Life insurance is a contract between an individual and an insurance company, where the individual pays premiums in exchange for the insurer providing a lump sum payment, known as a death benefit, to the designated beneficiaries upon the insured's death. Life insurance planning is essential as it ensures the financial security of one's loved ones in the event of the insured's untimely death, thereby providing peace of mind and financial stability. The primary objectives of life insurance planning are to replace lost income, cover outstanding debts, and maintain the family's financial stability in the event of the policyholder's death. Term life insurance provides coverage for a specified period of time and includes level term, decreasing term, and annual renewable term policies. Level Term: Level term insurance offers a fixed death benefit and premium for the duration of the policy term, providing consistent coverage throughout the policy period. Decreasing Term: Decreasing term insurance features a death benefit that decreases over time, making it suitable for individuals with decreasing financial obligations, such as mortgage repayment. Annual Renewable Term: Annual renewable term insurance allows policyholders to renew their coverage annually, with premiums increasing each year to account for the policyholder's increasing age. Whole life insurance is a type of policy that provides lifelong coverage, meaning it will pay out a death benefit no matter when the policyholder dies. It combines a death benefit with a cash value component that grows over time. The cash value earns interest, typically at a fixed rate, and policyholders can borrow against it or withdraw it. Universal life insurance is similar to whole life insurance but offers more flexibility in premium payments and an adjustable death benefit. Policyholders can change their premium payments and death benefit amount over time to meet their changing needs. The policy also includes a cash value component that earns interest, which can be used to pay premiums or withdrawn. Variable life insurance combines a death benefit with an investment component. Policyholders can invest in a variety of investment options, such as stocks and bonds, and the cash value of the policy grows based on the performance of those investments. However, the value of the policy can also decrease if the investments perform poorly. Indexed universal life insurance is similar to universal life insurance, but the cash value component is tied to the performance of a market index, such as the S&P 500. This allows policyholders to benefit from market gains without being exposed to market losses. However, the growth potential of the policy may be limited by caps and floors set by the insurance company. Final expense insurance is a type of permanent life insurance specifically designed to cover funeral and burial costs and other end-of-life expenses. The death benefit is typically smaller than other types of policies and premiums are usually lower. This type of policy is intended to provide financial assistance to the policyholder's family during a difficult time. Life insurance planning should consider various financial needs and goals, such as income replacement, debt repayment, education funding, estate planning, and charitable giving. Income Replacement: Income replacement ensures that the policyholder's dependents can maintain their current standard of living in the event of the insured's death. Debt Repayment: Debt repayment addresses the need for life insurance to cover outstanding debts, such as mortgages and loans, that the policyholder's dependents may inherit. Education Funding: Education funding is an important consideration for policyholders who want to ensure that their children's education expenses are covered in the event of the insured's death. Estate Planning: Estate planning involves using life insurance to provide liquidity for estate taxes and other expenses, thereby preserving the insured's estate for their beneficiaries. Charitable Giving: Charitable giving involves using life insurance to leave a legacy by providing financial support to a chosen charity or cause upon the insured's death. Risk tolerance is the degree of financial uncertainty an individual is comfortable with when investing in a life insurance policy. It is influenced by various factors, such as personal financial goals, investment experience, and future financial needs. Some individuals may be comfortable with higher levels of financial risk and prefer policies such as variable life insurance, which offer investment options and a potentially higher return on investment. Others may prefer lower levels of risk and opt for policies such as whole life insurance, which provide a guaranteed death benefit and cash value component. Time horizon is another essential factor to consider when choosing a life insurance policy. It is the expected length of time a policyholder intends to maintain the policy. The time horizon can impact the choice of policy type because some policies, such as term life insurance, are designed to provide coverage for a specific period, while others, like whole life insurance, are intended to provide lifelong coverage. Affordability is also a crucial consideration in choosing a life insurance policy. It refers to the policyholder's ability to consistently pay the required premiums over the life of the policy. The premium payments for different types of life insurance policies can vary widely, and policyholders must choose a policy that fits their budget without sacrificing essential coverage. Health and lifestyle factors are significant considerations when purchasing life insurance coverage. Insurance companies use factors such as age, medical history, and smoking status to determine a policyholder's risk level and determine the cost of coverage. Policyholders with a history of medical conditions or unhealthy lifestyle habits may have difficulty obtaining coverage or may be required to pay higher premiums. On the other hand, those who are young, healthy, and have a low-risk profile may have more options and more affordable rates available to them. Determining the appropriate amount of life insurance coverage involves using methods such as income replacement, needs-based, and human life value methods. Income Replacement Method: The income replacement method calculates the amount of life insurance needed based on the policyholder's annual income multiplied by the number of years the income should be replaced. Needs-Based Method: The needs-based method assesses the policyholder's various financial obligations and goals, such as outstanding debts and future expenses, to determine the required life insurance coverage. Human Life Value Method: The human life value method estimates the present value of the insured's future earnings, considering factors such as income, inflation, and the time value of money. Inflation should be taken into account when determining life insurance needs, as it can erode the purchasing power of the death benefit over time. Regularly reviewing and updating life insurance coverage is crucial to ensure that the policy remains adequate in light of life events and changes in financial goals. Life Events: Significant life events, such as marriage, divorce, childbirth, or purchasing a home, can impact life insurance needs and necessitate a policy review. Changes in Financial Goals: Changes in financial goals, such as paying off a mortgage or saving for retirement, can also affect life insurance needs and require adjustments to the policy. When selecting a life insurance policy, individuals should carefully evaluate the various policy types to determine which one best suits their needs, goals, and risk tolerance. Policyholders should compare the features of different policies and optional riders, such as waiver of premium, accidental death benefit, accelerated death benefit, guaranteed insurability, and long-term care rider. Waiver of Premium: The waiver of premium riders allows policyholders to maintain their coverage without paying premiums if they become disabled and unable to work. Accidental Death Benefit: The accidental death benefit rider provides an additional death benefit if the insured dies as a result of an accident. Accelerated Death Benefit: The accelerated death benefit rider allows the policyholder to access a portion of the death benefit if diagnosed with a terminal illness. Guaranteed Insurability: The guaranteed insurability rider enables policyholders to purchase additional coverage without undergoing a medical exam, typically at specified intervals or after specific life events. Long-Term Care Rider: The long-term care rider provides financial assistance for long-term care expenses, such as nursing home care or home health care, by using a portion of the death benefit. When choosing an insurance company, individuals should consider factors such as financial strength ratings, reputation, and customer service. Financial Strength Ratings: Financial strength ratings, provided by independent rating agencies, assess insurance companies' financial stability and claims-paying ability. Reputation: The reputation of an insurance company can provide insight into its history, reliability, and overall customer satisfaction. Customer Service: Customer service is an important factor when selecting an insurance company, as it can impact the policyholder's experience with claims processing and policy management. Life insurance death benefits are generally paid tax-free to beneficiaries, providing financial security without additional tax burdens. The cash value component of permanent life insurance policies, such as whole life and universal life, grows tax-deferred, allowing policyholders to potentially accumulate significant savings. Policyholders can access the cash value of permanent life insurance policies through tax-free loans and withdrawals, subject to certain limitations and potential tax consequences. Section 1035 of the Internal Revenue Code allows policyholders to exchange one life insurance policy for another or a life insurance policy for an annuity without triggering taxable events, provided certain requirements are met. An irrevocable life insurance trust (ILIT) is a legal entity created to own and manage a life insurance policy, with the trust beneficiaries receiving the policy proceeds upon the insured's death. ILITs offer several benefits, including estate tax minimization, asset protection, and control over policy proceeds. Estate Tax Minimization: By placing a life insurance policy within an ILIT, the policy proceeds are excluded from the insured's taxable estate, potentially reducing estate tax liability. Asset Protection: ILITs provide asset protection by shielding the life insurance policy from creditors and legal claims against the insured's estate. Control Over Policy Proceeds: ILITs enable grantors to maintain control over the distribution of policy proceeds to beneficiaries, ensuring that the proceeds are used according to the grantor's wishes. Regular life insurance planning reviews are essential to ensure that coverage remains adequate in light of changes in financial needs, goals, and personal circumstances. Collaborating with a financial professional and an insurance broker can help individuals navigate the complexities of life insurance planning and select the most suitable policies for their unique needs and goals. Ultimately, life insurance planning is a critical component of a comprehensive financial plan, providing financial security and peace of mind for loved ones in the event of the policyholder's death.What Is Life Insurance Planning?

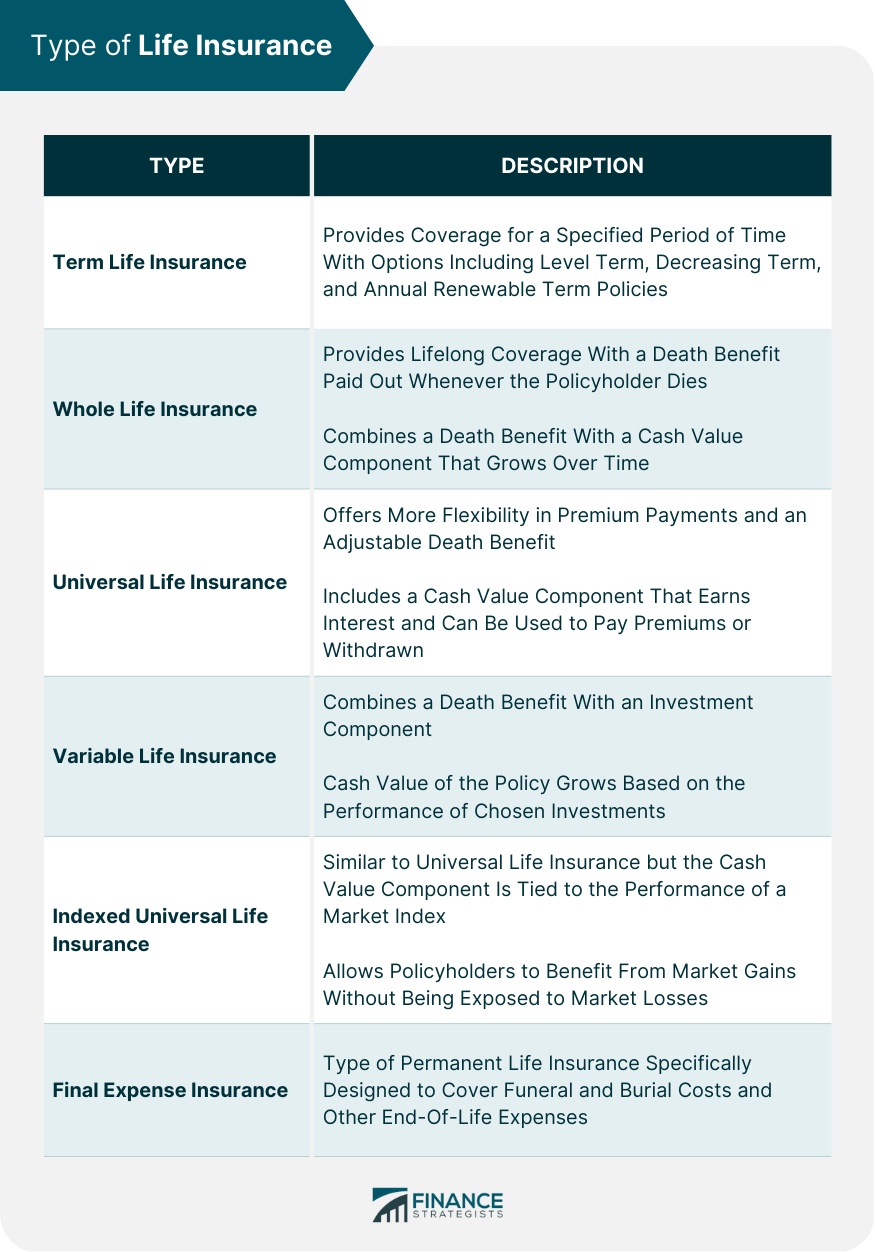

Types of Life Insurance

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

Indexed Universal Life Insurance

Final Expense Insurance

Factors to Consider in Life Insurance Planning

Financial Needs and Goals

Risk Tolerance

Time Horizon

Affordability

Health and Lifestyle

Assessing Life Insurance Needs

Methods for Calculating Coverage

Consideration of Inflation

Reviewing and Updating Coverage

Choosing a Life Insurance Policy

Evaluating Different Policy Types

Comparing Policy Features and Riders

Selecting an Insurance Company

Life Insurance Tax Considerations

Tax-Free Death Benefits

Cash Value Accumulation

Policy Loans and Withdrawals

1035 Exchanges

Life Insurance Trusts

Irrevocable Life Insurance Trust

Benefits of ILITs

Final Thoughts

Life Insurance Planning FAQs

Life insurance planning is the process of determining the appropriate amount and type of life insurance coverage needed to provide financial security for loved ones in the event of the insured's death.

The different types of life insurance include term life insurance, whole life insurance, universal life insurance, variable life insurance, indexed universal life insurance, and final expense insurance.

Factors to consider in life insurance planning include financial needs and goals, risk tolerance, time horizon, affordability, and health and lifestyle.

Life insurance needs can be assessed using methods such as income replacement, needs-based, and human life value methods, taking into account factors such as inflation.

When choosing a life insurance policy, important considerations include evaluating different policy types, comparing policy features and riders, and selecting a reputable insurance company.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.