The NAIC is a U.S.-based organization of state insurance regulators that aims to promote efficient and effective regulation of the insurance industry. It serves as a forum for cooperation and coordination among state regulators and provides essential resources and support to ensure a consistent and robust regulatory framework across the nation. The NAIC was founded in 1871 to address the need for greater cooperation and coordination among state insurance regulators. Since then, the organization has played a crucial role in shaping insurance regulation in the U.S. by developing model laws, standards, and best practices. The mission of the NAIC is to assist state insurance regulators in protecting consumers and ensuring fair, competitive, and solvent insurance markets. Its objectives include promoting uniformity in insurance regulation, providing resources for state regulators, and fostering collaboration and information-sharing among its members. The NAIC comprises the chief insurance regulators from all 50 U.S. states, the District of Columbia, and five U.S. territories. Members work together to develop and implement regulatory standards and share information on insurance regulation and enforcement. The NAIC's Executive Committee is composed of officers and other elected members responsible for setting the organization's agenda and providing strategic direction. This committee ensures the NAIC's goals and objectives align with the needs of state insurance regulators and consumers. To address specific regulatory issues, the NAIC establishes task forces and working groups comprised of member regulators with relevant expertise. These groups focus on a range of topics, such as financial regulation, market conduct, and consumer protection, to develop and refine regulatory standards and best practices. The NAIC employs a professional staff to support its members and their regulatory efforts. This includes providing technical expertise, research, data analysis, and training, as well as coordinating communication and collaboration among state regulators. One of the primary functions of the NAIC is to develop model laws, regulations, and guidelines for state insurance regulators. These models help promote uniformity and consistency in insurance regulation across the nation, while also adapting to emerging risks and market trends. The NAIC fosters cooperation and coordination among state insurance regulators through information sharing, joint examinations, and enforcement actions. By working together, state regulators can more effectively address cross-border issues and ensure a consistent approach to regulating the insurance industry. The NAIC provides essential resources and support to state insurance regulators, including technical expertise, research, training, and data analysis. These resources help regulators stay informed and equipped to handle the complex challenges of overseeing the insurance industry. The NAIC collects and analyzes data from the insurance industry to monitor trends, identify emerging risks, and inform regulatory decisions. This data also helps state regulators assess the financial health of insurers and ensure they maintain adequate capital and reserves to protect policyholders. The NAIC is dedicated to protecting insurance consumers by promoting transparent, fair, and competitive insurance markets. It develops consumer protection standards and guidelines, provides educational resources, and facilitates communication between state regulators and consumers to address complaints and concerns. The NAIC develops model laws and regulations to provide guidance to state insurance regulators and promote consistency across jurisdictions. These models address various aspects of insurance regulation, including solvency, market conduct, and consumer protection, and are frequently adopted or adapted by states to fit their specific needs. The NAIC's Financial Regulation Standards and Accreditation Program establishes benchmarks for state insurance departments to ensure effective financial oversight of insurers. The program involves a rigorous review of state insurance department operations, with accreditation granted to those that meet or exceed the established standards. The NAIC promotes effective market regulation through initiatives such as the Market Conduct Annual Statement (MCAS), which collects data on insurance company operations to help identify potential market conduct issues. This information assists regulators in monitoring market practices and taking appropriate enforcement actions when necessary. The NAIC is committed to providing consumers with information and resources to help them make informed insurance decisions. This includes offering educational materials on various insurance topics, providing tools to compare insurance products, and facilitating communication between consumers and state regulators to address concerns or complaints. The NAIC engages in international regulatory cooperation to share best practices and promote consistent global insurance standards. By working with foreign counterparts and international organizations, the NAIC supports the development of sound regulatory frameworks and fosters international collaboration to address cross-border insurance issues. The NAIC's work on model laws and regulatory standards has a significant impact on state and federal insurance policies. By providing guidance and expertise, the NAIC helps shape the regulatory landscape and ensures a consistent approach to insurance regulation across the country. The NAIC collaborates with other regulatory bodies, such as the Federal Insurance Office (FIO) and the National Association of Insurance and Financial Advisors (NAIFA), to address insurance-related issues and promote a cohesive regulatory environment. This collaboration enhances the effectiveness of insurance regulation and fosters a unified approach to addressing industry challenges. The NAIC plays a crucial role in the ongoing evolution of insurance regulation by adapting its model laws, guidelines, and standards to reflect changes in the industry and emerging risks. By staying at the forefront of regulatory developments, the NAIC ensures that state insurance regulators have the tools and resources necessary to effectively oversee the insurance market. The NAIC advocates for the preservation of state-based insurance regulation, emphasizing the benefits of a localized approach that allows for greater flexibility and responsiveness to individual state needs. By championing this model, the NAIC helps ensure that insurance regulation remains tailored to the unique requirements of each jurisdiction. One of the key challenges facing the NAIC is striking the right balance between preserving state autonomy in insurance regulation and promoting national consistency. While the organization strives to create uniform standards, it must also respect the diverse needs and priorities of individual states. The NAIC faces the challenge of ensuring that state insurance regulators have access to the resources and expertise needed to effectively regulate their respective markets. This requires ongoing investment in training, technology, and support services to help regulators navigate the complexities of the insurance industry. As the insurance industry evolves, the NAIC must adapt its regulatory framework to address new risks and trends. This requires ongoing research, analysis, and collaboration with industry stakeholders to identify and respond to emerging challenges. The NAIC must address concerns and criticisms from various stakeholders, including insurers, consumer advocates, and lawmakers. By engaging in open dialogue and actively seeking feedback, the NAIC can work to refine its regulatory approach and maintain its credibility as an effective and responsive regulatory body. The National Association of Insurance Commissioners (NAIC) plays a vital role in promoting efficient and effective regulation of the insurance industry in the United States. By fostering cooperation and coordination among state insurance regulators, the NAIC ensures a consistent and robust regulatory framework nationwide. The organization's mission is to protect consumers and ensure fair, competitive, and solvent insurance markets. Through its model laws, standards, and best practices, the NAIC shapes insurance regulations and develops guidelines for state regulators. The NAIC also provides essential resources and support to state regulators, including technical expertise, research, and training. Additionally, the NAIC engages in international regulatory cooperation and advocates for state-based insurance regulation. However, challenges such as balancing state autonomy with national consistency, ensuring adequate resources for regulators, responding to emerging risks, and addressing industry concerns require ongoing attention and adaptation. Overall, the NAIC plays a crucial role in shaping and maintaining a robust insurance regulatory environment in the United States.What Is the National Association of Insurance Commissioners (NAIC)?

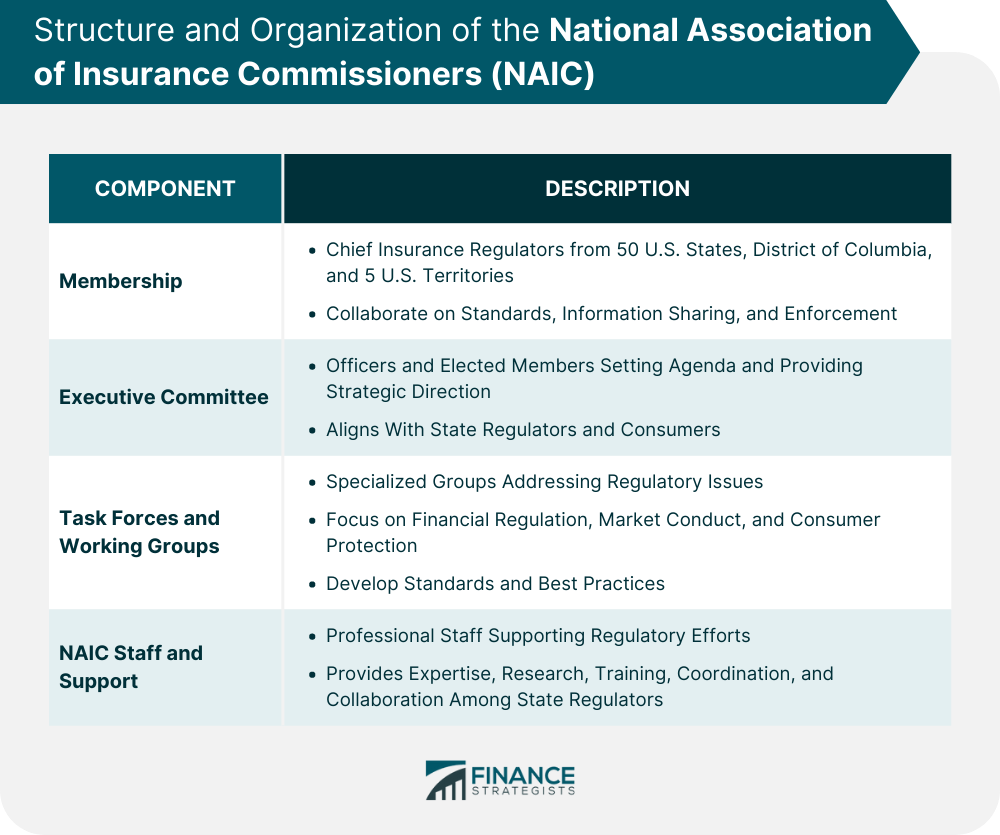

Structure and Organization of the NAIC

Membership

Executive Committee

Task Forces and Working Groups

NAIC Staff and Support

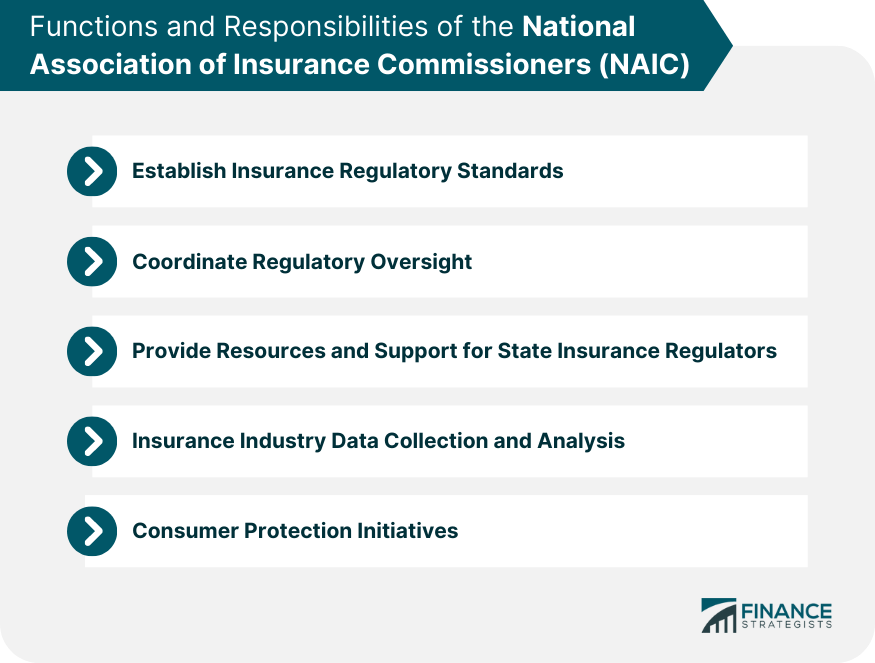

Functions and Responsibilities of the NAIC

Establishing Insurance Regulatory Standards

Coordinating Regulatory Oversight

Providing Resources and Support for State Insurance Regulators

Insurance Industry Data Collection and Analysis

Consumer Protection Initiatives

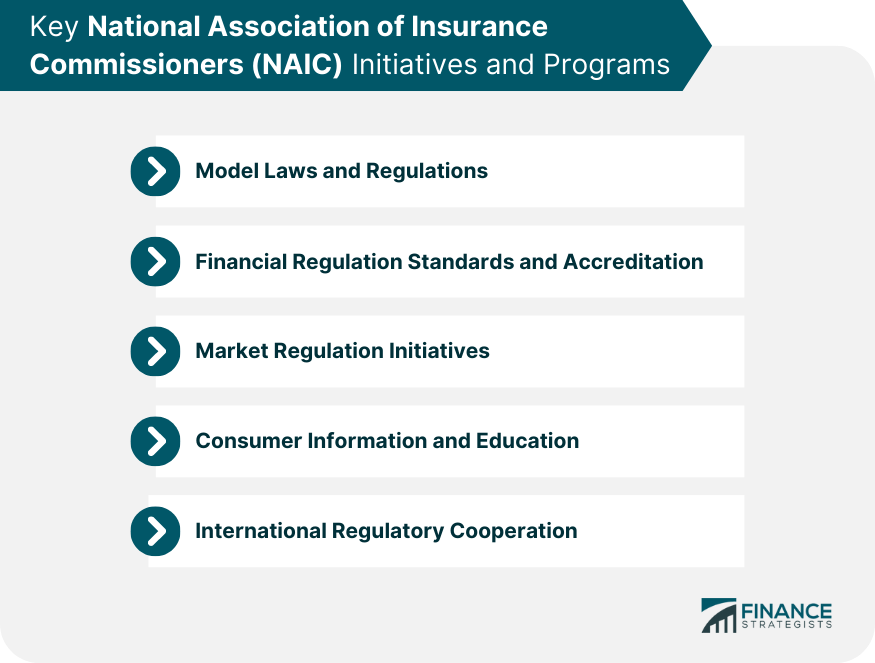

Key NAIC Initiatives and Programs

Model Laws and Regulations

Financial Regulation Standards and Accreditation

Market Regulation Initiatives

Consumer Information and Education

International Regulatory Cooperation

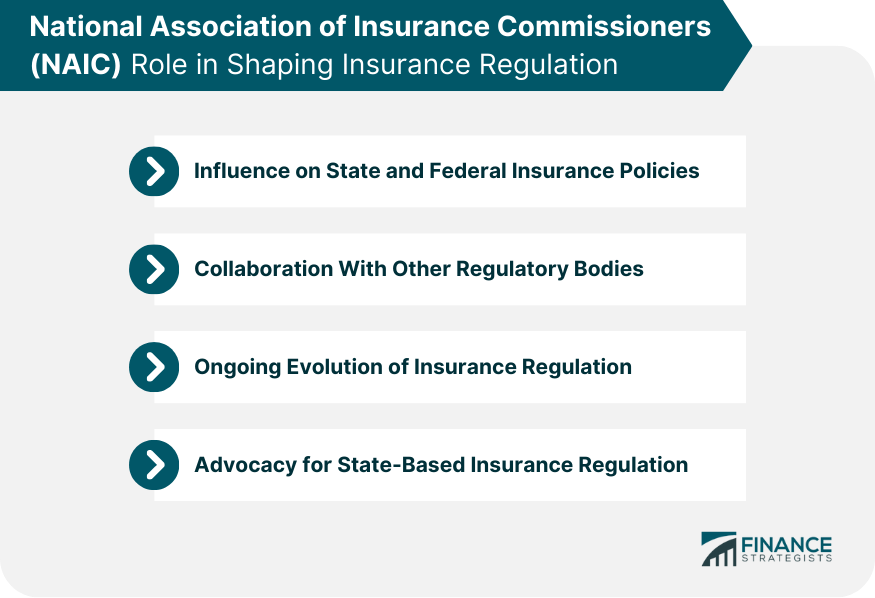

NAIC's Role in Shaping Insurance Regulation

Influence on State and Federal Insurance Policies

Collaboration With Other Regulatory Bodies

Ongoing Evolution of Insurance Regulation

Advocacy for State-Based Insurance Regulation

Challenges and Criticisms of the NAIC

Balancing State Autonomy with National Consistency

Ensuring Adequate Resources and Expertise for State Regulators

Responding to Emerging Risks and Trends in the Insurance Industry

Addressing Industry Concerns and Criticisms

Final Thoughts

National Association of Insurance Commissioners (NAIC) FAQs

The National Association of Insurance Commissioners (NAIC) is a U.S.-based organization of state insurance regulators that aims to promote efficient and effective regulation of the insurance industry. Its purpose is to provide a forum for cooperation and coordination among state regulators and to offer resources and support to ensure a consistent regulatory framework across the nation.

The NAIC influences insurance regulation by developing model laws, regulations, and guidelines for state insurance regulators, promoting uniformity and consistency across jurisdictions. The organization also works closely with other regulatory bodies and plays a crucial role in shaping state and federal insurance policies.

The NAIC provides essential resources and support to state insurance regulators, including technical expertise, research, training, data analysis, and coordination of communication and collaboration among state regulators. This helps regulators stay informed and equipped to handle the complex challenges of overseeing the insurance industry.

Some key initiatives and programs of the NAIC include developing model laws and regulations, establishing financial regulation standards and accreditation, coordinating market regulation initiatives, providing consumer information and education, and fostering international regulatory cooperation.

The NAIC faces challenges and criticisms related to balancing state autonomy with national consistency in insurance regulation, ensuring adequate resources and expertise for state regulators, responding to emerging risks and trends in the insurance industry, and addressing concerns and criticisms from various stakeholders, including insurers, consumer advocates, and lawmakers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.