A named perils insurance policy provides coverage for specific perils, events, or hazards explicitly listed in the policy. It contrasts with all-risk policies, which cover all perils except those specifically excluded. The purpose of a named perils policy is to provide coverage tailored to the specific risks faced by the insured. These policies are generally more affordable than all-risk policies, as they cover a narrower range of perils. In contrast to named perils policies, all-risk insurance policies provide broader coverage, protecting against all perils except those explicitly excluded. These policies often come at a higher cost, as they offer more comprehensive protection. Homeowners insurance is a type of named perils policy designed to protect homeowners from financial losses due to specific perils, such as fire or theft. It typically covers the structure of the home, personal property, and liability. Renters insurance is another type of named perils policy, designed for tenants. It generally covers personal property and liability, but not the structure of the rented property, which is the landlord's responsibility. Business insurance policies can also be structured as named perils policies, covering specific risks faced by businesses, such as property damage or theft. These policies can be customized to fit the unique needs of each business. Fire and lightning coverage protects against damage or loss resulting from fires or lightning strikes. This is a standard peril included in most named perils policies. Windstorm and hail coverage provides protection against damage caused by windstorms, hurricanes, or hailstorms. This coverage is particularly important in areas prone to these weather events. Explosion coverage protects against damages caused by explosions, which can result from gas leaks or other accidents. This coverage is typically included in most named perils policies. Riot and civil commotion coverage provides protection against damages caused by riots, civil disturbances, or other acts of public disorder. This coverage helps ensure financial stability in times of unrest. Aircraft coverage protects against damage caused by aircraft, including self-propelled missiles and spacecraft. This coverage is important for properties located near airports or flight paths. Vehicle coverage provides protection against damage caused by vehicles, excluding those owned or operated by the insured. This coverage is especially important for properties near busy roads or highways. Smoke coverage protects against damage resulting from smoke, including smoke from fires or other sources. This coverage is valuable for properties with potential exposure to smoke-related damages. Vandalism and malicious mischief coverage protects against damage caused by intentional acts of destruction or defacement. This coverage is essential for safeguarding properties from potential vandalism. Theft coverage provides protection against the loss of personal property due to theft or burglary. This coverage is important for maintaining financial security in the event of property loss. Falling objects' coverage protects against damage caused by objects falling from the sky, such as tree branches or meteorites. This coverage is essential for properties in areas with potential falling object hazards. Weight of ice, snow, or sleet coverage provides protection against damage caused by the weight of accumulated ice, snow, or sleet. This coverage is particularly important in regions with harsh winter weather conditions. This coverage protects against damage caused by the accidental discharge or overflow of water or steam from plumbing, heating, or air conditioning systems. This coverage is essential for properties with potential risks related to water or steam systems. This coverage provides protection against damages caused by sudden and accidental tearing apart, cracking, burning, or bulging of a building's structure, appliances, or systems. This coverage helps maintain the integrity of the property. Freezing coverage protects against damage caused by freezing of plumbing, heating, or air conditioning systems. This coverage is crucial for properties in cold climates where freezing temperatures are common. Volcanic eruption coverage protects against damage resulting from volcanic eruptions and related events, such as ash, dust, or lava flow. This coverage is particularly important for properties located near active volcanoes. Endorsements can be added to named perils policies to expand coverage for additional perils not initially included in the policy. This allows policyholders to tailor their coverage to better suit their unique needs and risks. Policyholders can choose to exclude specific perils from their named perils policy to lower their premiums. However, doing so may leave them exposed to financial losses resulting from the excluded perils. Policy limits and deductibles can be customized to fit the policyholder's desired level of financial protection and affordability. Higher limits offer more protection, while higher deductibles can lower premium costs but require greater out-of-pocket expenses in the event of a loss. The location of the property and the associated risk exposure are significant factors affecting the cost of named perils insurance policies. Properties in high-risk areas, such as those prone to natural disasters or with a high crime rate, are more expensive to insure. The value of the property and the estimated cost of replacing it in the event of a loss also influence the cost of named perils insurance policies. The higher the value and replacement cost, the more expensive the policy is likely to be. The deductible and policy limits chosen by the policyholder affect the cost of named perils insurance policies. Higher deductibles and lower policy limits typically result in lower premiums, while lower deductibles and higher policy limits result in higher premiums. The policyholder's claims history can also affect the cost of named perils insurance policies. Policyholders with a history of filing claims may pay higher premiums, as they are considered higher risk. Finally, the insurance provider and policy options selected by the policyholder can affect the cost of named perils insurance policies. Different insurance companies offer different rates, and policy options vary, making it essential to shop around and compare quotes. When purchasing a named perils insurance policy, it's important to research potential insurance providers to find a reputable and reliable company. Online reviews, recommendations from friends and family, and professional associations can provide valuable insights. Comparing quotes and policy options from different insurance providers can help policyholders find the best coverage for their needs and budget. It's important to consider the premium cost, policy limits, deductibles, and coverage options. Policyholders should carefully review and understand the terms and conditions of their named perils insurance policy before purchasing. This includes knowing what is and isn't covered, the deductible amount, and any policy limits. Insurance agents and brokers can provide expert guidance and help policyholders find the best-named perils insurance policy for their specific needs. They can also help with the claims process if the need arises. After experiencing a loss covered by their named perils insurance policy, policyholders should take immediate steps to protect their property and prevent further damage. They should then contact their insurance provider as soon as possible to begin the claims process. Policyholders should document and provide evidence of the damage to their property, including photographs, receipts, and repair estimates. This will help expedite the claims process and ensure a fair settlement. Policyholders should maintain open and honest communication with their insurance provider throughout the claims process. They should provide any requested information promptly and ask questions if they are unsure about any aspect of the process. The settlement process and timelines vary depending on the policy and the insurance provider. Policyholders should carefully review their policy to understand the settlement process and what to expect in terms of timelines and payment. When choosing a named perils insurance policy, it's essential to assess personal risks and needs. This includes considering the location of the property, the type of property, and the specific perils that are most likely to occur. Policyholders should carefully review the policy coverage and exclusions to ensure they have the protection they need. This includes checking for any excluded perils and determining if additional coverage is necessary. Comparing the costs and benefits of different named perils insurance policies can help policyholders find the best coverage for their needs and budget. It's important to consider the premium cost, deductible amount, policy limits, and coverage options. Endorsements and additional coverage options can provide additional protection for specific risks not covered by a standard named perils insurance policy. Policyholders should consider their individual needs and risks when evaluating these options. Having a named perils insurance policy can provide valuable financial protection against specific risks faced by the insured. By tailoring coverage to specific perils, policyholders can maintain financial stability and peace of mind. When purchasing a named perils insurance policy, it's essential to find a balance between coverage and cost. Policyholders should carefully evaluate their needs and risks and choose a policy that offers adequate protection at an affordable price. Finally, policyholders should regularly review and update their named perils insurance policy coverage to ensure it continues to meet their changing needs and risks. This includes adding endorsements or adjusting policy limits and deductibles as necessary. A named perils insurance policy provides targeted protection against specific risks and hazards, and can be a cost-effective alternative to all-risk policies. Policyholders should carefully evaluate their individual needs and risks, research potential insurance providers, and work with an agent or broker to find the best policy for their needs. By regularly reviewing and updating their policy coverage, policyholders can maintain financial stability and peace of mind.What Is the Named Perils Insurance Policy?

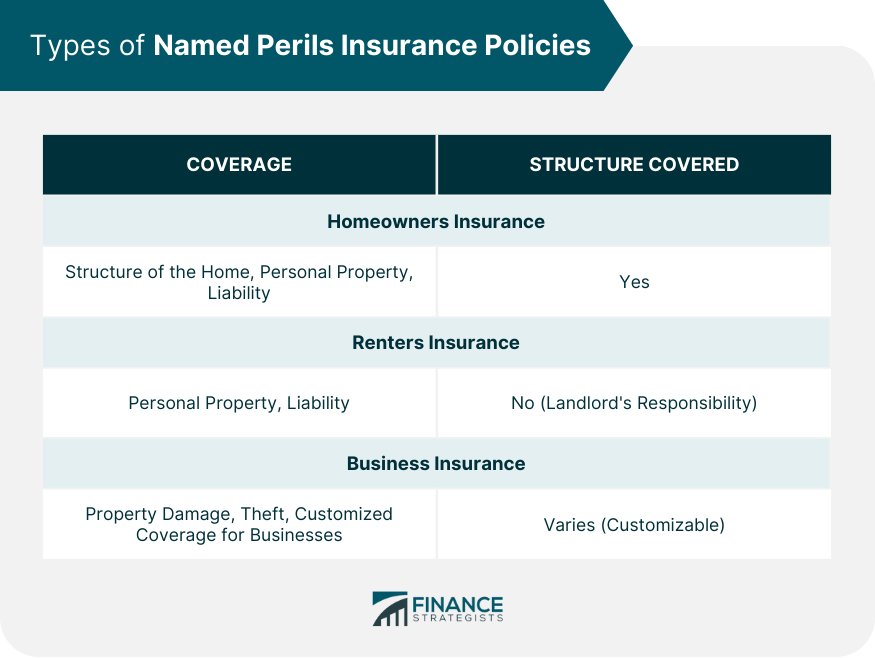

Types of Named Perils Insurance Policies

Homeowners Insurance

Renters Insurance

Business Insurance

Common Named Perils Covered

Fire and Lightning

Windstorm and Hail

Explosion

Riot and Civil Commotion

Aircraft

Vehicles

Smoke

Vandalism and Malicious Mischief

Theft

Falling Objects

Weight of Ice, Snow, or Sleet

Accidental Discharge or Overflow of Water or Steam

Sudden and Accidental Tearing Apart, Cracking, Burning, or Bulging

Freezing

Volcanic Eruption

Customizing Named Perils Insurance Policy

Adding Endorsements to Cover Additional Perils

Excluding Specific Perils

Choosing Policy Limits and Deductibles

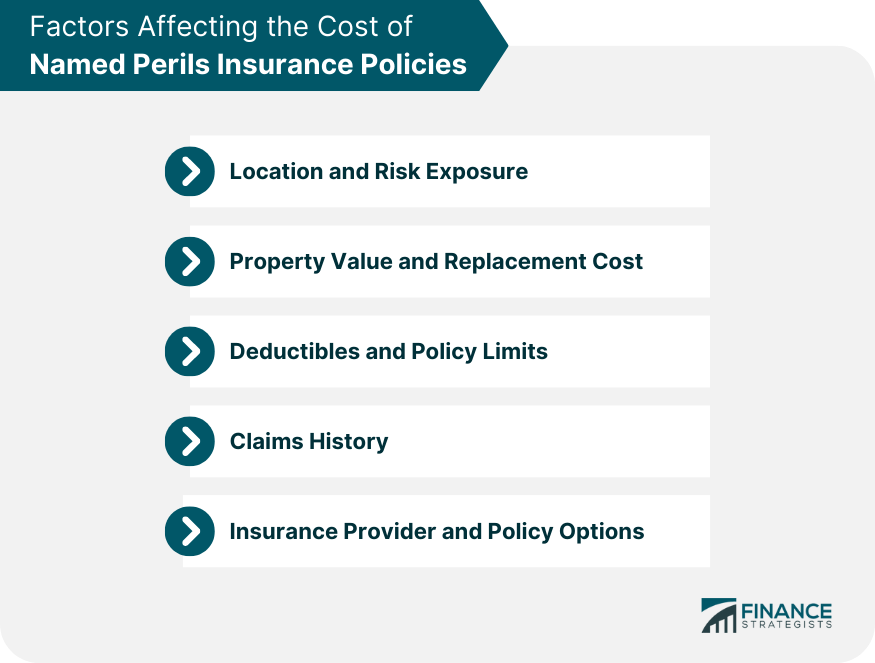

Factors Affecting the Cost of Named Perils Insurance Policies

Location and Risk Exposure

Property Value and Replacement Cost

Deductibles and Policy Limits

Claims History

Insurance Provider and Policy Options

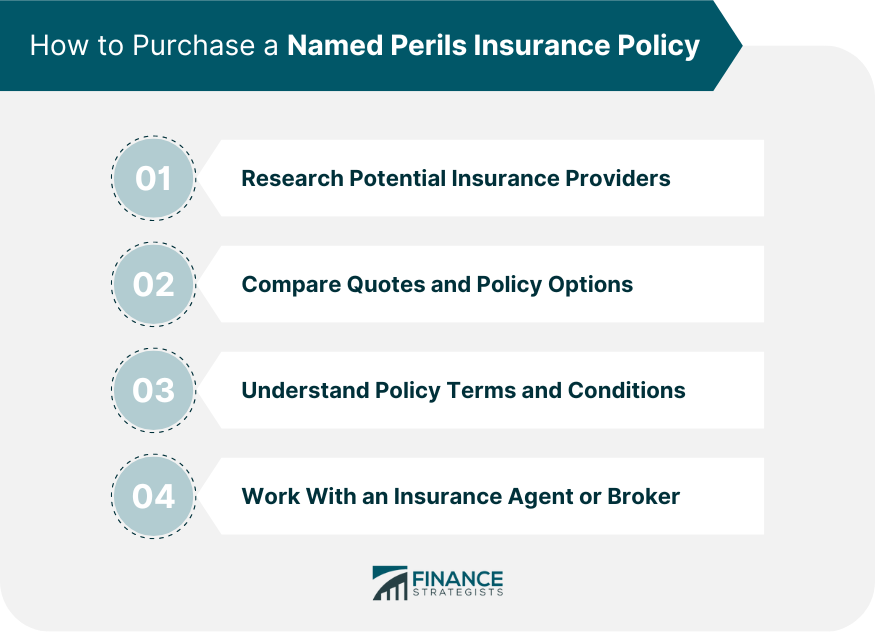

How to Purchase a Named Perils Insurance Policy

Research Potential Insurance Providers

Compare Quotes and Policy Options

Understand Policy Terms and Conditions

Work With an Insurance Agent or Broker

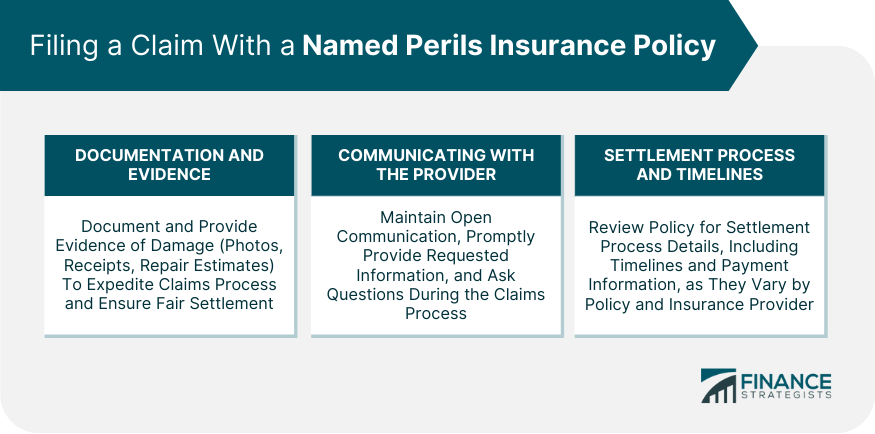

Filing a Claim With a Named Perils Insurance Policy

Documentation and Evidence of Damage

Communicating With the Insurance Provider

Settlement Process and Timelines

Tips for Choosing the Right Named Perils Insurance Policy

Assess Personal Risks and Needs

Evaluate Policy Coverage and Exclusions

Compare Costs and Benefits of Different Policies

Consider Endorsements and Additional Coverage Options

Final Thoughts

Named Perils Insurance Policy FAQs

A named perils insurance policy is a type of insurance that provides coverage for specific perils, events, or hazards explicitly listed in the policy. It contrasts with all-risk policies, which cover all perils except those specifically excluded.

A named perils insurance policy can cover a range of perils, including fire, windstorm and hail, explosion, riot and civil commotion, aircraft, vehicles, smoke, vandalism, theft, falling objects, weight of ice, snow, or sleet, accidental discharge or overflow of water or steam, freezing, and volcanic eruption.

The cost of a named perils insurance policy is affected by several factors, including location and risk exposure, property value and replacement cost, deductibles and policy limits, claims history, and insurance provider and policy options.

To purchase a named perils insurance policy, it's important to research potential insurance providers, compare quotes and policy options, understand policy terms and conditions, and work with an insurance agent or broker.

After experiencing a loss covered by their named perils insurance policy, policyholders should take immediate steps to protect their property and prevent further damage. They should then contact their insurance provider as soon as possible to begin the claims process and document and provide evidence of the damage to their property.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.