VA Life Insurance refers to a type of life insurance coverage specifically designed for veterans of the United States Military and their eligible family members. It is a program offered by the Department of Veterans Affairs (VA) with the objective of providing financial protection to veterans and their loved ones in the event of a veteran's death. The purpose of VA Life Insurance is to ensure that veterans and their families have access to affordable and reliable life insurance coverage to secure their financial well-being. VA Life Insurance policies offer various coverage options, including death benefits, and often feature competitive premiums. This benefit can assist with various expenses such as funeral costs, outstanding debts, mortgage payments, and everyday living expenses. VA life insurance plays a crucial role by offering veterans and their families an extra layer of financial security, ensuring their loved ones are financially supported during difficult times. VGLI is a post-separation renewable term life insurance program available to veterans who had Servicemembers' Group Life Insurance (SGLI) coverage during their active duty. VGLI allows veterans to convert their SGLI coverage into renewable term insurance that can be continued for a lifetime. The coverage amount is based on the amount of SGLI coverage the veteran had at the time of separation. S-DVI is a life insurance program specifically designed for veterans with service-connected disabilities. It provides coverage to veterans who have been rated by the VA as having a service-connected disability. S-DVI offers two types of coverage: S-DVI Veterans' Life Insurance and Supplemental S-DVI, with varying benefit levels and premium rates. VMLI is a mortgage protection insurance program for severely disabled veterans who have received a VA grant for the purchase of specially adapted housing. It helps to pay off the outstanding mortgage balance on the veteran's adapted home in the event of their death. VMLI coverage decreases over time as the mortgage is paid off. While specific coverage and benefits may vary depending on the policy type, the following elements are commonly found in VA life insurance policies: The primary purpose of VA life insurance is to provide a death benefit to designated beneficiaries upon the veteran's passing. The death benefit is a lump sum payment that can be used by beneficiaries to cover various expenses, such as funeral costs, outstanding debts, and ongoing living expenses. The amount of the death benefit is determined by the policy type and the coverage selected by the veteran. Some VA life insurance policies, such as Service-Disabled Veterans' Insurance, may offer disability coverage in addition to the death benefit. Disability coverage provides financial protection in the event that the insured veteran becomes disabled due to a service-connected injury or illness. This coverage can provide income replacement or financial assistance for medical expenses, rehabilitation, and other disability-related costs. Veterans' Mortgage Life Insurance (VMLI) is a specific VA life insurance policy designed to provide mortgage protection to severely disabled veterans who have received a VA grant for specially adapted housing. In the event of the insured veteran's death, VMLI helps pay off the outstanding mortgage balance on the adapted home. This coverage ensures that the veteran's family can continue to reside in the specially adapted home without the burden of a mortgage. To access VA life insurance, veterans need to meet certain eligibility criteria established by the Department of Veterans Affairs. These criteria help determine whether a veteran qualifies for the coverage. The following factors are typically considered: Veterans must have served in the United States military and meet specific requirements regarding the length and type of service. Different VA life insurance policies may have varying service requirements, such as minimum active duty periods or specific dates of service. The veteran's discharge status plays a crucial role in determining eligibility for VA life insurance. Generally, veterans with an honorable discharge, general discharge under honorable conditions, or other-than-dishonorable discharge are eligible for VA life insurance programs. However, veterans with dishonorable discharges are typically ineligible. While most VA life insurance policies do not require a medical exam for eligibility, the veteran's health condition may still be a consideration. Certain severe health conditions or disabilities may impact eligibility for specific policies, such as the Service-Disabled Veterans' Insurance program. Once veterans have assessed their eligibility, they can proceed with applying for VA life insurance. The application process for VA life insurance involves several steps. Veterans need to gather the necessary information and documentation to complete the application accurately. Understanding the application process helps streamline the overall experience and ensures that veterans provide all the required information. To apply for VA life insurance, veterans must submit specific documentation and forms. This section outlines the documents typically required, such as proof of military service, health information, and beneficiary designations. Once the application is submitted, it undergoes an underwriting process. This involves assessing the applicant's medical history and other relevant factors to determine the insurability and premium rates. The underwriting process may involve a review of medical records, interviews, or medical examinations. Understanding this process helps veterans anticipate any potential requirements or delays in policy approval. After approval, the VA life insurance policy comes into effect, and veterans become policyholders. This section explains the effective dates of the policy and outlines the steps required to activate the coverage. When a policyholder passes away, beneficiaries need to initiate the process of filing a VA life insurance claim to receive the death benefit. To ensure a smooth and efficient claims process, beneficiaries must gather the necessary documentation. One of the primary documents required to file a VA life insurance claim is the policyholder's death certificate. This document serves as official proof of the policyholder's passing and is typically obtained from the relevant authorities, such as the attending physician or the local registrar of vital statistics. Beneficiaries may need to provide proof of their identity to establish their relationship to the deceased policyholder and their entitlement to the death benefit. This can be done through documents such as government-issued identification cards, birth certificates, or marriage certificates. Beneficiaries must provide accurate and up-to-date information regarding their contact details and relationship to the deceased policyholder. This information helps ensure that the death benefit reaches the intended recipients without any complications. It is crucial for policyholders to designate beneficiaries when setting up their VA life insurance policy. Beneficiary designations specify who will receive the death benefit upon the policyholder's passing. By keeping beneficiary designations current and accurate, policyholders can ensure that their intended recipients receive the death benefit without delays or disputes. Life circumstances can change over time, such as marriages, divorces, births, or deaths within the family. It is important for policyholders to periodically review their beneficiary designations and make updates as necessary to reflect any changes in their personal circumstances. This helps ensure that the death benefit goes to the intended individuals or entities. Once a VA life insurance claim is filed, the insurance provider initiates a verification process to ensure the validity of the claim and the submitted documentation. This may involve reviewing the death certificate, beneficiary information, and policy details. Beneficiaries may have options for receiving the death benefit, such as a lump sum payment or annuity payments. Each option has its own implications in terms of tax considerations, investment opportunities, and financial planning. When it comes to the income tax treatment of VA life insurance benefits, there is good news for beneficiaries – in general, the death benefits they receive are tax-free. This means that the beneficiaries do not have to include the VA life insurance proceeds as taxable income on their federal tax returns. Whether the death benefit is paid out in a lump sum or through installment payments, it is typically exempt from income tax. This favorable tax treatment ensures that the beneficiaries can fully utilize the benefit amount without any tax obligations, providing them with much-needed financial support during a challenging time. While VA life insurance benefits are generally tax-free, it's important to note that certain situations may qualify for additional tax exemptions or exclusions. These exemptions or exclusions are designed to provide further tax relief to individuals in specific circumstances. For example, benefits received by a surviving spouse of a deceased veteran are often exempt from federal income tax. This means that the surviving spouse can receive the VA life insurance proceeds without having to pay income tax on them. Additionally, if the VA life insurance proceeds are used to cover funeral expenses, they may be excluded from income tax as well. These exemptions and exclusions serve to alleviate the tax burden on beneficiaries and allow them to make the most of the VA life insurance benefits they receive. VA life insurance policies can have estate tax implications, depending on the value of the policyholder's estate. Estate tax is a tax imposed on the transfer of a person's assets after their death. If the total value of the policyholder's estate, including the VA life insurance policy, exceeds the estate tax exemption threshold set by the IRS, estate taxes may be levied on the estate. It's important for policyholders to be aware of these potential estate tax implications when considering their overall estate planning. VA Life Insurance is a specialized life insurance program offered by the Department of Veterans Affairs (VA) to provide financial protection for veterans and their eligible family members. It ensures affordable and reliable coverage in the event of a veteran's death. VA Life Insurance policies offer various benefits, including death benefits, competitive premiums, disability coverage for service-connected disabilities, and mortgage protection for adapted housing. Eligibility criteria are based on military service, discharge status, and health condition. The application process involves submitting required documentation and undergoing underwriting. Filing a VA Life Insurance claim requires documentation such as a death certificate and proof of identity. Designating and updating beneficiaries is crucial, and the review of beneficiary designations is recommended to reflect changes in personal circumstances. VA life insurance benefits are generally tax-free for beneficiaries, with potential exemptions for surviving spouses and exclusions for funeral expenses. Estate tax implications may arise if the total value of the estate, including the VA life insurance policy, exceeds the IRS exemption threshold. Understanding these aspects empowers veterans and their families to make informed decisions regarding their insurance coverage and estate planning.Definition of VA Life Insurance

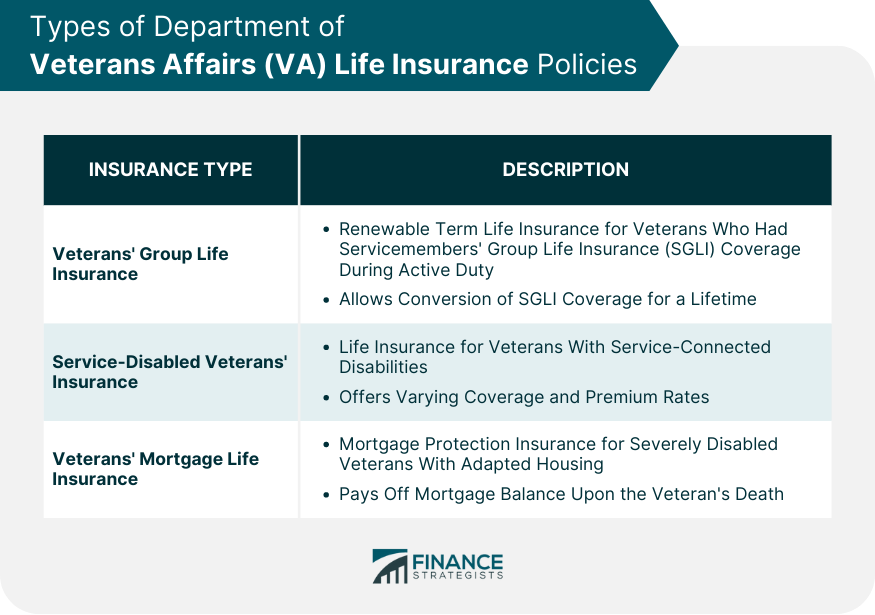

Types of VA Life Insurance Policies

Veterans' Group Life Insurance (VGLI)

Service-Disabled Veterans' Insurance (S-DVI)

Veterans' Mortgage Life Insurance (VMLI)

Coverage and Benefits of VA Life Insurance Policies

Death Benefit

Disability Coverage

Mortgage Protection

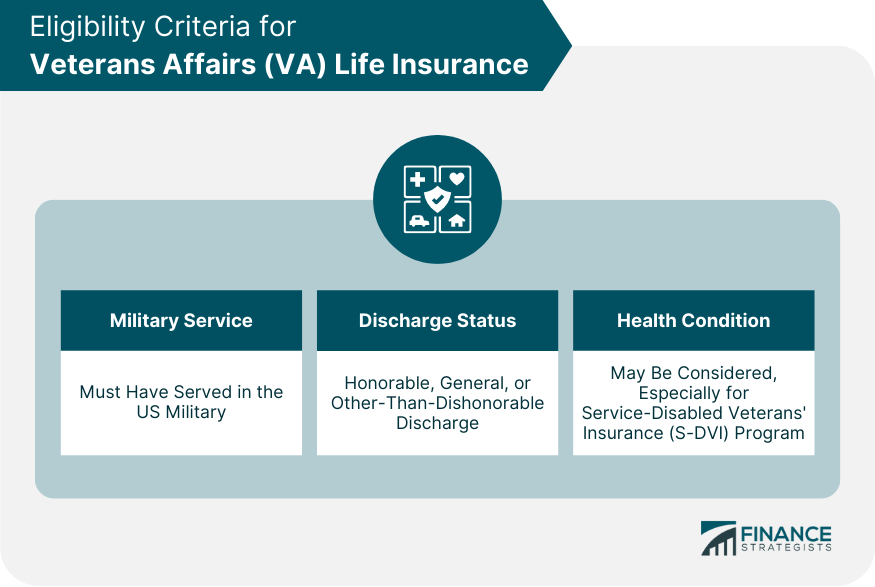

Eligibility Criteria for VA Life Insurance

Military Service

Discharge Status

Health Condition

Applying for VA Life Insurance

Submission of Required Documentation and Forms

Underwriting and Approval Process

Policy Activation

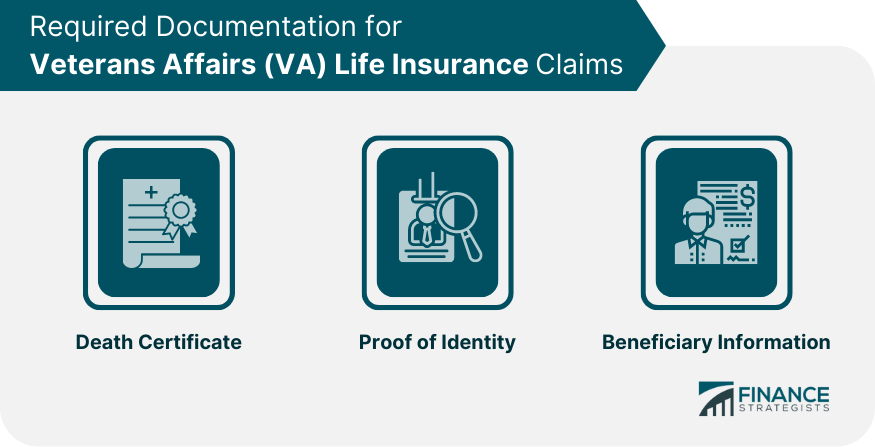

Filing a VA Life Insurance Claim

Required Documentation for Claims

Death Certificate

Proof of Identity

Beneficiary Information

Beneficiary Designation and Updates

Importance of Designating Beneficiaries

Reviewing and Updating Beneficiary Designations

Processing and Disbursement of Death Benefits

Claim Verification

Disbursement Options

Tax Considerations for VA Life Insurance

Income Tax Treatment of VA Life Insurance Benefits

Tax Exemptions and Exclusions

Estate Tax Implications of VA Life Insurance

Final Thoughts

VA Life Insurance FAQs

VA Life Insurance is a program offered by the Department of Veterans Affairs (VA) that provides life insurance coverage for veterans and their eligible family members.

Veterans, active-duty service members, and members of the Selected Reserve or National Guard are typically eligible for VA Life Insurance. Spouses and dependent children of veterans may also be eligible in certain cases.

VA offers several types of life insurance policies, including Veterans' Group Life Insurance (VGLI), Service-Disabled Veterans' Insurance (S-DVI), and Veterans' Mortgage Life Insurance (VMLI).

In general, VA life insurance death benefits are tax-free for the beneficiaries. However, it's important to consider potential estate tax implications based on the value of the policyholder's estate.

To apply for VA Life Insurance, you can complete the necessary forms and submit them to the Department of Veterans Affairs. The application process typically involves providing required documentation and undergoing an underwriting and approval process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.