What Are Medicaid Asset Transfer Rules?

Medicaid is a government-sponsored healthcare program that provides coverage for low-income individuals and families. To be eligible for Medicaid, applicants must meet specific financial criteria.

Medicaid asset transfer rules help prevent people from transferring assets to others in order to meet the financial eligibility requirements for Medicaid. These rules are essential to ensure that the program's limited resources are allocated to those who genuinely need assistance.

These rules are complex, and non-compliance can lead to severe penalties. It is crucial to understand and follow these rules when considering transferring assets to qualify for Medicaid.

Federal Laws Governing Medicaid Asset Transfers

Deficit Reduction Act of 2005 (DRA)

The Deficit Reduction Act of 2005 (DRA) made significant changes to the Medicaid asset transfer rules. This legislation aimed to prevent people from exploiting the Medicaid system by transferring assets to qualify for benefits.

The DRA established a look-back period and penalties for non-compliance. It also outlined the types of transfers subject to these rules, which will be discussed further in this article.

Medicaid Look-Back Period

The Medicaid look-back period is the timeframe during which asset transfers are reviewed to determine eligibility for Medicaid. This period is essential to ensure that applicants are not inappropriately transferring assets to qualify for benefits.

Currently, the look-back period is set at 60 months or five years before the date of application for Medicaid. If a non-exempt transfer is discovered during this period, penalties may be imposed, including delaying or denying Medicaid benefits.

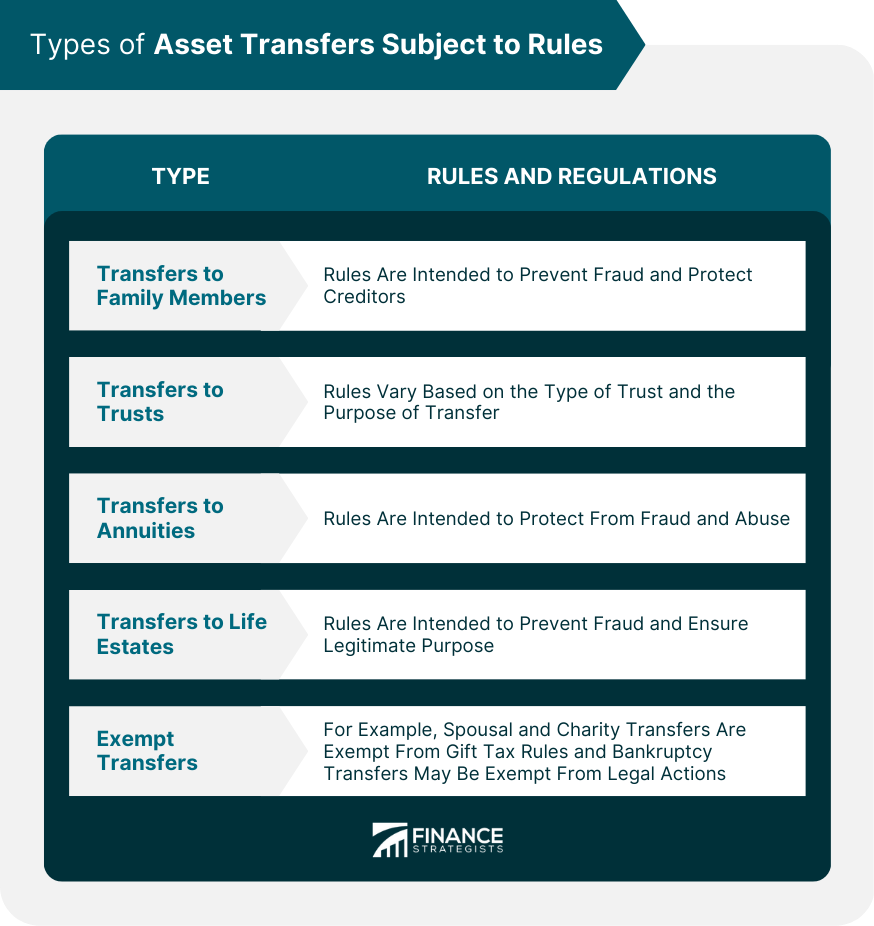

Types of Asset Transfers Subject to Rules

Asset transfers can be subject to various rules and regulations, depending on the type of transfer being made. In this section, we will discuss the different types of asset transfers that are subject to rules.

Transfers to Family Members

Transfers to family members are subject to various rules and regulations, primarily to prevent fraud and protect the interests of creditors.

For example, if a person transfers assets to a family member for less than fair market value, the transfer may be considered a gift and subject to gift tax rules.

Additionally, if the transfer is made with the intention of defrauding creditors, the transfer may be considered fraudulent and subject to legal action.

Transfers to Trusts

Transferring assets to a trust can be an effective way to manage and protect assets. However, these transfers are subject to rules and regulations that vary depending on the type of trust and the purpose of the transfer.

For example, transfers to an irrevocable trust are generally subject to gift tax rules, while transfers to a revocable trust are not.

Transfers to Annuities

Transferring assets to an annuity can provide a reliable source of income in retirement. However, these transfers are subject to rules and regulations that aim to protect consumers from fraudulent or abusive practices.

For example, annuity contracts must disclose all fees and charges, and the purchaser must have a clear understanding of the terms and conditions of the contract.

Transfers to Life Estates

A life estate is a legal arrangement in which a person retains the right to use and enjoy a property for the rest of their life, after which the property passes to another person or entity.

Transfers to life estates are subject to rules and regulations that aim to prevent fraud and ensure that the transfer is made for a legitimate purpose.

Exempt Transfers

Some transfers are exempt from rules and regulations governing asset transfers. For example, transfers made to a spouse or a qualified charity are generally exempt from gift tax rules.

Additionally, transfers made as part of a bankruptcy proceeding may be exempt from certain legal actions.

Strategies for Compliant Asset Transfers

Spend-Down Techniques

Spend-down techniques involve using excess assets to pay for items or services that directly benefit the Medicaid applicant, such as home modifications or medical equipment.

These techniques can help individuals meet Medicaid's financial eligibility requirements without incurring penalties.

When using spend-down techniques, it is important to carefully document all expenses and ensure that they are allowable under Medicaid guidelines. Consulting with a professional, such as an elder law attorney, can help ensure that spend-down techniques are used appropriately.

Creation of Special Needs Trusts

Special needs trusts are specifically designed to hold assets for a disabled individual without affecting their eligibility for government benefits like Medicaid.

Establishing a special needs trust can help protect assets while ensuring that the beneficiary maintains access to essential healthcare services.

However, setting up a special needs trust is a complex process that requires the assistance of a knowledgeable attorney.

Failure to properly establish and manage the trust can result in penalties and loss of Medicaid eligibility. Therefore, it is crucial to seek professional guidance when considering this strategy.

Use of Long-Term Care Insurance

Long-term care insurance can help cover the costs of nursing home care, assisted living, and other long-term care services. By purchasing a long-term care insurance policy, individuals can protect their assets while ensuring access to the care they need.

However, long-term care insurance can be expensive, and not all policies provide the same level of coverage. It is essential to carefully evaluate different policy options and choose the one that best suits the individual's needs and financial situation.

Medicaid Asset Protection Trusts (MAPTs)

Medicaid Asset Protection Trusts (MAPTs) are a type of irrevocable trust designed to protect assets from being counted towards Medicaid eligibility.

When assets are transferred into an MAPT, they are no longer considered the applicant's property and do not affect Medicaid eligibility.

However, establishing an MAPT can be complex, and improper setup or management can lead to penalties. It is essential to work with an experienced attorney when considering an MAPT to ensure that it is properly established and maintained.

State Variations in Medicaid Asset Transfer Rules

Differences in Look-Back Periods

While the federal look-back period is set at 60 months, some states may have shorter look-back periods. These differences can impact the penalties and exemptions associated with asset transfers.

It is essential to understand the specific look-back period in the state where the Medicaid applicant resides. Consult with a professional, such as an elder law attorney, to ensure compliance with state-specific rules and regulations.

State-Specific Exemptions

Each state may have its own set of exemptions and rules regarding Medicaid asset transfers. These exemptions can impact the types of transfers that are allowed and the penalties associated with non-compliant transfers.

Understanding state-specific exemptions is crucial when planning for long-term care and Medicaid eligibility. Working with a knowledgeable professional can help ensure that asset transfers are compliant with both federal and state regulations.

Conclusion

Medicaid asset transfer rules aim to prevent individuals from transferring assets to meet financial eligibility requirements for Medicaid. These rules are complex and can result in severe penalties for non-compliance.

The Deficit Reduction Act of 2005 established a look-back period and penalties for non-compliance, which can impact transfers to family members, trusts, annuities, life estates, and exempt transfers.

Strategies for compliant asset transfers include spend-down techniques, special needs trusts, long-term care insurance, and Medicaid asset protection trusts.

State-specific variations in Medicaid asset transfer rules, such as differences in look-back periods and exemptions, can impact compliance and eligibility.

It is crucial to seek professional assistance when considering asset transfers and to be aware of the federal and state regulations governing these transactions.

By doing so, individuals can protect their assets while ensuring access to essential healthcare services through Medicaid.

Medicaid Asset Transfer Rules FAQs

Medicaid asset transfer rules refer to the laws and regulations that govern the transfer of assets for the purpose of qualifying for Medicaid.

Generally, any asset that can be converted into cash or used to pay for long-term care expenses is subject to Medicaid asset transfer rules.

Yes, some exemptions include transfers to a spouse, a disabled child, or a trust for the benefit of a disabled individual.

Yes, but you must do so within the allowable transfer period, which is usually five years before applying for Medicaid.

Violating Medicaid asset transfer rules can result in a period of ineligibility for Medicaid benefits, meaning you will be responsible for paying for your own long-term care expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.