Medicare benefits are a federal health insurance program that provides coverage for eligible individuals over the age of 65 and those with certain disabilities or medical conditions. Medicare is divided into four parts, each providing specific types of coverage for different medical needs. Medicare benefits are essential for many individuals to access necessary medical care and services. Medicare provides coverage for a range of medical needs, including hospital stays, doctor visits, prescription drugs, and preventive care. Understanding Medicare benefits and eligibility is critical to ensuring access to necessary medical services and maintaining financial stability. Medicare Part A benefits provide coverage for inpatient hospital care, skilled nursing care, hospice care, and home health care. Inpatient hospital care includes services such as room and board, nursing care, and meals. Skilled nursing care refers to services provided by licensed nurses or therapists in a skilled nursing facility or at home. Hospice care is provided to individuals with terminal illnesses who have a life expectancy of six months or less. Home health care is provided to individuals who require skilled nursing or therapy services at home. Medicare Part A benefits are generally automatic for eligible individuals and do not require a monthly premium. However, there are certain limits to Part A coverage, such as the number of days covered for inpatient hospital care and the amount of coverage for skilled nursing care. Medicare Part B benefits provide coverage for outpatient medical services, such as doctor visits, laboratory tests, and diagnostic services. Part B benefits also cover some preventive services, such as annual wellness visits, flu shots, and cancer screenings. Part B benefits require a monthly premium, which is based on income and may have additional out-of-pocket costs, such as deductibles and coinsurance. However, some individuals may be eligible for assistance with these costs through programs such as Medicaid. Medicare Part C benefits, also known as Medicare Advantage plans, are offered by private insurance companies and provide coverage for all Part A and Part B benefits, as well as additional services such as dental and vision care. Part C plans may also offer prescription drug coverage. Part C benefits require a monthly premium and may have additional out-of-pocket costs, such as deductibles and coinsurance. However, Part C plans may also offer additional benefits, such as gym memberships or transportation services. Medicare Part D benefits provide coverage for prescription drugs. Part D benefits are offered by private insurance companies and require a monthly premium and may have additional out-of-pocket costs, such as deductibles and coinsurance. Part D benefits vary depending on the plan and may cover different types of drugs or have different coverage limits. It is important for individuals to carefully review the options available to them and choose a plan that meets their specific needs. Eligibility for Medicare benefits is based on age, with individuals over the age of 65 being eligible for benefits. Individuals who are under the age of 65 may also be eligible for benefits if they have certain disabilities or medical conditions. Individuals who are under the age of 65 and have been receiving Social Security Disability Insurance (SSDI) for 24 months are eligible for Medicare benefits. Individuals with end-stage renal disease may be eligible for Medicare benefits, regardless of age. Eligibility requirements for ESRD are complex, and individuals with ESRD are encouraged to work with a knowledgeable professional to understand their eligibility and coverage options. Medicare Part A benefits provide coverage for inpatient hospital services, including hospital stays, skilled nursing care, and hospice care. Inpatient hospital services are generally covered at 100% for the first 60 days of care. Medicare Part B benefits provide coverage for outpatient medical services, such as doctor visits, laboratory tests, and diagnostic services. Outpatient medical services may require a copayment or coinsurance. Medicare Part D benefits provide coverage for prescription drugs. Prescription drug coverage may vary depending on the plan selected, and individuals are encouraged to review their coverage options carefully. Medicare benefits provide coverage for a range of preventive services, including annual wellness visits, mammograms, and colonoscopies. Preventive services are generally covered at 100% with no out-of-pocket costs. Medicare Part A benefits provide coverage for home health care services, including skilled nursing care and therapy services. Home health care services may require a copayment or coinsurance. Medicare Part A benefits provide coverage for skilled nursing facility care. Skilled nursing facility care is generally covered at 100% for the first 20 days of care and may require a copayment or coinsurance for days 21-100. Medicare benefits may have out-of-pocket costs, such as copayments, coinsurance, and deductibles. The costs of Medicare benefits may vary depending on the type of coverage and services received. Medicare benefits do not cover all medical services and treatments. Services not covered by Medicare benefits may include cosmetic procedures, hearing aids, and long-term care. Medicare Part D benefits may have coverage limits and restrictions, such as the "donut hole," which is a coverage gap where beneficiaries are responsible for a higher percentage of the cost of prescription drugs. Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies and provide coverage for all Part A and Part B benefits, as well as additional services such as dental and vision care. Medicare Advantage plans may also offer prescription drug coverage. Supplemental Medicare insurance plans, also known as Medigap plans, are offered by private insurance companies and provide additional coverage for out-of-pocket costs associated with Medicare benefits. Medigap plans may cover deductibles, coinsurance, and copayments. Cost-saving programs, such as the Medicare Savings Programs and Extra Help, can help eligible individuals save money on their Medicare benefits. These programs provide financial assistance with Medicare premiums, deductibles, and copayments. In conclusion, Medicare benefits are a federal health insurance program that provides coverage for eligible individuals over the age of 65 and those with certain disabilities or medical conditions. Medicare is divided into four parts, each providing specific types of coverage for different medical needs. Eligibility for Medicare benefits is based on age, with individuals over the age of 65 being eligible for benefits. Medicare benefits provide critical coverage for eligible individuals to access necessary medical services and treatments. However, Medicare benefits may have out-of-pocket costs, such as copayments, coinsurance, and deductibles, and they do not cover all medical services and treatments. To ensure continued access to necessary medical services, it is important for individuals to stay informed about changes to Medicare policies and regulations and to regularly review and update their coverage. Resources are available to help individuals and families understand Medicare benefits and eligibility requirements, including the Medicare website, Social Security Administration offices, and knowledgeable professionals, such as Medicare counselors and insurance agents.Definition of Medicare Benefits

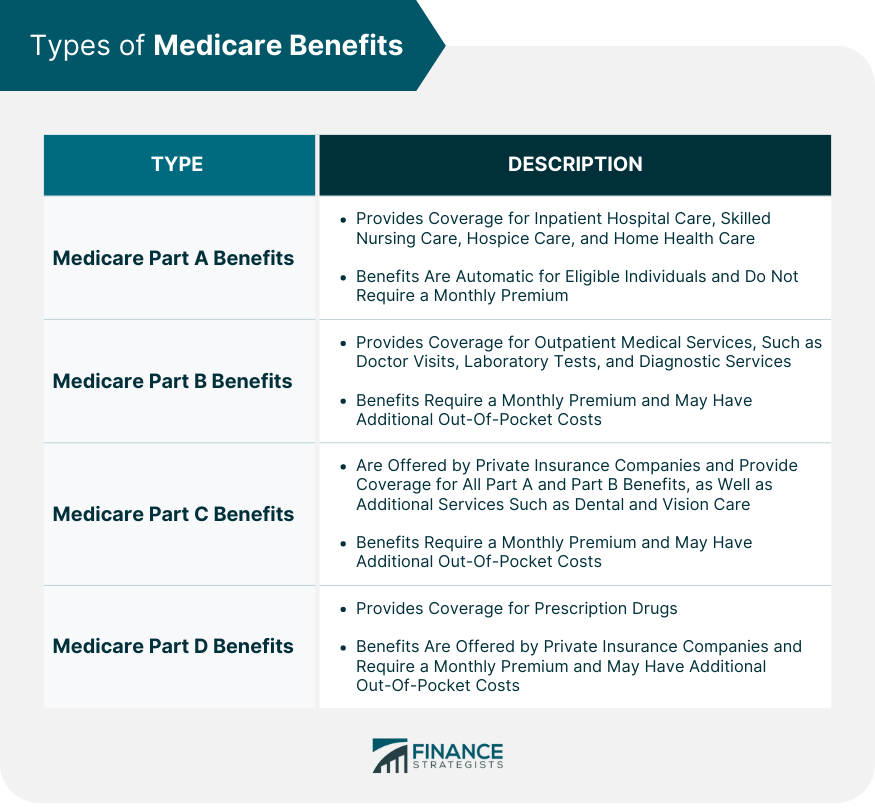

Types of Medicare Benefits

Medicare Part A Benefits

Medicare Part B Benefits

Medicare Part C Benefits

Medicare Part D Benefits

Eligibility for Medicare Benefits

Age Eligibility

Disability Eligibility

End-Stage Renal Disease (ESRD) Eligibility

Coverage under Medicare Benefits

Inpatient Hospital Services

Outpatient Medical Services

Prescription Drugs

Preventive Services

Home Health Care

Skilled Nursing Facilities

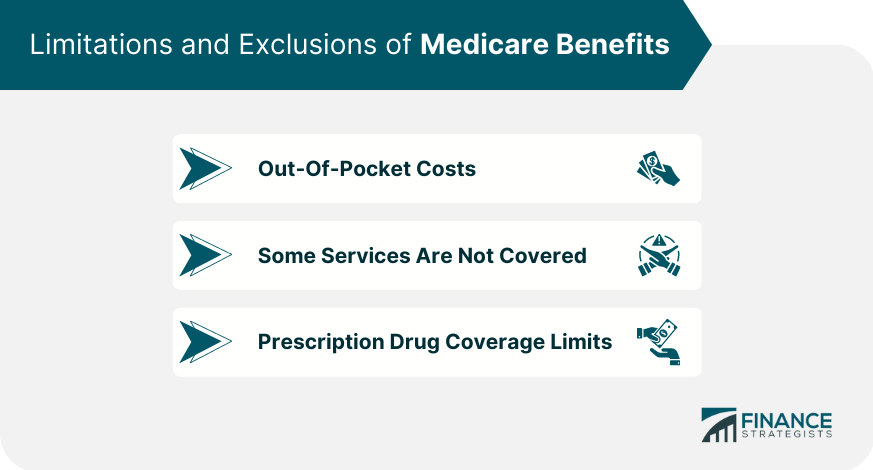

Limitations and Exclusions of Medicare Benefits

Out-Of-Pocket Costs

Some Services Are Not Covered

Prescription Drug Coverage Limits

Additional Benefits

Medicare Advantage Plans

Supplemental Medicare Insurance Plans

Cost-Saving Programs

Bottom Line

Medicare Benefits FAQs

Medicare benefits are federal health insurance programs for people aged 65 or older and those with certain disabilities or medical conditions.

There are four types of Medicare benefits, including Parts A, B, C, and D, each with different coverage options.

Individuals aged 65 or older, those with certain disabilities, and people with end-stage renal disease are eligible for Medicare benefits.

Medicare benefits may have out-of-pocket costs, such as copayments, coinsurance, and deductibles. Some medical services and treatments, such as cosmetic procedures, hearing aids, and long-term care, are not covered by Medicare benefits. Additionally, Medicare Part D benefits may have coverage limits and restrictions, such as the "donut hole," which is a coverage gap where beneficiaries are responsible for a higher percentage of the cost of prescription drugs.

You can enroll in Medicare benefits during the initial enrollment period, which is usually three months before and after your 65th birthday, or during the annual open enrollment period.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.