Life insurance is a crucial financial tool that provides a measure of financial security to individuals and their families. In the event of the policyholder's death, the beneficiaries receive a lump sum payout, known as the life insurance proceeds. However, when it comes to distributing these proceeds, many people wonder if they are subject to inheritance tax. To understand the implications of inheritance tax on life insurance, it is essential to first grasp the concept of inheritance tax itself. Inheritance tax, also known as estate tax or death duty, is a tax levied on the estate (assets) of a deceased person before the distribution to their beneficiaries. The tax amount is typically based on the value of the estate at the time of death. Whether you have to pay inheritance tax on life insurance proceeds depends on several factors, including how the policy is owned, who the beneficiary is, and the laws in your jurisdiction. It's important to clarify that life insurance proceeds are typically not subject to income tax. The beneficiary of a life insurance policy generally receives the proceeds tax-free. However, if the deceased owned their life insurance policy, the death benefit may be included in their estate for estate tax purposes (also known as inheritance tax in some countries). If the estate is large enough to trigger the estate tax, the life insurance proceeds can push the estate’s value higher, which may result in a larger portion of the estate being subject to tax. One common method used to avoid having life insurance proceeds included in the estate is to have the policy owned by an irrevocable life insurance trust (ILIT). If the trust owns the policy, the death benefit may be excluded from the deceased's estate, avoiding potential estate tax implications. However, setting up an ILIT is not without its complexities and should be done with the advice of a qualified estate planning attorney or a tax advisor. Also, there might be implications if the policyholder transfers an existing policy into an ILIT, specifically if the policyholder dies within three years of the transfer (in the U.S.). Keep in mind that the rules and regulations surrounding inheritance tax and life insurance can be complex and may vary based on your location. Therefore, it's recommended that individuals consult with a tax or estate planning professional to understand the potential tax implications based on their specific circumstances. Factors that determine if inheritance tax is applicable to life insurance proceeds include: Ownership plays a significant role in determining if life insurance proceeds will be subject to inheritance tax. If the deceased owned the policy at the time of their death, the policy's death benefit could be included in the value of the estate, potentially subjecting it to estate taxes. The way the beneficiary is designated also affects whether life insurance proceeds are subject to inheritance tax. If the estate is the beneficiary, the insurance proceeds will likely be included in the estate's value and could be subject to estate tax. However, if a person or a trust is named as the beneficiary, the proceeds are typically paid directly to them, bypassing the estate and potentially avoiding estate tax. The total value of the estate is another important factor. In some jurisdictions, estate or inheritance tax only applies if the estate exceeds a certain threshold. For example, in the U.S., as of 2024, estates valued at less than $13.61 million ($13.99 million in 2025) per individual or $27.22 million ($27.98 million in 2025) per married couple are not subject to federal estate tax. Policyholder's Jurisdiction Tax laws can vary significantly based on the policyholder's location. Different countries, and even different states within the U.S., have different rules regarding the taxation of life insurance proceeds. It is important to consult with a tax advisor who is familiar with the specific laws in the policyholder's jurisdiction. A trust, specifically an Irrevocable Life Insurance Trust (ILIT), can be set up to own the life insurance policy. This arrangement can help avoid having the death benefit included in the estate. However, this requires careful planning and there are rules to follow to ensure the policy is not included in the estate, such as the policyholder not dying within three years of transferring an existing policy to an ILIT. Exemptions from inheritance tax in relation to life insurance proceeds can vary depending on the jurisdiction and specific circumstances. However, some common exemptions may include: In many jurisdictions, if the beneficiary of the life insurance policy is the policyholder's spouse, the proceeds may be exempt from inheritance tax. This exemption is often based on the aim of providing financial security for the surviving spouse. It recognizes the importance of ensuring that the spouse is not burdened with additional tax liabilities during an already challenging time. By exempting life insurance proceeds received by a spouse, governments seek to support the financial well-being and stability of surviving spouses. Certain jurisdictions may offer exemptions or reduced tax rates for life insurance proceeds left to immediate family members, such as children or grandchildren. The goal is to support the financial well-being of the family members and facilitate intergenerational wealth transfer. These exemptions recognize the significance of maintaining the family's financial stability and reducing the tax burden on the next generation. By providing preferential treatment for life insurance proceeds received by immediate family members, jurisdictions aim to preserve family wealth and facilitate its smooth transfer. Some regions provide exemptions or thresholds for small estates, where the total value of the estate, including life insurance proceeds, falls below a certain limit. In such cases, inheritance tax may not be applicable. This exemption recognizes that taxing small estates may impose a disproportionate burden on the beneficiaries, especially when the assets primarily consist of life insurance proceeds. By exempting small estates from inheritance tax, jurisdictions aim to simplify the administrative process and reduce the financial impact on beneficiaries. In certain instances, if the life insurance policy designates a qualified charitable organization as the beneficiary, the proceeds may be exempt from inheritance tax. This exemption encourages charitable giving and supports philanthropic endeavors. It recognizes the valuable contributions that charities make to society and incentivizes individuals to include charitable organizations in their estate plans. By exempting life insurance proceeds designated for charitable purposes from inheritance tax, jurisdictions seek to promote charitable giving and facilitate the realization of philanthropic goals. When the beneficiary of a life insurance policy is the policyholder's spouse, inheritance tax exemptions often apply. In many jurisdictions, transfers of assets between spouses are considered tax-free due to the goal of maintaining financial stability for the surviving spouse. Therefore, the life insurance proceeds received by the spouse may not be subject to inheritance tax. However, it is essential to review the local laws and regulations, as there may be limitations or specific requirements to qualify for this exemption. In some cases, life insurance proceeds left to children or grandchildren may be subject to inheritance tax. The tax treatment varies depending on the applicable laws and the value of the estate. Some jurisdictions may impose inheritance tax on the portion of the estate that exceeds a certain threshold, while others may provide exemptions or reduced tax rates for beneficiaries who are immediate family members. It is crucial to understand the specific rules governing inheritance tax for children or grandchildren to determine the potential tax liability on life insurance proceeds. When the beneficiary of a life insurance policy is someone other than a spouse or family member, the inheritance tax implications can be more complex. In many jurisdictions, life insurance proceeds left to non-family members may be subject to inheritance tax, especially if the value of the estate exceeds certain thresholds. The tax rates and exemptions can vary significantly, so it is crucial to consult the specific laws and regulations to determine the tax implications for non-family beneficiaries. Directly naming a beneficiary on the life insurance policy, as opposed to having the proceeds paid to your estate, generally allows the proceeds to bypass your estate and thus avoid estate or inheritance taxes. However, this depends on your relationship with the beneficiary and specific tax laws in your jurisdiction. Setting up an ILIT allows you to remove the policy from your estate, thereby avoiding estate taxes. The policy is owned and controlled by the trust, not by you, making it exempt from your estate's value for tax purposes. Remember that the transfer must adhere to specific rules to be valid. This strategy works in conjunction with an ILIT. Instead of paying the premiums yourself, you gift money to the trust beneficiaries, who then pay the policy premiums. These gifts can qualify for the annual gift tax exclusion, minimizing or eliminating any gift tax liability. This type of policy insures two lives, usually spouses, and pays out upon the death of the second insured. This delay in payout allows the surviving spouse to utilize the marital deduction and can also reduce the amount of insurance needed, as estate taxes might be lower at the second death. Use estate planning strategies to fully take advantage of any available estate and gift tax exemptions. This could mean making annual tax-free gifts to reduce the size of your estate or setting up charitable trusts. Estate planning and minimizing inheritance tax can be complex tasks involving nuanced tax laws. Therefore, it is wise to engage with a qualified estate planning attorney or tax advisor who can provide guidance tailored to your individual circumstances and the latest tax laws. Whether you pay inheritance tax on life insurance depends on factors like policy ownership, beneficiary, estate value, jurisdiction, and use of trusts. Typically, proceeds are not subject to income tax but may be included in the estate for tax purposes if the deceased owned the policy. Exemptions to inheritance tax exist, such as spousal, family, small estates, and charitable exemptions. Tax implications vary based on the beneficiary. Minimizing inheritance tax involves strategic planning like naming a beneficiary directly, establishing an Irrevocable Life Insurance Trust, gifting money for premiums, considering a second-to-die policy, maximizing exemptions, and seeking professional advice. Consult with tax advisors or estate planning professionals for a better understanding of specific circumstances.Overview of Life Insurance and Inheritance Tax

Do You Have to Pay Inheritance Tax on Life Insurance?

Determining Factors for Inheritance Tax on Life Insurance

Ownership of the Life Insurance Policy

Beneficiary Designation

Estate Value

Utilization of Trusts

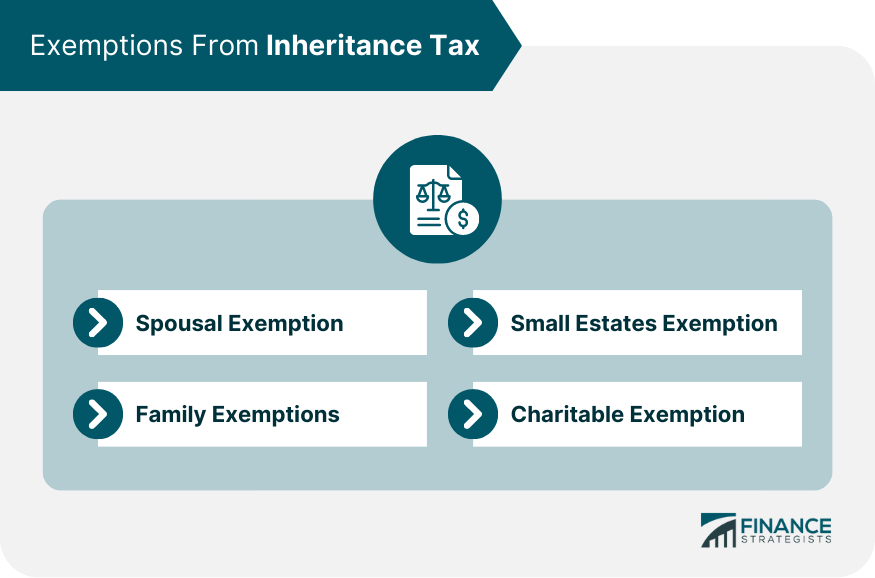

Exemptions From Inheritance Tax

Spousal Exemption

Family Exemption

Small Estates Exemption

Charitable Exemption

Inheritance Tax Implications for Different Scenarios

Scenario 1: Beneficiary Is a Spouse

Scenario 2: Beneficiary Is a Child or Grandchild

Scenario 3: Beneficiary Is Someone Other Than a Spouse or Family Member

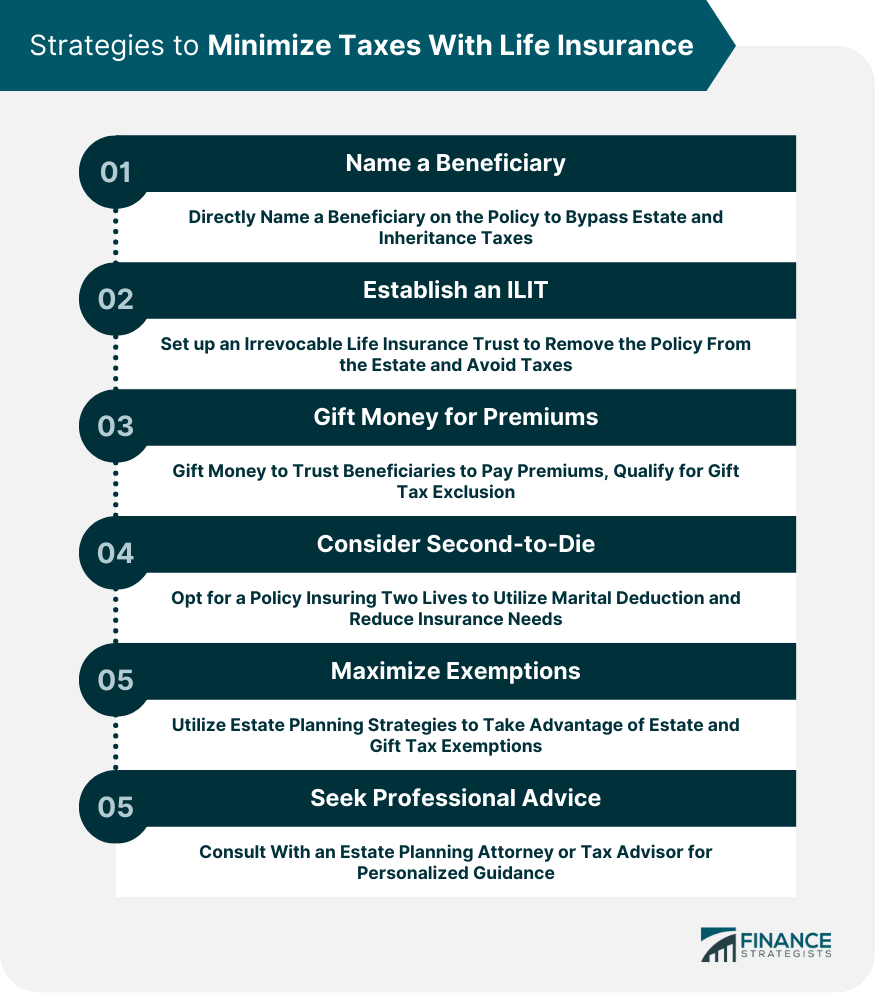

Strategies to Minimize Taxes With Life Insurance

Naming a Beneficiary

Establish an Irrevocable Life Insurance Trust (ILIT)

Gift Money to Pay Premiums

Consider a Second-to-Die Policy

Maximize Your Exemptions

Seek Professional Advice

Conclusion

Do You Have to Pay Inheritance Tax on Life Insurance? FAQs

In general, life insurance proceeds are not usually subject to inheritance tax. The payout from a life insurance policy is typically exempt from inheritance tax as long as the policy is written in trust or the beneficiaries named in the policy are individuals or charities.

Yes, in some cases, life insurance payouts may be subject to inheritance tax. If the policy is not written in trust or the beneficiaries named are the policyholder's estate, the proceeds may be included in the estate for inheritance tax purposes. It's important to seek professional advice to understand the specific tax implications in your situation.

Transferring ownership of a life insurance policy to a trust or another individual can potentially exempt the proceeds from inheritance tax. Consult with professionals to understand the specific requirements and implications.

Yes, exemptions can apply based on factors such as spousal relationships, immediate family beneficiaries, small estates, and charitable designations. Exemptions vary by jurisdiction, so consult local tax laws for specific details.

Estate planning strategies like establishing trusts, utilizing gifting strategies, and taking advantage of exemptions and allowances provided by tax laws can help minimize inheritance tax on life insurance. Seek guidance from professionals to implement appropriate strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.