SGLI is a life insurance program for active-duty military personnel, reservists, and National Guard members. The program provides affordable, low-cost term life insurance coverage to eligible service members and their families. The purpose of SGLI is to provide financial protection and peace of mind to military families in the event of the service member's death. The program offers competitive premium rates, flexible coverage options, and additional benefits for those who suffer from traumatic injuries. SGLI coverage is available to active-duty members of the Army, Navy, Air Force, Marines, Coast Guard, commissioned members of the National Oceanic and Atmospheric Administration (NOAA), and the Public Health Service (PHS). It is also available for cadets and midshipmen of the service academies, and members of the Reserve and National Guard. SGLI coverage is available in increments of $50,000, up to a maximum coverage amount of $500,000. Service members can choose the amount of coverage that best suits their needs and financial goals. SGLI offers low premium rates, which are based on the service member's age and the chosen coverage amount. Premiums are automatically deducted from the service member's pay. SGLI coverage continues as long as the service member remains on active duty or in the reserves. Coverage can be extended for up to two years after separation or release from active duty or the reserves, under certain circumstances. When a service member leaves the military, they have the option to convert their SGLI coverage to Veterans' Group Life Insurance (VGLI), which provides renewable term life insurance coverage for veterans. The conversion must be done within 1 year and 120 days from the date of separation. FSGLI provides coverage for the spouses and dependent children of service members covered under SGLI. Spousal coverage is available in increments of $10,000, up to a maximum of $100,000. FSGLI also provides automatic coverage for dependent children at no additional cost. Each dependent child is covered for $10,000. TSGLI is an additional benefit available to SGLI policyholders that provides financial support to those who suffer from qualifying traumatic injuries. TSGLI pays a benefit between $25,000 and $100,000, depending on the nature and severity of the injury. The benefit can be used to cover medical expenses, rehabilitation costs, and other financial needs related to the injury. Service members can designate one or more beneficiaries to receive the SGLI death benefit. Beneficiaries can be individuals, trusts, or legal entities, and the service member can specify how the benefit should be divided among the beneficiaries. In the event of a service member's death, the designated beneficiary or a legal representative must file a claim for the SGLI death benefit. The claim must be accompanied by a certified copy of the service member's death certificate. SGLI death benefits can be paid out in a lump sum or as an annuity with equal monthly payments spread over a specified period. Beneficiaries can choose the payout option that best suits their financial needs and goals. SGLI offers affordable premium rates, making it an attractive option for eligible service members looking for life insurance coverage. Service members are not required to undergo a medical exam to qualify for SGLI coverage, simplifying the enrollment process and ensuring that coverage is available to all eligible individuals. SGLI allows service members to choose their coverage amount, offering flexibility to tailor the policy to their specific financial needs and goals. All eligible service members are guaranteed coverage under the SGLI program, ensuring that life insurance protection is available to those who need it most. SGLI coverage is limited to the duration of a service member's active duty or reserve service, potentially leaving a coverage gap after separation or retirement. While SGLI can be converted to VGLI after separation, VGLI premiums may be higher than those for SGLI, particularly for older veterans or those with health issues. SGLI coverage may not be sufficient to meet the financial needs of all service members and their families, necessitating additional life insurance coverage from private insurers. Term life insurance provides coverage for a specified period, typically 10 to 30 years. While it can offer lower premiums than SGLI, it does not provide the same level of guaranteed coverage for eligible service members. Permanent life insurance, such as whole or universal life, provides coverage for the insured's lifetime and may accumulate cash value. However, premiums for permanent life insurance are generally higher than those for SGLI or term life insurance. Private life insurance policies offer a range of coverage options and premium rates, but may require medical exams and underwriting. Service members should carefully compare private life insurance options with SGLI to determine the best fit for their needs. Eligible service members are automatically enrolled in SGLI, with the maximum coverage amount of $500,000, unless they choose to decline or reduce their coverage. Service members can update their SGLI coverage amount, designate or update beneficiaries, and make changes to their coverage by using the SGLI Online Enrollment System (SOES). Service members can elect to decline or reduce their SGLI coverage by submitting the appropriate form to their personnel office or through the SOES. Life insurance is a critical financial planning tool for service members and their families. SGLI provides affordable, guaranteed coverage to eligible individuals, offering peace of mind and financial protection in the event of the service member's death. When considering life insurance options, service members should carefully assess their personal and family needs, taking into account their financial goals, the needs of their beneficiaries, and the available coverage options. By doing so, they can choose a policy that best aligns with their unique circumstances and financial objectives. While SGLI offers several advantages, service members should weigh its benefits against other life insurance options available in the market. Factors to consider include premium rates, coverage duration, and the need for additional coverage beyond what SGLI offers. As life circumstances change, service members should regularly review and update their SGLI coverage to ensure it continues to meet their evolving needs. This may include updating beneficiaries, adjusting coverage amounts, or considering additional life insurance policies.What Is Servicemembers' Group Life Insurance (SGLI)?

Coverage Details

Coverage Amounts

Premium Rates

Duration of Coverage

Conversion to Veterans' Group Life Insurance

Additional SGLI Programs

Family Servicemembers' Group Life Insurance (FSGLI)

Spousal Coverage

Dependent Child Coverage

Traumatic Injury Protection (TSGLI)

Eligibility for TSGLI

Benefits of TSGLI

SGLI Claims and Payouts

Designating Beneficiaries

Filing a Claim

Death Benefit Payout Options

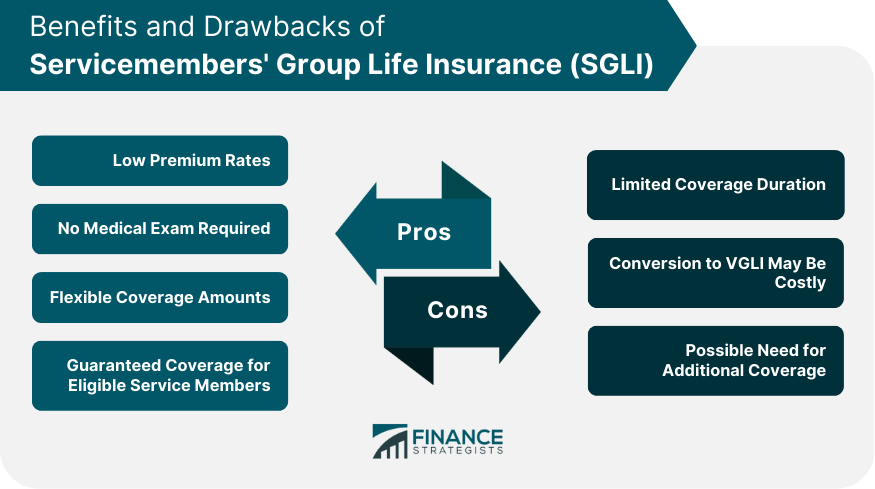

Advantages of SGLI

Low Premium Rates

No Medical Exam Required

Flexible Coverage Amounts

Guaranteed Coverage for Eligible Service Members

Disadvantages of SGLI

Limited Coverage Duration

Conversion to VGLI May Be Costly

Possible Need for Additional Coverage

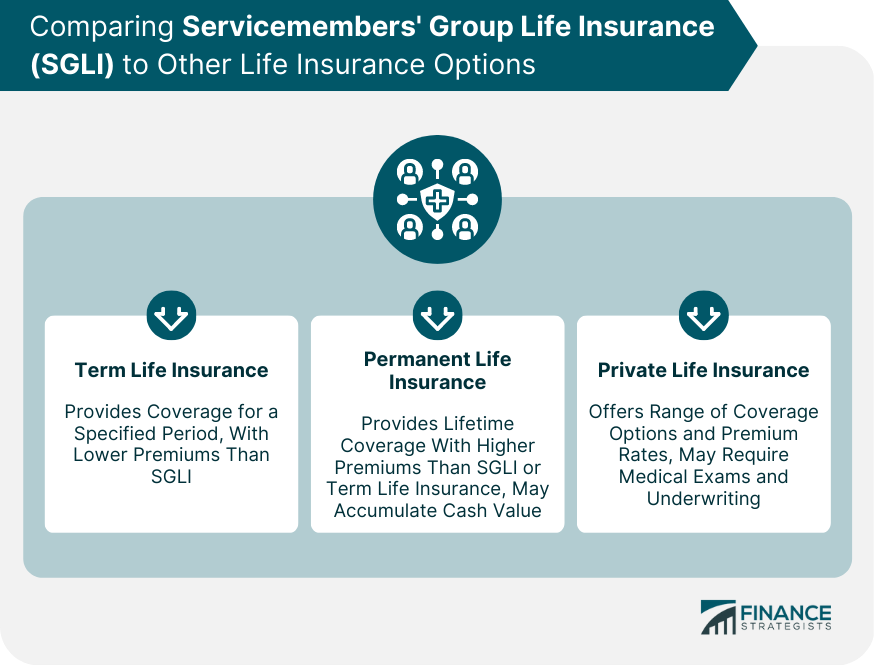

Comparing SGLI to Other Life Insurance Options

Term Life Insurance

Permanent Life Insurance

Private Life Insurance

How to Enroll in SGLI

Automatic Enrollment for Eligible Service Members

Updating Coverage Information and Beneficiaries

Electing or Declining Coverage

Conclusion

Importance of Life Insurance for Service Members

Assessing Personal and Family Needs for Insurance Coverage

Weighing SGLI Against Other Options

Regularly Reviewing and Updating Coverage

Servicemembers' Group Life Insurance (SGLI) FAQs

Servicemembers' Group Life Insurance (SGLI) is a life insurance program for active-duty service members, members of the National Guard, and Reservists. It provides low-cost, term life insurance coverage up to a maximum of $400,000.

Active-duty service members, members of the National Guard, and Reservists are eligible for SGLI coverage. Members of the Ready Reserve and Individual Ready Reserve can also apply for coverage if they are scheduled to perform at least 12 periods of inactive duty for training per year.

SGLI coverage provides a lump-sum payment to the designated beneficiary in the event of the service member's death. The coverage amount is based on the service member's pay grade and can be increased or decreased based on their individual needs.

Yes, service members can opt-out of SGLI coverage or choose a lower coverage amount. They can also name their spouse or children as beneficiaries and update their beneficiary designations at any time.

SGLI coverage ends 120 days after a service member leaves the military, unless they convert their coverage to Veterans' Group Life Insurance (VGLI) or another individual life insurance policy. VGLI is a similar program that provides life insurance coverage for veterans and is offered through the Department of Veterans Affairs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.