Fire insurance is a type of insurance policy that provides protection against losses resulting from fire damage. It is designed to cover the cost of repairing or rebuilding property that has been damaged or destroyed by fire. Fire insurance policies typically cover losses resulting from fires caused by lightning, faulty wiring, and other types of accidental fires. Property owners, such as homeowners, business owners, and landlords, can purchase fire insurance policies to protect their investments against the financial losses that may result from fire damage. There are different types of fire insurance policies that homeowners, business owners, and landlords can purchase depending on their specific needs. The most common types of fire insurance policies include: Homeowners insurance typically includes coverage for fire damage as part of the policy. Homeowners insurance policies vary in terms of coverage limits, deductibles, and exclusions. Business insurance policies can include coverage for fire damage, as well as other types of risks such as liability and property damage. Business insurance policies are typically customized to meet the specific needs of a business. Landlord insurance policies provide protection for landlords against losses resulting from fire damage to their rental properties. These policies can also provide coverage for lost rental income due to fire damage. To obtain fire insurance, homeowners, business owners, and landlords must first determine the coverage they need and the amount of coverage required. Fire insurance coverage typically ranges from $100,000 to $1 million or more, depending on the size of the property and the risks involved. Once the coverage amount is determined, property owners must find a reputable insurance company that offers fire insurance. The insurance company will typically require a completed application, financial statements, and other documentation to determine the property owner's risk level and premium rate. Once the application is approved, the property owner must pay the premium, and the insurance company will issue the fire insurance policy. The policy will outline the coverage and limitations of the policy, as well as the premium rate and any deductibles. Fire insurance policies typically cover losses resulting from fire damage, including damage to the structure of the property and personal belongings. However, there are limitations to what is covered by the policy. For example, most fire insurance policies do not cover losses resulting from floods, earthquakes, or other natural disasters. Fire insurance policies also have limits on the amount of coverage provided. The amount of coverage is determined by the premium paid, and property owners must ensure that the coverage amount is sufficient to cover potential losses. If a fire occurs, the property owner must file a claim with the insurance company. The claim process typically involves providing documentation of the loss, such as police reports or financial statements. Once the claim is approved, the insurance company will provide financial compensation for the loss, up to the coverage limit of the fire insurance policy. The most significant benefit of fire insurance is protection against fire damage. Fires can cause significant damage to homes, businesses, and rental properties, resulting in significant financial losses. Fire insurance policies can provide coverage for the costs of repairing or rebuilding damaged property, helping property owners recover from losses and continue their operations. Fire insurance policies also provide financial security for property owners. Property owners who experience fire damage can face significant financial losses that may be difficult to recover from without insurance. Fire insurance policies provide peace of mind and financial protection for property owners, ensuring that they are prepared for the unexpected. Fire insurance policies typically provide coverage for the costs of repairing or rebuilding property that has been damaged or destroyed by fire. This coverage can include the cost of materials, labor, and other expenses associated with repairing or rebuilding damaged property. Fire insurance policies can also provide coverage for the replacement cost of damaged or destroyed property, ensuring that property owners can replace their belongings or property if necessary. The cost of fire insurance varies depending on several factors, including the amount of coverage needed, the type of property, and the risk level of the property. For example, a property located in an area with a high risk of wildfires may have a higher premium rate than a property located in an area with a low risk of wildfires. Other factors that may influence the cost of fire insurance include the age of the property, the condition of the property, and the level of fire protection measures in place, such as fire alarms and sprinkler systems. While the cost of fire insurance may seem high, it is important to consider the potential cost of fire damage. Fires can cause significant damage to properties, resulting in financial losses that may be difficult to recover from without insurance. Investing in fire insurance is a wise decision to protect against these potential losses and ensure financial security. Fire insurance is a specific type of insurance policy that provides coverage for losses resulting from fire damage. Home insurance policies, on the other hand, are broader policies that provide coverage for a wide range of risks, including fire damage, theft, and liability. While fire insurance and home insurance are different types of insurance policies, they can work together to provide complete coverage for property owners. By purchasing both types of insurance, property owners can ensure that they are protected against a wide range of risks. Fire insurance is a critical component of risk management for homeowners, business owners, and landlords. It provides financial protection against losses resulting from fire damage and ensures that property owners can recover and continue their operations. As such, it is important for property owners to carefully consider their need for fire insurance and obtain coverage that best fits their specific needs. While the cost of fire insurance may seem high, it is important to consider the potential cost of fire damage and the financial security provided by insurance. Moreover, property owners should also consider other types of insurance policies, such as home insurance or business insurance, to provide complete coverage against a wide range of risks. As technology continues to advance, we can expect to see more advanced fire detection and prevention systems or new types of coverage for emerging risks in the future. In conclusion, investing in fire insurance is a wise decision for property owners who seek to protect themselves against the financial losses that may result from fire damage. By taking the necessary steps to obtain adequate coverage and understand the limitations and benefits of fire insurance policies, property owners can ensure that their investments remain protected and that they can continue their operations even in the face of unexpected disasters.What Is Fire Insurance?

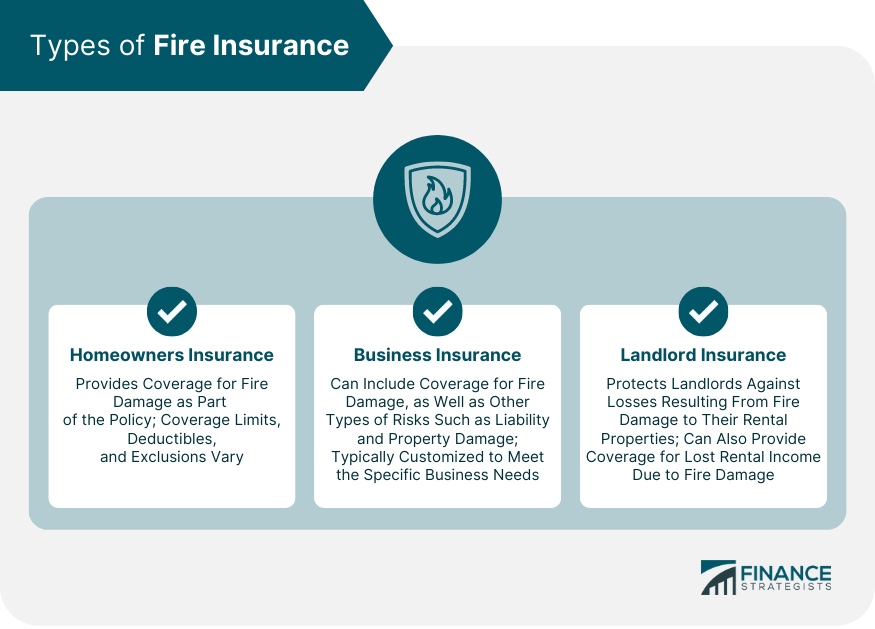

Types of Fire Insurance

Homeowners Insurance

Business Insurance

Landlord Insurance

How Fire Insurance Works

Steps to Obtaining Fire Insurance

Coverage and Limitations of Fire Insurance

Claim Process for Fire Insurance

Benefits of Fire Insurance

Protection Against Fire Damage

Financial Security for Property Owners

Coverage for Rebuilding and Replacement Costs

Cost of Fire Insurance

Factors That Influence the Cost of Fire Insurance

Comparison of the Cost of Fire Insurance to the Cost of Fire Damage

Fire Insurance vs Home Insurance

Differences Between Fire Insurance and Home Insurance

How They Can Work Together to Provide Complete Coverage

Final Thoughts

Fire Insurance FAQs

Fire insurance is a type of property insurance that covers damage caused by fire. It provides financial protection to property owners against the loss or damage of their property due to fire.

Fire insurance policies cover losses resulting from fire and related perils, such as smoke, water damage, and structural damage caused by fire. Most policies also provide coverage for damage caused by explosions, lightning, and other similar events.

Fire insurance works by providing financial protection to policyholders for damage or loss to their property due to fire. The policyholder pays a premium to the insurer, and in return, the insurer provides coverage for losses caused by fire up to the policy limit. In the event of a fire, the policyholder must file a claim with the insurance company and provide proof of loss.

Fire insurance is essential for anyone who owns property that could be damaged by fire. This includes homeowners, renters, and business owners. If you have a mortgage on your property, your lender may require you to carry fire insurance as a condition of your loan.

The cost of fire insurance varies depending on several factors, including the value of the property, the location, and the level of coverage required. Premiums for fire insurance can range from a few hundred to several thousand dollars per year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.