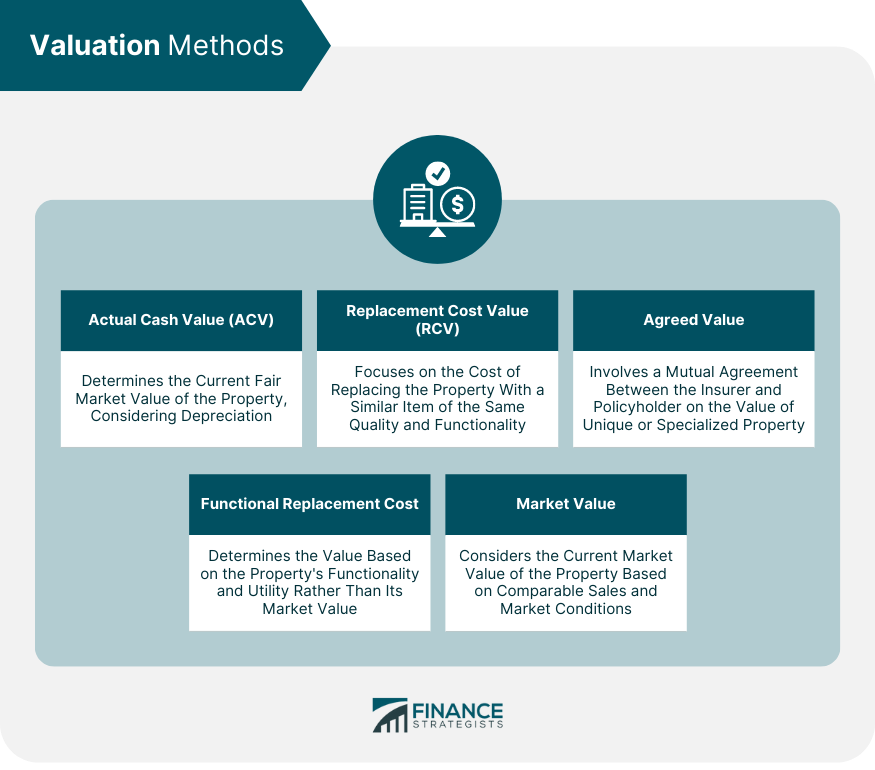

The valuation clause is a crucial provision in property and casualty insurance policies. It defines how the value of an insured property is determined in the event of a covered loss. It specifies the method or basis for valuing the property, such as actual cash value (ACV), replacement cost value (RCV), agreed value, functional replacement cost, or market value. The primary purpose of the valuation clause is to ensure that policyholders receive fair compensation for their damaged or destroyed property. By establishing a clear valuation method, the clause aims to prevent disputes and promote transparency in the claims settlement process. It also serves as a risk management tool for insurers, as it helps them assess potential financial exposure and calculate appropriate premiums. When a covered loss occurs, the valuation clause comes into play to determine the value of the insured property at the time of the loss. This value serves as the basis for calculating the amount of compensation the policyholder is entitled to receive. Several factors are taken into consideration when valuing insured property. These factors may include the property's age, condition, market trends, depreciation, and any applicable deductibles. Different valuation methods can be used depending on the policy terms and the type of property being insured. Here are some commonly used valuation methods: The ACV method determines the value of the property based on its current fair market value, taking into account depreciation. It considers the property's age, condition, and useful life to calculate the amount payable to the policyholder. The RCV method focuses on the cost of replacing the property with a similar item of the same quality and functionality. It does not consider depreciation and provides coverage for the full replacement cost. The agreed value method involves a mutual agreement between the insurer and the policyholder regarding the value of the insured property. This method is commonly used for unique or specialized items whose value may be difficult to determine through traditional valuation methods. The functional replacement cost method determines the value of the property based on its functionality and utility rather than its actual market value. This method is often used for commercial properties or equipment where the market value may not reflect the property's true worth. The market value method considers the current market value of the property, which is typically determined by assessing comparable sales data and market conditions. This method is commonly used for properties that are bought and sold frequently, such as real estate. The valuation clause may also include provisions for adjustments and deductibles. Adjustments can be made to the calculated value based on specific policy terms, endorsements, or additional coverage options. Deductibles, on the other hand, represent the portion of the loss that the policyholder is responsible for paying out of pocket. One of the key benefits of the valuation clause is that it ensures policyholders receive fair compensation for their damaged or destroyed property. By using established valuation methods, insurers can determine the appropriate amount to reimburse the policyholder based on the property's value at the time of the loss. The valuation clause provides protection against underinsurance, which occurs when the insured property is undervalued. Underinsurance can result in inadequate compensation and financial loss for the policyholder. By accurately valuing the property, the valuation clause helps prevent this issue and ensures that policyholders have sufficient coverage. Different types of property may require different valuation methods. The valuation clause offers flexibility by allowing policyholders and insurers to agree on the most appropriate method for valuing the insured property. This flexibility ensures that the valuation accurately reflects the unique characteristics and value of the property being insured. For insurers, the valuation clause plays a crucial role in risk management. By using consistent and reliable valuation methods, insurers can assess the potential financial exposure associated with insuring different types of properties. This enables them to calculate appropriate premiums, ensuring a balanced risk-to-reward ratio. Determining the value of the property can sometimes lead to disagreements between policyholders and insurers. Differences in interpretation, market fluctuations, or subjective assessments can all contribute to such disputes. It is important for policyholders to carefully review the valuation clause and understand how their property's value will be determined to minimize the potential for disagreements. The valuation clause can have an impact on the premiums policyholders pay for their insurance coverage. Properties with higher valuations may require higher premiums to adequately cover potential losses. Policyholders should consider the cost implications and ensure that the coverage aligns with their risk tolerance and financial capabilities. Valuing unique or specialized property can be challenging, as there may be limited market data or comparable sales to rely on. In such cases, utilizing specialized valuation methods or seeking professional appraisals may be necessary to accurately determine the property's value. Policyholders with unique assets should discuss their valuation needs with their insurers to ensure appropriate coverage. Depreciation and the aging of insured property pose challenges when determining its value. The valuation clause must account for these factors to ensure that the compensation adequately reflects the property's current worth. Insurers typically consider the property's age, condition, and expected useful life to calculate depreciation and adjust the valuation accordingly. Policyholders may face difficulties during the claims settlement process if they cannot provide sufficient documentation or proof of the property's value. It is essential for policyholders to maintain detailed records, such as purchase receipts, appraisals, or expert opinions, to substantiate the value of their insured property. Claims disputes can arise when policyholders and insurers have differing opinions on the value of the insured property. Effective communication and documentation of valuation methods can help prevent or resolve such disputes. Policyholders should engage in open dialogue with their insurers and seek professional assistance, if needed, to reach a fair settlement. The value of the property can change over time due to various factors, such as market trends, renovations, or improvements. Policyholders should review their insurance coverage periodically and update the valuation to ensure that it accurately reflects any changes in the property's value. Failure to do so may result in inadequate coverage in the event of a loss. Policyholders should carefully review the valuation clause and policy language to understand how their property's value will be determined. It is important to clarify any ambiguous terms or seek clarification from the insurer to ensure a clear understanding of the valuation process. Policyholders should maintain thorough documentation of their property's value, including purchase receipts, appraisals, or expert opinions. This documentation serves as evidence in the event of a loss and can help streamline the claims settlement process. Property values can change over time, so it is essential to regularly reassess and update the valuation to reflect any significant changes. Policyholders should discuss these updates with their insurers and provide the necessary documentation to ensure accurate coverage. For unique or specialized property, obtaining professional appraisals or seeking expert assistance can ensure an accurate valuation. Appraisers and experts have the knowledge and experience to determine the value of complex assets and provide reliable assessments. The valuation clause in property and casualty insurance policies plays a crucial role in determining fair compensation for policyholders in the event of a loss. By understanding the purpose, methods, and considerations of the valuation clause, policyholders can navigate the claims settlement process with confidence. While the valuation clause offers benefits such as fair compensation, protection against underinsurance, and flexibility in valuation methods, there are also limitations and challenges to consider. Policyholders should be aware of potential disputes, premium impact, and coverage challenges for unique assets. By following best practices such as reviewing policy language, maintaining documentation, regularly reevaluating valuations, and seeking professional assistance when needed, policyholders can effectively utilize the valuation clause.What Is the Valuation Clause?

How the Valuation Clause Works

Determine the Value of Insured Property

Factors Considered in Valuation

Methods Used for Valuation

Actual Cash Value (ACV) Method

Replacement Cost Value (RCV) Method

Agreed Value Method

Functional Replacement Cost Method

Market Value Method

Adjustments and Deductibles

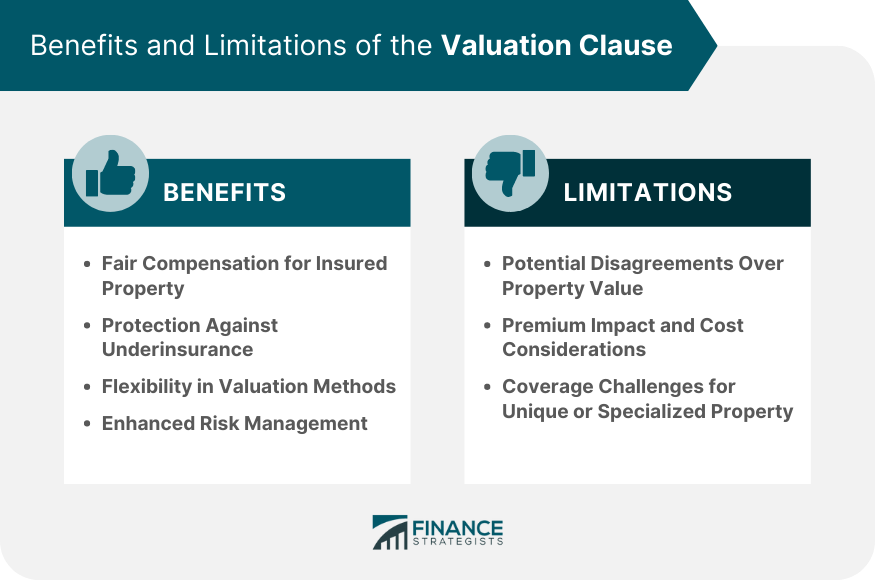

Benefits and Advantages of the Valuation Clause

Fair Compensation for Insured Property

Protection Against Underinsurance

Flexibility in Valuation Methods

Enhanced Risk Management

Limitations and Considerations of the Valuation Clause

Potential Disagreements Over Property Value

Premium Impact and Cost Considerations

Coverage Challenges for Unique or Specialized Property

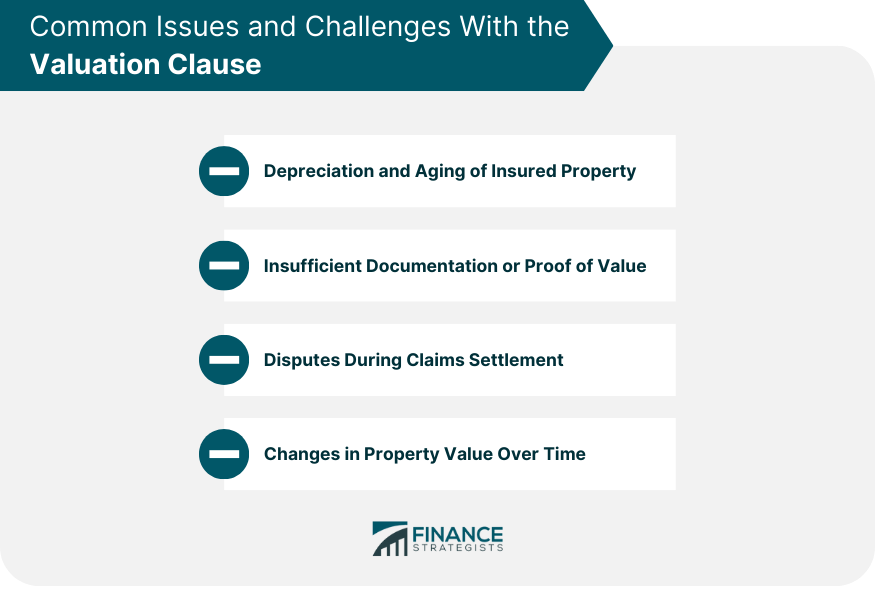

Common Issues and Challenges With the Valuation Clause

Depreciation and Aging of Insured Property

Insufficient Documentation or Proof of Value

Disputes During Claims Settlement

Changes in Property Value Over Time

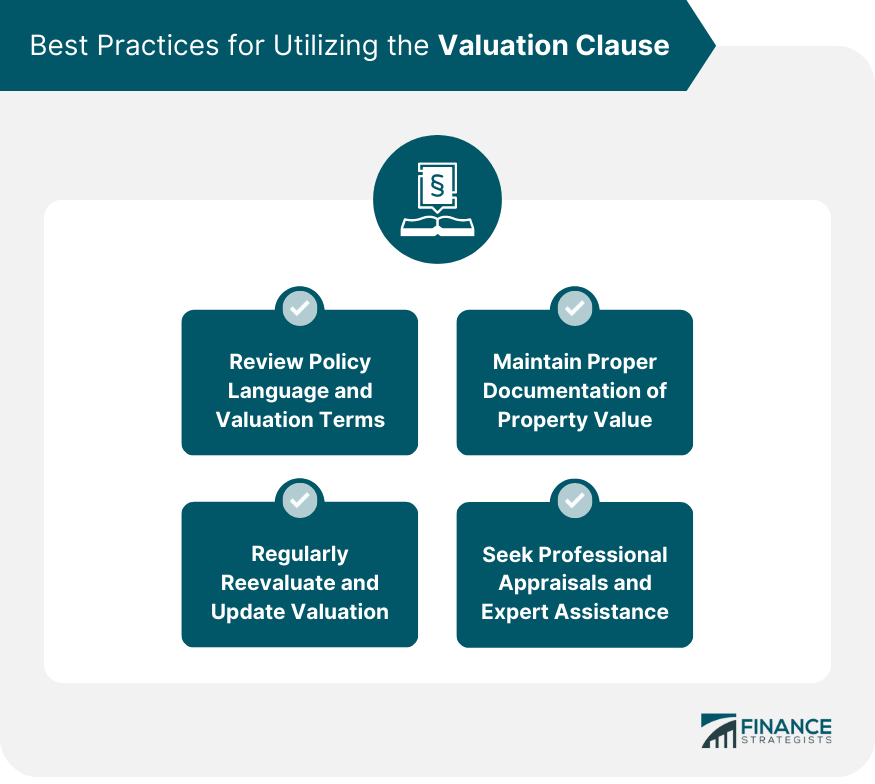

Best Practices for Utilizing the Valuation Clause

Review Policy Language and Valuation Terms

Maintain Proper Documentation of Property Value

Regularly Reevaluate and Update Valuation

Seek Professional Appraisals and Expert Assistance

Bottom Line

Valuation Clause FAQs

The valuation clause is a provision in insurance policies that determines the value of insured property in the event of a covered loss.

The valuation clause establishes the method or basis for valuing the property, such as actual cash value (ACV), replacement cost value (RCV), agreed value, functional replacement cost, or market value.

The valuation clause ensures fair compensation for damaged or destroyed property, protects against underinsurance, offers flexibility in valuation methods, and enhances risk management for insurers.

Limitations include potential disagreements over property value, premium impact and cost considerations, coverage challenges for unique or specialized property, and changes in property value over time.

Best practices include reviewing policy language and valuation terms, maintaining proper documentation of property value, regularly reevaluating and updating valuation, and seeking professional appraisals and expert assistance for unique assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.