A mutual insurance company is an organization owned by its policyholders, providing insurance coverage to its members. The concept of mutual insurance dates back to the 17th century when European communities pooled resources to share risks. Mutual insurance companies serve the purpose of offering long-term stability, competitive pricing, and a community-oriented approach to their members. In a mutual insurance company, policyholders are the owners, making them the primary beneficiaries of the company's profits. Unlike stock insurance companies, mutual insurers have no shareholders, which ensures that policyholders' interests are prioritized above the pursuit of profits for external investors. A mutual insurance company is governed by a board of directors elected by the policyholders. Policyholders have voting rights, allowing them to influence the company's decision-making process and hold the board accountable for their actions. This democratic approach to governance ensures transparency and fairness in the company's operations. The management team of a mutual insurance company oversees daily operations, implements strategies, and manages risk. Their compensation structure often differs from that of stock insurers, with a focus on long-term performance and alignment with policyholders' interests rather than short-term gains for shareholders. Property and casualty mutual insurance companies provide coverage for damage to property and liability arising from accidents or other events. These insurers often cater to specific industries or regions, allowing them to offer tailored coverage and risk management solutions to their policyholders. Mutual life insurance companies offer life insurance policies, including term, whole, and universal life coverage. Policyholders benefit from the long-term stability of these companies, as well as potential dividends and surplus distribution, which can enhance the value of their policies. Mutual health insurance companies provide health coverage for individuals, families, and employer groups. They focus on offering affordable and comprehensive plans to their members, prioritizing policyholders' health needs and well-being over profit maximization. Some mutual insurance companies focus on specialty lines or niche markets, such as marine, agricultural, or professional liability insurance. By concentrating on specific sectors, these companies can develop expertise and provide specialized coverage tailored to the unique risks faced by policyholders in these industries. Mutual insurance companies distribute their profits primarily through policyholder dividends and surplus distribution. Policyholders may receive dividends in the form of reduced premiums, cash payments, or additional coverage. Surplus distribution ensures that any excess funds are returned to policyholders, further aligning the company's interests with those of its members. Mutual insurance companies obtain capital from policyholder premiums, retained earnings, and other financial instruments such as surplus notes. These companies must maintain sufficient capital and reserves to meet regulatory requirements, ensuring they can cover policyholder claims and maintain financial stability in the face of market fluctuations and unexpected events. Mutual insurers often adopt conservative investment strategies, prioritizing the preservation of capital and long-term stability over aggressive growth. This approach reduces the potential impact of market volatility on the company's financial position, ensuring it can continue to fulfill its obligations to policyholders. The asset allocation strategy of a mutual insurance company involves diversifying investments across various asset classes, such as equities, bonds, and real estate, to minimize risk and optimize returns. Mutual insurers typically maintain a conservative allocation, with a higher proportion of fixed-income securities to ensure the company's financial stability and ability to meet policyholder claims. One of the main advantages of mutual insurance companies is their policyholder-centric approach. Since policyholders are the owners, the company's primary objective is to serve their interests, leading to a focus on customer satisfaction, fairness, and transparency in operations. Mutual insurance companies are known for their long-term stability and focus, as they prioritize sustainable growth and financial strength over short-term profit maximization. This commitment to the long-term benefits of their policyholders results in a more stable and reliable insurance provider. Mutual insurance companies often have lower costs and offer more competitive pricing than their stock insurance counterparts. The absence of shareholders allows these companies to reinvest profits into the business, reduce premiums, and distribute dividends, ultimately benefiting policyholders. Many mutual insurance companies embody community-oriented values, focusing on the needs of their policyholders and the communities they serve. This local focus allows them to better understand the unique risks and insurance needs of their members, resulting in tailored coverage and personalized service. Mutual insurance companies face stiff competition from stock insurers, which often have greater access to capital and can be more aggressive in their growth strategies. Stock insurers may also offer more innovative products, putting pressure on mutual insurers to adapt and evolve to stay competitive. The rapid pace of technological advancements and innovation presents challenges for mutual insurance companies, as they need to invest in technology and digital infrastructure to meet customer expectations and streamline operations. Embracing technology is crucial to remain relevant in an increasingly digital insurance landscape. Keeping up with regulatory changes and maintaining compliance can be a challenge for mutual insurance companies, as regulations may vary across jurisdictions and evolve over time. Ensuring adherence to these regulations is critical to protect policyholders' interests and maintain the company's reputation. Attracting and retaining top talent is crucial for mutual insurance companies to remain competitive and drive growth. The industry faces a growing talent gap, making it essential for mutual insurers to invest in employee development, offer competitive compensation, and promote a positive work culture. Mutual insurance companies offer a unique policyholder-centric approach to insurance, with benefits such as long-term stability, competitive pricing, and community-oriented values. Despite facing challenges like competition, technological advancements, and talent recruitment, mutual insurers can capitalize on future trends and opportunities, such as mergers and acquisitions, digital transformation, and sustainable investing. Mutual insurance companies play a crucial role in the insurance industry, offering an alternative to stock insurers and emphasizing the needs and interests of their policyholders. Their commitment to serving their members and communities contributes to a more diverse and inclusive insurance landscape. By embracing innovation, investing in technology, and adapting to changing market dynamics, mutual insurance companies can continue to grow and thrive in the evolving insurance landscape. Focusing on their policyholders' needs and staying true to their community-oriented values will be essential for their long-term success and resilience.What Is a Mutual Insurance Company?

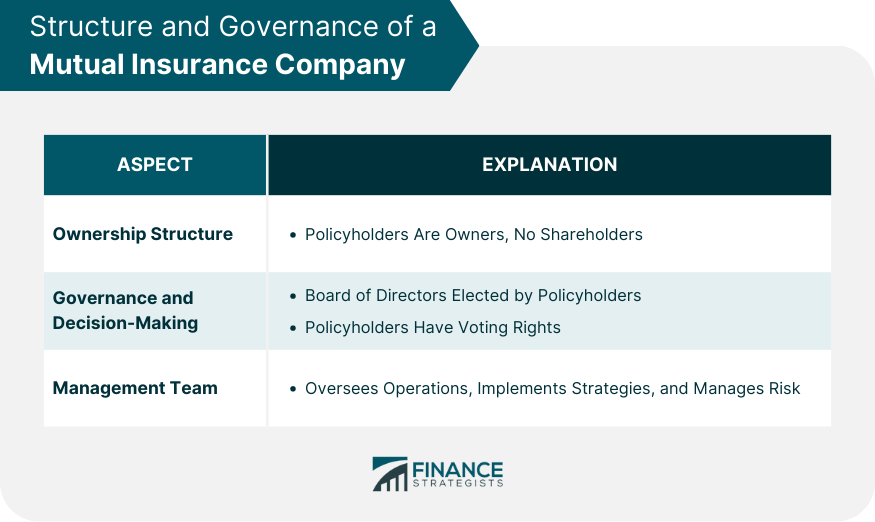

Structure and Governance of a Mutual Insurance Company

Ownership Structure: Policyholders and Absence of Shareholders

Governance and Decision-Making: Board of Directors and Voting Rights

Management Team: Roles, Responsibilities, and Compensation

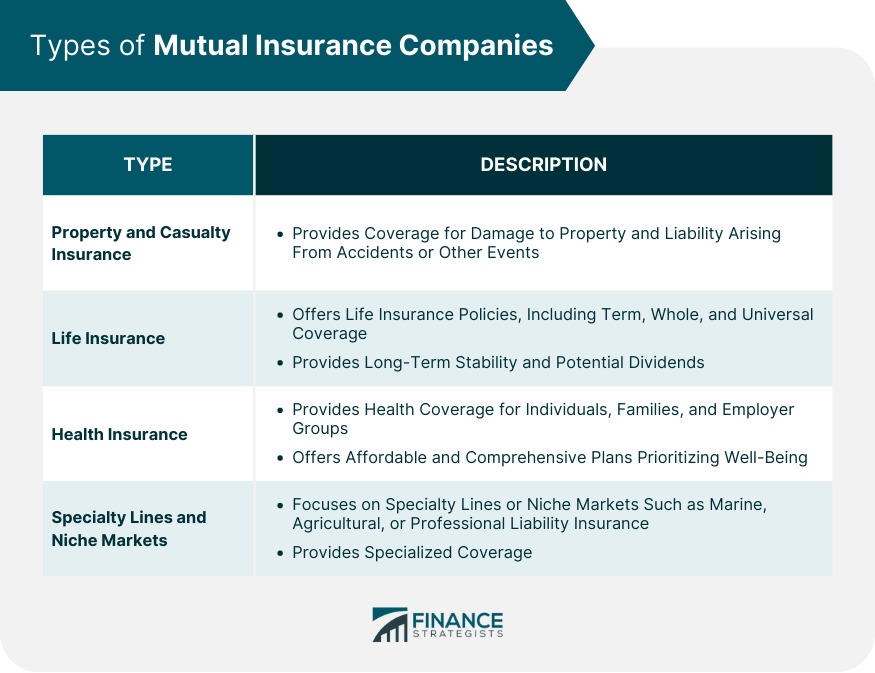

Types of Mutual Insurance Companies

Property and Casualty Insurance

Life Insurance

Health Insurance

Specialty Lines and Niche Markets

Financial Aspects of Mutual Insurance Companies

Profit Distribution: Policyholder Dividends and Surplus Distribution

Capital and Reserves: Sources and Regulatory Requirements

Investment Strategies: Conservative vs Aggressive Approaches

Asset Allocation

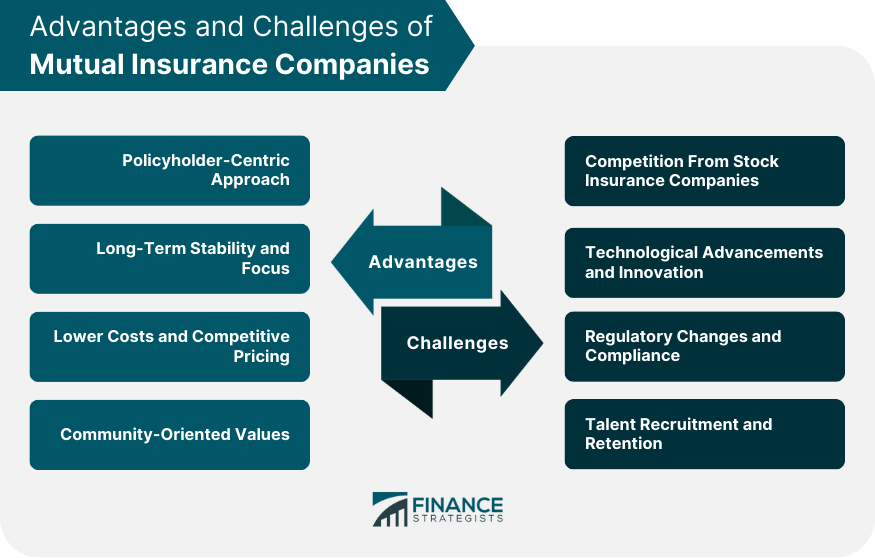

Advantages of Mutual Insurance Companies

Policyholder-Centric Approach

Long-Term Stability and Focus

Lower Costs and Competitive Pricing

Community-Oriented Values

Challenges Faced by Mutual Insurance Companies

Competition From Stock Insurance Companies

Technological Advancements and Innovation

Regulatory Changes and Compliance

Talent Recruitment and Retention

Final Thoughts

Mutual Insurance Company FAQs

A mutual insurance company is an organization owned by its policyholders, with a focus on serving their interests rather than maximizing profits for shareholders. Unlike stock insurance companies, mutual insurers prioritize long-term stability, competitive pricing, and community-oriented values.

Mutual insurance companies offer various types of insurance coverage, including property and casualty insurance, life insurance, health insurance, and specialty lines for niche markets. They cater to specific industries, regions, or sectors, allowing for tailored coverage and risk management solutions.

Mutual insurance companies maintain a conservative approach to investments and asset allocation, prioritizing capital preservation and long-term stability. They also hold sufficient capital and reserves to meet regulatory requirements, ensuring they can cover policyholder claims and maintain financial stability during market fluctuations or unexpected events

Choosing a mutual insurance company offers several benefits, including a policyholder-centric approach, long-term stability and focus, lower costs and competitive pricing, and community-oriented values. These features ensure that policyholders' interests are prioritized and that they receive reliable, personalized service.

Mutual insurance companies face challenges such as competition from stock insurance companies, technological advancements and innovation, regulatory changes and compliance, and talent recruitment and retention. To stay competitive, mutual insurers need to embrace digital transformation, invest in technology, adapt to regulatory changes, and attract top talent.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.