Can You Own a House and Get Medicaid?

Owning a home and qualifying for Medicaid is feasible, yet it demands careful navigation through complex state-specific rules and federal guidelines, especially regarding stringent asset limits for long-term care eligibility.

A primary residence is typically exempt from these limits, up to an equity value usually ranging from $730,000 to $1,097,000 in 2025 ($713,000 or $1,071,000 in 2024), depending on the state.

Additional considerations include the homeowner’s intent to return, and whether a spouse, dependent, or disabled child resides in the house.

However, it is crucial to be mindful of Medicaid’s estate recovery program, which aims to reclaim costs from the deceased recipient’s estate, potentially involving the house, though there are protections for surviving family members.

Engaging in Medicaid planning, with strategies like irrevocable trusts and careful asset transfers, is common, but requires precision to sidestep penalties.

Seeking advice from an elder law attorney or Medicaid planning professional is vital to navigating these complexities and securing assets while maintaining Medicaid eligibility.

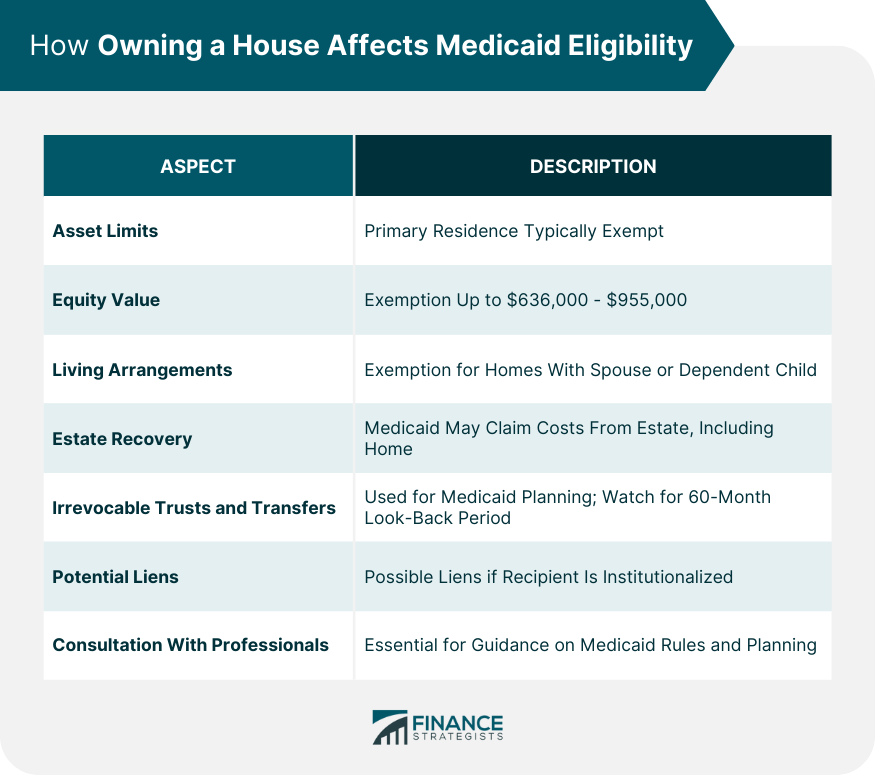

How Owning a House Affects Medicaid Eligibility

Owning a house can have a significant impact on Medicaid eligibility, as Medicaid is designed to provide health coverage for low-income individuals and families, and it considers both income and assets when determining eligibility.

Here’s how owning a house may affect Medicaid eligibility:

Asset Limits

Medicaid has stringent asset limits to qualify for benefits. However, a primary residence is often considered an exempt asset, meaning it does not count toward these limits.

The exemption usually applies if the Medicaid applicant intends to return to the home, even if they are currently living in a long-term care facility.

Equity Value

There is an equity limit on the exemption for a primary residence. As of the last update in 2025, this limit is generally between $730,000 to $1,097,000 in 2025 ($713,000 or $1,071,000 in 2024), depending on the state.

If the equity value of the home exceeds these limits, the individual might not qualify for Medicaid.

Living Arrangements

If the applicant's spouse or a dependent child lives in the home, it is usually exempt from the asset test, regardless of the equity value.

Estate Recovery

Medicaid can seek reimbursement from the estate of a deceased beneficiary for the costs of their care.

This could potentially involve the home, though protections are in place for surviving spouses, dependent children, and siblings with an equity interest in the home.

Irrevocable Trusts and Transfers

Some individuals engage in Medicaid planning by placing their home in an irrevocable trust or transferring it to family members.

However, this needs to be done carefully due to the Medicaid look-back period, which is typically 60 months before applying for Medicaid. Transfers made within this period could result in penalties and a delay in eligibility.

Potential Liens

In some cases, Medicaid can place a lien on a home if the recipient is permanently institutionalized, though enforcement of the lien is subject to specific family circumstances and state regulations.

Consultation With Professionals

Given the complexity of these rules and the variation between states, consulting with an elder law attorney or Medicaid planning professional is crucial.

They can provide guidance on how to structure assets and plan for long-term care while preserving Medicaid eligibility.

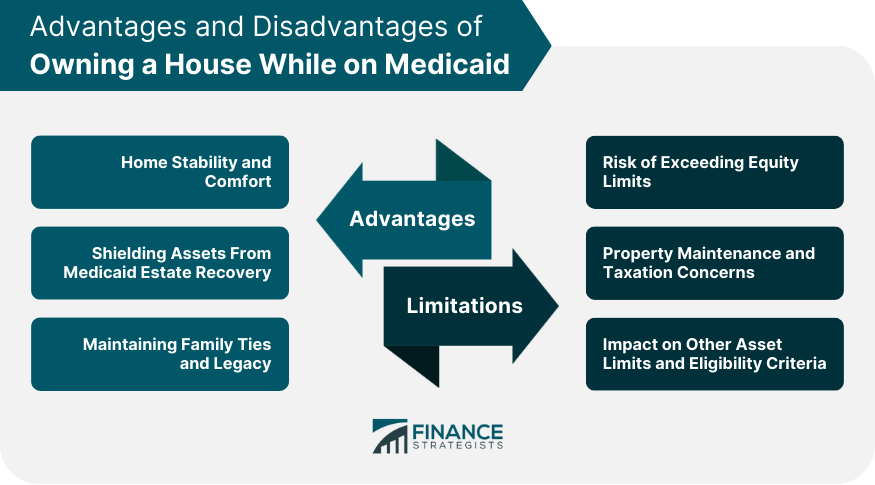

Advantages of Owning a House While on Medicaid

Home Stability and Comfort

A home offers more than just a roof over one's head. It's a sanctuary and a place filled with memories. Staying in a familiar environment can significantly enhance a person's mental and emotional well-being, especially during challenging health situations.

Shielding Assets From Medicaid Estate Recovery

After a Medicaid recipient's passing, the state often attempts to recoup some healthcare costs from the individual's estate. Having a home can sometimes offer a protective barrier against such recovery, ensuring that other assets remain untouched.

Maintaining Family Ties and Legacy

A family home often holds decades of memories and stands as a symbol of familial bonds. Retaining homeownership can ensure that these bonds remain strong and that future generations have a tangible connection to their ancestry.

Limitations and Considerations in Owning a House While on Medicaid

Risk of Exceeding Equity Limits

The real estate market isn't static. As property values rise and fall, homeowners need to keep a close eye on their home's equity, especially if they are near the Medicaid equity threshold.

Property Maintenance and Taxation Concerns

A home brings along responsibilities. Even if there's no mortgage, property taxes, repairs, insurance, and general maintenance can strain limited finances. These costs need to be factored into any long-term planning.

Impact on Other Asset Limits and Eligibility Criteria

While the primary residence might enjoy exemptions, its presence can influence how other assets are assessed. Moreover, if a person owns multiple properties, only the primary residence enjoys the exemption, potentially affecting Medicaid eligibility.

Practical Steps for Homeowners Applying for Medicaid

Consulting a Medicaid Planner or Attorney

Medicaid's rules are multifaceted and vary by state. To navigate this complex terrain, seeking advice from experts specializing in Medicaid planning can prove invaluable.

Evaluating Home Equity and Other Assets

Understanding the worth of one's assets, especially home equity, is essential. Regular appraisals can help keep homeowners informed and prepared for any potential Medicaid eligibility shifts.

Utilizing Strategies to Retain Homeownership and Ensure Medicaid Eligibility

Several legal avenues can help balance the dual goals of homeownership and Medicaid eligibility. Trusts, property transfers, and specific residence rights can play a pivotal role in this balance.

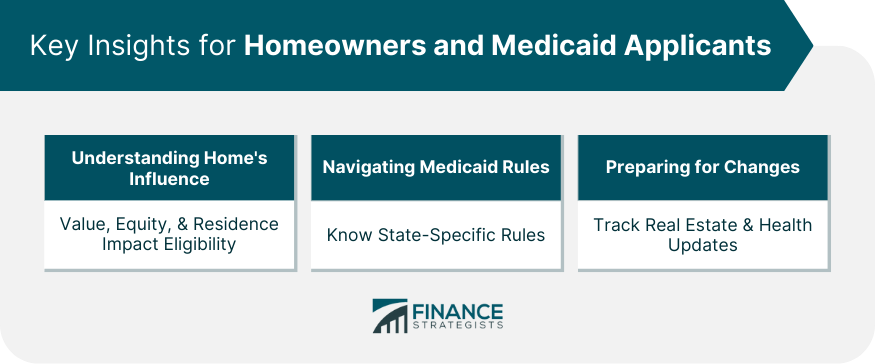

Key Insights for Homeowners and Medicaid Applicants

Understanding Home's Influence on Medicaid Eligibility

The value of a home, its equity, and its status as a primary residence can greatly influence Medicaid eligibility. Being informed can help homeowners make wise decisions.

Navigating Medicaid Rules and Regulations

Each state has its unique Medicaid framework. Continual awareness and understanding of these rules can ensure compliance and sustained benefits.

Preparing for Potential Changes and Challenges

With the ever-evolving nature of real estate markets, Medicaid regulations, and personal health situations, preparedness is key. Taking proactive steps today can prevent challenges down the line.

Conclusion

Homeownership and Medicaid eligibility can coexist, but the relationship between the two is intricate.

A home is more than just an asset; it offers stability, comfort, and a legacy. However, it also comes with responsibilities and potential challenges, especially when navigating Medicaid's complex rules.

Through careful planning, awareness, and expert advice, individuals can enjoy the benefits of their homes and still access Medicaid's crucial health services. Knowledge and preparedness are the cornerstones to achieving this balance.

Can You Own a House and Get Medicaid? FAQs

Homeownership can influence Medicaid eligibility, but primary residences are typically exempted. However, specific conditions, especially related to home equity, do apply.

Yes, homeownership provides stability and comfort, and can protect assets from Medicaid estate recovery, besides preserving family ties and legacy.

Homeowners need to monitor their home's equity value, consider ongoing property maintenance costs, and understand the impact of the residence on other asset assessments.

Consulting Medicaid planners, regularly evaluating home equity, and using legal strategies like trusts can help balance homeownership with Medicaid eligibility.

No, while many assets are considered, some, like the primary residence, might be exempt or non-countable under certain conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.