Survivorship life insurance, also known as second-to-die or joint life insurance, is a type of life insurance policy that insures two individuals, typically spouses or partners, under one policy. The death benefit is paid out only after the death of the second insured individual. This type of policy is primarily used for estate planning purposes, helping to cover estate taxes and other expenses that may arise upon the death of the surviving spouse. It also provides financial security for beneficiaries, such as children or other family members. Survivorship life insurance policies can be either term or permanent, with permanent policies offering additional benefits, such as cash value accumulation and flexibility in premium payments. Survivorship life insurance policies are structured to provide a single death benefit after both insured individuals have passed away. The policy remains in force as long as premiums are paid, and the death benefit is paid to the designated beneficiaries. Premiums for survivorship life insurance policies are generally lower than those for two individual policies due to the longer expected life expectancy of the couple. The death benefit is typically a predetermined amount that is paid out tax-free to the beneficiaries upon the death of the second insured. Permanent survivorship life insurance policies, such as whole or universal life, accumulate cash value over time. Policyholders can access this cash value through loans or withdrawals, which can provide additional financial flexibility during the insureds' lifetimes. One of the primary advantages of survivorship life insurance is the lower premiums compared to purchasing two separate policies. This makes it a more cost-effective solution for couples who want to ensure their estate planning needs are met. Survivorship life insurance policies are a valuable tool in estate planning, helping to cover estate taxes and other expenses that may arise upon the death of the surviving spouse. This ensures that the couple's assets are passed on to their beneficiaries with minimal financial burden. In some cases, one spouse may have difficulty obtaining life insurance coverage due to health issues. A survivorship life insurance policy allows both spouses to be insured under a single policy, providing coverage even if one spouse may be deemed uninsurable by traditional underwriting standards. Survivorship life insurance policies can also be used in business succession planning, providing funds to buy out a deceased partner's share of the business or cover other business-related expenses upon the death of both partners. The primary disadvantage of survivorship life insurance is that the death benefit is not paid until both insured individuals have passed away. This means that the surviving spouse does not receive any immediate financial support from the policy upon the death of the first spouse. Survivorship life insurance policies offer less flexibility in policy design compared to individual policies, as the coverage and death benefit are tied to both insured individuals. In the event of a divorce, the policy may need to be terminated or restructured, potentially resulting in higher policy costs or the loss of coverage altogether. While survivorship life insurance policies generally have lower premiums than individual policies, they may not provide the same level of coverage or flexibility for the insured individuals. Individual life insurance policies pay out a death benefit upon the death of the insured person, providing immediate financial support for the surviving spouse or other beneficiaries. In contrast, survivorship life insurance policies pay out the death benefit only after both insured individuals have passed away. Individual life insurance policies offer more flexibility in terms of coverage options and policy design, allowing each insured person to customize their policy to meet their specific needs. Survivorship life insurance policies, on the other hand, are structured to meet the needs of both insured individuals under a single policy, which may limit customization options. Survivorship life insurance policies are specifically designed to address estate planning needs and can help minimize estate taxes and other expenses upon the death of the surviving spouse. Individual life insurance policies can also be used for estate planning purposes, but may not provide the same level of tax efficiency or coverage for estate expenses. Before purchasing a survivorship life insurance policy, couples should carefully assess their financial goals and insurance needs, taking into account factors such as estate planning, potential estate taxes, and the financial security of their beneficiaries. Couples should also consider the different types of survivorship life insurance policies available, such as term or permanent policies, and evaluate the various features and benefits of each policy type to determine which best aligns with their financial goals and needs. Due to the complexity of survivorship life insurance policies and their role in estate planning, it is essential to work with a qualified insurance agent or financial advisor who can provide guidance and expertise in selecting the most appropriate policy for the couple's unique circumstances. Survivorship life insurance can play a crucial role in financial planning for couples, providing valuable estate planning benefits and financial security for beneficiaries. While these policies may have some disadvantages compared to individual policies, their unique benefits make them a valuable tool in comprehensive financial planning. Couples should carefully weigh the benefits and drawbacks of survivorship life insurance policies, taking into consideration their financial goals, insurance needs, and the potential advantages of alternative life insurance options. Finally, working with a qualified insurance agent or financial advisor is essential in selecting the most appropriate survivorship life insurance policy and ensuring that it is properly structured to meet the couple's financial goals and estate planning needs.What Is Survivorship Life Insurance?

How Survivorship Life Insurance Works

Policy Structure

Premiums and Death Benefits

Cash Value Accumulation

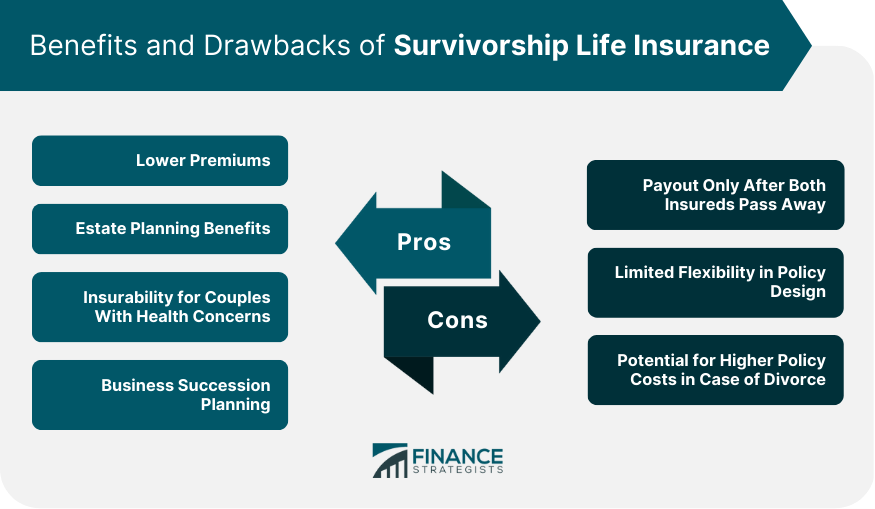

Advantages of Survivorship Life Insurance

Lower Premiums

Estate Planning Benefits

Insurability for Couples With Health Concerns

Business Succession Planning

Disadvantages of Survivorship Life Insurance

Payout Only After Both Insureds Pass Away

Limited Flexibility in Policy Design

Potential for Higher Policy Costs in Case of Divorce

Comparison With Individual Life Insurance Policies

Premium Costs

Death Benefit Payout Structure

Policy Flexibility

Estate Planning and Tax Implications

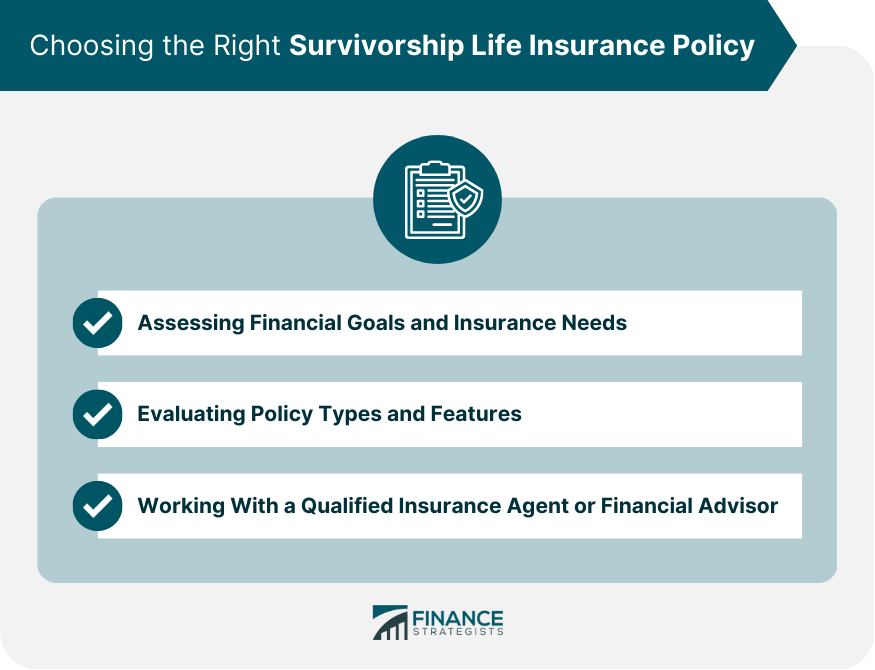

Choosing the Right Survivorship Life Insurance Policy

Assessing Financial Goals and Insurance Needs

Evaluating Policy Types and Features

Working With a Qualified Insurance Agent or Financial Advisor

Conclusion

Survivorship Life Insurance FAQs

Survivorship life insurance, also known as second-to-die life insurance, is a type of life insurance policy that insures two people and pays a death benefit only after both people have passed away.

In a survivorship life insurance policy, the death benefit is paid out only after both insured individuals have died. Premiums are typically lower than those for individual life insurance policies because the insurance company assumes that it will take longer for the death benefit to be paid out.

Survivorship life insurance is typically purchased by married couples or business partners who want to leave a legacy for their heirs or provide funds for estate planning purposes.

Survivorship life insurance can provide several benefits, including lower premiums compared to individual life insurance policies, estate planning benefits, and flexibility in how the death benefit is used.

Survivorship life insurance can be used to help pay estate taxes or provide liquidity for the estate. The death benefit can be used to provide funds for heirs, equalize inheritances between beneficiaries, or fund buy-sell agreements for business partners.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.