Life insurance plays an essential role in protecting the financial well-being of individuals and their families. It provides a sense of security by offering a payout or death benefit to beneficiaries upon the policyholder's demise. However, when it comes to taxation, it is crucial to understand the rules and regulations that govern life insurance policies. Taxation on life insurance is multifaceted and depends on various factors like the type of insurance, the policyholder's estate, and specific circumstances. It has a substantial impact on readers as it influences financial planning and wealth management. Understanding the tax implications can help in making informed decisions and maximizing the benefits of life insurance. Term life insurance is a type of life insurance that provides coverage for a specific period, like 10, 20, or 30 years. The death benefit from term life insurance is typically tax-free unless the policy was turned over to the beneficiary for a price, a situation known as the "transfer-for-value" rule. Whole life insurance provides lifelong coverage and has a cash value component that grows over time. The death benefit is generally tax-free, but there may be taxes on the cash value if you surrender the policy or if it matures while you're still alive. Universal life insurance is a type of permanent life insurance with a cash value component that earns interest. While the death benefit is usually tax-free, withdrawing more than your basis (the total amount of premiums paid) from the cash value will be taxable. Variable life insurance is a permanent life insurance policy with an investment component. The death benefit is typically tax-free, but any investment gains may be subject to taxes if you surrender the policy or take out a loan against the policy's cash value. In general, life insurance proceeds paid to a beneficiary because of the insured person's death are not included as gross income, and so not taxable. However, any interest you receive is taxable and should be reported as interest received. If the insured owns the policy at the time of death, the proceeds may be subject to federal estate tax. To avoid this, many people set up an irrevocable life insurance trust (ILIT) to own and control their life insurance policies. If you transfer a life insurance policy for cash or other valuable consideration, the proceeds may be subject to the gift tax. It's best to consult a tax advisor to understand the potential tax implications of such a transfer. If a life insurance policy is sold or otherwise transferred for valuable consideration, the death benefit above the price paid for the policy and any additional premiums paid may be taxable. This is known as the transfer-for-value rule. When a cash-value life insurance policy is surrendered, the amount received in excess of the policyholder's cost basis (the premiums paid into the policy minus any dividends or withdrawals) is considered taxable income. Any interest paid on life insurance proceeds, either left with the insurer or paid out incrementally, is considered taxable income by the IRS. However, the base policy benefit is typically tax-free. In instances where a business takes out a policy on an employee or group of employees, the benefits may be considered taxable income under specific conditions. There are various strategies to mitigate potential tax burdens, like using life insurance proceeds to fund a Roth IRA or establishing an irrevocable life insurance trust (ILIT). It's recommended to consult with a financial advisor to discuss these options. Life insurance plays a crucial role in estate planning. It can provide liquidity to pay estate taxes, debts, and other expenses, thus preserving the deceased's assets for their heirs. Also, setting up an ILIT can help avoid estate taxes on the insurance proceeds. Given the complexity of tax laws surrounding life insurance, it's crucial to consult with a tax advisor or financial planner. They can provide guidance tailored to your specific circumstances and future goals. The IRS has specific rules and regulations regarding the taxability of life insurance proceeds. Understanding these rules can help ensure you're in compliance and help you avoid any unexpected tax liabilities. Tax laws are subject to change. For example, the Tax Cuts and Jobs Act of 2017 made significant changes to the tax code that affected life insurance. Staying abreast of any new laws or modifications to existing laws can ensure you're not caught off guard. Understanding the tax implications of life insurance is essential to effective financial planning. While life insurance proceeds are generally tax-free, exceptions exist. Factors such as the type of policy, the estate of the policyholder, and specific scenarios such as the "transfer-for-value" rule may alter this. Income tax, estate tax, and gift tax are all aspects to consider when navigating the taxation landscape of life insurance. There are strategies to mitigate potential tax burdens and these can be discussed with a financial advisor or tax professional. Through informed decision-making and careful planning, life insurance can be a powerful tool in wealth management and preservation.Is Life Insurance Taxable?

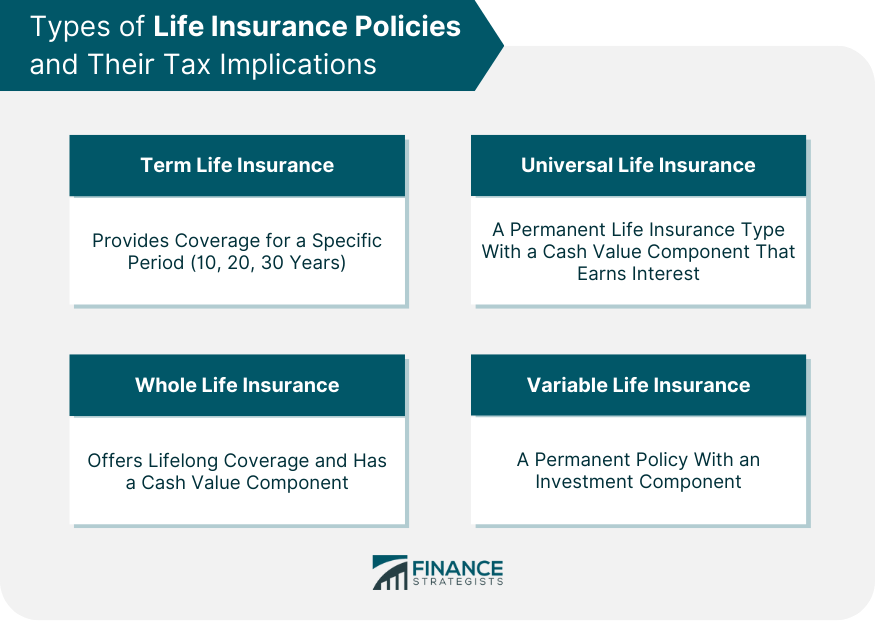

Types of Life Insurance Policies and Their Tax Implications

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

Understanding the Tax Rules for Life Insurance

Income Tax Implications

Estate Tax Implications

Gift Tax Implications

Exceptions: When Life Insurance Benefits Are Taxable

Transfer-For-Value Rule

Cash Surrender Value in Case of Policy Termination

Interest Income From Life Insurance

Policy Taken Out by a Business Entity

Life Insurance and Tax Planning

Strategies to Mitigate Potential Tax Burdens

Role of Life Insurance in Estate Planning

Consulting With a Tax Advisor or Financial Planner

Life Insurance Tax Laws: Understanding the Fine Print

IRS Rules and Regulations

Recent Changes in Tax Laws Concerning Life Insurance

Conclusion

Is Life Insurance Taxable FAQs

No, life insurance is not taxable under all circumstances. Generally, life insurance proceeds received by beneficiaries upon the death of the insured are not considered taxable income. However, certain situations, such as cashing out a policy's cash value or falling under the "transfer-for-value" rule, can trigger tax implications.

The type of life insurance policy can significantly affect its tax implications. For example, term life insurance death benefits are typically tax-free, unless subject to the "transfer-for-value" rule. In contrast, while the death benefit from cash value policies (like whole, universal, and variable life insurance) is generally tax-free, taxes may apply to the cash value component under specific circumstances.

Yes, if you earn interest on life insurance proceeds, this interest is considered taxable income by the IRS, even though the base policy benefit is typically tax-free.

Various strategies can help mitigate potential tax burdens. These include using life insurance proceeds to fund a Roth IRA or establishing an irrevocable life insurance trust (ILIT). Consulting with a tax advisor or financial planner can provide tailored guidance.

Yes, when a business takes out a life insurance policy on an employee or group of employees, the death benefits may be considered taxable income under specific conditions. It's essential to consult with a tax advisor to understand these potential tax implications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.