Personal lines insurance refers to a type of insurance coverage that is designed to protect individuals and their personal assets. It includes various types of insurance policies that are tailored to meet the specific needs of individuals and households. Personal lines insurance commonly includes auto insurance, homeowners insurance, renters insurance, and personal liability insurance. These policies provide financial protection against potential risks and losses associated with personal property damage, theft, accidents, and legal liabilities. Personal lines insurance is typically purchased by individuals directly from insurance companies or through agents or brokers. It plays a crucial role in safeguarding individuals' financial well-being and providing peace of mind in the face of unforeseen events. Understanding the definition and importance of personal lines insurance can help individuals make informed decisions about protecting their personal assets and mitigating risks. Homeowners insurance is designed to protect homeowners from financial loss due to damage to their property, liability claims, and additional living expenses if they are forced to live elsewhere temporarily. The main components of homeowners insurance coverage include dwelling, personal property, and liability protection. Premiums for homeowners insurance are influenced by factors such as the home's age, construction type, location, and the policyholder's claims history. Renters insurance offers financial protection for tenants, covering their personal belongings and providing liability coverage in case of accidents or damage to the rented property. Coverage components typically include personal property, liability, and additional living expenses. Premiums for renters insurance depend on factors such as the value of the tenant's possessions, the location of the rental property, and the presence of safety features like smoke detectors and security systems. Auto insurance provides financial protection for drivers in case of accidents, theft, or damage to their vehicles. Coverage components may include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. Premiums for auto insurance are determined by factors such as the driver's age, driving record, vehicle type, and location. Personal umbrella insurance offers additional liability coverage beyond the limits of standard homeowners, renters, or auto insurance policies. This type of insurance can protect policyholders from large liability claims that may exceed their primary insurance coverage. Premiums for personal umbrella insurance depend on the policyholder's risk profile and the amount of additional coverage desired. There are several other personal lines insurance products available to protect specific assets or activities. These include watercraft insurance for boats and other water vessels, motorcycle insurance for motorbikes and scooters, and recreational vehicle insurance for RVs, campers, and travel trailers. Insurance brokers act as intermediaries between clients and insurance companies, helping clients find the most suitable coverage for their unique needs and risk exposures. They advise on appropriate coverage and policy limits, compare quotes from multiple insurers, assist with claims processing, and provide ongoing policy management and updates. Property and casualty insurance is a broad category of insurance that encompasses personal lines insurance products. It covers policyholders for loss or damage to their property and liability claims arising from accidents or damage to others' property. Key principles of property and casualty insurance include indemnity, insurable interest, utmost good faith, and risk pooling. Pricing for personal lines insurance policies is influenced by various factors. Risk factors such as the insured's age, occupation, location, and claims history can significantly impact premiums. Deductibles and policy limits also affect pricing, with higher deductibles typically leading to lower premiums. Discounts and bundling options, such as combining auto and homeowners insurance with the same carrier, can help policyholders save money. Geographic location can also play a role, as areas prone to natural disasters or high crime rates may result in higher premiums. The claims process for personal lines insurance typically begins with the policyholder reporting the claim to their insurance broker. The broker will then gather documentation and evidence related to the claim, such as photos, repair estimates, and police reports. An insurance adjuster is assigned to the case to assess the damage, verify the claim, and determine the appropriate payout. The adjuster's role is crucial in the claims process, as they work closely with both the policyholder and the insurance company to ensure a fair settlement. After the adjuster's assessment, negotiations may take place between the insurance company and the policyholder to reach a mutually agreeable payout. Once an agreement is reached, the insurance company will issue the payment to the policyholder or directly to the service providers involved in the repair or replacement process. Selecting the right insurance broker for personal lines insurance is vital to ensure the best possible coverage and service. Factors to consider when choosing a broker include: Look for brokers with extensive experience and knowledge in personal lines insurance. An experienced broker will have a deep understanding of the various products and carriers, which can help clients find the best coverage for their needs. Research the broker's reputation and reads customer reviews to get a sense of their level of service and expertise. Look for brokers who are well-regarded in the industry and have a track record of satisfied clients. Choose a broker that offers a wide range of services, including policy management, claims assistance, and risk management advice. This can help ensure that clients receive comprehensive support throughout their insurance journey. A broker's relationship with insurance carriers is crucial, as it can impact the quality of coverage and pricing options available to clients. Look for brokers who have strong relationships with multiple insurance companies, which can increase the likelihood of finding the best coverage at a competitive price. Effective communication is key when working with an insurance broker. Look for brokers who are easily accessible and responsive to inquiries, as this can make a significant difference in the overall customer experience. Personal Lines Insurance is essential for protecting individuals and families from the financial impact of unexpected events. With various types of coverage available, such as homeowners, renters, auto, and personal umbrella insurance, policyholders can tailor their protection to suit their unique needs and risk exposures. Insurance brokers play a critical role in helping clients find the best coverage, advising on appropriate policy limits, and providing ongoing support throughout the claims process. Key factors affecting Personal Lines Insurance pricing include the insured's risk factors, deductibles and policy limits, discounts and bundling options, and geographic location. Being aware of these factors can help policyholders make informed decisions about their insurance coverage. The claims process for Personal Lines Insurance involves reporting the claim to the broker, gathering documentation and evidence, working with an insurance adjuster, and negotiating a settlement. The broker's expertise and guidance are invaluable in ensuring a smooth and successful claims experience. Choosing the right insurance broker is vital to ensure the best possible coverage and service. Look for brokers with experience and expertise in the industry, a strong reputation, a wide range of services, and solid relationships with insurance carriers. Don't hesitate to seek professional services from a trusted insurance broker to help navigate the complex world of Personal Lines Insurance and secure the protection you and your family deserve.Definition of Personal Lines Insurance

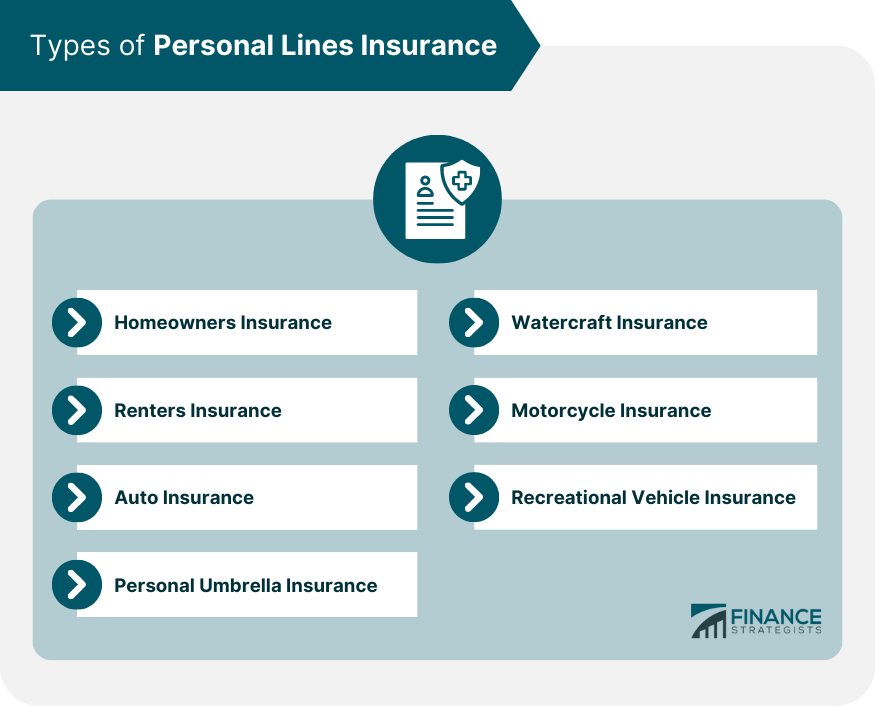

Types of Personal Lines Insurance

Homeowners Insurance

Renters Insurance

Auto Insurance

Personal Umbrella Insurance

Other Personal Lines Insurance Products

Role of Insurance Brokers in Personal Lines Insurance

Property and Casualty Insurance Basics

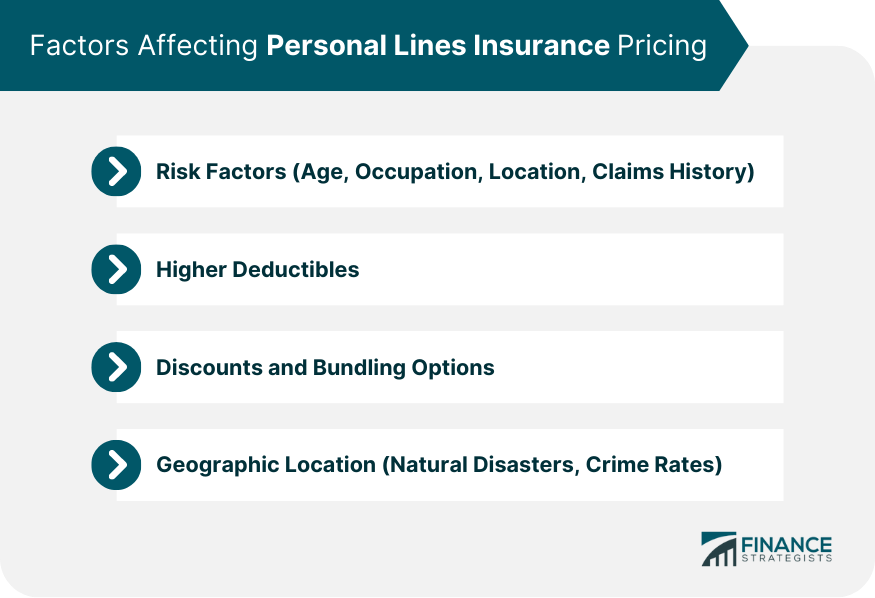

Factors Affecting Personal Lines Insurance Pricing

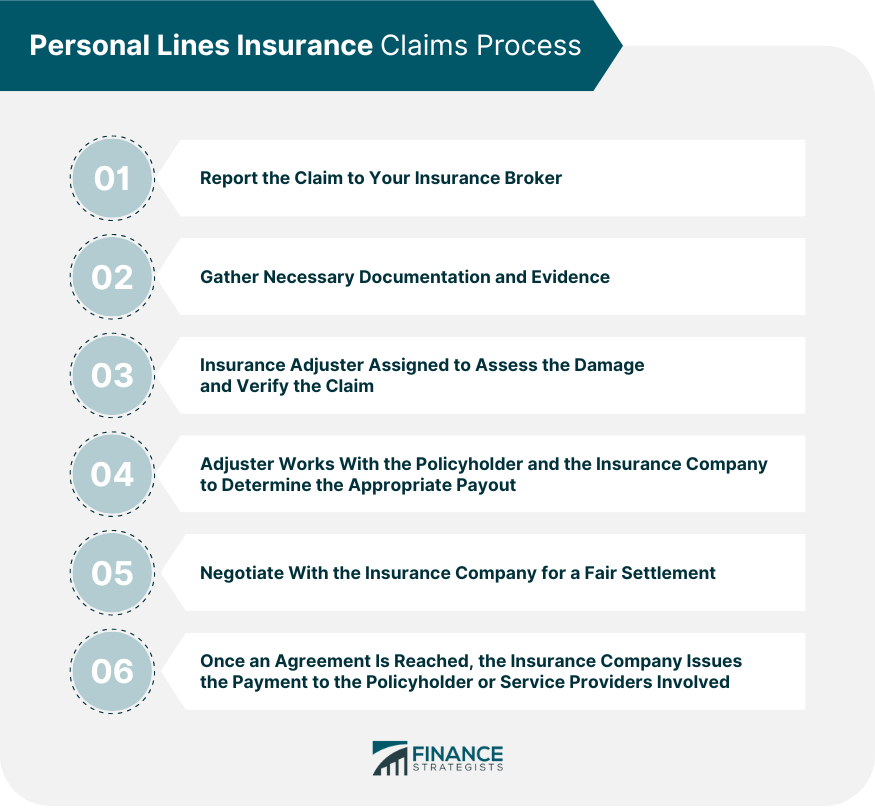

Personal Lines Insurance Claims Process

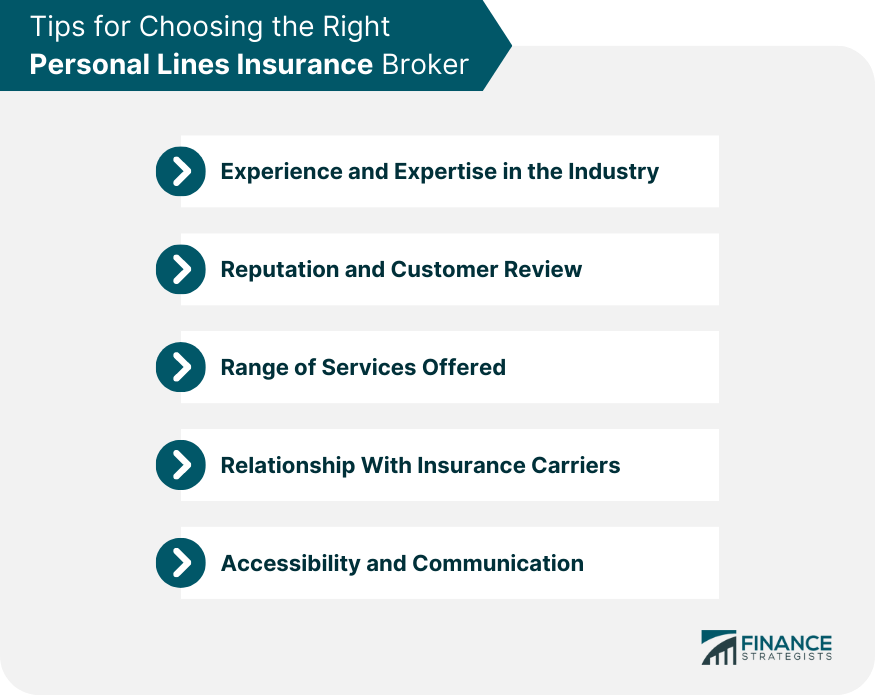

Tips for Choosing the Right Personal Lines Insurance Broker

Experience and Expertise in the Industry

Reputation and Customer Review

Range of Services Offered

Relationship With Insurance Carriers

Accessibility and Communication

Conclusion

Personal Lines Insurance FAQs

Personal Lines Insurance refers to insurance coverage designed to protect individuals and families from financial loss due to unexpected events such as accidents, property damage, or liability claims. It is crucial for safeguarding personal assets and ensuring financial stability in the face of unforeseen circumstances.

Various types of Personal Lines Insurance include homeowners insurance, renters insurance, auto insurance, personal umbrella insurance, watercraft insurance, motorcycle insurance, and recreational vehicle insurance. Each type of coverage is tailored to protect specific assets or activities.

Insurance brokers play a critical role in helping clients navigate the complex world of Personal Lines Insurance. They advise clients on appropriate coverage and policy limits, compare quotes from multiple insurers, assist with claims processing, and provide ongoing policy management and updates.

Several factors influence the pricing of Personal Lines Insurance policies, including the insured's risk factors (age, occupation, location, and claims history), deductibles and policy limits, discounts and bundling options, and geographic location (areas prone to natural disasters or high crime rates may have higher premiums).

The claims process for Personal Lines Insurance typically involves reporting the claim to the insurance broker, gathering documentation and evidence, working with an insurance adjuster to assess the damage and verify the claim, negotiating a settlement, and receiving a payout from the insurance company. The insurance broker plays a significant role in guiding clients through each step of the process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.