Life insurance, a contract between an individual and an insurance company, is crucial in financial planning. By paying a premium, the individual, known as the policyholder, secures a death benefit that the insurer promises to pay to the beneficiaries upon the policyholder's death. This benefit serves as financial protection, ensuring the policyholder's dependents can manage economically in their absence. There are primarily two types of life insurance—term life and whole life insurance. Term life insurance covers a specific period, while whole life insurance covers the policyholder's entire lifetime and an added cash value component. Within these types, there are several variations, including universal life, variable life, and others, each tailored to different needs and circumstances. Life insurance offers financial protection to your loved ones during your demise. It covers a range of expenses, including funeral costs, outstanding debts, and can replace lost income, ensuring your dependents maintain their living standards. Some policies also offer additional benefits, such as coverage for accidental death, dismemberment, and terminal or chronic diseases. However, coverage varies based on policy type, the policyholder's health status, age, and lifestyle. Understanding your life insurance policy's coverage details is crucial to protect you. You can make informed decisions to secure your family's financial future by examining what life insurance covers. Life insurance can help cover funeral expenses, which often amount to thousands of dollars, reducing the financial burden on the bereaved family. The payout from a life insurance policy can also be used to settle the policyholder's outstanding debts, such as mortgages, personal loans, or credit card bills. One of the main functions of life insurance is to replace the income the policyholder would have generated had they lived, ensuring their dependents can maintain their standard of living. This benefit is paid out if the policyholder suffers severe injury or death due to an accident. Typically, it provides a lump-sum payment and can be a standalone policy or a rider on a standard life insurance policy. The policy stipulates the events are considered accidental, and the payout depends on the severity of the injury. Some life insurance policies cover terminal illnesses or chronic diseases, allowing policyholders to receive a portion of the death benefit while still alive. Known as an accelerated death benefit, this option is often included in policies at no extra charge but may also be available as a rider. It helps policyholders manage their healthcare costs and provides financial relief when needed. Riders are benefits that can be added to a basic life insurance policy. They allow policyholders to customize their coverage to suit their needs, often at an extra cost. They're particularly beneficial for those with specific health concerns or lifestyle factors that a standard policy might not fully cover. This rider covers severe illnesses like heart attacks, strokes, or cancer. The policyholder can receive a lump-sum payment in case of a diagnosed critical illness. This payout is usually deducted from the death benefit and can cover medical expenses, lost income, or other financial needs arising from the illness. If the policyholder becomes disabled and cannot work, this rider offers financial support. Specifically, it provides a monthly income or waives the policy premiums while the policyholder cannot work. This rider offers peace of mind, ensuring financial stability in the face of unforeseen disabilities. This rider pays an additional benefit if the policyholder dies in an accident. In such a situation, the beneficiaries receive the standard death benefit and an additional amount from this rider. It's particularly beneficial for those involved in high-risk occupations or hobbies, enhancing the financial safety net for their beneficiaries. This rider helps cover the costs of long-term care services, such as home health care or assisted living. If the policyholder needs help with daily activities due to a chronic illness or disability, the long-term care rider can provide regular payments. It is a sensible addition for those who want to protect their assets and savings from potentially high long-term care costs. The death benefit is the sum assured that the beneficiaries receive upon the policyholder's death. The payout method can significantly impact how the beneficiaries manage the funds and their financial future. The insurer pays the full death benefit at once to the beneficiaries. This payout method provides a significant amount of money immediately, allowing beneficiaries to cover immediate costs, settle debts, or invest as they see fit. It's the most straightforward payout option, ensuring beneficiaries have the full benefit. The insurer pays the death benefit as a series of payments over a certain period. This payout method provides a consistent income, benefiting beneficiaries who may need to be more adept at managing a large lump sum. The annuity option can also provide potential tax benefits depending on the jurisdiction. The insurer pays the death benefit in regular installments, with a set interest rate applied to the remaining balance. This option can provide a reliable income stream and ensure that the death benefit lasts for a specific period. It's often adjustable, allowing beneficiaries to alter the installment amount as their financial needs change. Insurance companies consider several factors when determining coverage limits and premiums, shaping the financial protection provided by the policy. Insurers consider the policyholder's health status when setting premiums and coverage terms. Pre-existing conditions, family medical history, and overall health can influence the premium amount and the policy's approval. A healthier individual often receives better premium rates. Older policyholders typically face higher premiums due to the increased mortality risk. Life insurance is generally less expensive when purchased at a younger age, highlighting the importance of early planning for life insurance coverage. Insurers may charge higher premiums or limit coverage for policyholders with risky habits like smoking or dangerous hobbies. These lifestyle factors increase the insurer's risk, leading to adjustments in coverage terms and premium rates. The type of policy and its term will also affect coverage, with longer terms and permanent policies generally offering more comprehensive coverage. For instance, whole life insurance offers lifelong coverage and a cash value component, making it a more extensive coverage option than term insurance. While life insurance provides broad financial protection, specific exclusions and limitations apply, potentially impacting beneficiaries' payout. Most life insurance policies include a suicide clause, which means the policy won't pay out if the policyholder dies by suicide within a certain period after the policy starts, typically two years. This clause protects the insurer from fraudulent practices, although it can leave beneficiaries without financial support in such tragic circumstances. The contestability period allows the insurer to investigate and deny claims made within two years of the policy if they discover misrepresentation or fraud. This provision safeguards the insurer but underscores the importance of honesty during the application process. If the policyholder intentionally provided incorrect information when applying for insurance, the insurer could reduce the death benefit or deny the claim. Misrepresentation affects the insurer's risk assessment, hence their reaction when discovered, reinforcing the need for accurate and truthful disclosure. If a policyholder dies while participating in dangerous activities or from excluded causes of death like war or illegal activities, the insurer might not pay the death benefit. Policyholders must understand these exclusions and discuss them with their insurance provider. Choosing the right life insurance policy requires careful consideration of personal circumstances. Consider your financial obligations, such as debts, income replacement needs, and future expenses, to determine the right amount of coverage. It's essential to consider your dependents' financial needs, mortgage or other loans, and potential future expenses like your children's education. A thorough financial assessment ensures your life insurance policy can adequately cover these obligations. The younger and healthier you are, the more affordable the policy. Buying life insurance when you're young and in good health allows you to lock in a lower premium rate for the duration of the policy. Considering future health risks based on your current lifestyle and family medical history is crucial. Review the different types of life insurance policies and their coverage to decide which suits your needs best. While term life insurance might be suitable for temporary coverage, whole-life or universal life insurance can provide lifelong coverage and additional benefits. Understanding the nuances of each policy type allows you to choose the coverage that aligns best with your long-term financial goals. Consider the cost of the policy, including premiums, fees, and potential out-of-pocket costs associated with additional benefits or riders. While finding a policy, you can afford is essential, ensuring it provides adequate coverage is equally important. Comparing different policies based on cost and coverage can help you find the best value for your investment. Life insurance is a critical element of financial planning. Policyholders must understand their coverage, ensuring the right policy serves their and their beneficiaries' needs. From funeral expenses to income replacement, understanding the breadth of coverage is crucial. Life insurance provides a financial buffer, addressing costs such as funeral expenses, debt repayments, and long-term care. The policyholder's age, health, and lifestyle influence premium rates and coverage, while riders offer additional benefits. Policies include limitations, such as suicide clauses and exclusions for specific causes of death. Choosing the right policy involves understanding one's financial needs, health status, and policy options. While life insurance can be complex, a knowledgeable insurance broker can demystify the process, understanding policy types, riders, and exclusions. By proactively securing a life insurance policy, you safeguard your financial future.Overview of Life Insurance

What Does Life Insurance Cover?

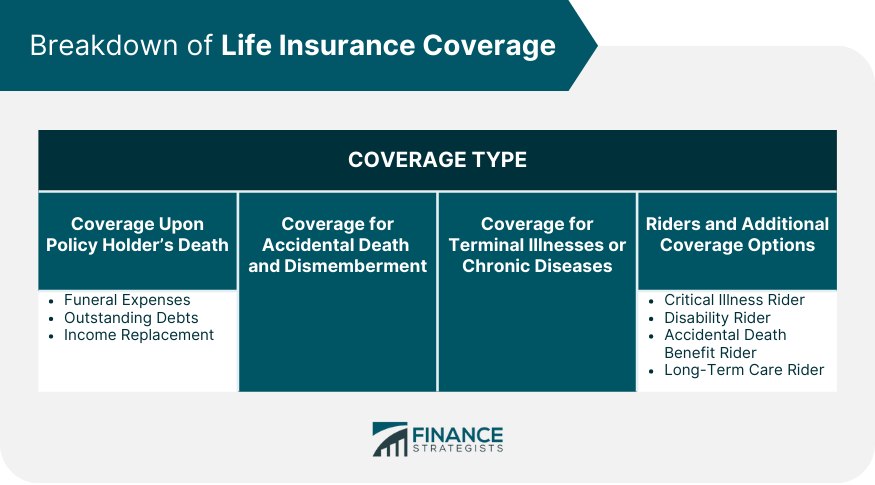

Detailed Breakdown of Life Insurance Coverage

Coverage Upon the Policyholder's Death

Funeral Expenses

Outstanding Debts

Income Replacement

Coverage for Accidental Death and Dismemberment

Coverage for Terminal Illnesses or Chronic Diseases

Riders and Additional Coverage Options

Critical Illness Rider

Disability Rider

Accidental Death Benefit Rider

Long-Term Care Rider

How Beneficiaries Receive the Death Benefit

Lump-Sum Payout

Annuity Option

Installment Option

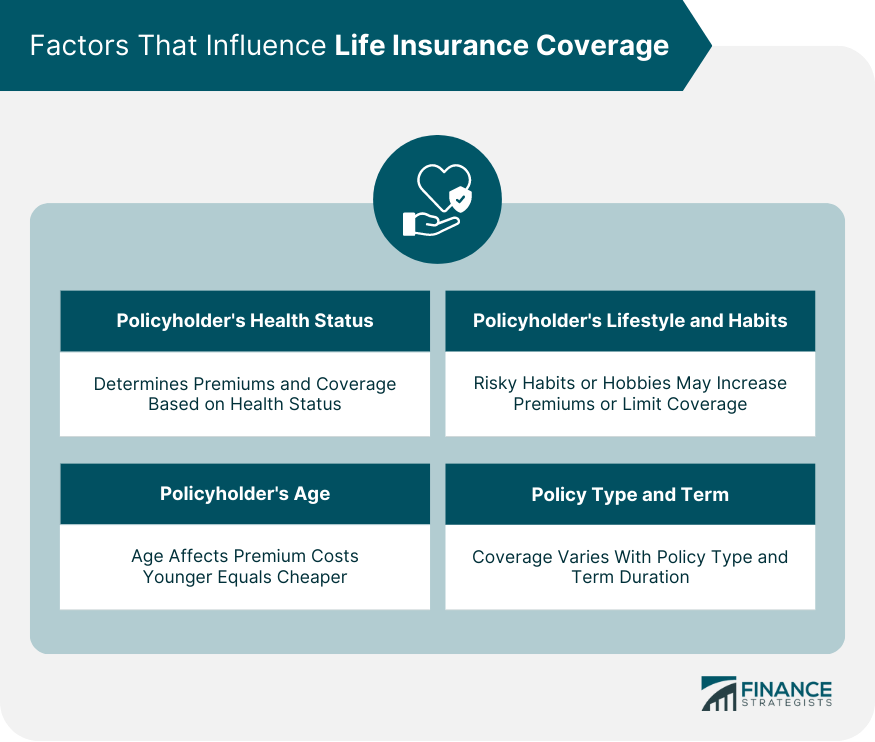

Factors That Influence Life Insurance Coverage

Policyholder's Health Status

Policyholder's Age

Policyholder's Lifestyle and Habits

Policy Type and Term

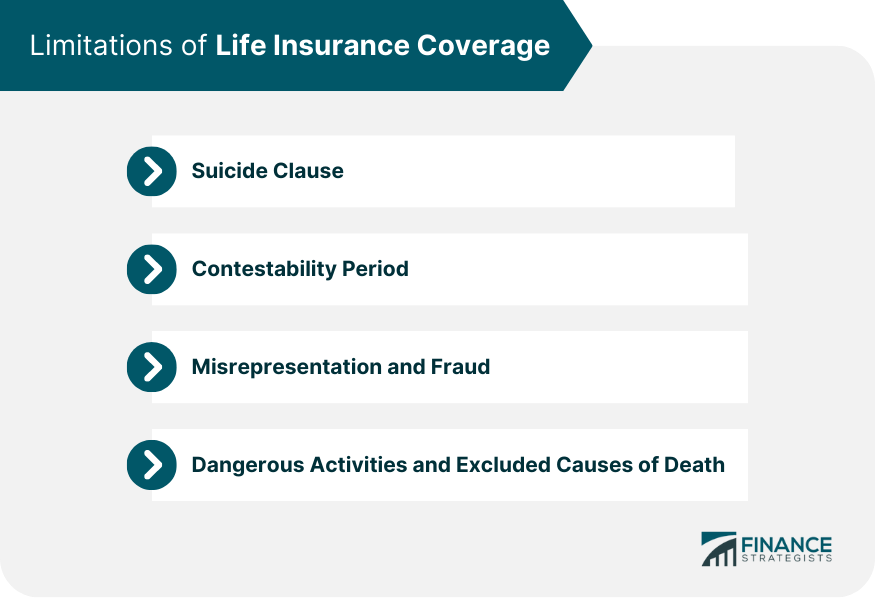

Limitations of Life Insurance Coverage

Suicide Clause

Contestability Period

Misrepresentation and Fraud

Dangerous Activities and Excluded Causes of Death

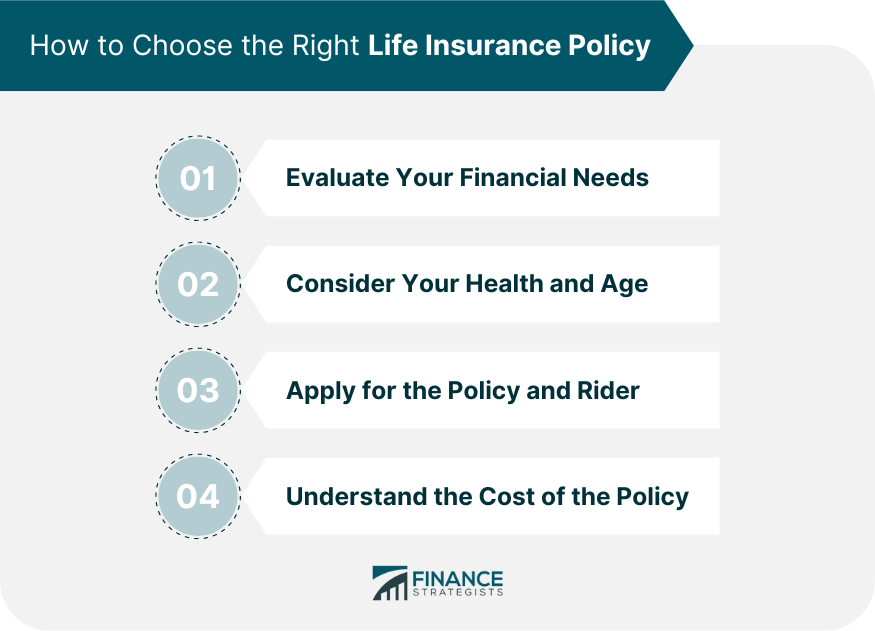

How to Choose the Right Life Insurance Policy

Evaluating Your Financial Needs

Considering Your Health and Age

Analyzing Policy Types and Coverage

Understanding the Cost of the Policy

Conclusion

What Does Life Insurance Cover? FAQs

Life insurance covers various expenses upon the policyholder's death, including funeral expenses, outstanding debts, and income replacement. The specific coverage depends on the policy terms.

Term life insurance offers coverage for a specific period, while whole life insurance provides lifelong coverage and a cash value component. Thus, the question "What does life insurance cover?" will yield different answers based on the type of insurance.

Some life insurance policies offer riders for critical illness or disability. These allow the policyholder to access part of the death benefit early if they become critically ill or disabled.

Typical exclusions include death due to suicide within a specific period after the policy start date, death during the contestability period due to misrepresentation or fraud, and death resulting from high-risk activities or excluded causes.

Life insurance offers different payout options, such as lump-sum payouts, annuities, or regular installments. The specific options depend on the policy terms and the insurer.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.