A lump sum payment is a large amount of money paid once and in full rather than in smaller payments over time. They often occur with legal settlements, inheritances, lottery winnings, and retirement plans. The purpose of lump sum payments is to streamline the transaction and eliminate the need for additional payments down the road. Lump sum payments have several advantages, including flexibility and simplicity. However, they can also be disadvantageous if the recipient is not prepared to manage a large sum of money at once. Lump sum payments can also be subject to higher taxes, so it is essential to consult a tax professional before agreeing to any lump sum payment. Let us say that you have received a lump sum payment of $1,000,000 and decided to invest 60% of that in the stock market. If you choose to invest long-term (ten years) with an interest rate of 10%, you will earn a hefty income. Because of compounding interest, investing money for an extended period allows it to accrue more interest than if invested for shorter periods. Therefore, if you invest $600,000 at an interest rate of 10% for ten years, you will have an estimated return of $956,245.48. If you opt to get the lump sum payment, the total value of your investment will be $1,556,245.48. On the other hand, if you opt to get a monthly payment for your investment, you would get roughly $12,968.71 per month for ten years. There are a few advantages to receiving lump sum payments. While lump sum payments may seem like a windfall, there are several potential disadvantages to consider before accepting one. When you receive a lump sum payment, some of the factors that can affect the tax liability are the size of the payment, filing status, and state of residency. For example, a person wins $5 million in the lottery and chooses to take the entire winnings via lump sum payment. As a single filer, he hits the 37% tax rate and will therefore owe $1,812,955 in Federal income taxes. Additional taxes may apply depending on the rules of the state where he resides. The best way to determine the tax implications of your lump sum payment is to speak with a tax professional. They can help you understand the taxes that may be due on the money and how to minimize any potential liability. A lump sum payment is a single, one-time payment. This type of payment does not provide any ongoing income or regular payments for the recipient and must be budgeted accordingly. On the other hand, annuity payments are recurring payments that occur over a period of time. The primary benefit of an annuity is that it provides a steady income stream, allowing individuals to plan their finances with greater accuracy. Annuities can also offer tax advantages depending on the circumstances. Consider a $5 million lottery win to illustrate lump sum and annuity payments. If you take the lump sum payment, you will be in the highest tax bracket and owe taxes on the entire winnings. Choosing an annuity could stretch payments over the years. Your annuity payment might be $200,000 a year. This will likely put you in a lower tax bracket, reducing the amount of taxes owed. Generally speaking, a lump sum payment can be the best option when it is used to pay down debts or make significant investments. When used for these purposes, a lump sum payment can provide substantial financial relief and offer significant returns on investment. A lump sum payment may not be the best option if you are unsure of your future financial needs. If you anticipate that your expenses could change over time, for instance, due to medical bills or other unforeseen costs, then it would be better to choose an annuity instead. An annuity can provide a steady stream of payments, allowing easier budgeting and planning for the future. Ultimately, making an informed decision about whether or not a lump sum payment is right for you will depend on your individual needs and financial goals. A lump sum payment is a one-time payment for the total amount of an insurance policy benefit, legal settlements, inheritances, lottery winnings, or retirement plans. Lump sum payments offer the option to receive benefits in a single payout rather than in periodic payments. Although there are some potential risks associated with a lump sum payment, it can also be an excellent opportunity to make smart financial decisions that will benefit the recipient in the long run. With careful planning and guidance from a financial advisor, a lump sum payment can be used to achieve lasting financial security.What Is a Lump Sum Payment?

Example of Lump Sum Payment

Advantages of Lump Sum Payment

Disadvantages of Lump Sum Payment

Tax Implications of Lump Sum Payment

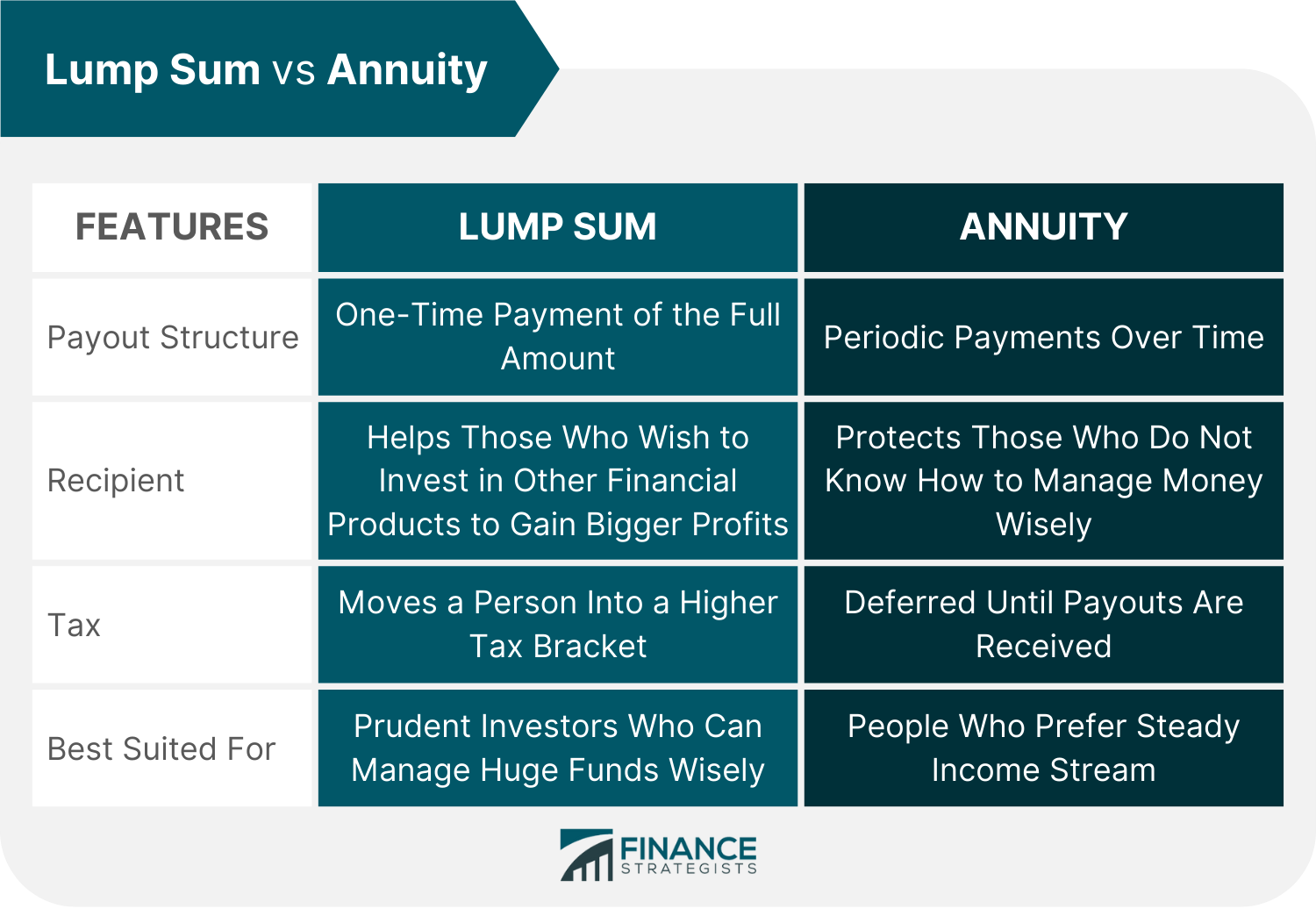

Lump Sum vs Annuity Payments

Is Lump Sum Payment the Best Option?

Final Thoughts

Lump Sum Payment FAQs

Under a lump sum arrangement, a retiree receives a one-time payment equal to the present value of all future pension payments. This can be used for the retiree's wishes, providing them immediate financial security and flexibility.

There are several benefits to receiving a lump sum payment instead of periodic payments. For one, lump sum payments can immediately pay off debts or allow you to purchase an asset at a hefty price. It also offers peace of mind, knowing you have the total amount of money upfront.

A lump sum payment, or single payment, is when you get your payout as one large cash amount instead of installment payments over time.

Yes, lump sum payments are taxable. The tax liability will depend on factors like the size of the lump sum, filing status, and state of residency.

An example of a lump sum payment would be if someone won the lottery and received their winnings all at once in one large payment. Another example might be if someone sold their house and received the entire sale price in one lump sum.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.