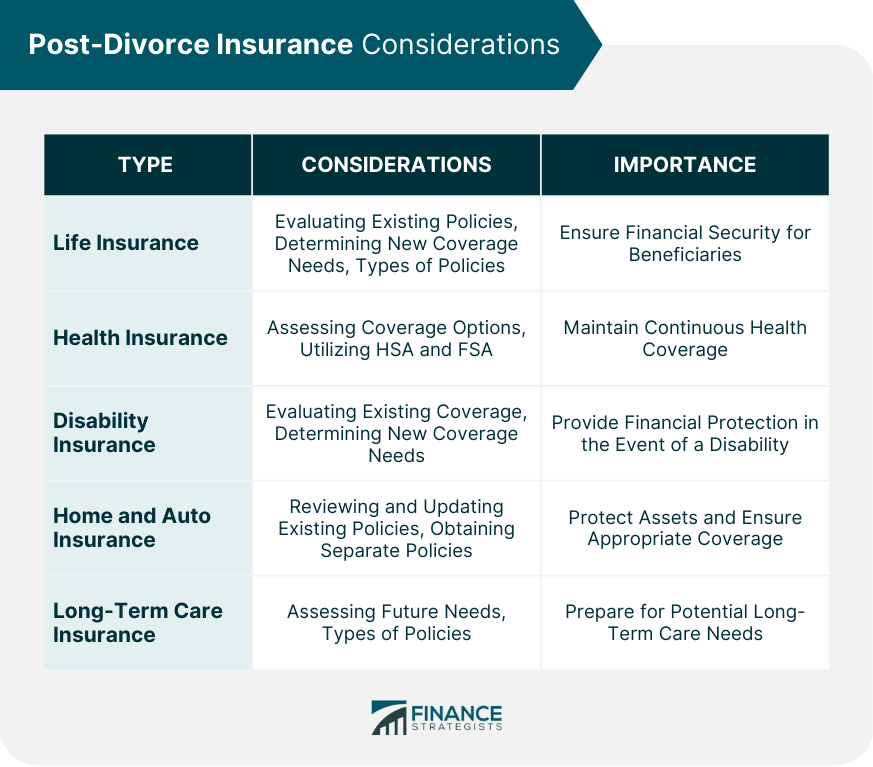

Divorce can bring about significant changes in your life, and insurance planning is an important aspect to consider during this transition. Post-Divorce Insurance Planning is the process of evaluating and securing appropriate insurance coverage following a divorce. It's important because divorce often leads to changes in insurance needs, and adequate coverage is essential to protect both parties in case of unexpected events or emergencies. The steps for post-divorce insurance planning involve assessing current insurance coverage, considering changes in life situation, evaluating future needs, determining a budget, researching insurance options, and updating policies. It is important to regularly review and update coverage to ensure it continues to meet changing needs. Planning is essential to ensure adequate coverage and protection for unexpected events or emergencies. It is crucial to review your current life insurance policies post-divorce. You may need to update the beneficiary designations, as well as the policy ownership, to reflect your new circumstances. This process ensures that the intended individuals receive the benefits upon your death, and you maintain control over the policies. Your life insurance coverage needs may change after a divorce. Assessing income replacement requirements and factoring in child support or alimony payments can help determine the appropriate amount of coverage. It is essential to have adequate life insurance to provide financial security for your loved ones. There are two main types of life insurance policies to consider post-divorce: term life and permanent life. Term life insurance provides coverage for a specified period, while permanent life insurance offers coverage for your entire life, as long as premiums are paid. Each type has its benefits and drawbacks, and the choice depends on your specific needs and financial goals. Health insurance is another critical aspect to address after a divorce. You may need to consider continuing coverage under your ex-spouse's plan, obtaining coverage through your employer, or purchasing an individual health insurance policy. It is essential to maintain continuous health coverage to protect yourself from unexpected medical expenses. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can help manage healthcare costs. These accounts allow you to set aside pre-tax income for qualified medical expenses, providing tax advantages and financial flexibility. Post-divorce, you may need to establish new accounts or update existing ones to reflect your new situation. Disability insurance provides financial protection in the event of a disabling illness or injury. Reviewing your current coverage post-divorce ensures that you have adequate protection in place. You may need to update your policy to reflect your new financial responsibilities and income levels. Your disability insurance needs may change after a divorce. Evaluating your new financial obligations, such as child support or alimony payments, and your ability to maintain your lifestyle in the event of a disability is essential. Adequate disability insurance coverage can provide peace of mind and financial security. After a divorce, it's important to review and update your home and auto insurance policies. You may need to remove your ex-spouse's name from the policies or adjust coverage levels based on your new living situation. Ensuring your policies are up to date can prevent potential issues down the road. In some cases, obtaining separate home and auto insurance policies after a divorce may be necessary. This can help protect your assets and ensure you have the appropriate level of coverage for your individual needs. Comparing quotes from multiple providers can help you find the best policy at the most affordable price. As you age, the need for long-term care may become a reality. Planning for potential long-term care needs post-divorce is an essential aspect of your overall insurance strategy. Evaluating your future care needs and the potential costs involved can help you make informed decisions about long-term care insurance. There are various types of long-term care insurance policies available, each with different features and benefits. Traditional long-term care policies, hybrid policies that combine life insurance with long-term care benefits, and short-term care policies are some options to consider. Understanding the differences and selecting the most suitable policy can provide financial protection and peace of mind as you age. Post-divorce insurance planning has numerous benefits that can help protect you and your family in the aftermath of a divorce. Here are some of the key benefits of post-divorce insurance planning: Divorce often leads to changes in insurance needs, and adequate coverage is essential to protect both parties in case of unexpected events or emergencies. By planning your post-divorce insurance coverage, you can ensure that you have the necessary insurance to protect yourself and your family. Post-divorce insurance planning can provide financial protection in the event of unexpected events or emergencies. With the right coverage, you can avoid financial burdens that may arise from unexpected events such as medical emergencies, accidents, or natural disasters. Knowing that you and your family are adequately protected can provide peace of mind during what can be a stressful and challenging time. Post-divorce insurance planning can help you feel more secure in your future by ensuring that you have the necessary insurance coverage to protect yourself and your family. By evaluating your insurance needs and shopping around for coverage, you may be able to save money on insurance premiums. This can help you manage your expenses and reduce financial stress after a divorce. Post-divorce insurance planning provides the opportunity to customize your coverage to meet your specific needs. This means you can choose the type of coverage that works best for you and your family, providing the flexibility to adjust your coverage as your needs change. While post-divorce insurance planning has numerous benefits, there are also some potential drawbacks that should be considered. Here are some of the key drawbacks of post-divorce insurance planning: The insurance landscape can be complex, and evaluating your insurance needs and finding the right coverage can be challenging. This may require significant research and the help of an insurance professional. Adequate insurance coverage can be expensive, and planning your post-divorce insurance coverage may require a significant financial investment. This may be a challenge for individuals who are already facing financial strain due to a divorce. Even with careful planning, there may be gaps in your insurance coverage that leave you exposed to financial risk in the event of an unexpected event or emergency. Post-divorce insurance planning can be time-consuming, requiring significant effort to research and evaluate your insurance needs and coverage options. Divorce is a challenging and emotional time, and post-divorce insurance planning can add to this burden. Dealing with insurance can be stressful and overwhelming, which may be particularly challenging for individuals who are already struggling with the emotional fallout from a divorce. Regular insurance reviews are crucial, particularly after significant life events like divorce. These reviews ensure that your insurance policies continue to meet your needs and provide the necessary protection. Periodic evaluations can help identify any gaps in coverage and allow you to make adjustments as needed. Navigating the complexities of post-divorce insurance planning can be challenging. Working with an experienced insurance professional can help you understand your options and make informed decisions. They can assist you in evaluating your current policies, identifying new coverage needs, and selecting the most appropriate policies for your unique situation.What Is Post-Divorce Insurance Planning?

Life Insurance Considerations

Evaluating Existing Policies

Determining New Coverage Needs

Types of Life Insurance Policies

Health Insurance Considerations

Assessing Post-Divorce Health Coverage Options

Health Savings Accounts and Flexible Spending Accounts

Disability Insurance Considerations

Evaluating Existing Coverage

Determining New Coverage Needs

Home and Auto Insurance Considerations

Reviewing and Updating Existing Policies

Obtaining Separate Policies Post-Divorce

Long-Term Care Insurance Considerations

Assessing Future Long-Term Care Needs

Types of Long-Term Care Insurance Policies

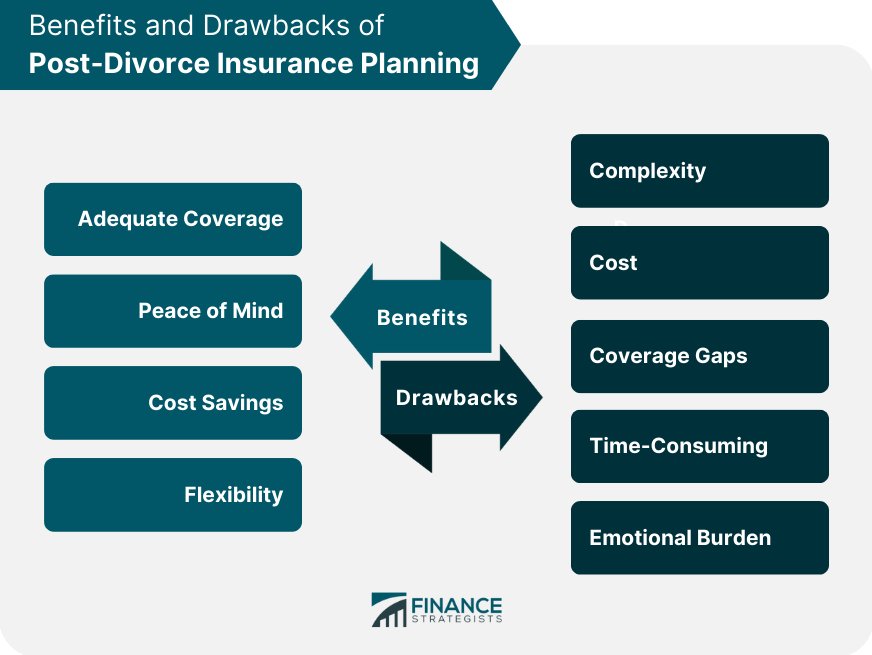

Benefits of Post-Divorce Insurance Planning

Adequate Coverage

Peace of Mind

Cost Savings

Flexibility

Drawbacks of Post-Divorce Insurance Planning

Complexity

Cost

Coverage Gaps

Time-Consuming

Emotional Burden

Final Thoughts

Post-Divorce Insurance Planning FAQs

Post-divorce insurance planning is the process of evaluating and securing appropriate insurance coverage following a divorce.

Common types of insurance to consider include health insurance, life insurance, disability insurance, auto insurance, and homeowner's or renter's insurance.

Post-divorce insurance planning is important to ensure that both parties have appropriate insurance coverage and are protected in the event of unexpected events or emergencies.

The benefits of post-divorce insurance planning include adequate coverage, peace of mind, cost savings, and flexibility.

Yes, consulting with an insurance professional can be beneficial in helping you navigate the complex insurance landscape and make informed decisions about your insurance coverage post-divorce.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.