A viatical settlement is a financial transaction in which a terminally or chronically ill policyholder (the viator) sells their life insurance policy to a third party (the viatical settlement provider) for a lump sum payment. The payment is typically less than the policy's death benefit but greater than its cash surrender value. Viatical settlements emerged in the 1980s in response to the AIDS epidemic, allowing terminally ill patients to access much-needed funds for medical expenses and other needs. Today, viatical settlements are used by policyholders with various terminal or chronic illnesses to access immediate cash to cover medical costs, living expenses, or other financial needs. The viator is the life insurance policyholder who sells their policy to a viatical settlement provider. The viator is typically someone with a terminal or chronic illness who needs immediate funds to cover medical expenses, living costs, or other financial needs. The viatical settlement provider is a company or individual that purchases life insurance policies from viators. They become the new policy owner and beneficiary, assuming responsibility for paying premiums and receiving the death benefit upon the viator's death. A viatical settlement broker is a professional who represents the policyholder in the transaction, helping them find a suitable viatical settlement provider and negotiate the best possible offer for their life insurance policy. The buyer, or investor, is the individual or entity that invests in the purchased life insurance policy. They provide the funds to the viatical settlement provider to purchase the policy and expect a return on their investment when the death benefit is paid out. Eligibility for a viatical settlement typically depends on the policyholder's life expectancy and the type and value of their life insurance policy. Generally, policyholders with a life expectancy of less than two to four years and a policy with a minimum face value of $100,000 are considered eligible. An essential factor in determining the value of a viatical settlement offer is the policyholder's life expectancy. Medical professionals or life expectancy underwriters provide these estimates based on the policyholder's medical records and other relevant factors. The viatical settlement provider calculates an offer for the policy based on the policy's face value, the policyholder's life expectancy, and the expected return on investment for the buyer. The offer is typically a percentage of the policy's death benefit. Once the policyholder accepts an offer, they sign a contract with the viatical settlement provider. The provider then pays the policyholder the agreed-upon amount, takes over premium payments, and becomes the new policy owner and beneficiary. A viatical settlement provides policyholders with immediate cash that can be used to cover medical expenses, living costs, or other financial needs. By selling their life insurance policy, policyholders are relieved from the ongoing responsibility of paying premiums. Viatical settlements can offer attractive returns for investors, particularly if the policyholder's life expectancy is shorter than expected. Investing in viatical settlements can help investors diversify their investment portfolios by adding a non-correlated asset class. By selling their life insurance policy, policyholders relinquish the death benefit that would have been paid to their beneficiaries. This may leave their loved ones with less financial support in the event of the policyholder's death. Although proceeds from viatical settlements are generally tax-free for terminally ill individuals, there may be tax implications for chronically ill policyholders or those who don't meet specific IRS criteria. Viatical settlement transactions can be susceptible to fraud. Policyholders should work with reputable, licensed brokers and providers to minimize this risk. If the policyholder lives longer than expected, the investor may receive a lower return on their investment, as they continue to pay premiums for a more extended period. Changes in regulations or legal disputes can impact the value of a viatical settlement investment, potentially leading to losses for investors. Viatical settlement investments are generally illiquid, meaning they can be challenging to sell or redeem before the policyholder's death. Ensure that the viatical settlement provider and broker are licensed and regulated in the state where the transaction is taking place. Check their records for any disciplinary actions or complaints. Research the provider and broker's experience and reputation in the industry. Seek recommendations from trusted sources or read online reviews to gather information about their customer satisfaction and professionalism. A reputable viatical settlement provider and broker should be transparent about the transaction process, fees, and potential risks. They should be willing to answer questions and provide regular updates throughout the process. Viatical settlements offer a valuable financial solution for policyholders with terminal or chronic illness, providing immediate cash to cover expenses and reduce financial burdens. These settlements can be a source of relief for individuals facing difficult medical conditions, allowing them to access funds from their life insurance policy while they are still alive. At the same time, viatical settlements can be an attractive opportunity for investors seeking high returns and portfolio diversification. However, it is important for both policyholders and investors to understand the risks involved and work with reputable providers and brokers to ensure a successful and secure transaction.What Are Viatical Settlements?

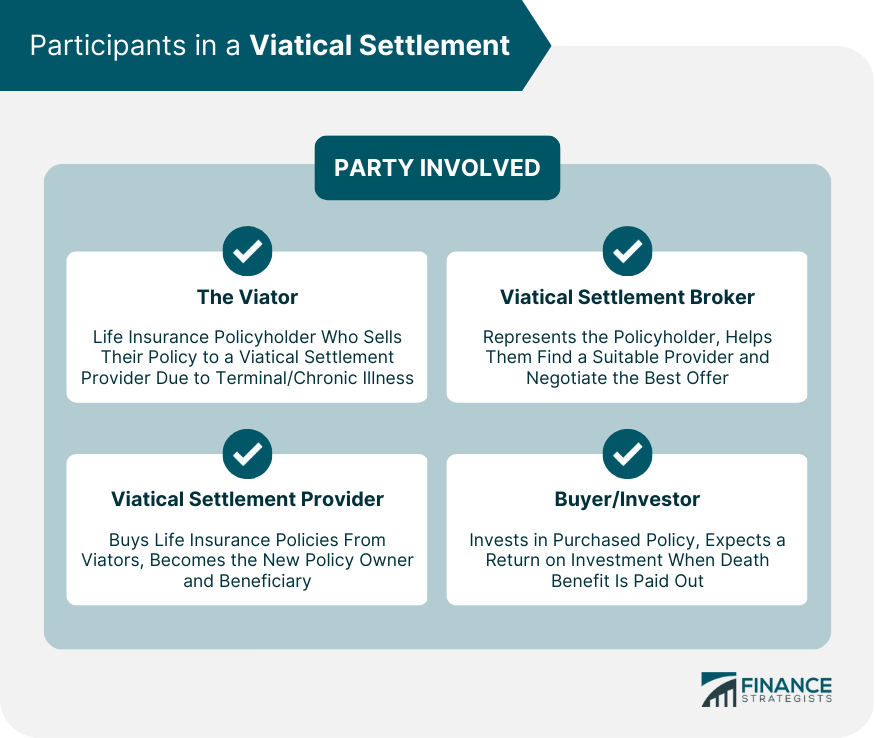

Participants in a Viatical Settlement

The Viator (Policyholder)

The Viatical Settlement Provider

The Viatical Settlement Broker

The Buyer or Investor

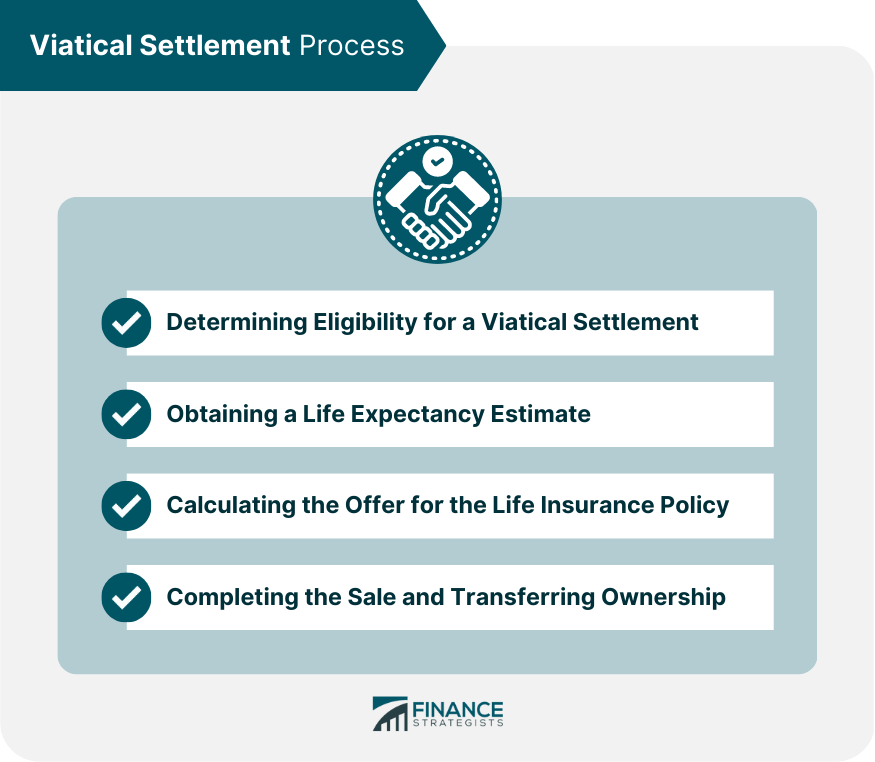

Viatical Settlement Process

Determining Eligibility for a Viatical Settlement

Obtaining a Life Expectancy Estimate

Calculating the Offer for the Life Insurance Policy

Completing the Sale and Transferring Ownership

Benefits of Viatical Settlements

Benefits for Policyholders

Access to Immediate Funds

Relief from Premium Payments

Benefits for Investors

Potential for High Returns

Diversification of Investment Portfolio

Risks and Considerations in Viatical Settlements

Risks for Policyholders

Loss of Death Benefit

Tax Implications

Potential Fraud

Risks for Investors

Longevity Risk

Regulatory and Legal Risks

Illiquidity Risk

Choosing a Viatical Settlement Provider and Broker

Licensing and Regulation

Experience and Reputation

Transparency and Communication

Conclusion

Viatical Settlements FAQs

Viatical settlements are financial transactions where an individual sells their life insurance policy to a third-party company for a lump sum payment, which is typically a percentage of the policy's face value. The third-party company then becomes the policy's beneficiary and assumes responsibility for paying the premiums until the policyholder passes away.

Viatical settlements are typically considered by individuals with a terminal or chronic illness who need additional funds to cover medical expenses or other costs associated with their condition. The lump sum payment from the viatical settlement can provide immediate financial relief, but the policyholder's beneficiaries will no longer receive the death benefit from the policy.

The value of a viatical settlement is determined based on several factors, including the policy's face value, the policyholder's life expectancy, and the policy's premiums. Typically, the shorter the life expectancy of the policyholder, the higher the value of the settlement.

One risk associated with viatical settlements is the possibility that the policyholder may outlive their life expectancy, which would result in lower returns for the settlement provider. Additionally, viatical settlements may be subject to taxation and may not be available in all states.

Alternatives to viatical settlements include other financial arrangements, such as life settlements or accelerated death benefits. Life settlements involve selling a life insurance policy to a third-party company for a lump sum payment, but are typically considered by individuals who are not terminally ill. Accelerated death benefits allow policyholders to access a portion of their death benefit while they are still alive to cover medical expenses or other costs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.