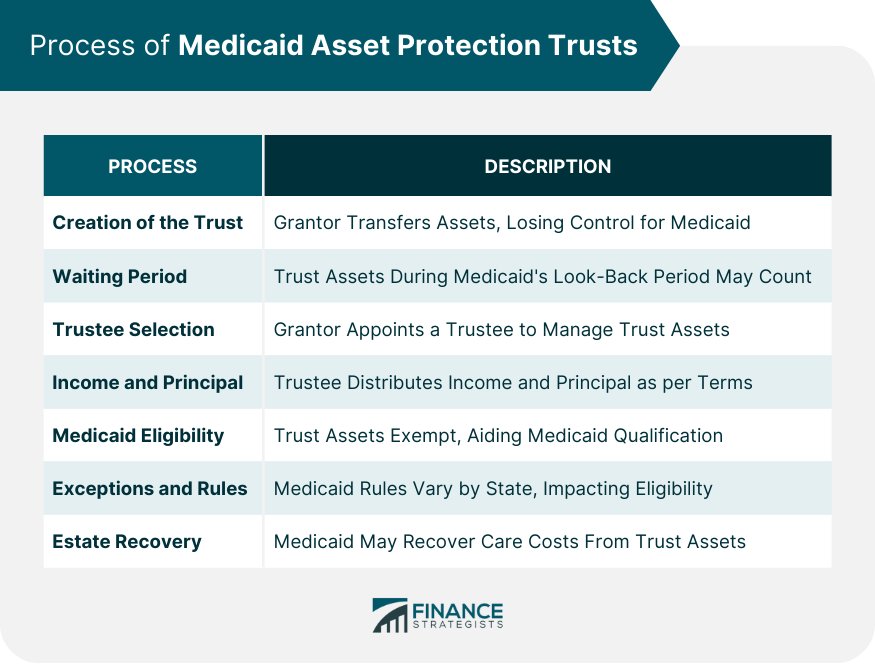

Medicaid Asset Protection Trust (MAPT) is a specialized type of irrevocable trust. Its primary objective is to safeguard a person's valuable assets from being used to cover long-term care expenses. By doing this, it also positions the individual to become eligible for Medicaid's long-term care provisions. Such trusts are a pillar in elder law planning, enabling seniors to achieve both asset protection and essential healthcare support. Medicaid Asset Protection Trusts have a two-fold objective. First, they help seniors protect their hard-earned assets from the towering costs of long-term care. Considering that long-term care can sometimes run into thousands of dollars a month, the significance of such protection cannot be understated. Second, they ensure that certain assets are not counted when Medicaid evaluates an individual's application, improving the chances of qualifying for Medicaid support. This dual benefit ensures seniors can receive the care they need without jeopardizing their life savings or their family's inheritance. The primary goal of a MAPT is to shield assets from being counted as part of an individual's or couple's countable assets when determining Medicaid eligibility. Here's how a Medicaid Asset Protection Trust typically works: Creation of the Trust: To establish a MAPT, an individual (the grantor) typically works with an attorney to draft a trust document. The grantor then transfers certain assets into the trust, removing them from their ownership and control. Irrevocable Nature: A key feature of a MAPT is that it is irrevocable. Once the assets are transferred into the trust, the grantor no longer has direct control over them. This is important because Medicaid has a look-back period (usually five years) during which they assess asset transfers to prevent people from giving away their assets just to qualify for Medicaid. Waiting Period: As mentioned above, Medicaid has a look-back period. Any assets transferred into the trust during this period may still be counted for Medicaid eligibility purposes. It's crucial to plan ahead and establish trust well before needing Medicaid benefits. Trustee Selection: The grantor must appoint a trustee to manage the trust and make decisions regarding the assets held within it. The grantor can choose a trusted family member, friend, or professional trustee for this role. Income and Principal: The trustee has the authority to distribute income and principal from the trust to beneficiaries, including the grantor and their spouse, if applicable. However, the trustee must adhere to the terms and restrictions outlined in the trust document. Medicaid Eligibility: The assets in the MAPT are exempt from Medicaid eligibility calculations, allowing the grantor to qualify for benefits like nursing home care while preserving assets for their spouse or heirs. Exceptions and Rules: Medicaid rules and regulations vary by state, and there are exceptions and restrictions to consider. For example, some states have different look-back periods, and certain assets may still be counted as available for Medicaid eligibility purposes. Estate Recovery: In some cases, Medicaid may seek to recover the costs of care from the assets held in the trust after the grantor and their spouse (if applicable) pass away. However, the rules regarding estate recovery can also vary by state. Establishing a Medicaid Asset Protection Trust can be a complex legal process, and it should be done in consultation with an attorney experienced in elder law and Medicaid planning. Additionally, the trust should be created well before needing Medicaid benefits to ensure compliance with the look-back period rules. Medicaid often requires applicants to spend most of their assets before granting benefits. With a MAPT, these assets are protected from such requirements, ensuring that they remain intact. Beyond immediate needs, a MAPT also looks after the future. By keeping assets safe, it ensures that the next generation can inherit them, preserving family wealth over time. Trustees aren't just stewards—they're also investors. They can choose how the trust's assets are invested, looking for growth opportunities or safer yields, depending on the trust's objectives. Assets in the trust aren't static—they can grow. Whether it's through wise investments, property appreciation, or other means, the trust can increase in value over time. Knowing that there's a safety net in place brings peace. Beneficiaries understand that the assets remain secure even as the senior member receives care. Applications for Medicaid can be nerve-wracking, but with a MAPT in place, there's one less thing to worry about. This trust's irrevocable nature is a double-edged sword. While it provides protection, it also limits access to the primary assets. This restriction might not sit well with some, especially those who value having control over their resources. After its establishment, tweaking the trust's terms can be a Herculean task. This rigidity requires careful planning at the outset. Selling assets from the trust might bring tax consequences. Especially if those assets have appreciated, capital gains taxes could reduce the trust's overall value. Depending on the size of the trust and prevailing laws, there might be estate tax implications when the original owner passes away. Setting up a trust like this isn't a DIY project. It requires expertise, an understanding of current laws, and a clear vision of the trust's objectives. There's a cost to set it up, and there are costs to maintain it. From legal fees to potential taxes and trustee compensations, these expenses need careful consideration. Though powerful, MAPTs are not magic shields. They need to be set up correctly, and even then, they can't guarantee absolute protection. While both are trusts, their structures, purposes, and implications differ vastly. MAPTs are specially designed with Medicaid in mind, while revocable trusts offer more flexibility but less protection. A MAPT is a tool, not a ticket. Having one doesn't automatically qualify someone for Medicaid. It's a strategic move in a broader game plan. Such trusts require precision. Working closely with a legal expert in elder law ensures that all boxes are ticked. The legal landscape changes. Regular reviews ensure the trust remains compliant and serves its intended purpose effectively. Medicaid rules aren't uniform—they vary from state to state. Ensuring the trust aligns with local regulations is crucial. This is a pivotal decision. The trustee's competence and integrity directly influence the trust's effectiveness. Strategizing on how the assets are distributed, both in terms of timing and amount, can make a considerable difference in the trust's performance. A trust isn't a set-and-forget entity. It requires monitoring, reviews, and sometimes adjustments to ensure it's always in top shape. The Medicaid Asset Protection Trust stands as a valuable resource for individuals seeking to safeguard their assets from potential long-term care expenses. In gaining insight into its mechanics, advantages, and possible challenges, families can make well-informed choices that safeguard their assets while maintaining access to essential care services. Despite the manifold benefits it provides, the trust's intricacies underscore the significance of seeking expert guidance, remaining vigilant regarding evolving regulations, and proactively managing the trust to ensure the most favorable outcomes.What Is a Medicaid Asset Protection Trust? (MAPT)

How Medicaid Asset Protection Trusts Work

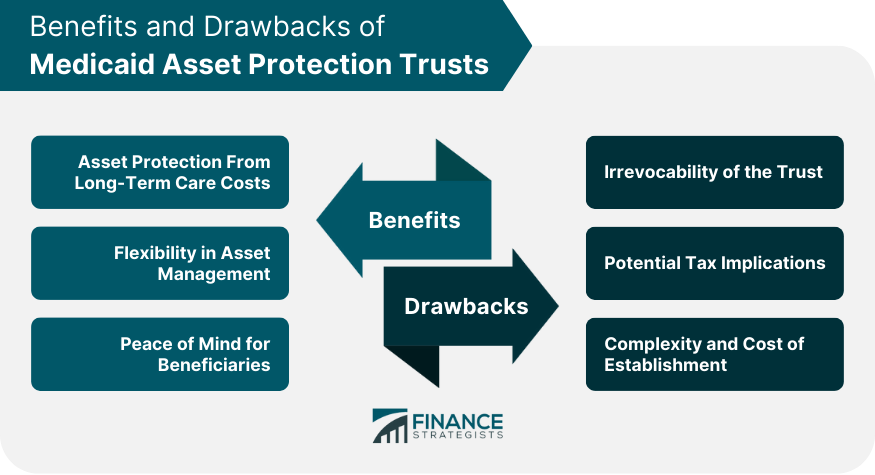

Benefits of Medicaid Asset Protection Trusts

Asset Protection From Long-Term Care Costs

Shielding Assets From Medicaid Spend-Down

Preservation of Family Wealth

Flexibility in Asset Management

Selection of Trust Investments

Potential for Growth of Assets

Peace of Mind for Beneficiaries

Ensuring Care Costs Are Covered

Minimizing Stress During Medicaid Application

Drawbacks of Medicaid Asset Protection Trusts

Irrevocability of the Trust

Limited Access to Principal

Difficulty in Changing Trust Terms

Potential Tax Implications

Capital Gains Considerations

Possible Estate Tax Issues

Complexity and Cost of Establishment

Need for Expert Legal Guidance

Initial and Ongoing Trust Expenses

Common Misconceptions About Medicaid Asset Protection Trusts

Not a Guaranteed Shield From Medicaid Spend-Down

Not the Same as a Simple Revocable Trust

Doesn't Immediately Make You Medicaid Eligible

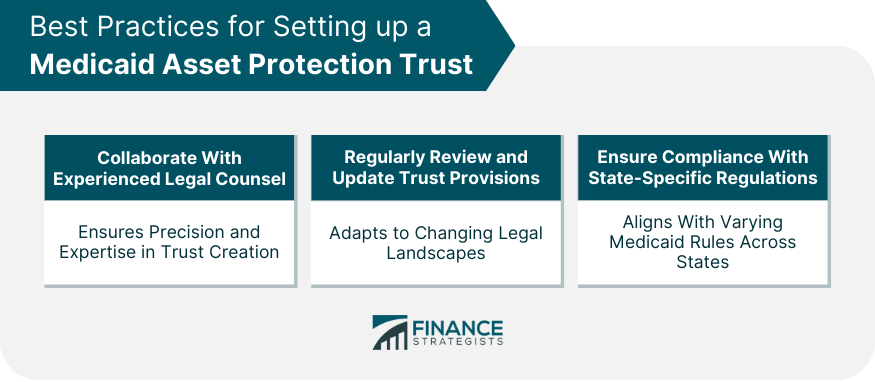

Best Practices for Setting up a Medicaid Asset Protection Trust

Collaborate With Experienced Legal Counsel

Regularly Review and Update Trust Provisions

Ensure Compliance With State-Specific Regulations

Practical Considerations When Using a Medicaid Asset Protection Trust

Selection of a Trustee

Asset Distribution Strategies

Monitoring Trust Performance and Compliance Over Time

Conclusion

Medicaid Asset Protection Trust FAQs

MAPT is a specialized irrevocable trust designed to protect assets from being used for long-term care costs while aiding eligibility for Medicaid's care provisions.

MAPT helps seniors shield their assets from rising long-term care expenses and increases their chances of qualifying for Medicaid support, ensuring they don't jeopardize their savings or inheritance.

Medicaid's five-year look-back rule scrutinizes asset transfers to the MAPT. Transfers within this period before applying to Medicaid can lead to penalties, delaying benefits.

MAPT offers protection from long-term care costs, shields assets from Medicaid spend-down, ensures family wealth preservation, and provides flexibility in asset management.

Yes, the irrevocable nature of MAPT limits access to primary assets, there might be potential tax implications, and the establishment can be complex and costly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.