Life insurance policy exchanges provide policyholders with the opportunity to replace their existing life insurance policy with a new one that better aligns with their current needs and objectives. These exchanges can be an effective way to enhance policy features, lower premiums, or optimize cash value growth. As life circumstances change, individuals may find that their existing life insurance policy no longer meets their financial needs. For example, a policyholder may require a higher death benefit to provide for an expanded family or may need to reduce their premium payments due to changes in their financial situation. Life insurance products are constantly evolving, and newer policies may offer features or benefits that are not available in older policies. Policyholders may consider an exchange to take advantage of these improved features, such as more competitive interest rates or enhanced riders. Policyholders may find that they can obtain a new life insurance policy with lower premiums, either due to changes in their health status, age, or advances in underwriting practices. Lower premiums can make maintaining the policy more affordable over the long term. Some policyholders may desire to exchange their policy for one that offers better cash value growth potential. This can be particularly important for those who rely on the cash value of their policy for supplemental retirement income or as a source of emergency funds. Certain types of life insurance policy exchanges may provide tax benefits, such as the deferral of capital gains tax on the exchange. This can be an attractive feature for policyholders who are concerned about tax-efficient wealth management. A Section 1035 exchange allows policyholders to exchange one life insurance policy for another without incurring any immediate tax consequences. To qualify for a 1035 exchange, the new policy must be of equal or greater value than the old policy, and the policyholder must not receive any cash in the exchange. The primary benefit of a 1035 exchange is the ability to defer taxes on the exchange. However, this type of exchange may not be suitable for all policyholders, as it requires the new policy to be of equal or greater value than the old policy. A conversion exchange involves replacing a term life insurance policy with a permanent policy, such as whole life or universal life insurance. This type of exchange can be advantageous for policyholders who want to maintain life insurance coverage beyond the term of their initial policy. The main benefit of a conversion exchange is the ability to secure permanent life insurance coverage without undergoing a new medical exam. However, policyholders should be aware that permanent policies generally come with higher premiums than term policies. An internal policy exchange occurs when a policyholder exchanges their existing policy for a different policy within the same insurance company. This type of exchange may be beneficial for policyholders who want to maintain their relationship with their current insurer while taking advantage of new policy features or benefits. Internal policy exchanges can offer a streamlined process and may result in lower fees or charges than external exchanges. However, policyholders may be limited in their options for new policies within the same insurance company. Policyholders should carefully review the features and benefits of both their existing policy and the proposed new policy to ensure that the exchange will meet their needs and objectives. A thorough cost comparison should be conducted, taking into account not only the premiums but also any fees, charges, or surrender penalties associated with the exchange. Policyholders should carefully weigh the potential cost savings against any potential loss of benefits or increased costs in the new policy. When considering an exchange, it is essential to evaluate the financial strength and reputation of the new insurance company. Policyholders should research the company's financial ratings, claims-paying history, and customer service to ensure that they are entrusting their life insurance needs to a reliable insurer. Life insurance policy exchanges may have tax implications, particularly if the exchange is not structured as a 1035 exchange or if the policyholder receives any cash as part of the transaction. Policyholders should consult with a tax professional to understand the potential tax consequences of an exchange. Exchanging a life insurance policy may result in surrender charges or penalties, particularly if the policy is relatively new. Policyholders should be aware of any potential charges and weigh them against the benefits of the exchange. Policyholders should begin by reviewing their current policy and evaluating whether it still meets their financial needs and objectives. Next, policyholders should research potential new policies and conduct a thorough comparison of features, benefits, and costs. Before making a decision, policyholders should consult with a financial advisor or insurance agent who can provide guidance and recommendations based on their specific situation and needs. Once a decision has been made, policyholders will need to complete the necessary paperwork and fulfill any requirements associated with the exchange, such as providing medical records or completing a new medical exam. After the exchange has been completed, policyholders should monitor the performance of their new policy and make any necessary adjustments to ensure that it continues to meet their needs and objectives. When exchanging a life insurance policy, policyholders may lose certain benefits or features associated with their existing policy, such as accrued cash value or guaranteed insurability. While some policy exchanges may result in lower premiums, others may lead to higher premiums or costs, particularly if the policyholder is older or in poorer health than when they initially purchased their existing policy. As mentioned earlier, policy exchanges may result in surrender charges or penalties, particularly if the policy is relatively new. These charges should be carefully considered when weighing the benefits of an exchange. Life insurance policy exchanges may have tax implications, particularly if the exchange is not structured as a 1035 exchange or if the policyholder receives any cash as part of the transaction. Policyholders should be aware of these potential tax consequences and consult with a tax professional if necessary. Policyholders may find that they have reduced insurability due to their age or health when applying for a new policy, which could result in higher premiums or even denial of coverage. Life insurance policy exchanges can be a valuable strategy for adapting insurance coverage to align with evolving needs and objectives. Policyholders should carefully consider their reasons for an exchange, such as changes in financial needs, improved policy features, lower premiums, better cash value growth, and tax benefits. It is essential to understand the different types of exchanges, including Section 1035 exchanges, conversion exchanges, and internal policy exchanges, as well as their respective benefits and drawbacks. Before making any decisions, consider factors like policy features, cost comparisons, company reputation, tax implications, and surrender charges. By thoroughly evaluating all aspects of life insurance policy exchanges and seeking professional guidance, policyholders can optimize their coverage to meet their financial needs and protect their loved ones.Life Insurance Policy Exchanges Overview

Reasons for Considering a Life Insurance Policy Exchange

Change in Financial Needs

Improved Policy Features

Lower Premiums

Improved Cash Value Growth

Tax Benefits

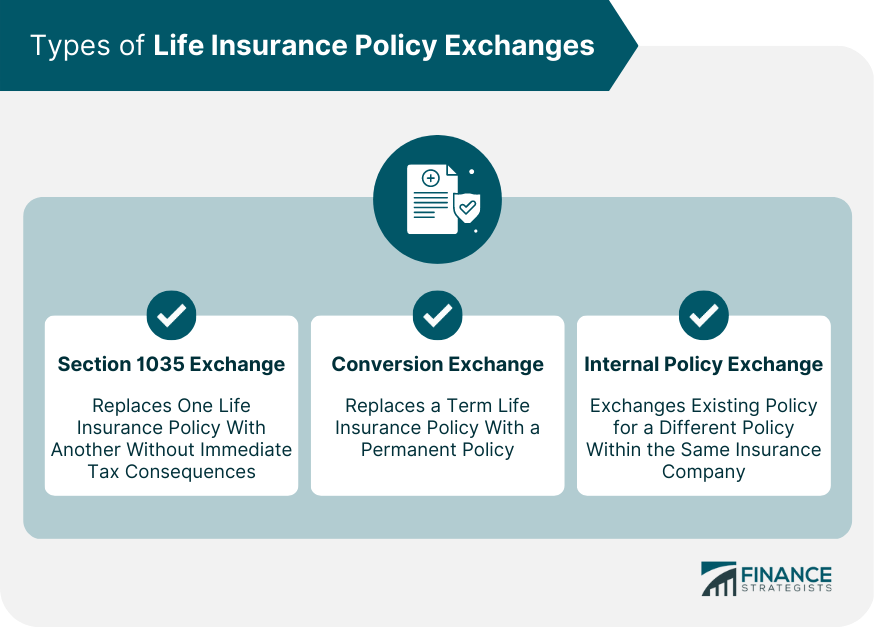

Types of Life Insurance Policy Exchanges

Section 1035 Exchange

Benefits and Drawbacks

Conversion Exchange

Benefits and Drawbacks

Internal Policy Exchange

Benefits and Drawbacks

Factors to Consider Before Exchanging a Life Insurance Policy

Policy Features and Benefits

Cost Comparison

Company Strength and Reputation

Potential Tax Implications

Surrender Charges and Penalties

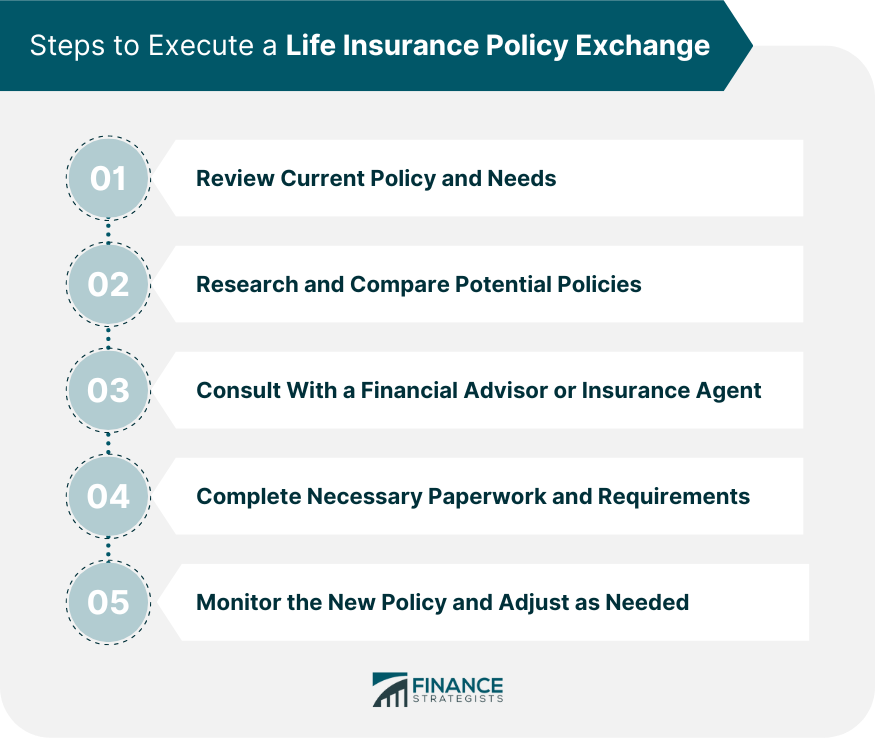

Steps to Execute a Life Insurance Policy Exchange

Review Current Policy and Needs

Research and Compare Potential Policies

Consult With a Financial Advisor or Insurance Agent

Complete Necessary Paperwork and Requirements

Monitor the New Policy and Adjust as Needed

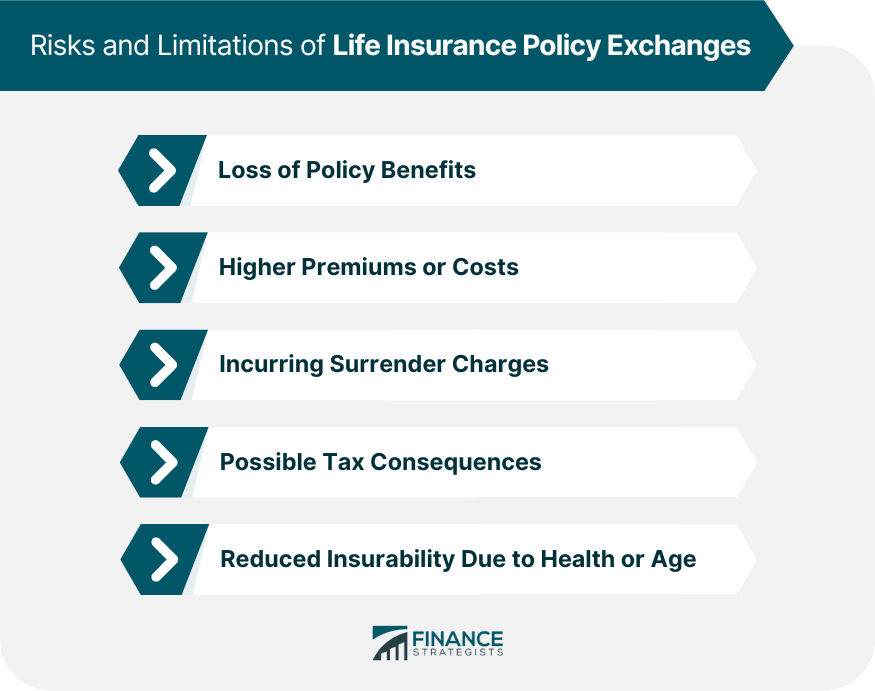

Risks and Limitations of Life Insurance Policy Exchanges

Loss of Policy Benefits

Higher Premiums or Costs

Incurring Surrender Charges

Possible Tax Consequences

Reduced Insurability Due to Health or Age

The Bottom Line

Life Insurance Policy Exchanges FAQs

Life insurance policy exchanges can be beneficial for a variety of reasons, including changes in financial needs, improved policy features, lower premiums, better cash value growth, and potential tax benefits.

The most common types of life insurance policy exchanges include Section 1035 exchanges, conversion exchanges, and internal policy exchanges, each offering different benefits and drawbacks depending on the policyholder's situation.

Before engaging in life insurance policy exchanges, policyholders should consider policy features and benefits, cost comparison, company strength and reputation, potential tax implications, and any surrender charges or penalties that may apply.

Life insurance policy exchanges can have tax implications, especially if the exchange is not structured as a 1035 exchange or if the policyholder receives cash as part of the transaction. It is essential to consult with a tax professional to understand the potential tax consequences of an exchange.

Risks and limitations of life insurance policy exchanges may include loss of policy benefits, higher premiums or costs, incurring surrender charges, possible tax consequences, and reduced insurability due to health or age. It is crucial to weigh these risks and consult with professionals before making any decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.