Irrevocable beneficiaries are individuals or entities named in a life insurance policy or specific types of trusts who are guaranteed rights to the policy benefits or trust assets. The defining characteristic of an irrevocable beneficiary is that their designation cannot be changed or removed without their explicit consent. Such status ensures a significant level of security for the beneficiary, protecting their entitled benefits from potential future changes in the policyholder's circumstances or wishes. The purpose of designating an irrevocable beneficiary is to safeguard the interests of the beneficiary, ensure the precise distribution of assets, provide potential tax advantages, and protect the policy benefits from creditors. However, this designation also necessitates careful consideration due to its permanent and inflexible nature. The distinction between a revocable beneficiary and an irrevocable beneficiary lies in the policyholder's ability to change the beneficiary designation. In the case of a revocable beneficiary, the policyholder retains the right to alter the beneficiary at any point in time without notifying or seeking permission from the current beneficiary. On the contrary, for irrevocable beneficiaries, the policyholder is unable to make changes to the beneficiary designation without the express consent of the beneficiary involved. The first step in naming an irrevocable beneficiary is to identify the person or entity you want to secure benefits for. This could be a spouse, child, relative, friend, or trust. Given the irreversible nature of this designation, it is crucial to consult with a legal advisor before proceeding. They can provide guidance on the implications and legal requirements of this decision. Once decided, you need to complete the required paperwork to officially name the irrevocable beneficiary. This generally involves providing the beneficiary's full name, date of birth, and social security number. Finally, it's advisable to communicate with the potential beneficiary about the designation. This ensures they are aware of their rights and responsibilities as an irrevocable beneficiary. The irrevocable beneficiary feature is often used in life insurance policies. It provides a secure mechanism for policyholders to ensure the intended parties receive the policy benefits. This security comes from the irrevocable nature of the designation, safeguarding the beneficiary from arbitrary removal or replacement. Irrevocable beneficiaries are less common but can still exist in other insurance policies, such as annuity contracts and certain types of retirement accounts. The principle remains the same; the policy owner cannot change the beneficiary without the consent of the irrevocable beneficiary. An irrevocable beneficiary enjoys robust legal protection. Once an irrevocable beneficiary is designated in a policy, they have a legally vested interest in the policy benefits. This right cannot be annulled or modified without their explicit agreement. Upon the policyholder's demise, the irrevocable beneficiary is entitled to receive the policy benefits or payouts as outlined in the contract. This right takes precedence over any conflicting claims, including those arising from wills or other estate documents. In situations such as divorce or the policyholder's death, the rights of the irrevocable beneficiary remain intact. Even if the policyholder's will or divorce settlement indicates a different allocation of the policy benefits, the irrevocable beneficiary's rights supersede these directives. Designating an irrevocable beneficiary provides assurance to the beneficiary, safeguarding their interests and ensuring they will receive the promised benefits, regardless of future circumstances. Irrevocable beneficiaries can also offer potential tax benefits. In some cases, the designation of an irrevocable beneficiary can remove the value of the policy from the policyholder's taxable estate, thereby reducing potential estate taxes. Another significant advantage of an irrevocable beneficiary is that it offers protection from creditors. Once a policyholder names an irrevocable beneficiary, the policy's benefits typically cannot be claimed by creditors to repay the policyholder's debts. An irrevocable beneficiary designation can be an effective tool in advanced estate planning. It allows for the strategic allocation of assets and wealth transfer, ensuring the realization of the policyholder's wishes. For policyholders, knowing that their loved ones will receive financial support, irrespective of changes in personal relationships or financial standing, can provide a strong sense of security and satisfaction. The major disadvantage of an irrevocable beneficiary designation lies in its inflexibility. Once named, it becomes a challenge for the policyholder to alter the beneficiary designation, which can be restrictive if circumstances change. Disputes can arise if other heirs or beneficiaries feel the allocation of benefits is unjust. Such conflicts can result in legal proceedings and cause additional stress for all parties involved. Making changes to an irrevocable beneficiary designation requires the consent of the current beneficiary. This process can be challenging, particularly in strained relationships or when the beneficiary is unresponsive or unreachable. If the irrevocable beneficiary is a person who is or may become eligible for public assistance, the receipt of policy benefits could impact their eligibility for such programs. This is particularly relevant for beneficiaries with special needs. Although it can be a useful tool in estate planning, the irrevocable beneficiary designation can also complicate the process. It requires careful consideration and legal advice to ensure it aligns with the overall estate planning goals. Designating an irrevocable beneficiary in an insurance policy is a crucial decision with far-reaching implications. While it affords a level of security and assurance for beneficiaries, ensuring that they receive their entitled benefits regardless of any future changes in circumstances, it also demands a high level of commitment from policyholders. With potential tax advantages, protection from creditors, and a guaranteed method for precise asset distribution, an irrevocable beneficiary designation can be a potent tool in effective estate planning. However, its inflexible nature, potential for familial conflict, and the challenges in altering the designation warrant a comprehensive understanding and careful consideration. Thus, while exploring such an option, it's always advisable to seek expert legal advice, taking into account one's unique circumstances, relationships, and estate planning goals.What Are Irrevocable Beneficiaries?

Differences Between Revocable and Irrevocable Beneficiaries

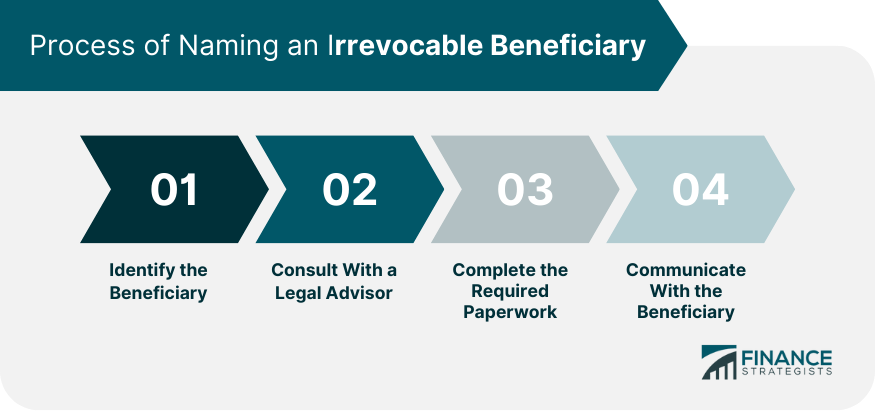

Process of Naming an Irrevocable Beneficiary

Identify the Beneficiary

Consult With a Legal Advisor

Complete the Required Paperwork

Communicate With the Beneficiary

Role of an Irrevocable Beneficiary in Insurance Policies

Legal Rights of Irrevocable Beneficiaries

Inability of Policy Owner to Change Without Consent

Rights to Policy Benefits and Payouts

Rights in Case of Policy Holder's Death or Divorce

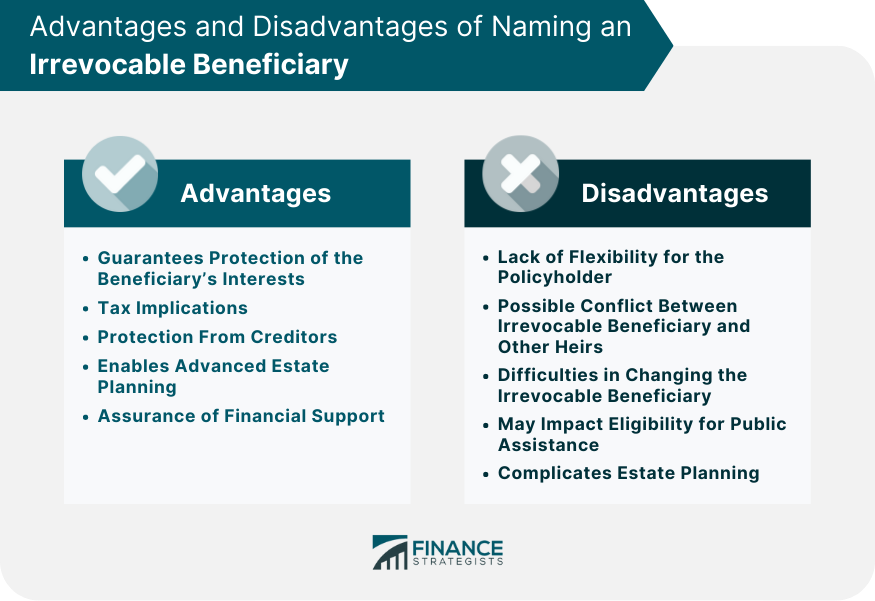

Advantages of Naming an Irrevocable Beneficiary

Guarantees Protection of the Beneficiary's Interests

Tax Implications

Protection From Creditors

Enables Advanced Estate Planning

Assurance of Financial Support

Disadvantages of an Irrevocable Beneficiary

Lack of Flexibility for the Policyholder

Possible Conflict Between Irrevocable Beneficiary and Other Heirs

Difficulties in Changing the Irrevocable Beneficiary

May Impact Eligibility for Public Assistance

Complicates Estate Planning

Final Thoughts

Irrevocable Beneficiaries FAQs

An irrevocable beneficiary is an individual or entity designated in a life insurance policy who has a guaranteed right to the policy benefits. The policyholder cannot change or remove an irrevocable beneficiary without their explicit consent.

The main difference between an irrevocable beneficiary and a revocable beneficiary lies in the ability of the policyholder to change the beneficiary designation. An irrevocable beneficiary cannot be changed without their consent, while a revocable beneficiary can be changed at any time by the policyholder without notification or consent.

An irrevocable beneficiary has a legally vested interest in the benefits of the insurance policy. They are entitled to the policy benefits upon the death of the policyholder, and their rights supersede any conflicting claims, such as those arising from wills or other estate documents.

The main advantage of an irrevocable beneficiary is that it guarantees the protection of the beneficiary's interests. It can also offer tax benefits and protect the policy's benefits from being claimed by creditors. However, it can also create a lack of flexibility for the policyholder and potential conflict with other heirs. Additionally, it can complicate the process of changing the beneficiary or adjusting the estate plan.

To designate an irrevocable beneficiary, you first need to identify the person or entity you wish to benefit. Next, consult a legal advisor to understand the implications of your decision. Then, complete the necessary paperwork provided by your insurance company, including the beneficiary's full name, date of birth, and social security number. It's advisable to communicate with the potential beneficiary about the designation to ensure they are aware of their rights and responsibilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.