Variable survivorship life insurance, also known as second-to-die or last-to-die life insurance, is a policy that covers two individuals, typically a married couple. The policy pays out the death benefit only after the death of the second insured person. It provides a unique coverage structure, designed to cater to specific financial planning needs such as estate planning and wealth transfer. The policy combines aspects of both permanent life insurance and investment products, allowing policyholders to allocate a portion of their premiums to investment accounts. This feature provides the potential for higher cash value growth, although it also exposes policyholders to investment risks. The cash value and death benefit may vary depending on the performance of the chosen investments. Variable survivorship life insurance holds importance for several reasons. It helps provide financial support to heirs and beneficiaries, ensuring that estate taxes and other expenses are covered after the death of both insured individuals. This can be especially beneficial for couples with a considerable amount of assets, as it helps prevent the need for heirs to sell off assets to cover estate taxes and other costs. Furthermore, the investment component of variable survivorship life insurance offers policyholders the opportunity to grow their cash value over time. This feature not only increases the potential death benefit but also serves as a long-term investment strategy, allowing policyholders to diversify their financial portfolios and potentially achieve higher returns. Variable survivorship life insurance policies typically involve flexible premium payments. Policyholders can adjust the amount and frequency of their premiums within certain limits, based on their financial situations and objectives. This flexibility allows policyholders to adapt their coverage to their changing needs and circumstances over time. It is essential to note that the premium payments are typically higher for variable survivorship life insurance policies than for other types of life insurance, due to the combined coverage of two individuals and the investment component. However, these higher premiums can potentially result in greater cash value growth and larger death benefits. The death benefit in a variable survivorship life insurance policy is paid out after the death of the second insured individual. This payout provides financial support to the beneficiaries, helping them cover estate taxes, debts, and other expenses. The death benefit amount can vary depending on the performance of the investments tied to the policy. Since the death benefit is only paid after both insured individuals pass away, variable survivorship life insurance policies are usually less expensive than purchasing two separate permanent life insurance policies. This affordability makes it an attractive option for couples seeking joint coverage and estate planning solutions. The cash value component of variable survivorship life insurance policies allows policyholders to accumulate tax-deferred savings over time. A portion of the premiums is allocated to investment accounts, which may include stocks, bonds, and mutual funds. The performance of these investments determines the growth of the cash value, as well as the death benefit. Policyholders can access their cash value through policy loans or withdrawals, although these actions may impact the death benefit and incur taxes. The cash value also serves as a financial safety net, providing policyholders with an additional source of funds in case of emergencies or financial hardships. Variable survivorship life insurance policies offer a range of investment options for policyholders to choose from, allowing them to tailor their investment strategies based on their risk tolerance and financial goals. These options typically include various stock, bond, and mutual fund accounts managed by professional investment firms. By diversifying their investments, policyholders can potentially achieve higher returns and reduce their exposure to market volatility. However, it is crucial to remember that investing in variable survivorship life insurance carries inherent risks, and there are no guarantees of returns or cash value growth. Policyholders should carefully consider their investment choices and consult with a financial advisor to ensure they make informed decisions. One of the primary benefits of variable survivorship life insurance is its usefulness in estate planning. The policy provides a substantial death benefit after the death of both insured individuals, ensuring that heirs and beneficiaries have the necessary funds to cover estate taxes and other expenses. This can help prevent the need to sell off family assets, such as a home or a business, to pay these costs. Additionally, the policy's death benefit can be structured to bypass probate, allowing for a quicker and smoother transfer of assets to the beneficiaries. This feature helps minimize legal complications and delays, providing financial security to the family during a difficult time. Variable survivorship life insurance policies offer several tax advantages. The growth of the cash value within the policy is tax-deferred, allowing policyholders to accumulate savings without incurring taxes on the gains. This can lead to a higher cash value and a larger death benefit over time. Furthermore, the death benefit paid out to beneficiaries is generally income tax-free, providing them with a valuable source of financial support. This tax benefit can be especially significant for high net worth couples, who may face substantial estate taxes upon their passing. The investment component of variable survivorship life insurance allows policyholders to participate in the financial markets, potentially achieving higher returns on their cash value. With a variety of investment options available, policyholders can diversify their portfolios and tailor their strategies to their risk tolerance and financial goals. While the investment aspect introduces an element of risk, it also provides policyholders with the opportunity to grow their cash value and death benefit substantially over time. This feature can make variable survivorship life insurance an attractive option for individuals seeking both life insurance coverage and investment growth. Variable survivorship life insurance policies offer a high degree of flexibility in terms of premium payments, death benefits, and investment choices. Policyholders can adjust their premiums within certain limits, allowing them to adapt their coverage to their changing financial needs. The policy also provides the option to access the cash value through loans or withdrawals, offering a source of emergency funds or financial support during challenging times. This flexibility can be an appealing feature for policyholders who value the ability to adapt their coverage and financial strategies as their circumstances change. One of the primary drawbacks of variable survivorship life insurance is the higher fees associated with the policy. These fees can include administrative costs, investment management fees, and insurance charges. The higher fees can reduce the overall return on the policy's investments and eat into the cash value growth. Policyholders should carefully review the fee structure of any variable survivorship life insurance policy they are considering and compare it to other life insurance and investment options to determine if the potential benefits outweigh the costs. While the investment component of variable survivorship life insurance can provide the potential for higher returns, it also exposes policyholders to investment risks. The performance of the investments tied to the policy can impact both the cash value and death benefit, potentially leading to losses if the investments perform poorly. Policyholders should be aware of these risks and ensure they are comfortable with the level of risk associated with their chosen investments. Consulting with a financial advisor can help individuals make informed decisions about their investment strategies and risk tolerance. Variable survivorship life insurance policies can be complex, with numerous features, investment options, and fees to consider. Navigating the policy and making informed decisions about coverage, investments, and premiums can be challenging, particularly for individuals without a strong background in finance or insurance. Before purchasing a variable survivorship life insurance policy, individuals should ensure they fully understand the policy's features and implications. Working with a knowledgeable financial advisor or insurance agent can help policyholders make well-informed decisions and develop a comprehensive financial plan that aligns with their needs and goals. Although variable survivorship life insurance policies allow policyholders to access their cash value through loans or withdrawals, these actions can have consequences. Taking a policy loan or making a withdrawal may reduce the death benefit, and withdrawals may be subject to taxes. Additionally, accessing the cash value can negatively impact the policy's overall performance and growth potential. As a result, policyholders should view the cash value component of their variable survivorship life insurance as a long-term investment rather than an easily accessible source of funds. In cases where liquidity is a priority, individuals may want to explore alternative financial products that offer more accessible funds without impacting their life insurance coverage. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If the insured person dies during the term, the policy pays out a death benefit to the beneficiaries. Term life insurance is generally more affordable than permanent life insurance options, such as variable survivorship life insurance, as it does not include a cash value component. However, term life insurance does not offer the same investment opportunities, estate planning benefits, or tax advantages as variable survivorship life insurance. Individuals should consider their specific financial needs and goals when choosing between term and variable survivorship life insurance. Whole life insurance is a type of permanent life insurance that provides coverage for the insured person's entire life, as long as premiums are paid. It also includes a cash value component, which grows at a guaranteed rate over time. Whole life insurance offers some of the same estate planning and tax benefits as variable survivorship life insurance but lacks the investment component and associated risks. For individuals seeking a more conservative and stable cash value growth option, whole life insurance may be a suitable alternative to variable survivorship life insurance. However, it may not provide the same potential for higher returns and investment diversification. Universal life insurance is another type of permanent life insurance that offers flexibility in premium payments and death benefit amounts. Like variable survivorship life insurance, universal life insurance includes a cash value component, which earns interest based on a rate set by the insurance company. While universal life insurance does not offer the same investment options as variable survivorship life insurance, it provides a more predictable and stable cash value growth. Policyholders should weigh the benefits and risks of each policy type to determine the best fit for their financial needs and goals. Variable survivorship life insurance is a unique and versatile financial product that offers both life insurance coverage and investment opportunities. With its estate planning benefits, tax advantages, and flexible features, it can be an attractive option for couples seeking joint coverage and a long-term investment strategy. However, it is essential to consider the potential disadvantages of variable survivorship life insurance, such as high fees, investment risks, complexity, and limited liquidity. Before purchasing a policy, individuals should consult with a financial advisor to ensure they understand the policy's features and implications and make well-informed decisions that align with their financial goals. Ultimately, variable survivorship life insurance can be a valuable financial tool for some individuals, but it may not be the best fit for everyone. By comparing the features, benefits, and drawbacks of various life insurance options, policyholders can make the best choice for their unique needs and circumstances.What Is Variable Survivorship Life Insurance?

Importance of Variable Survivorship Life Insurance

Features of Variable Survivorship Life Insurance

Premiums

Death Benefit

Cash Value

Investment Options

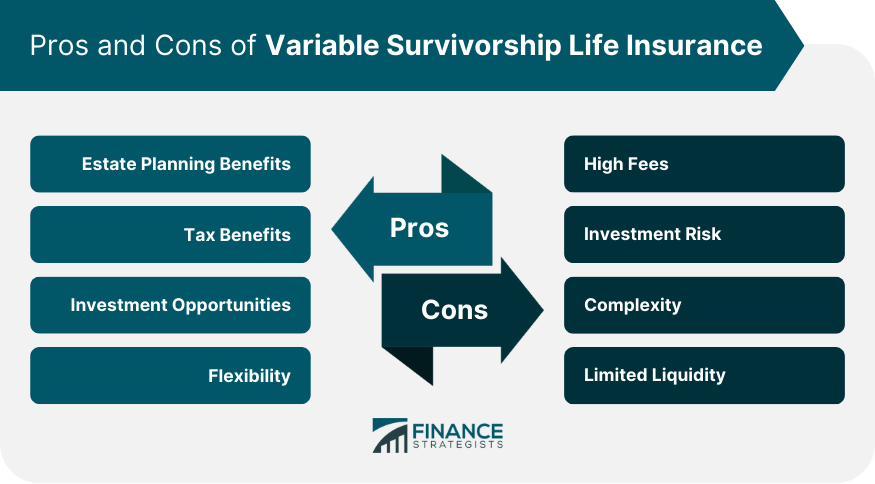

Advantages of Variable Survivorship Life Insurance

Estate Planning

Tax Benefits

Investment Opportunities

Flexibility

Disadvantages of Variable Survivorship Life Insurance

High Fees

Investment Risk

Complexity

Limited Liquidity

Comparison With Other Types of Life Insurance

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Final Thoughts

Variable Survivorship Life Insurance FAQs

Variable Survivorship Life Insurance is a type of life insurance policy that insures two lives and pays out a death benefit after the second person dies.

The pros of Variable Survivorship Life Insurance include tax benefits, investment opportunities, flexibility, and the ability to use it for estate planning.

The cons of Variable Survivorship Life Insurance include high fees, investment risk, complexity, and limited liquidity.

Variable Survivorship Life Insurance is different from other types of life insurance because it insures two lives and pays out after the second person dies. It also offers investment options and tax benefits.

Whether Variable Survivorship Life Insurance is right for you depends on your specific financial goals and circumstances. It may be a good choice if you are seeking estate planning benefits and have a high net worth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.