Hazardous Activity in the finance realm refers to actions or decisions made by corporations, investors, or financial institutions that carry a high level of risk. This term typically describes activities such as speculative actions, aggressive trading strategies, or operations in high-risk regions. The purpose of identifying and understanding hazardous activities is to better manage and mitigate the associated financial, operational, legal and compliance, and reputational risks. By recognizing these activities, investors and corporations can develop effective risk management strategies and make more informed investment decisions. A deeper comprehension of hazardous activities also enables regulatory bodies to implement relevant controls and oversight mechanisms, promoting stability in the financial markets. Understanding hazardous activities is crucial in today's increasingly complex and interconnected global financial landscape. Hazardous activities carry several risks, which can be classified into four major categories: financial, operational, legal, compliance, and reputational risks. Financial risks represent the potential for significant financial loss due to hazardous activities. For instance, an aggressive trading strategy, while it might bring high returns, also runs the risk of considerable loss if market conditions are not favorable. Operational risks refer to the potential failures in the operational procedures of a company, which can be magnified when engaging in hazardous activities. For example, a financial institution using complex financial instruments might fail to properly control or manage these tools, leading to significant operational issues. Legal and compliance risks are tied to the potential for regulatory infractions or lawsuits that can result from hazardous activities. These activities may not comply with financial regulations, leading to penalties, lawsuits, or sanctions from regulatory bodies. Finally, reputational risks are related to the potential damage to a firm's reputation due to engagement in hazardous activities. This might result in a loss of clients, investors, or public trust, which can seriously harm a company's financial performance. Engagement in hazardous activities can affect a company's stock valuation. Investors might perceive the company as risky, which can lead to a decrease in the stock price. Conversely, if risky activities result in high returns, the stock price might increase significantly. Investors also consider hazardous activities when devising their investment strategies. Some investors might prefer to invest in companies that engage in high-risk, high-return activities, while others might opt for safer investments. Understanding hazardous activities is crucial in risk management. Investors need to assess the potential risks associated with these activities and devise strategies to mitigate these risks. Due diligence is a critical step in mitigating the risks of hazardous activities. It involves thoroughly investigating and understanding the risks associated with a particular activity or investment before proceeding. Compliance and auditing play crucial roles in mitigating the risks of hazardous activities. Regular audits can help identify any non-compliance or risky activities, allowing companies to take corrective action before the risks escalate. Insurance can also be used as a mitigating factor. It allows companies to transfer some of the risks associated with hazardous activities to the insurance company, thereby protecting themselves from potential financial loss. Financial derivatives, such as options and futures, can be used to hedge against the risks of hazardous activities. By using these financial instruments, investors can protect themselves from adverse price movements. The SEC is responsible for enforcing federal securities laws and regulating the securities industry. It has the authority to investigate and take legal action against companies involved in hazardous financial activities. FINRA is a self-regulatory organization that oversees brokerage firms and their registered representatives. It is responsible for enforcing rules governing the ethical practices of its member firms, which includes monitoring hazardous activities. The Federal Reserve and other central banks also play a role in managing hazardous activities by implementing monetary policy and supervising and regulating banks and other financial institutions to ensure the stability of the financial system. International regulatory bodies, such as the Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO), also play a crucial role in managing hazardous activities on a global scale. They set international standards and promote effective regulation and supervision to ensure global financial stability. Hazardous activities, entailing high-risk actions or decisions in the financial sector, have profound implications on investment strategies, stock valuation, and risk management. They carry significant financial, operational, legal, compliance, and reputational risks. Due diligence, compliance and auditing, insurance, and use of financial derivatives are effective measures for risk mitigation. Regulatory bodies such as the SEC, FINRA, central banks, and international regulatory institutions play a pivotal role in supervising these activities, ensuring financial market stability. The future of hazardous activities is being shaped by technology, globalization, and evolving regulations, introducing new challenges and complexities. It's crucial for investors and corporations to stay abreast of these changes, developing adaptive risk management strategies to navigate the evolving financial landscape. Through understanding and effectively managing hazardous activities, stability can be promoted in the global financial markets, benefiting both investors and corporations.What Is Hazardous Activity?

Understanding the Risks Involved in Hazardous Activities

Financial Risks

Operational Risks

Legal and Compliance Risks

Reputational Risks

Role of Hazardous Activities in Investment Decision Making

Impact on Stock Valuation

Influence on Investment Strategies

Importance in Risk Management

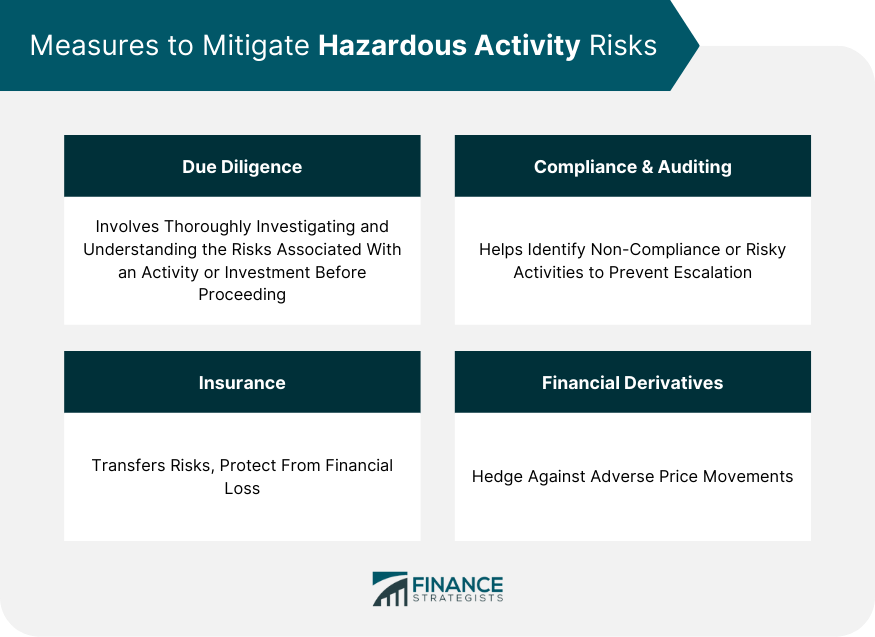

Measures to Mitigate Hazardous Activity Risks

Importance of Due Diligence

Role of Compliance and Auditing

Insurance as a Mitigating Factor

Use of Financial Derivatives to Hedge Risk

Role of Regulatory Bodies in Managing Hazardous Activity

Securities and Exchange Commission (SEC)

Financial Industry Regulatory Authority (FINRA)

Federal Reserve and Other Central Banks

International Regulatory Bodies

Final Thoughts

Hazardous Activity FAQs

A hazardous activity in finance refers to actions or decisions made by corporations, investors, or financial institutions that entail a high level of risk. These activities can include speculative activities, aggressive trading strategies, or operations in high-risk areas.

Hazardous activities have a profound influence on investment decision-making, particularly in relation to stock valuation, investment strategies, and risk management. They can affect a company's stock value, shape an investor's strategy based on risk tolerance, and play a crucial role in how investors manage and mitigate risks.

The collapse of Lehman Brothers in 2008 serves as a significant example of corporate failure due to hazardous activities. The company was heavily involved in the subprime mortgage market, a high-risk activity that led to its eventual bankruptcy.

Several measures can help mitigate the risks of hazardous activities. These include carrying out thorough due diligence, ensuring compliance and regular auditing, procuring insurance to transfer some risks, and using financial derivatives such as options and futures to hedge against potential adverse price movements.

Technological advancements have introduced new forms of hazardous activities. For instance, the rise of cryptocurrencies has led to a new form of financial speculation, which carries its own set of risks. As technology continues to evolve, new types of hazardous activities may emerge, requiring constant vigilance and adaptive risk management strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.