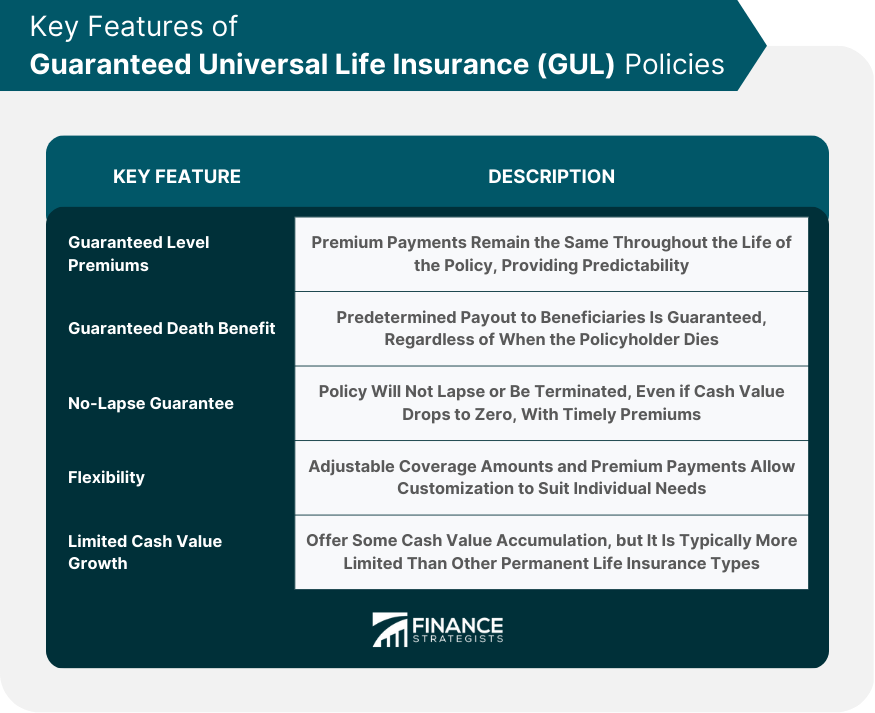

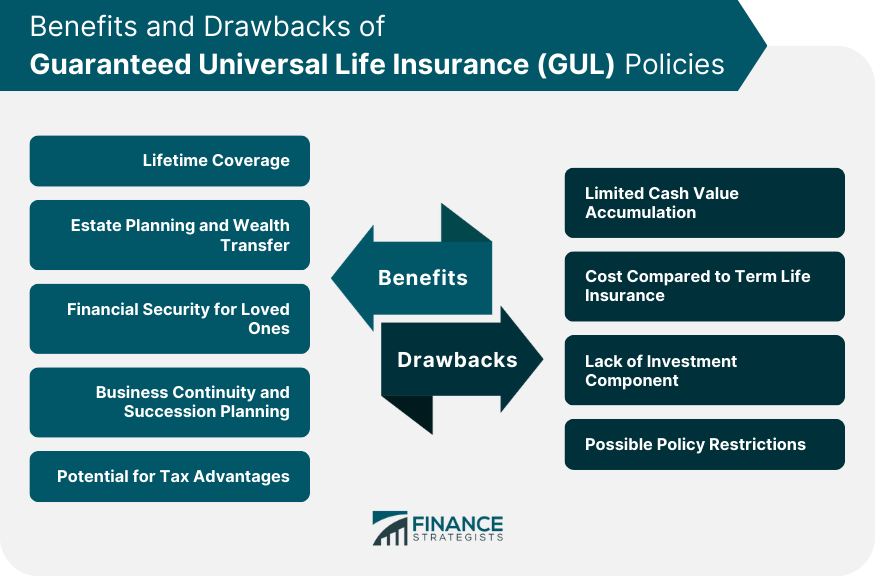

Guaranteed Universal Life Insurance is a unique type of life insurance policy that combines elements of both term and permanent life insurance. This type of policy provides the policyholder with a guaranteed death benefit that lasts for their entire lifetime while offering the flexibility of adjustable premiums and coverage. One of the main features of GUL policies is that they have guaranteed level premiums, meaning that the premium payments remain the same throughout the life of the policy. This allows policyholders to have predictable and manageable premium payments. GUL policies provide a guaranteed death benefit, which ensures that the beneficiaries receive a predetermined payout upon the death of the policyholder. This death benefit is guaranteed to last for the entire lifetime of the insured, providing financial security for loved ones. A no-lapse guarantee is an essential feature of GUL policies. This guarantee ensures that the policy will not lapse or be terminated, even if the cash value drops to zero, as long as the required premium payments are made. GUL policies offer flexibility in both coverage and premium payments. Policyholders can adjust their coverage amount and premium payments to suit their changing needs and financial circumstances. While GUL policies typically have limited cash value accumulation compared to other types of permanent life insurance, they still offer some cash value growth. This cash value can be accessed through policy loans or withdrawals, but it's essential to understand the potential impact on the policy's guarantees. To qualify for a GUL policy, applicants must meet certain age and health requirements. Most insurance companies offer GUL policies to individuals up to a specific age, typically around 85 years old. Applicants may also be required to undergo a medical exam and answer health-related questions as part of the underwriting process. Financial underwriting is another essential aspect of the GUL application process. Insurance companies will evaluate an applicant's financial situation, income, and assets to determine the appropriate coverage amount and premium payments. GUL policies often come with the option to add various riders and endorsements, which can provide additional benefits and coverage options. Common riders include accelerated death benefits, disability waivers of premium, and long-term care riders. When selecting a GUL policy, it is essential to consider your individual needs and goals. This may include factors such as desired coverage amount, premium payment flexibility, and additional policy features or riders. Research and compare various insurance companies and GUL products to find the best policy for your needs. Consider factors such as financial strength ratings, customer service, and policy options. When comparing GUL policies, it is crucial to evaluate the premiums, coverage amounts, and policy features. This will help you determine the best policy for your specific needs and budget. Consulting with an insurance professional can be helpful when choosing a GUL policy. They can provide guidance and answer questions about policy options, underwriting, and more. One of the main advantages of GUL policies is the lifetime coverage they provide. This ensures that the policyholder's beneficiaries will receive a death benefit, regardless of when the policyholder passes away. GUL policies can be an effective tool for estate planning and wealth transfer, as they provide a tax-free death benefit to beneficiaries. This can help to minimize estate taxes and ensure that loved ones receive the intended inheritance. The guaranteed death benefit provided by GUL policies ensures that the policyholder's loved ones will have financial security in the event of the policyholder's death. This can be used to cover funeral expenses, pay off debts, or provide ongoing financial support. GUL policies can also be used to fund buy-sell agreements or other business succession planning strategies, ensuring the continuity of a business and providing financial security for the remaining partners or owners. The death benefit provided by GUL policies is typically tax-free, providing a valuable tax advantage for beneficiaries. Compared to other types of permanent life insurance, GUL policies typically have limited cash value accumulation. This can be a drawback for individuals seeking a policy with a more substantial investment component or looking to use the cash value for retirement planning. GUL policies are generally more expensive than term life insurance policies due to their lifetime coverage and guaranteed death benefit. This higher cost may not be suitable for individuals with limited budgets or who only require coverage for a specific period. Unlike variable universal life or indexed universal life policies, GUL policies do not have an investment component. This means that policyholders do not have the opportunity to participate in market gains or choose investment options to potentially grow their cash value. Some GUL policies may have restrictions or limitations, such as surrender charges or limitations on policy loans and withdrawals. Policyholders should carefully review their policy terms and conditions to understand any potential restrictions. Conduct regular policy reviews to ensure that your GUL policy remains in line with your changing needs and goals. This may include adjusting coverage amounts, premium payments, or adding riders as needed. It is essential to keep your GUL policy up-to-date with any changes in your personal or financial situation. This may include updating your beneficiaries or adjusting your coverage amount in response to significant life events, such as marriage, divorce, or the birth of a child. Utilize any optional riders and endorsements that can provide additional benefits or coverage options. This may include features such as accelerated death benefits, disability waivers of premium, or long-term care riders. Ensure that you have a plan in place to make premium payments on your GUL policy, as lapses in payment can potentially jeopardize the policy's guarantees. Guaranteed Universal Life Insurance policies offer a combination of features of both term and permanent life insurance. They provide policyholders with a guaranteed death benefit that lasts for their entire lifetime while offering the flexibility of adjustable premiums and coverage. Key features of GUL policies include guaranteed level premiums, a predetermined payout to beneficiaries, a no-lapse guarantee, and flexibility in both coverage and premium payments. GUL policies also offer some cash value growth, but it is typically more limited than other permanent life insurance types. To choose the right GUL policy, it is essential to assess individual needs and goals, compare insurance companies and products, evaluate premiums, coverage, and policy features, and work with an insurance professional. GUL policies have benefits such as lifetime coverage, estate planning and wealth transfer, financial security for loved ones, business continuity and succession planning, and potential tax advantages. However, they also have potential drawbacks and limitations, such as limited cash value accumulation, higher cost compared to term life insurance, lack of investment component, and possible policy restrictions.Definition of Guaranteed Universal Life Insurance (GUL)

Key Features of GUL Policies

Guaranteed Level Premiums

Guaranteed Death Benefit

No-Lapse Guarantee

Flexibility in Coverage and Premium Payments

Cash Value Accumulation

Eligibility and Underwriting for GUL Policies

Age and Health Requirements

Financial Underwriting

Optional Riders and Endorsements

How to Choose the Right GUL Policy

Assessing Individual Needs and Goals

Comparing Insurance Companies and Products

Evaluating Premiums, Coverage, and Policy Features

Working With an Insurance Professional

Benefits of GUL Policies

Lifetime Coverage

Estate Planning and Wealth Transfer

Financial Security for Loved Ones

Business Continuity and Succession Planning

Potential for Tax Advantages

Additionally, the cash value growth within a GUL policy is tax-deferred, meaning that policyholders do not have to pay taxes on the growth until they withdraw or access the funds. This can be a beneficial tax planning strategy for individuals in higher tax brackets.Potential Drawbacks and Limitations of GUL Policies

Limited Cash Value Accumulation

Cost Compared to Term Life Insurance

Lack of Investment Component

Possible Policy Restrictions

Tips for Maintaining and Managing a GUL Policy

Regular Policy Reviews

Updating Coverage and Beneficiaries

Leveraging Policy Riders and Endorsements

Planning for Premium Payments

Conclusion

Guaranteed Universal Life Insurance (GUL) FAQs

Guaranteed universal life insurance (GUL) is a type of life insurance policy that combines elements of both term and permanent life insurance. GUL provides a guaranteed death benefit that lasts for the policyholder's entire lifetime while offering flexibility in premium payments and coverage.

Guaranteed universal life insurance (GUL) differs from other types of life insurance in several ways. Unlike term life insurance, GUL provides lifetime coverage and a guaranteed death benefit. Compared to other permanent life insurance policies, GUL typically has limited cash value accumulation and does not have an investment component.

Key features of guaranteed universal life insurance (GUL) policies include guaranteed level premiums, a guaranteed death benefit, a no-lapse guarantee, flexibility in coverage and premium payments, and limited cash value accumulation.

The main benefits of guaranteed universal life insurance (GUL) policies include lifetime coverage, estate planning and wealth transfer, financial security for loved ones, business continuity and succession planning, and potential tax advantages.

When choosing a guaranteed universal life insurance (GUL) policy, consider factors such as your individual needs and goals, the insurance company's financial strength and customer service, policy features and riders, and the premiums and coverage amounts. It is also helpful to consult with an insurance professional for guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.