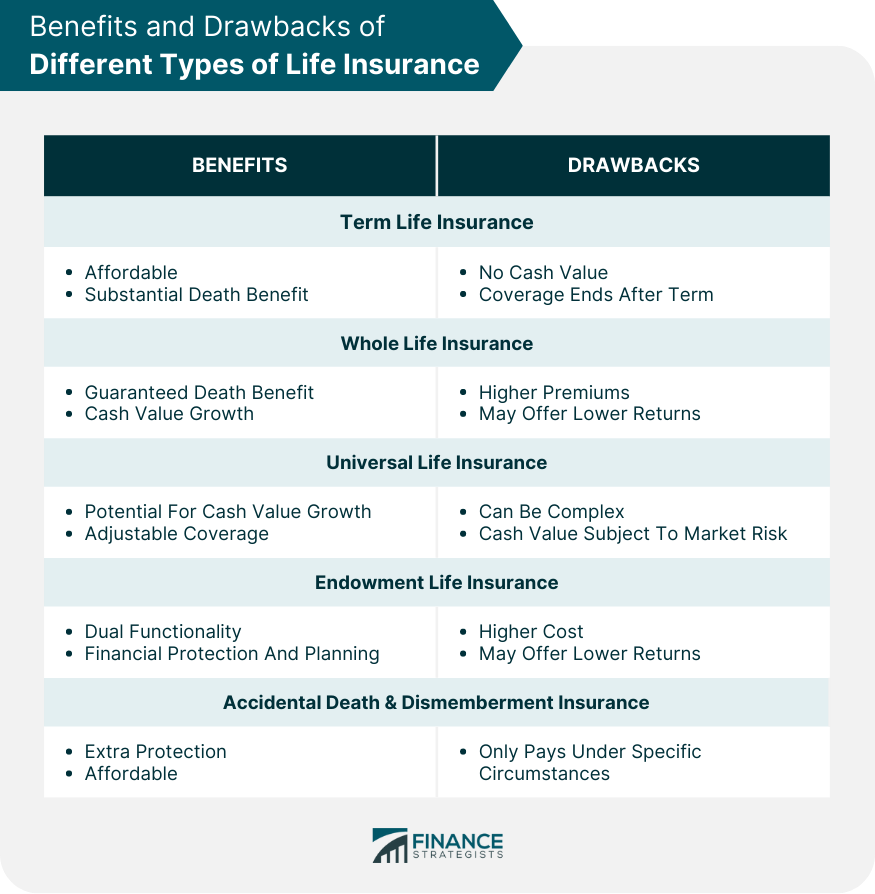

Benefits of Different Types of Life Insurances

This policy may be suitable for individuals who want the potential for cash value growth and the flexibility to adjust coverage as their needs change.

It can be an affordable addition to a life insurance portfolio and provide added peace of mind for individuals in high-risk jobs or hobbies.Limitations of Different Types of Life Insurance

Bottom Line

Different Types of Life Insurances FAQs

There are several types of life insurance, including Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Endowment Life Insurance, and Accidental Death & Dismemberment Insurance. Each type offers different coverage lengths, death benefits, and potential for cash value accumulation.

Each type of life insurance caters to individual needs differently. For example, Term Life Insurance is typically the most affordable and straightforward, making it a good choice for those needing coverage for a specific period. In contrast, Whole Life and Universal Life Insurances offer a cash value component, potentially appealing to those looking for an investment element.

Yes, in some cases. For instance, Convertible Term Life Insurance allows you to switch your term policy to a permanent policy like Whole Life Insurance without requiring a medical examination. Additionally, Universal Life Insurance offers flexibility in adjusting premium payments and death benefit amounts as your needs change.

Each type of life insurance has potential drawbacks. Term Life Insurance, for example, only provides coverage for a specific period, and if the policyholder outlives the term, coverage ends. Whole Life Insurance, on the other hand, can be more expensive than other types, and the cash value component might not offer as high a return as other investments. It's crucial to understand the potential downsides before choosing a policy.

The payouts, or death benefits, are paid to the designated beneficiaries upon the death of the policyholder. The way these payouts are made can vary based on the type of life insurance. For most types, beneficiaries can choose between receiving the death benefit as a lump sum or in installments. However, certain conditions may affect these payouts, such as the policyholder outliving a term life policy or specific injury conditions for Accidental Death & Dismemberment Insurance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.