Water Damage Insurance refers to a type of coverage included in homeowners insurance policies or purchased separately, which provides financial protection for damages to a property resulting from water-related events. Such events may include burst pipes, appliance malfunctions, heavy rainfall, snowmelt, and sewer or drain backups. This insurance helps cover the costs of repairs, replacements, and clean-up associated with water damage, ensuring homeowners have the necessary resources to restore their property after unexpected incidents. Standard homeowners insurance policies typically include coverage for sudden and accidental water damage. However, there are exclusions to this coverage, such as gradual water damage or flooding. It is essential to understand what your policy covers and consider purchasing additional insurance if needed. A typical homeowners insurance policy covers water damage resulting from events like burst pipes, overflowing bathtubs or sinks, and appliance malfunctions. These damages are generally covered if they are sudden and accidental, meaning they were not caused by neglect or lack of maintenance. While homeowners insurance covers many water damage scenarios, it does not cover all types of water damage. Common exclusions include gradual water damage, like slow leaks, as well as flooding from external sources. In these cases, additional insurance may be necessary. Homeowners in flood-prone areas should consider purchasing flood insurance. There are two primary sources of flood insurance: the National Flood Insurance Program and private flood insurance. The NFIP is a government-run program that provides flood insurance to homeowners, renters, and business owners. This program aims to reduce the impact of flooding on private and public structures. Flood insurance through the NFIP is available to those living in participating communities that adhere to specific floodplain management regulations. Private flood insurance is an alternative to the NFIP, offered by private insurance companies. These policies often provide more comprehensive coverage and higher limits than those available through the NFIP. However, private flood insurance may be more expensive, depending on your risk level and the insurer. Water backup and sump pump overflow coverage is an optional endorsement that homeowners can add to their insurance policy. This coverage provides protection for damages caused by sewer or drains backup and sump pump failure. This endorsement covers the cost of repairing or replacing damaged property and cleaning up after a sewer or drain backup. Coverage limits vary, so it's essential to discuss your needs with your insurance agent. Water backup and sump pump overflow coverage have limitations. Typically, it does not cover damages caused by flooding or water that seeps through the foundation. Additionally, there may be a separate deductible for this coverage, which can increase your out-of-pocket expenses in the event of a claim. Water damage insurance covers a variety of sudden and accidental events that can damage your home. Burst pipes can cause significant water damage, especially if they occur in hidden spaces, such as behind walls or under floors. Water damage insurance covers the cost of repairing or replacing the damaged pipe and any resulting damage to your home. Appliances like dishwashers, washing machines, and water heaters can malfunction, causing water damage to your home. Your insurance policy will likely cover the cost of repairing or replacing the damaged appliance and any resulting water damage. Weather-related water damage, such as heavy rainfall and snowmelt, can cause substantial harm to your home. While some weather-related damages are covered by your homeowners' insurance, others, like flooding, are not. It is essential to understand your coverage and consider additional insurance if necessary. Heavy rainfall can lead to roof leaks, overflowing gutters, and water seepage into your home. Most standard homeowners insurance policies cover these types of damages as long as they are sudden and accidental. In colder climates, snowmelt and ice dams can cause water damage to roofs and interior spaces. Ice dams occur when melting snow refreezes along the edge of a roof, preventing proper drainage. This can cause water to back up under the shingles and leak into the home. Most homeowners insurance policies cover damages resulting from ice dams and snowmelt. Sewer and drain backups can cause significant damage to your home and personal property. While standard homeowners insurance does not cover these damages, you can add water backup and sump pump overflow coverage to your policy for additional protection. Mold growth can result from water damage and pose serious health risks. Some homeowners insurance policies cover mold remediation, but the coverage varies by policy and state. It is essential to review your policy and discuss your options with your insurance agent. Water damage insurance has certain exclusions and limitations that homeowners should be aware of. Gradual water damage, such as slow leaks or seepage, is typically not covered by homeowners insurance. This type of damage is considered a maintenance issue and is the homeowner's responsibility. Water damage caused by negligence or lack of maintenance is not covered by insurance. Homeowners are expected to maintain their property and take necessary precautions to prevent water damage. Standard homeowners insurance does not cover damages resulting from floods. Homeowners in flood-prone areas should consider purchasing separate flood insurance through the NFIP or a private insurer. When you discover water damage in your home, it is essential to take the following steps to ensure a successful insurance claim: Take photos or videos of the damaged areas, including any damaged personal property. This documentation will be crucial when filing your insurance claim. Take reasonable steps to prevent further damage, such as shutting off the water supply or placing tarps over damaged roofs. Your insurance company may require you to take these actions to ensure coverage. After documenting the damage and taking steps to mitigate further damage, contact your insurance company as soon as possible. They will provide you with the necessary forms and information to begin the claims process. Insurance companies have specific timelines and requirements for filing water damage claims. Be sure to adhere to these timelines and provide all required documentation to avoid delays or denials of your claim. During the claims process, an insurance adjuster will evaluate the damage to your home and personal property. They will determine the cause of the damage and the extent of the repairs needed. The adjuster will assess the damage and prepare a written estimate for the cost of repairs. They will also determine whether the damage is covered under your policy and if any exclusions or limitations apply. If you disagree with the adjuster's assessment, you have the right to negotiate the claim. Provide any additional documentation or evidence to support your case, and consider hiring a public adjuster or attorney to assist with negotiations. Once your claim is approved, you will receive an insurance payout to cover the cost of repairs or replacement. When receiving your insurance payout, it's essential to understand the difference between actual cash value (ACV) and replacement cost coverage. ACV coverage pays for the cost of repairing or replacing damaged items minus depreciation. Replacement cost coverage pays for the cost of repairing or replacing damaged items without accounting for depreciation. While replacement cost coverage provides more comprehensive protection, it often comes with higher premiums. Your insurance payout may be subject to deductibles and policy limits. A deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in, while policy limits represent the maximum amount your insurance company will pay for a covered claim. Be aware of these amounts when reviewing your policy and filing a claim. Before purchasing water damage insurance, it's crucial to assess your risk level. Consider your home's location and geography when determining your risk for water damage. Homes in flood-prone areas or regions with heavy rainfall and snowfall may require additional insurance coverage. Older homes and those constructed with materials more susceptible to water damage may require more comprehensive coverage or higher policy limits. When purchasing water damage insurance, it's essential to compare policies and providers to ensure you get the best coverage at the best price. Review the coverage options offered by different insurance companies and consider any additional endorsements or riders that may be necessary to provide adequate protection. Compare premiums and deductibles for each policy, and determine which option offers the best value for your specific needs. To ensure you have the right coverage for your home, consider enhancing your insurance policy with endorsements and riders. If your home is at high risk for water damage, you may want to increase your policy limits to ensure adequate coverage. Consider adding endorsements or riders for specific water damage risks, such as sewer and drain backup or sump pump overflow coverage. Preventing water damage is essential for protecting your home and avoiding costly repairs. Conduct regular home inspections and maintenance to identify potential water damage risks. Inspect your plumbing systems for leaks, corrosion, and other signs of damage. Repair or replace damaged components as needed. Check your roof and gutters for damage, debris, and proper drainage. Regularly clean your gutters and repair or replace damaged roof materials. Invest in water damage prevention devices to protect your home from potential risks. Install a sump pump in your basement or crawl space to prevent water accumulation and reduce the risk of flooding. Place water leak detectors around your home, near appliances, and plumbing systems, to alert you to potential leaks and water damage. Develop an emergency plan to prepare for and respond to potential water damage events. Identify evacuation routes and safe meeting points in case of flooding or other water damage emergencies. Keep a list of emergency contacts, including your insurance agent, plumber, and restoration professionals, to expedite the recovery process. Water damage insurance is a vital component of protecting your home and financial well-being from the unexpected costs associated with water-related incidents. Understanding the types of coverage available, such as standard homeowners insurance, flood insurance, water backup, and sump pump overflow coverage, can help you make informed decisions about the best policy for your specific needs. It is crucial to assess your risk level based on factors like location, geography, and home construction to determine the appropriate coverage. Regular home inspections, maintenance, and the installation of water damage prevention devices can significantly reduce the likelihood of experiencing water damage. Should you need to file a claim, knowing the steps to take and working with insurance adjusters can help ensure a smooth process. Don't hesitate to seek professional services to assist in choosing the right water damage insurance coverage and taking preventive measures to protect your home.Definition of Water Damage Insurance

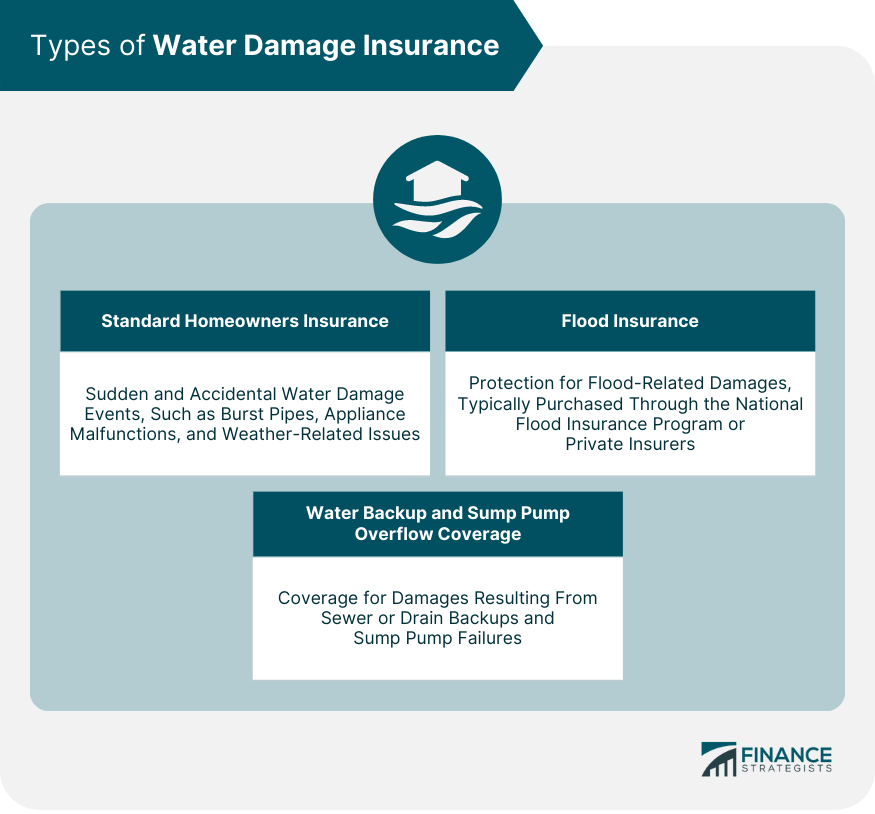

Types of Water Damage Insurance

Homeowners Insurance

Standard Coverage

Exclusions

Flood Insurance

National Flood Insurance Program (NFIP)

Private Flood Insurance

Water Backup and Sump Pump Overflow Coverage

Coverage Details

Limitations

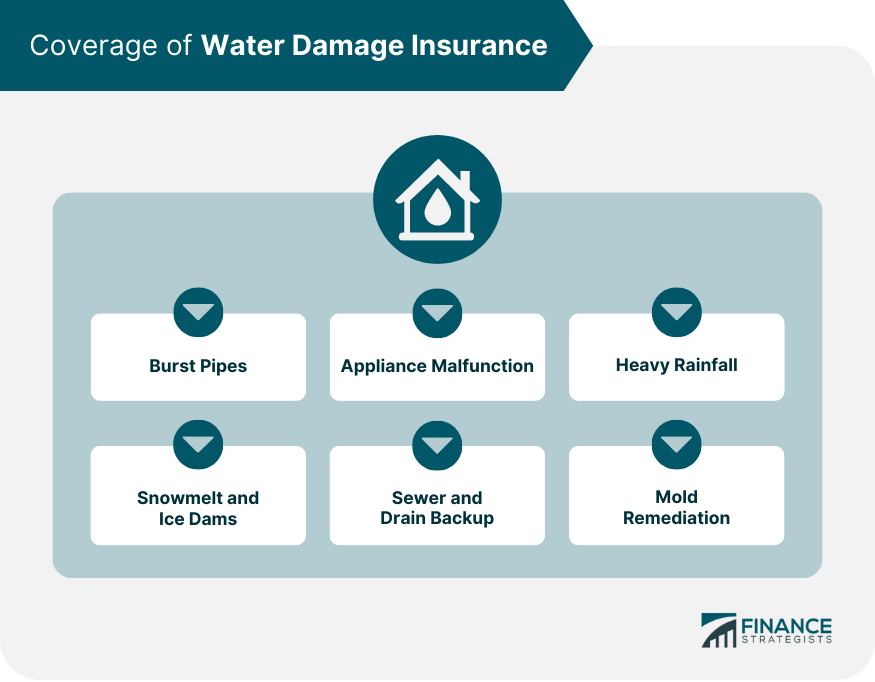

Coverage of Water Damage Insurance

Sudden and Accidental Water Damage

Burst Pipes

Appliance Malfunctions

Weather-Related Water Damage

Heavy Rainfall

Snowmelt and Ice Dams

Sewer and Drain Backup

Mold Remediation

Exclusions and Limitations

Gradual Water Damage

Negligence and Lack of Maintenance

Floods

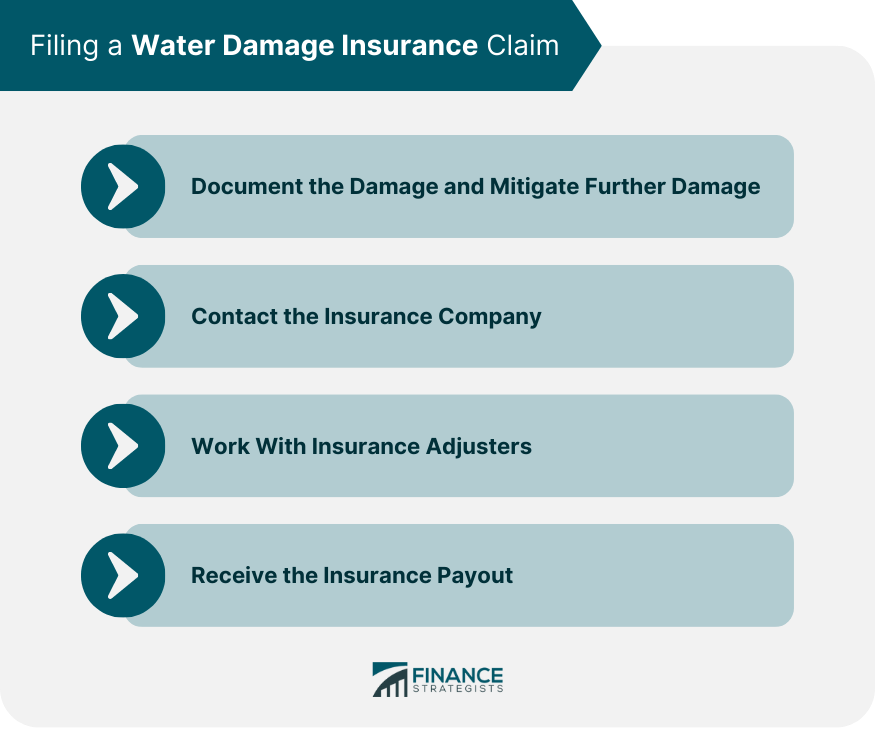

Filing a Water Damage Insurance Claim

Document the Damage and Mitigate Further Damage

Contacting the Insurance Company

Timelines and Requirements

Working With Insurance Adjusters

Evaluation of Damage

Negotiating the Claim

Receiving the Insurance Payout

Actual Cash Value vs Replacement Cost Coverage

Deductibles and Policy Limits

Tips for Purchasing Water Damage Insurance

Assessing Your Risk

Location and Geography

Home Construction and Age

Comparing Insurance Policies and Providers

Coverage Options

Premiums and Deductibles

Enhancing Coverage with Endorsements and Riders

Increased Limits

Additional Coverage Options

Water Damage Prevention and Maintenance

Regular Home Inspections and Maintenance

Plumbing Systems

Roof and Gutters

Installing Water Damage Prevention Devices

Sump Pumps

Water Leak Detectors

Creating an Emergency Plan

Evacuation Routes

Emergency Contacts

Conclusion

Water Damage Insurance FAQs

Water damage insurance, as part of a standard homeowners insurance policy, typically covers sudden and accidental water damage events, such as burst pipes, appliance malfunctions, and weather-related issues like heavy rainfall or snowmelt. However, it usually does not cover gradual water damage, negligence, or floods.

While most homeowners insurance policies include some level of water damage insurance, it is essential to review your specific policy to understand what is and isn't covered. In some cases, you may need additional coverage, such as flood insurance or water backup and sump pump overflow coverage, to ensure comprehensive protection.

To file a water damage insurance claim, first document the damage by taking photos or videos. Then, take steps to mitigate further damage, such as shutting off the water supply or covering damaged roofs with tarps. Finally, contact your insurance company as soon as possible and provide the necessary documentation to begin the claims process.

The National Flood Insurance Program (NFIP) is a government-run program that provides flood insurance to homeowners in participating communities that adhere to specific floodplain management regulations. Private flood insurance, on the other hand, is offered by private insurance companies and often provides more comprehensive coverage and higher limits than the NFIP. However, private flood insurance may be more expensive depending on your risk level and the insurer.

To prevent water damage and reduce the likelihood of filing water damage insurance claims, regularly inspect and maintain your home's plumbing systems, roof, and gutters. Install water damage prevention devices such as sump pumps and water leak detectors, and develop an emergency plan that includes evacuation routes and emergency contacts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.