Life insurance provides protection and financial security to individuals and their loved ones. It serves as a contract between the policyholder and the insurance company. The policyholder pays premiums in exchange for a death benefit that is paid out to the beneficiaries upon the policyholder's death. Beneficiaries play a vital role in the life insurance policy as they are the individuals or entities designated by the policyholder to receive the death benefit. Beneficiaries can be family members, friends, charitable organizations, or even businesses. The policyholder has the flexibility to designate one or multiple beneficiaries and specify the percentage of the death benefit each should receive. One of the common questions surrounding life insurance is whether beneficiaries have to pay taxes on the death benefit they receive. In general, life insurance proceeds are not subject to income tax. The tax-free nature of life insurance death benefits is a significant advantage for beneficiaries, as it allows them to receive the full amount of the policy's death benefit without any tax deductions. Life insurance death benefits are typically received by beneficiaries income-tax-free. This means that the funds they receive are not considered taxable income and are not reported as such on their tax returns. The purpose of this tax exemption is to provide financial support to beneficiaries without subjecting them to additional tax burdens during a difficult time. To ensure the tax exemption of life insurance proceeds, certain conditions must be met. The policy must be considered a "qualified" life insurance policy under the Internal Revenue Code. Generally, most individual life insurance policies qualify for this tax treatment. Additionally, the death benefit must be paid out upon the policyholder's death and cannot be accelerated or received before death, with a few exceptions. While life insurance proceeds are typically tax-free, there are a few scenarios where some portion of the death benefit may be subject to taxation. For example, if the policyholder had previously transferred ownership of the policy to another individual or entity for valuable consideration, a portion of the death benefit known as the "transfer-for-value" may be taxable. It's important to consult with a tax advisor or financial professional to understand the specific tax implications that may arise in unique situations. In some cases, the death benefit from a life insurance policy may be included in the policyholder's estate for estate tax purposes. Estate taxes are typically imposed on large estates that exceed a certain threshold, which is determined by the tax laws of the jurisdiction. If the total value of the policyholder's estate, including the life insurance proceeds, exceeds the applicable threshold, estate taxes may apply. It's important to consult with an estate planning attorney or tax advisor to understand the estate tax laws and potential implications in your specific jurisdiction. Inheritance taxes are separate from estate taxes and are imposed on the beneficiaries who receive the assets from the deceased policyholder's estate. The tax rates and thresholds for inheritance taxes vary by jurisdiction. Some jurisdictions may exempt life insurance proceeds from inheritance taxes, while others may include them as part of the taxable estate. Life insurance policies can accumulate cash value over time, which earns interest or other investment gains. The tax treatment of these earnings depends on several factors, including the policy type and whether the policy is surrendered or remains in force. One of the advantages of certain types of life insurance policies, such as whole life insurance or universal life insurance, is the potential for tax-deferred growth. The cash value within the policy grows over time, and the investment gains are not subject to annual income tax. This tax deferral allows the cash value to accumulate more efficiently, as the earnings compound without being reduced by taxes. When a policyholder chooses to withdraw or surrender their life insurance policy, the tax treatment of the cash value depends on the amount of premiums paid into the policy compared to the total cash value. The portion of the withdrawal or surrender value that exceeds the total premiums paid may be subject to income tax. This taxable portion is considered to be the policy's earnings or gains. Another option available to policyholders with accumulated cash value is to take out a loan against the policy. Policy loans are not considered taxable income, as they are borrowed funds that need to be repaid. However, it's important to understand that if the policy lapses or is surrendered with an outstanding loan, the amount of the loan may be treated as taxable income to the extent that it exceeds the premiums paid into the policy. The cash surrender value of a life insurance policy refers to the amount of money that a policyholder is entitled to receive if they choose to surrender the policy before its maturity or before the insured's death. The taxation of the cash surrender value depends on the specific circumstances and how the policyholder utilizes the funds. The portion of the cash surrender value that exceeds the total premiums paid into the policy is generally considered taxable income. This portion is treated as the policy's earnings or gains, subject to income tax. It's important to note that surrendering a policy for its cash value may result in a significant tax liability, especially if the policy has been in force for a long time and has accumulated substantial cash value. If a policyholder has taken out a loan against the cash value of their life insurance policy and the policy is subsequently surrendered or lapses, the outstanding loan balance may be treated as taxable income. The tax treatment of the loan depends on the specific circumstances and should be discussed with a tax advisor or financial professional. Accelerated death benefits are provisions included in some life insurance policies that allow policyholders to access a portion of the death benefit while still alive if they are diagnosed with a terminal illness or a specified critical illness. In many cases, these benefits are received income-tax-free, providing financial assistance to policyholders during difficult times. Viatical settlements involve the sale of a life insurance policy to a third-party investor. This typically occurs when the policyholder has a life-threatening illness and is in need of immediate funds. The proceeds from a viatical settlement may be exempt from taxation. It's important to consult with a tax advisor or financial professional to understand the tax implications of viatical settlements in your specific jurisdiction. Structured settlements involve the payment of the life insurance proceeds in installments over a specified period. In certain circumstances, structured settlements may provide tax advantages for beneficiaries. Beneficiaries generally do not pay taxes on life insurance proceeds. Life insurance death benefits are typically tax-free, provided certain conditions are met. The tax-exempt nature of life insurance ensures that beneficiaries receive the full benefit amount without any tax deductions. However, there are potential tax liabilities to consider, such as estate taxes and inheritance taxes. Estate taxes may apply if the total value of the deceased's estate, including the life insurance proceeds, exceeds the estate tax exemption threshold. Inheritance taxes, on the other hand, may be imposed on beneficiaries depending on the state's tax laws. It is important for beneficiaries to understand the tax implications and reporting requirements. Consulting with a tax professional can provide further guidance and ensure compliance with tax regulations. Overview of Life Insurance

Do Beneficiaries Pay Taxes on Life Insurance?

General Tax Treatment of Life Insurance Proceeds

Conditions for Tax Exemption

Potential Tax Implications for Certain Scenarios

Tax Liabilities of Beneficiaries

Estate Taxes on Life Insurance Proceeds

Inheritance Taxes on Life Insurance Proceeds

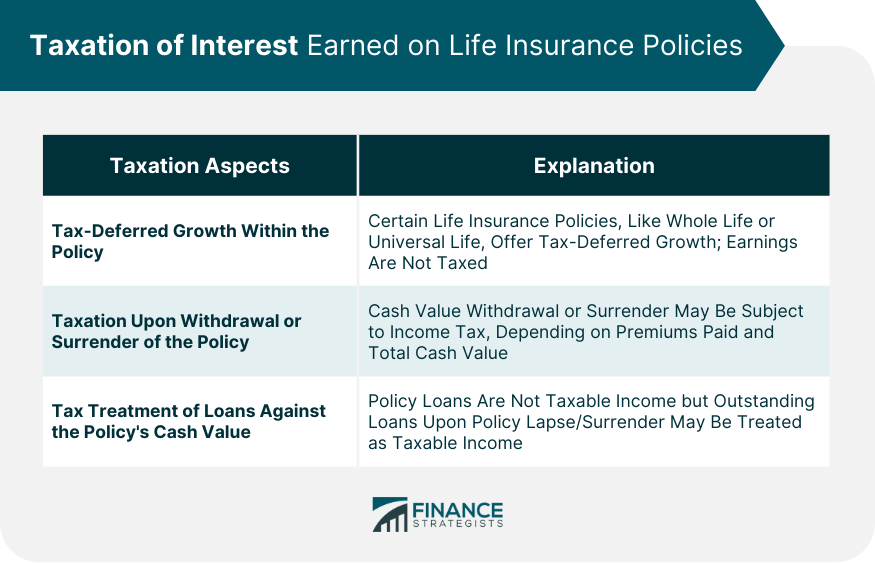

Taxation of Interest Earned on Life Insurance Policies

Tax-Deferred Growth Within the Policy

Taxation Upon Withdrawal or Surrender of the Policy

Tax Treatment of Loans Against the Policy's Cash Value

Taxation of Cash Surrender Value

Tax Implications of Surrendering a Life Insurance Policy

Taxable Portion of the Surrender Value

Tax Treatment of Loans Against the Cash Value

Exemptions From Taxation for Specific Circumstances

Accelerated Death Benefits

Viatical Settlements

Structured Settlements

Conclusion

Do Beneficiaries Pay Taxes on Life Insurance? FAQs

In general, life insurance death benefits are received income-tax-free and are not considered taxable income for beneficiaries. However, there may be exceptions if the policy was transferred for valuable consideration or if the death benefit is included in the policyholder's taxable estate.

In most cases, beneficiaries are not required to report life insurance proceeds on their individual tax returns. However, if there are taxable portions of the death benefit or if estate or inheritance taxes apply, beneficiaries may have reporting obligations. It's important to consult with a tax advisor or financial professional to determine the specific reporting requirements in your jurisdiction.

Life insurance proceeds may be subject to estate taxes if they are included in the policyholder's taxable estate. The applicability of estate taxes depends on the total value of the estate, including the death benefit. Consulting with an estate planning attorney or tax advisor can provide guidance on estate tax laws and potential implications.

The cash surrender value of a life insurance policy is not subject to income tax as long as the total amount received does not exceed the total premiums paid into the policy. Any portion of the cash surrender value that exceeds the premiums paid may be considered taxable income.

Policy loans taken against the cash value of a life insurance policy are not considered taxable income, as they are borrowed funds that need to be repaid. However, if the policy lapses or is surrendered with an outstanding loan balance, the amount of the loan may be treated as taxable income to the extent that it exceeds the premiums paid into the policy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.