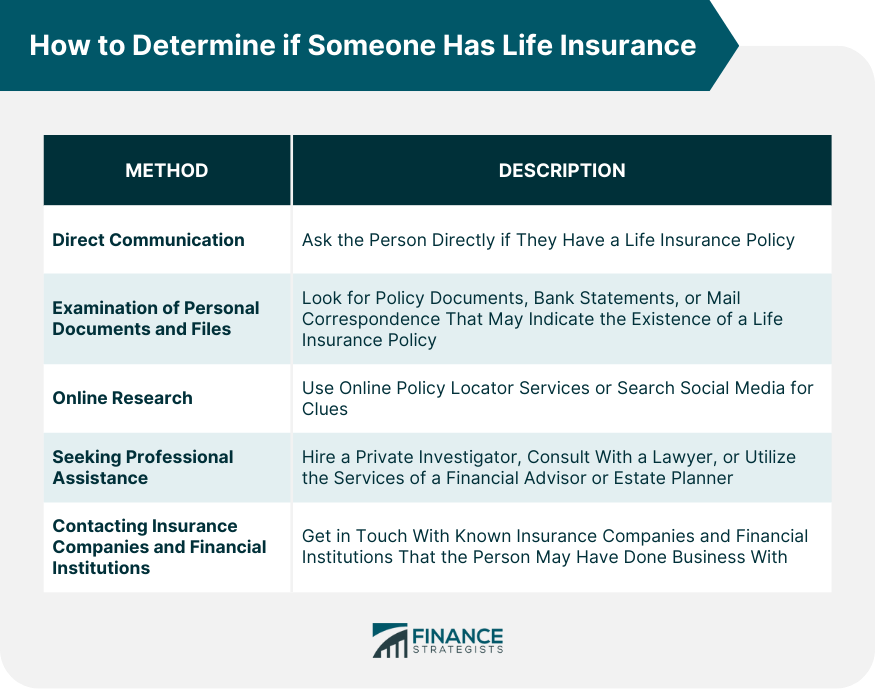

Finding out if someone has a life insurance policy can be a delicate matter, especially when it involves privacy and legal considerations. The following are ways to determine whether a person has a life insurance policy: One of the most straightforward ways to find out if someone has life insurance is to ask directly. Discussing life insurance may not be comfortable, but it's an important conversation, especially among family members. A person may disclose details about their policy willingly if they understand the significance of the information to their loved ones. If direct communication with the individual is not possible, you can try reaching out to close family members, friends, or their lawyer who might know about the life insurance policy. Searching through a person's personal files can also reveal information about life insurance. Policy documents, including the original life insurance policy or related paperwork, are concrete proof of life insurance. Regular payments to an insurance company may appear in the person's bank statements or credit card bills. Such payments are usually recurring and often bear the name of the insurance company. Insurance companies usually send regular mail to policyholders, such as updates on the policy, payment reminders, or policy statements. Keep an eye on the mail for clues. The internet can also be a valuable tool in your search. There are several online services designed to help people find lost life insurance policies. The National Association of Insurance Commissioners (NAIC) offers a free policy locator service. Sometimes, people disclose information about their insurance policies on social media platforms. While this is not a common practice due to privacy concerns, it's worth a shot. Check online payment history for any recurring payments or transfers to insurance companies. Professionals can help in the search for a life insurance policy. While this may seem extreme, private investigators have resources and databases not available to the public. They may be able to uncover a policy that you've been unable to find. Lawyers, especially those specializing in estate law or elder law, may have information about a person's life insurance policy, particularly if they helped prepare the person's will or estate plan. Financial advisors or estate planners are often involved in the process of obtaining life insurance, and they may have records or knowledge of the policy. Getting in touch with known insurance companies and financial institutions can also be useful. If you know the insurance companies the person had other types of insurance with, such as home or auto insurance, there's a chance they might also have a life insurance policy with the same company. Many banks offer life insurance policies as part of their financial services. It might be worth checking if the person purchased a policy through their bank. This tool helps conduct a search for the life insurance policies and annuity contracts of a deceased person. It's a valuable resource for those who think their loved one may have left an unclaimed life insurance policy. There are several common reasons why it may be important to know if someone has a life insurance policy: If you are a family member, spouse, or close friend, knowing if someone has a life insurance policy can help determine if you are named as a beneficiary. This information is crucial for understanding any potential financial support you may receive upon their passing. Life insurance can be an essential component of someone's financial plan. Knowing if someone has a life insurance policy can provide insights into their financial situation, including their assets and liabilities. This knowledge can help in estate planning, understanding their overall financial stability, and making informed decisions regarding their estate or inheritance. Life insurance proceeds are often used to settle debts, cover funeral expenses, and provide financial support for dependents or beneficiaries. Understanding if someone has a life insurance policy can assist in the settlement of their estate and ensure that the intended beneficiaries receive the necessary funds. In the case of a key person or business owner, knowing if they have a life insurance policy is important for business continuity planning. Life insurance can provide financial protection for the business, ensuring it can continue operations in the event of the individual's untimely death. If you are involved in legal proceedings, such as divorce or inheritance disputes, knowing if someone has a life insurance policy can be crucial for understanding their financial resources and potential obligations. Life insurance policies may also have implications for tax planning and obligations. It's worth noting that the disclosure of life insurance information is subject to privacy laws and the individual's consent. If the policyholder has passed away, and you suspect there is an unclaimed life insurance policy, several resources can help. There may be benefits left unclaimed after the policyholder's death. Life insurance companies turn unclaimed benefits over to the state's unclaimed property office after a certain period. Each state has an unclaimed property office, and they all have searchable databases online. Inputting the deceased's name may yield results if there are any unclaimed insurance proceeds. NAUPA is a non-profit organization that maintains a database of unclaimed property records from all states. They also provide resources to help people claim their property. When searching for someone else's life insurance policy, remember to respect privacy and understand the legal boundaries. Unless you're an authorized representative, a spouse, or a close family member with explicit permission, accessing someone else's financial information can violate privacy rights. Only inquire about someone's life insurance policy if you have a legitimate reason and the legal right to do so. The best practice is to obtain permission from the person or their legal representative. When contacting insurance companies and financial institutions or using services like the NAIC's policy locator, you will often need proof of death (like a death certificate) and proof of your legal right to access the information. Finding out if someone has life insurance necessitates a thoughtful, sensitive approach. By opening lines of direct communication or examining personal documents, one can ascertain this information. Online resources and professional assistance, such as private investigators, lawyers, and financial advisors, can also be invaluable. Leveraging resources like the NAIC's Life Insurance Policy Locator or NAUPA can shed light on potential unclaimed policies, particularly when a person has passed away. However, it's paramount to respect privacy and understand legal limitations, only pursuing information if you have a legitimate reason and the legal right. Transparency and permission are key. Ultimately, understanding someone's life insurance status can ensure their wishes are upheld, and beneficiaries receive due support.How to Determine if Someone Has Life Insurance

Direct Communication

Open Discussion

Asking Relevant Parties

Examination of Personal Documents and Files

Insurance Policy Documents

Bank Statements

Mail Correspondence

Online Research

Using Online Policy Locator Services

Checking Social Media for Clues

Online Payment History

Seeking Professional Assistance

Hiring a Private Investigator

Consulting With a Lawyer

Utilizing Financial Advisors or Estate Planners

Contacting Insurance Companies and Financial Institutions

Requesting Information from Known Insurance Companies

Inquiring About Policy at the Person's Bank

Utilizing the NAIC Life Insurance Policy Locator

Reasons for Needing to Know if Someone Has a Life Insurance

Beneficiary Designation

Financial Planning

Estate Settlement

Business Continuity

Legal and Financial Obligations

Tracking Down Unclaimed Life Insurance Policies

Searching for Unclaimed Insurance Benefits

Checking With State Unclaimed Property Offices

Inquiring at the National Association of Unclaimed Property Administrators (NAUPA)

Ethical and Legal Considerations

Respecting Privacy and Confidentiality

Understanding the Legal Boundaries

Necessity of Legal Document or Permission

Bottom Line

How Do You Find Out if Someone Has Life Insurance? FAQs

By going through their personal documents, such as insurance policy documents, bank statements, and mail correspondence, you can find evidence of a life insurance policy. Insurance policy documents would show if the policy is active, bank statements might indicate regular premium payments and mail correspondence from insurance companies could provide clues.

Online resources like the National Association of Insurance Commissioners (NAIC) Life Insurance Policy Locator service can help locate a policy. You can also investigate online payment histories for regular transfers to insurance companies, and sometimes social media profiles may contain related information.

Professionals such as private investigators, lawyers, and financial advisors can help find out if someone has life insurance. They have access to resources and databases that might not be publicly available, or they might already possess the information if they helped in drafting the person's will or financial plan.

To find out if a deceased person had a life insurance policy, you can search for unclaimed insurance benefits via state unclaimed property offices and the National Association of Unclaimed Property Administrators (NAUPA). These platforms list unclaimed properties, including life insurance proceeds.

It's important to respect privacy and understand the legal boundaries when finding out if someone has life insurance. Accessing someone's financial information can violate their privacy rights, so it's crucial to obtain permission from the person or their legal representative. You might also need proof of death and proof of your legal right to access this information, especially when contacting insurance companies or financial institutions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.