Life insurance policy riders are additional provisions or features that can be added to a life insurance policy to customize the coverage and meet the specific needs of the policyholder. These riders typically offer extra benefits or protections beyond what is included in the standard policy. Such include ability to increase or decrease the death benefit, add coverage for specific types of illnesses or disabilities, or provide accelerated death benefits if the policyholder becomes terminally ill. Riders can be added to a policy at the time of purchase or during the life of the policy, subject to the terms and conditions of the insurance contract. The accelerated death benefit rider allows the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness, typically with a life expectancy of 12 months or less. This rider can provide financial assistance for medical expenses, long-term care, or other end-of-life costs. To qualify for this rider, the policyholder must have a medical professional certify their terminal illness and life expectancy. The primary advantage of this rider is the financial relief it can provide during a difficult time. However, accessing the death benefit early will reduce the amount available for beneficiaries upon the policyholder's death. The waiver of premium rider ensures that the policyholder's life insurance coverage continues without premium payments in the event of total disability that prevents the policyholder from working. Qualifying conditions typically include a waiting period and a specific definition of total disability, which varies by insurer. The main advantage is the continuation of coverage without financial burden during a disability. A disadvantage is the additional cost of the rider and the potential for not meeting the insurer's definition of total disability. This rider provides additional benefits to the policyholder or beneficiaries in the event of the policyholder's accidental death or dismemberment, such as loss of limbs, eyesight, or hearing. Qualifying conditions include specific definitions of accidental death and dismemberment, which may vary by insurer. The primary advantage is the increased financial protection for the policyholder and their family in case of an accident. The disadvantage is the additional cost and the fact that the rider may never be used if the policyholder does not experience an accident. The guaranteed insurability rider allows the policyholder to purchase additional life insurance coverage without medical underwriting at specified intervals or upon certain life events, such as marriage or the birth of a child. Qualifying conditions include specified intervals or life events, which may vary by insurer. The main advantage is the ability to increase coverage without undergoing a medical exam. A disadvantage is the additional cost of the rider and the potential for not needing the additional coverage. The child rider provides life insurance coverage for the policyholder's children, typically up to a certain age or until they become financially independent. Qualifying conditions may include age limits and dependency status. The primary advantage is financial protection for the policyholder's family in the event of a child's death. The disadvantage is the additional cost and the potential for not needing coverage if the child remains healthy. The long-term care rider provides financial assistance for long-term care expenses, such as nursing home or home health care, if the policyholder becomes unable to perform activities of daily living. Qualifying conditions typically include the inability to perform a certain number of activities of daily living (ADLs), as defined by the insurer. The main advantage is the financial assistance provided for long-term care expenses. A disadvantage is the additional cost of the rider and the possibility of not needing long-term care services. The critical illness rider provides a lump-sum payment to the policyholder upon diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. Qualifying conditions include specific definitions of critical illnesses, which may vary by insurer. The primary advantage is the financial support provided during a critical illness, which can help cover medical expenses and lost income. The disadvantage is the additional cost and the potential for not experiencing a covered critical illness. The return of premium rider refunds some or all of the policyholder's paid premiums if the policyholder outlives the term of a term life insurance policy. Qualifying conditions typically include the policyholder outliving the term of the policy and having paid all required premiums. The main advantage is the potential refund of premiums paid, effectively providing "free" life insurance coverage if the policyholder outlives the term. The disadvantage is the additional cost of the rider and the potential for not receiving the refund if the policyholder dies during the term. The term conversion rider allows the policyholder to convert a term life insurance policy to a permanent policy, such as whole or universal life, without undergoing a medical exam. Qualifying conditions may include a specific time frame during which the conversion must take place and the type of permanent policy available for conversion. The primary advantage is the ability to maintain life insurance coverage without undergoing a medical exam, which can be beneficial for those with declining health. The disadvantage is the additional cost of the rider and the potential for not needing permanent coverage. Consider your unique financial needs, goals, and family situation when selecting policy riders. This will help ensure that the riders you choose provide the best protection for your specific circumstances. Evaluate the additional cost of each rider and weigh the potential benefits against the expense. Some riders may provide valuable protection, while others may not be necessary for your situation. Consider the flexibility and customization options offered by each rider. Some riders may allow you to adjust coverage levels or other features as your needs change over time. Research the reputation and financial strength of the insurance company offering the riders. A reputable company with a strong financial standing will be more likely to fulfill its obligations to policyholders. Life insurance policy riders play a crucial role in tailoring coverage to meet the policyholder's unique needs and circumstances. By understanding the common types of riders, their advantages and disadvantages, and the factors to consider when selecting them, you can make informed decisions about your life insurance coverage. It's essential to evaluate your individual needs and goals, the cost of riders, and the insurance company's reputation and financial strength to ensure you choose the right riders for your situation. Consult with a professional to help you navigate these choices and develop a comprehensive life insurance plan that addresses your specific needs and financial goals.Definition of Life Insurance Policy Riders

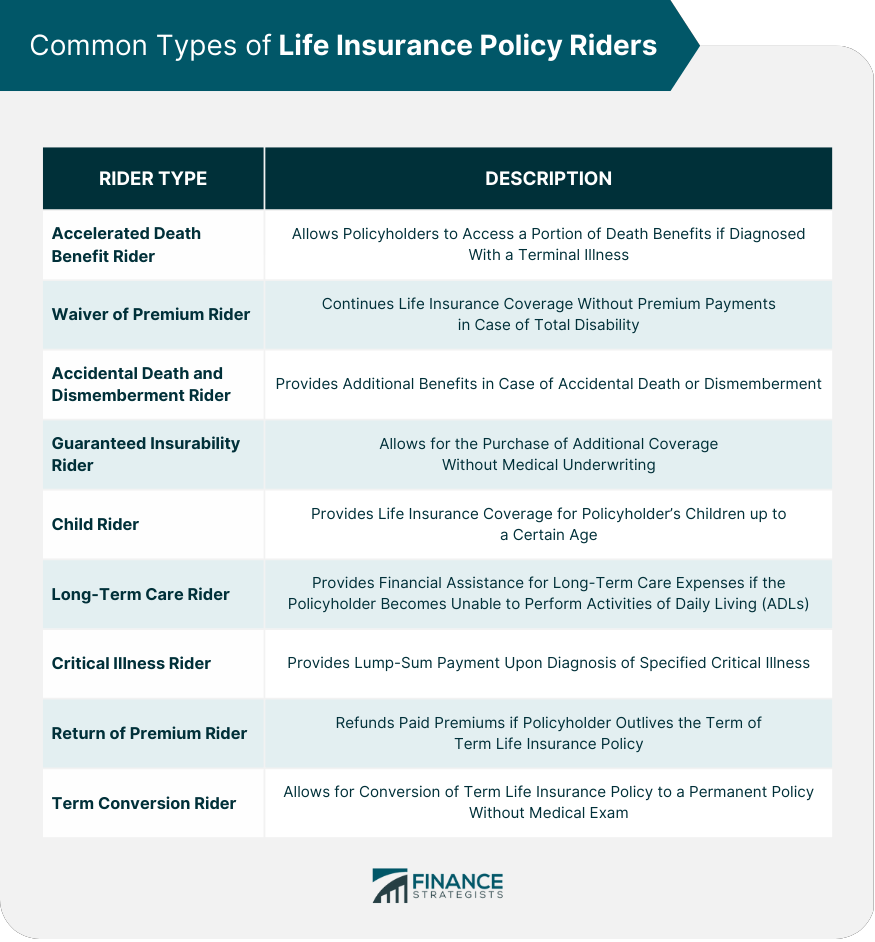

Common Types of Life Insurance Policy Riders

Accelerated Death Benefit Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Waiver of Premium Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Accidental Death and Dismemberment Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Guaranteed Insurability Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Child Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Long-Term Care Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Critical Illness Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Return of Premium Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Term Conversion Rider

Definition and Purpose

Qualifying Conditions

Advantages and Disadvantages

Factors to Consider When Selecting Policy Riders

Individual Needs and Goals

Cost of Riders

Flexibility and Customization Options

Insurance Company's Reputation and Financial Strength

Final Thoughts

Life Insurance Policy Riders FAQs

Life insurance policy riders are additional provisions or benefits added to a basic life insurance policy to customize the coverage to the policyholder's specific needs. They provide flexibility, allowing the policyholder to address unique situations and concerns that may not be covered by a standard life insurance policy.

To determine the appropriate life insurance policy riders for your situation, consider your individual needs, goals, and family circumstances. Evaluate the cost of each rider and weigh the potential benefits against the expense. Consulting with a professional can also help you choose the right riders for your unique needs.

Yes, many life insurance policy riders can be added or removed after purchasing a policy. However, the specific options and requirements for doing so may vary by insurer and policy type. It is essential to discuss your options with your insurance provider or a professional to understand the process and any associated costs.

The value of life insurance policy riders depends on your unique needs and circumstances. Some riders may provide significant benefits and financial protection, while others may not be necessary for your situation. It's essential to carefully consider the potential advantages and disadvantages of each rider and weigh them against the additional cost.

Some life insurance policy riders, such as the accelerated death benefit rider or long-term care rider, may impact the death benefit paid to beneficiaries by allowing the policyholder to access a portion of the death benefit early for specific purposes. When these riders are utilized, the death benefit paid to beneficiaries may be reduced by the amount accessed by the policyholder.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.