Variable Universal Life Insurance (VUL) is a type of permanent life insurance that combines the features of both universal life insurance and variable life insurance. This insurance product offers policyholders flexibility in premium payments, an adjustable death benefit, and the potential to grow cash value through investment options. Variable universal life insurance policies provide policyholders with several key features, including flexible premiums, an adjustable death benefit, cash value accumulation, and an investment component that offers a range of investment options. VUL policies are designed for individuals seeking a life insurance product that offers not only financial protection for their beneficiaries but also the opportunity to grow their wealth through investment options. Policyholders of VUL insurance can adjust their premium payments based on their financial circumstances. They can increase, decrease, or even skip premium payments, provided the policy has sufficient cash value to cover insurance costs. The death benefit in a VUL policy can be adjusted by the policyholder, allowing for increased or decreased coverage as needed to align with their financial goals and changing life circumstances. VUL policies accumulate cash value over time, which can be used for various purposes, such as paying premiums, taking out loans, or withdrawing funds. A significant aspect of VUL policies is the investment component, which allows policyholders to allocate a portion of their premiums to a range of investment options, including stocks, bonds, mutual funds, and money market funds. Policyholders can invest in individual stocks or stock funds, providing the potential for capital appreciation. Bond funds offer a more conservative investment option, providing income through interest payments. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, offering potential for growth and income. Money market funds are a low-risk investment option that invests in short-term debt securities, providing income and liquidity. VUL policies offer policyholders the flexibility to adjust their premium payments based on their financial needs and circumstances. With various investment options available, VUL policies provide policyholders with the potential for cash value growth based on the performance of the underlying investments. Policyholders can adjust their death benefit to meet their changing financial goals and life circumstances. VUL policyholders have the ability to choose and adjust their investment allocations, providing control over the growth potential and risk level of their cash value component. VUL policies offer tax advantages, such as tax-deferred growth of cash value and tax-free death benefits to beneficiaries. VUL policies are more complex than other types of life insurance, requiring policyholders to have a good understanding of investment options, fees, and charges. VUL policies can be more expensive than other types of life insurance due to higher premiums, fees, and charges associated with the investment component. The investment component of VUL policies carries inherent risk, as the performance of the underlying investments can fluctuate, affecting the policy's cash value and potentially the death benefit. If a policy's cash value is insufficient to cover insurance costs, the death benefit may be reduced or the policy may lapse, leaving the policyholder without coverage. Term life insurance provides coverage for a specific period, typically 10 to 30 years, and offers a death benefit only. It does not have a cash value component or investment options, making it less complex and more affordable than VUL policies. However, term life insurance does not provide lifelong coverage or the potential for cash value growth. Whole life insurance offers lifelong coverage with a guaranteed death benefit and a cash value component that grows at a guaranteed rate. While it provides more stability than VUL policies, it does not offer the same level of flexibility in premium payments or the potential for higher cash value growth through investment options. Traditional universal life insurance provides lifelong coverage, flexible premiums, and an adjustable death benefit like VUL policies. However, its cash value growth is based on a guaranteed minimum interest rate rather than investment options, making it less complex but also offering less potential for cash value growth. Indexed universal life insurance is similar to VUL policies in terms of flexibility and adjustable death benefits. However, the cash value growth is linked to a specific market index, such as the S&P 500, offering potential for higher returns than traditional universal life insurance but with less investment risk than VUL policies. When considering a VUL policy, it is essential to evaluate how it aligns with your financial goals, such as wealth accumulation, retirement planning, or estate planning. Understanding your risk tolerance is crucial when choosing a VUL policy, as the investment component carries inherent risks that can impact the policy's cash value and death benefit. The longer your time horizon, the more likely you can benefit from the potential cash value growth offered by a VUL policy, as you have more time for the investments to potentially recover from market fluctuations. Consider the costs associated with VUL policies, including higher premiums, fees, and charges, and ensure that the policy is affordable within your financial circumstances. Variable universal life insurance policies offer a unique combination of life insurance coverage and investment potential, making them a versatile financial planning tool for individuals with specific financial goals, risk tolerance, and time horizons. However, the complexity of VUL policies, including the inherent risks associated with the investment component, requires a thorough understanding of the product and its suitability within one's financial plan. When considering a VUL policy, it is essential to consult with financial advisors and insurance agents to assess the policy's alignment with your financial goals and needs. By evaluating various policy options and riders, you can ensure that your VUL policy serves as an effective component in your overall financial strategy, whether that includes wealth accumulation, retirement planning, or estate planning.What Is Variable Universal Life Insurance?

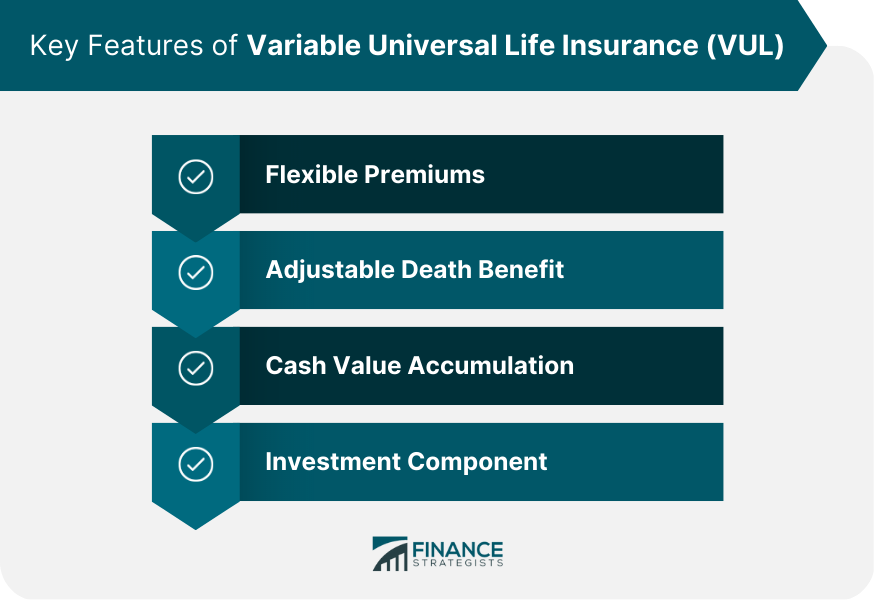

Key Features of Variable Universal Life Insurance

Flexible Premiums

Adjustable Death Benefit

Cash Value Accumulation

Investment Component

Types of Investment Options in VUL Policies

Stocks

Bonds

Mutual Funds

Money Market Funds

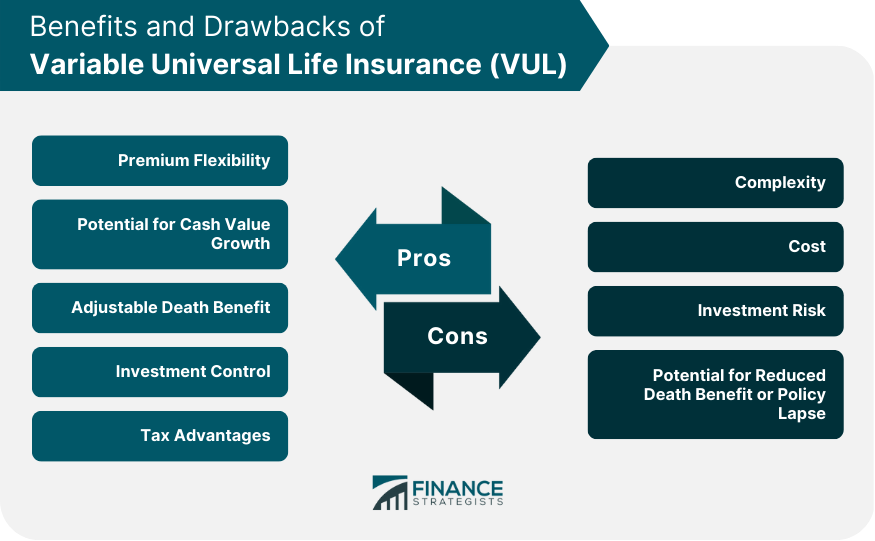

Advantages of Variable Universal Life Insurance

Premium Flexibility

Potential for Cash Value Growth

Adjustable Death Benefit

Investment Control

Tax Advantages

Disadvantages of Variable Universal Life Insurance

Complexity

Cost

Investment Risk

Potential for Reduced Death Benefit or Policy Lapse

Comparing VUL to Other Life Insurance Options

Term Life Insurance

Whole Life Insurance

Traditional Universal Life Insurance

Indexed Universal Life Insurance

Factors to Consider When Choosing Variable Universal Life Insurance

Financial Goals

Risk Tolerance

Time Horizon

Affordability

Conclusion

Variable Universal Life Insurance (VUL) FAQs

Variable Universal Life Insurance is a type of permanent life insurance policy that combines the features of universal life insurance with investment options. With VUL, policyholders have the ability to invest their premiums in a range of investment options, such as mutual funds or stocks.

Unlike traditional life insurance policies, VUL policies provide investment options. The policyholder's premiums are invested in a range of investment options that the policyholder selects, and the policy's cash value may increase or decrease depending on the performance of the investments. VUL policies also offer flexibility in the amount and timing of premium payments and the death benefit amount.

The primary benefit of VUL is the investment component, which can allow policyholders to potentially grow their policy's cash value over time. VUL policies also offer flexibility in premium payments and death benefit amounts, which can be adjusted as needed.

The investment component of VUL can also be a risk, as the policy's cash value may decrease if the investments perform poorly. Additionally, VUL policies may have higher fees than traditional life insurance policies due to the investment options and management of the policy's cash value.

VUL policies may be a good choice for individuals who have a higher risk tolerance and are interested in the potential for investment growth. However, VUL policies may not be the best choice for those who prioritize low-cost insurance coverage or prefer a more straightforward life insurance policy. It's important to consult with a financial professional to determine if VUL is the right choice for your individual needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.