TOLI refers to a life insurance policy owned by a trust, typically an irrevocable trust, rather than by an individual. The trust serves as the policy owner and beneficiary, providing additional control and flexibility in the distribution of policy proceeds. TOLI is often used in estate planning, wealth transfer, and asset protection strategies to help minimize estate taxes, protect assets from creditors, and efficiently transfer wealth to beneficiaries.

An ILIT is a common type of TOLI, designed to hold a life insurance policy outside of an individual's taxable estate. It provides the grantor the ability to reduce estate taxes, protect assets, and maintain control over the distribution of policy proceeds. A CRT is a TOLI that allows the grantor to receive income from the trust while benefiting a chosen charity upon the grantor's death. This type of TOLI provides tax benefits, including potential income tax deductions and estate tax reductions. A GRAT is a TOLI that allows the grantor to receive an annuity payment for a specified term while transferring the remaining assets to beneficiaries tax-free at the end of the term. This type of TOLI is commonly used to transfer wealth and minimize gift taxes. A Crummey Trust is a TOLI that allows for annual tax-free gifts to be made to beneficiaries, typically to help fund life insurance premiums. This type of TOLI provides the grantor with greater control over the distribution of policy proceeds. In a TOLI arrangement, the trust, rather than an individual, serves as the policy owner and beneficiary. This structure provides enhanced control and flexibility in the distribution of policy proceeds. TOLI allows the grantor to maintain control over the policy and its proceeds through the trust provisions and selection of a trustee. TOLI provides the ability to designate multiple beneficiaries, specify the timing and amount of distributions, and address specific estate planning needs. TOLI arrangements can offer significant tax benefits, including estate tax reduction, income tax deductions, and the potential for tax-free wealth transfers. One of the primary advantages of TOLI is its ability to reduce estate taxes. By transferring assets to a TOLI trust and using the proceeds from a life insurance policy to pay estate taxes, the grantor can ensure that their assets are distributed according to their wishes and are protected from estate taxes. Additionally, TOLI can provide tax-free cash to pay for estate taxes, which can be significant for high net worth estates. TOLI can be an effective tool for wealth transfer planning. By establishing a TOLI trust and funding it with life insurance, the grantor can provide tax-free cash to their beneficiaries, which can be used to pay for estate taxes, provide for education, or meet other financial needs. Additionally, TOLI can provide a predictable source of income for the beneficiaries, which can be particularly useful for those who are not financially savvy. TOLI can provide asset protection by transferring assets to a trust that is separate from the grantor's personal assets. By doing so, the assets held in the trust are protected from creditors and lawsuits. Additionally, TOLI can provide liquidity to pay for any outstanding debts or obligations, which can help protect the grantor's personal assets. TOLI can be used to support charitable giving by establishing a charitable trust that is funded with life insurance. The policy proceeds can be used to fund a charitable organization or to provide ongoing support for a specific cause. By establishing a TOLI trust for philanthropic purposes, the grantor can ensure that their legacy lives on and that their charitable goals are met. TOLI is a complex financial planning tool that requires careful planning and execution. It involves creating a trust, selecting the right insurance policy, determining the appropriate funding amount, and ensuring that the trust complies with all legal and tax requirements. This complexity can make TOLI difficult to understand and manage, particularly for those who are not familiar with insurance and estate planning. Once a TOLI trust is established, it is generally irrevocable. This means that the grantor cannot make changes or modifications to the trust or the insurance policy. While this may be desirable for some people who want to ensure that their assets are protected and distributed according to their wishes, it also means that they lose control over those assets. TOLI trusts require ongoing administration, which can be expensive. Trustee fees, legal fees, and insurance premiums are just a few of the costs that must be considered. These expenses can eat into the cash value of the policy, reducing its potential benefits. While TOLI can provide tax advantages, it can also create potential tax liabilities. For example, if the trust is not structured properly, it may be subject to estate taxes or income taxes. Additionally, if the grantor dies within three years of transferring the policy to the trust, the death benefit may be included in their estate for tax purposes. The trustee is responsible for managing the TOLI trust and ensuring that it complies with all legal and tax requirements. It is important to select a trustee who is experienced in managing trusts and understands the complexities of TOLI. Additionally, the trustee should be someone who can be trusted to act in the best interests of the trust beneficiaries. The type of insurance policy and the funding method will depend on the specific goals of the TOLI trust. For example, if the goal is to provide liquidity for estate taxes, a second-to-die policy may be appropriate. The funding method may also vary, from a lump-sum payment to ongoing premiums. It is important to work with an experienced insurance agent to select the right policy and funding method for the trust. The beneficiaries of the TOLI trust should be carefully considered. The trust can provide for one or more beneficiaries, and the distribution of the policy proceeds can be structured in a variety of ways. It is important to consider the tax implications of the distribution method, as well as the potential impact on the beneficiaries' financial situation. TOLI trusts are subject to both state and federal tax laws, which can be complex and vary depending on the specific situation. It is important to work with an experienced attorney or financial planner who understands these tax laws and can help ensure that the TOLI trust complies with all legal requirements TOLI can be an effective tool for high-net-worth individuals who want to protect their assets and minimize estate taxes. By transferring assets to a TOLI trust, the grantor can ensure that their assets are distributed according to their wishes and are protected from creditors and lawsuits. Additionally, TOLI can provide tax-free cash to pay for estate taxes, which can be significant for high-net-worth estates. TOLI can be used in business succession planning to provide liquidity for buy-sell agreements or to fund a key person insurance policy. By establishing a TOLI trust to hold the insurance policy, the business can ensure that the policy proceeds are available to buy out the deceased owner's share of the business or to fund the business operations in the event of a key person's death. TOLI can be used to transfer wealth to future generations in a tax-efficient manner. By establishing a TOLI trust and funding it with life insurance, the grantor can provide tax-free cash to their beneficiaries, which can be used to pay for estate taxes, provide for education, or meet other financial needs. Additionally, TOLI can provide a predictable source of income for the beneficiaries, which can be particularly useful for those who are not financially savvy. TOLI can be used to support philanthropic goals by establishing a charitable trust that is funded with life insurance. The policy proceeds can be used to fund a charitable organization or to provide ongoing support for a specific cause. By establishing a TOLI trust for philanthropic purposes, the grantor can ensure that their legacy lives on and that their charitable goals are met. Trust-owned life insurance can be an effective tool for estate and financial planning, providing advantages such as estate tax reduction, wealth transfer planning, asset protection, and charitable giving. However, TOLI also comes with potential disadvantages, such as complexity, irrevocability, trust administration expenses, and potential tax implications. When considering TOLI, it is important to carefully weigh the benefits and drawbacks and determine whether it is the right tool for your specific financial goals. Working with an experienced financial planner or attorney can help ensure that TOLI is structured properly and meets your goals. Ultimately, the role of TOLI in estate and financial planning will depend on the individual's specific circumstances and goals. While TOLI can be an effective tool in certain situations, it may not be appropriate for everyone.What Is Trust-Owned Life Insurance (TOLI)?

Types of Trust-Owned Life Insurance

Irrevocable Life Insurance Trust (ILIT)

Charitable Remainder Trust (CRT)

Grantor Retained Annuity Trust (GRAT)

Crummey Trust

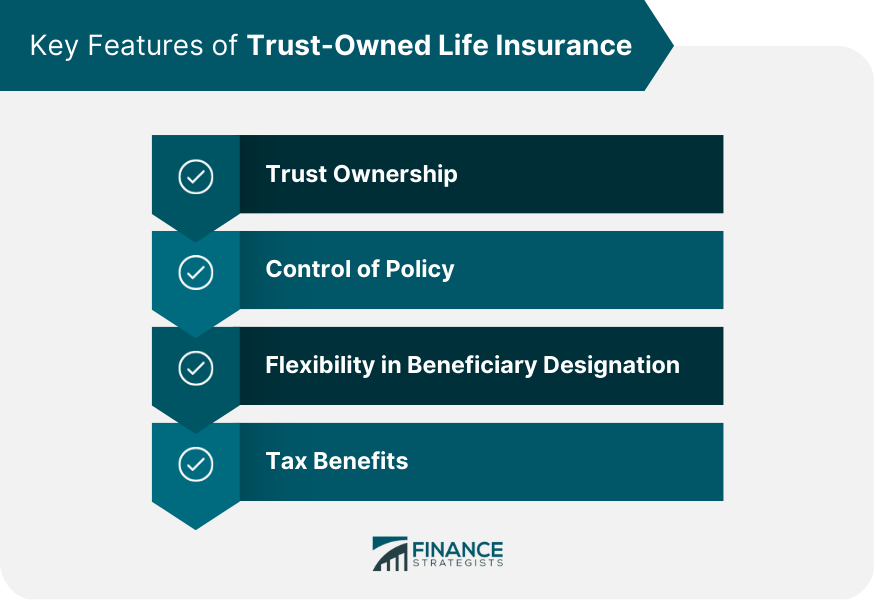

Key Features of Trust-Owned Life Insurance

Trust Ownership

Control of Policy

Flexibility in Beneficiary Designation

Tax Benefits

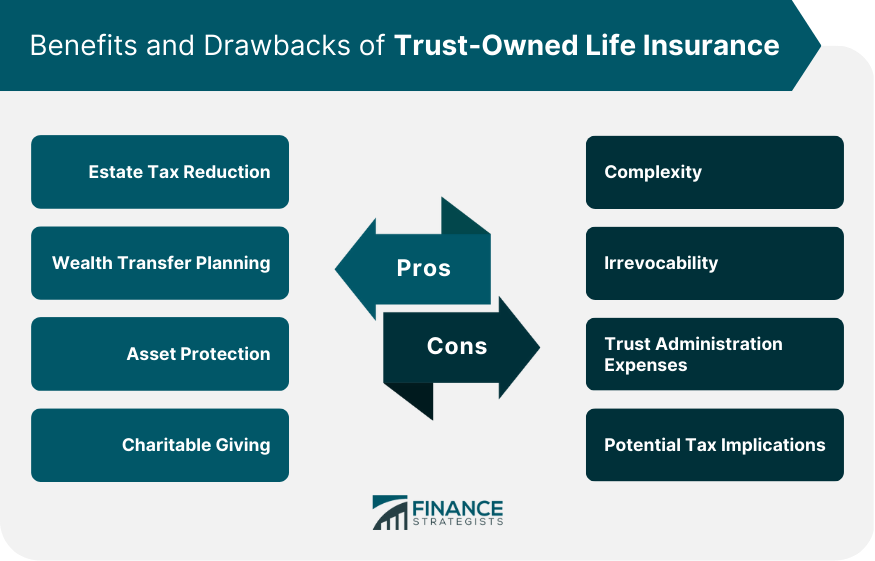

Advantages of Trust-Owned Life Insurance

Estate Tax Reduction

Wealth Transfer Planning

Asset Protection

Charitable Giving

Disadvantages of Trust-Owned Life Insurance

Complexity

Irrevocability

Trust Administration Expenses

Potential Tax Implications

Factors to Consider When Implementing TOLI

Selection of Trustee

Policy Type and Funding

Trust Beneficiaries

State and Federal Tax Laws

Common Use Cases for Trust-Owned Life Insurance

High-Net-Worth Individuals

Business Succession Planning

Family Wealth Transfer

Philanthropic Goals

Final Thoughts

Trust-Owned Life Insurance (TOLI) FAQs

Trust-Owned Life Insurance is a type of life insurance policy that is owned by a trust, typically established by a wealthy individual or family for estate planning purposes.

TOLI policies are purchased by a trust, which is the legal owner of the policy. The trust pays the premiums on the policy, and the death benefit is paid out to the beneficiaries named in the trust upon the death of the insured.

TOLI can provide several benefits, including tax-efficient wealth transfer, creditor protection, and liquidity to pay estate taxes and other expenses.

The risks associated with TOLI include policy lapse or termination, which can result in loss of coverage or unexpected tax liabilities, and changes in tax laws or insurance regulations that can impact the policy's performance.

TOLI is unique in that the policy is owned by a trust, rather than an individual, and is typically used for estate planning purposes. TOLI policies can also be more complex than other types of life insurance policies, requiring specialized knowledge and expertise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.