Valuable items coverage, also known as scheduled personal property coverage, is a type of insurance that provides extra protection for your high-value possessions. This coverage is designed to protect items that may not be adequately covered under a standard homeowners insurance policy. Examples of such items include jewelry, fine art, antiques, and collectibles. Valuable items coverage typically covers loss or damage to these items caused by a variety of perils, such as theft, fire, and water damage. If you own high-value possessions, you may assume that your homeowners insurance policy will fully cover them. However, this may not always be the case. Homeowners insurance policies typically have coverage limits for certain types of items, and may not provide coverage for some perils. In addition, homeowners insurance policies may not fully reimburse you for the actual value of your valuable items if they are lost or damaged. This is where valuable items coverage comes in - it can provide you with the extra protection and peace of mind you need to protect your precious possessions. Jewelry is a common type of valuable item that may require extra insurance protection. Valuable items coverage for jewelry typically covers loss or damage caused by theft, fire, and other perils. In addition, some policies may provide coverage for damage to a stone or loss of a stone due to a covered event. When insuring your jewelry, it's important to have your items appraised and to provide your insurance provider with a detailed description of each piece. Fine art is another type of valuable item that may require specialized insurance coverage. Valuable items coverage for fine art typically covers loss or damage caused by a variety of perils, such as fire, theft, and accidental damage. When insuring your fine art, it's important to have it appraised by a professional and to provide your insurance provider with a detailed description of each piece, including the artist, title, and medium. Antiques are valuable items that are often irreplaceable, making them particularly vulnerable to loss or damage. Valuable items coverage for antiques typically covers loss or damage caused by a variety of perils, such as theft, fire, and accidental damage. When insuring your antiques, it's important to have them appraised and to provide your insurance provider with a detailed description of each piece, including its age, origin, and condition. Collectibles are items that are valued for their rarity or uniqueness, such as coins, stamps, or sports memorabilia. Valuable items coverage for collectibles typically covers loss or damage caused by a variety of perils, such as theft, fire, and accidental damage. When insuring your collectibles, it's important to have them appraised and to provide your insurance provider with a detailed description of each piece, including its condition and provenance. When insuring your valuable items, it's important to have them appraised by a professional to determine their current value. The appraisal should include a detailed description of each item, including its condition, age, and provenance. This information will be used by your insurance provider to determine the coverage amount and premium for your valuable items coverage. The cost of valuable items coverage can vary depending on the type and value of the items being insured. Premiums for valuable items coverage are typically based on a percentage of the total value of the items being insured. In addition, valuable items coverage may require a deductible, which is the amount you will need to pay out-of-pocket before your insurance coverage kicks in. If your valuable item is lost, stolen, or damaged, you will need to file a claim with your insurance provider. When filing a claim, be sure to provide your insurance provider with a detailed description of the item and the circumstances of the loss or damage. Your insurance provider may also require documentation, such as a police report or appraisal, to process your claim. Valuable items coverage typically has coverage limits for each item or category of items. These limits are the maximum amount your insurance provider will reimburse you for a covered loss. It's important to review your policy carefully to ensure that your coverage limits are adequate for your valuable items. Valuable items coverage provides extra protection for your high-value possessions, protecting them against loss or damage caused by a variety of perils. This can include theft, fire, water damage, and accidental damage. Valuable items coverage provides reimbursement for the actual value of your items, as determined by an appraisal. This ensures that you are adequately compensated for your loss or damage, and can replace your valuable item with a similar one. Knowing that your high-value possessions are adequately protected can provide peace of mind. With valuable items coverage, you can rest assured that your precious possessions are covered in the event of a loss or damage. Valuable items coverage can be more expensive than standard homeowners insurance coverage, as it provides extra protection for high-value items. When considering purchasing valuable items coverage, it's important to review your budget to ensure that the cost is manageable. Consider whether you have valuable items that require extra insurance protection. If you own high-value possessions, such as jewelry, fine art, antiques, or collectibles, valuable items coverage may be necessary to adequately protect them. When purchasing valuable items coverage, it's important to research insurance providers to ensure that they have a good reputation for customer service and claims handling. Read reviews and check ratings from independent sources to help you make an informed decision. When purchasing valuable items coverage, be sure to review the policy details carefully. This includes coverage limits, premiums, deductibles, and exclusions. Understanding the policy details can help you determine whether the coverage is right for you and your valuable possessions. Valuable items coverage is a type of insurance that provides extra protection for high-value possessions. It covers loss or damage caused by a variety of perils, such as theft, fire, and accidental damage, and provides reimbursement for the actual value of your items. If you own high-value possessions, valuable items coverage can provide the extra protection and peace of mind you need to protect your precious possessions. When considering purchasing valuable items coverage, be sure to review the policy details carefully and research insurance providers to ensure that you are getting the best coverage for your needs.Definition of Valuable Items Coverage

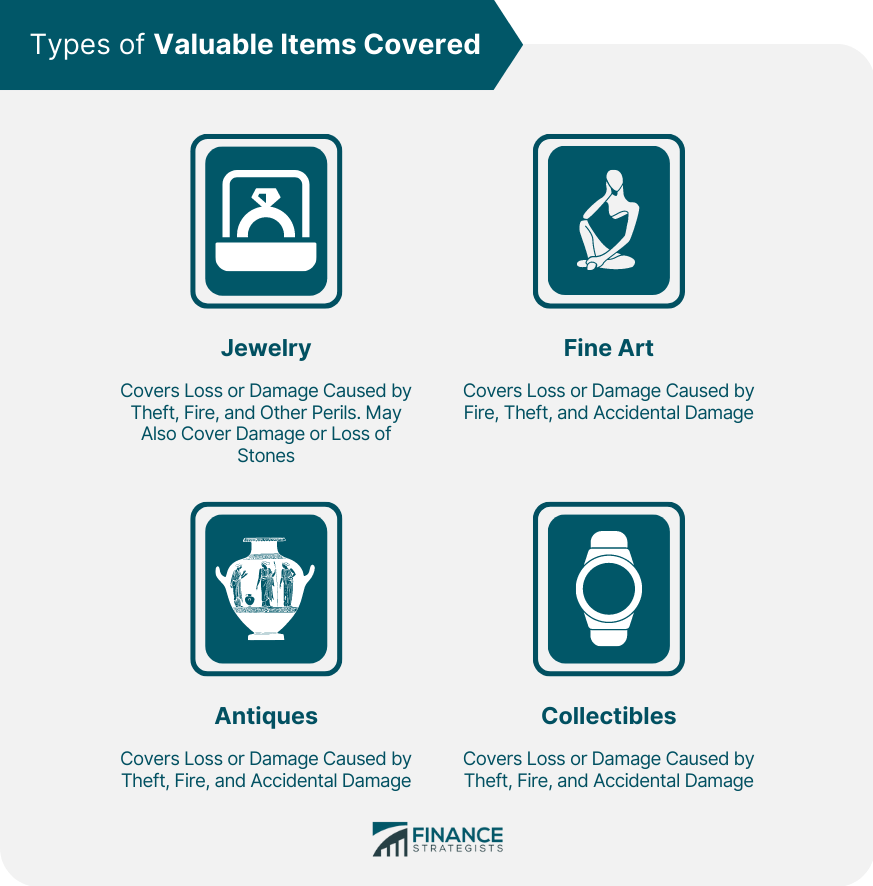

Types of Valuable Items Covered

Jewelry

Fine Art

Antiques

Collectibles

How Valuable Items Coverage Works

Valuation of Items

Premiums and Deductibles

Filing Claims

Coverage Limits

Benefits of Valuable Items Coverage

Protection Against Loss or Damage

Reimbursement for Appropriate Value

Peace of Mind

Considerations for Purchasing Valuable Items Coverage

Cost

Need for Coverage

Insurance Provider Reputation

Policy Details

Conclusion

Valuable Items Coverage FAQs

Valuable Items Coverage is an insurance policy that provides additional protection for high-value items such as jewelry, art, and collectibles.

Valuable Items Coverage typically covers loss, theft, or damage of high-value items that are not covered under standard homeowners or renters insurance policies.

To obtain Valuable Items Coverage, you need to add a rider or endorsement to your existing insurance policy. You'll typically need to provide an appraisal or receipt for the items you want to insure.

Items that can be covered under Valuable Items Coverage include but are not limited to jewelry, watches, furs, silverware, antiques, artwork, and collectibles.

Yes, Valuable Items Coverage may have exclusions such as loss or damage due to wear and tear, mysterious disappearance, or intentional acts. It's important to review your policy and understand the specific exclusions that apply.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.