Risk-based capital is a financial regulation that requires financial institutions to hold an amount of capital that is proportional to the risk they are exposed to. It is a measure of the minimum amount of capital a company must hold based on the level of risk it is exposed to. The primary purpose of risk-based capital is to ensure that financial institutions have enough capital to absorb potential losses arising from the risks they are exposed to. The importance of risk-based capital regulation lies in its ability to protect the safety and soundness of financial institutions, promote financial stability, and prevent systemic risk. Risk-based capital regulations originated in the 1980s as a response to the financial difficulties faced by savings and loan associations in the United States. Since then, many countries have implemented their own versions of risk-based capital regulations. Over time, the frameworks have evolved, becoming more sophisticated and better able to capture the risks that financial institutions are exposed to. Risk-based capital frameworks vary depending on the country and the type of financial institution. Some of the most widely used frameworks are discussed below. Solvency II is a European Union directive that establishes a regulatory framework for insurance companies. It requires insurers to hold a minimum level of capital based on the risks they are exposed to. The framework distinguishes between three types of risks: underwriting risk, market risk, and operational risk. In the United States, risk-based capital standards are established by the National Association of Insurance Commissioners (NAIC). The NAIC model act requires insurance companies to hold a minimum level of capital based on the risks they are exposed to. The capital requirements are divided into two tiers: tier 1 capital, which includes common equity and retained earnings, and tier 2 capital, which includes subordinated debt and other forms of capital. The NAIC model act is a set of guidelines that are adopted by individual states to regulate insurance companies. The model act requires insurance companies to hold a minimum level of capital based on the risks they are exposed to. The capital requirements are divided into two tiers: tier 1 capital and tier 2 capital. The Basel III Capital Framework is a global regulatory standard that establishes minimum capital requirements for banks. The framework requires banks to hold a minimum level of capital based on the risks they are exposed to. The capital requirements are divided into two tiers: tier 1 capital, which includes common equity and retained earnings, and tier 2 capital, which includes subordinated debt and other forms of capital. Other countries have their own versions of risk-based capital frameworks, including Canada, Australia, and Japan. These frameworks are tailored to the specific needs of their financial systems and may differ in their approach to measuring and managing risk. Risk-based capital frameworks typically have three key components: capital adequacy, risk-weighted assets, and capital requirements. Capital adequacy refers to the amount of capital a financial institution holds to absorb potential losses. Risk-based capital frameworks typically require financial institutions to hold a minimum level of capital based on the risks they are exposed to. Tier 1 capital is the highest quality form of capital and includes common equity and retained earnings. These types of capital are considered the most reliable and are able to absorb losses without causing the institution to become insolvent. Tier 2 capital includes subordinated debt and other forms of capital that are less reliable than tier 1 capital. These types of capital are able to absorb losses but may not be sufficient to prevent insolvency. Risk-weighted assets are the assets held by a financial institution that are adjusted for risk. Different types of assets carry different levels of risk, and risk-weighted assets reflect this by assigning a risk weight to each type of asset. Credit risk is the risk of loss arising from the failure of a borrower to repay a loan or meet its obligations. Risk-based capital frameworks assign risk weights to different types of loans and other credit exposures based on the creditworthiness of the borrower. Market risk is the risk of loss arising from changes in market conditions, such as interest rates, exchange rates, and asset prices. Risk-based capital frameworks assign risk weights to different types of market exposures based on the volatility of the market. Operational risk is the risk of loss arising from inadequate or failed internal processes, people, and systems or from external events. Risk-based capital frameworks assign risk weights to different types of operational risk based on the size and complexity of the institution. Capital requirements are the minimum levels of capital that financial institutions are required to hold based on their risk-weighted assets. Risk-based capital frameworks typically have three types of capital requirements. Minimum capital requirements are the minimum levels of capital that financial institutions are required to hold based on their risk-weighted assets. The capital conservation buffer is an additional layer of capital that financial institutions are required to hold above the minimum capital requirements. The buffer provides a cushion against losses and reduces the risk of insolvency. The countercyclical capital buffer is an additional layer of capital that financial institutions are required to hold during times of high credit growth to help mitigate the risk of a systemic crisis. Risk-based capital regulation provides several benefits, including enhanced financial stability, improved risk management, and greater transparency and market discipline. Risk-based capital regulation helps ensure the safety and soundness of financial institutions, reducing the risk of insolvency and promoting financial stability. Risk-based capital regulation encourages financial institutions to manage their risks more effectively by aligning capital requirements with the level of risk they are exposed to. Risk-based capital regulation promotes greater transparency and market discipline by requiring financial institutions to disclose their capital levels and risk exposures to investors and other stakeholders. Risk-based capital regulation faces several challenges and criticisms, including complexity and implementation costs, potential for regulatory arbitrage, and limitations in capturing systemic risk. Risk-based capital regulation is complex and can be difficult and expensive to implement, particularly for smaller financial institutions. Risk-based capital regulation may create opportunities for regulatory arbitrage, where financial institutions manipulate their risk exposures to reduce their capital requirements. Risk-based capital regulation may not be effective in capturing systemic risk, which is the risk of a widespread collapse of the financial system. The future of risk-based capital regulation is likely to involve further refinement and evolution to address some of the challenges and criticisms it currently faces. The Basel III reforms aim to strengthen the risk-based capital framework for banks and address some of the limitations identified in the current framework. These reforms include changes to the calculation of risk-weighted assets, changes to the minimum capital requirements, and the introduction of a leverage ratio requirement. International coordination is becoming increasingly important in the development of risk-based capital regulation, particularly in the context of global financial markets. International standard-setting bodies, such as the Basel Committee on Banking Supervision and the International Association of Insurance Supervisors, are working to develop globally consistent risk-based capital frameworks. There is likely to be greater emphasis on capturing and addressing systemic risk in risk-based capital regulation. This may involve the development of macroprudential tools and the incorporation of more macroeconomic variables into risk-based capital frameworks. Risk-based capital regulation is an important tool for promoting financial stability and ensuring the safety and soundness of financial institutions. Through the use of risk-weighted assets and capital requirements, risk-based capital regulation aligns the level of capital held by financial institutions with the level of risk they are exposed to, encouraging effective risk management and promoting market discipline. While risk-based capital regulation faces challenges and criticisms, such as complexity and potential for regulatory arbitrage, ongoing efforts to refine and improve the framework, such as the Basel III reforms, are underway. With increasing global interconnectedness and the potential for systemic risk, the continued evolution and effectiveness of risk-based capital regulation will remain a critical component of financial regulation in the years to come.What Is Risk-Based Capital?

Risk-Based Capital Frameworks

Solvency II in Europe

Risk-Based Capital Standards in the United States

National Association of Insurance Commissioners (NAIC) Model Act

Basel III Capital Framework for Banks

Other International Risk-Based Capital Frameworks

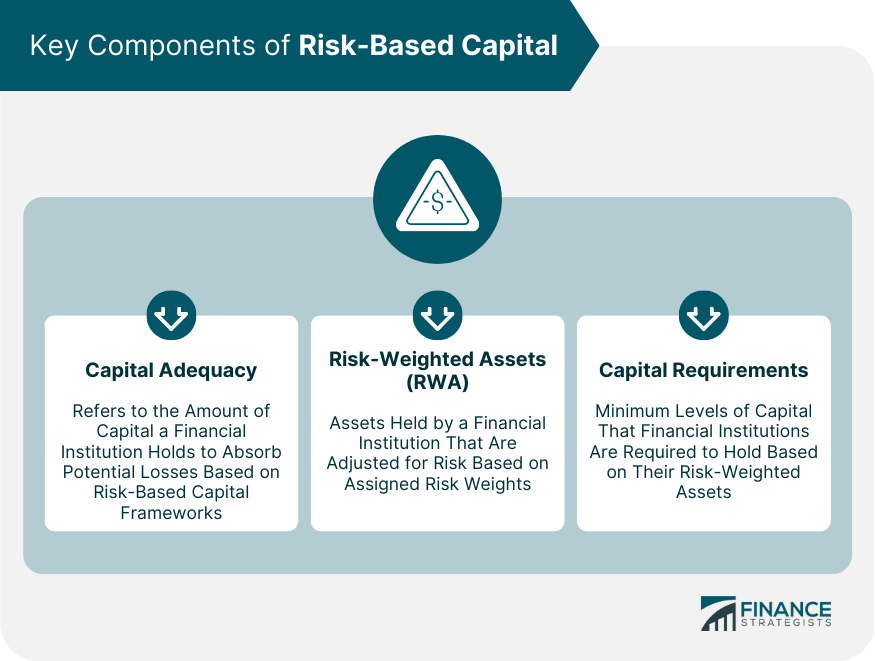

Key Components of Risk-Based Capital

Capital Adequacy

Tier 1 Capital

Tier 2 Capital

Risk-Weighted Assets (RWA)

Credit Risk

Market Risk

Operational Risk

Capital Requirements

Minimum Capital Requirements

Capital Conservation Buffer

Countercyclical Capital Buffer

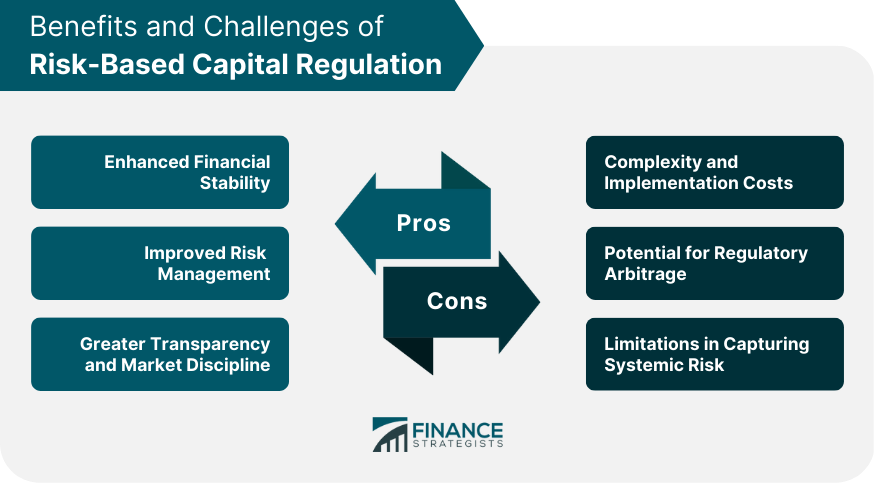

Benefits of Risk-Based Capital Regulation

Enhanced Financial Stability

Improved Risk Management

Greater Transparency and Market Discipline

Challenges and Criticisms of Risk-Based Capital Regulation

Complexity and Implementation Costs

Potential for Regulatory Arbitrage

Limitations in Capturing Systemic Risk

Future Developments in Risk-Based Capital Regulation

Basel III Reforms

International Coordination

Emphasis on Systemic Risk

Conclusion

Risk-Based Capital FAQs

Risk-based capital is a method of calculating the minimum capital that financial institutions, such as banks and insurance companies, are required to hold. It is based on the level of risk associated with the institution's assets, which is determined by assigning a risk weight to each asset.

Risk-based capital is important because it ensures that financial institutions hold sufficient capital to cover the risks associated with their assets. This helps to protect depositors and policyholders from losses, and it reduces the likelihood of financial institutions becoming insolvent.

Risk-based capital requirements are typically set by regulatory bodies, such as the Federal Reserve, the Office of the Comptroller of the Currency, or the National Association of Insurance Commissioners. These bodies set standards and guidelines for financial institutions to follow, in order to ensure that they are holding adequate levels of capital.

The calculation of risk-based capital is based on a formula that takes into account the level of risk associated with each asset held by the financial institution. The risk weight assigned to each asset is determined by the regulatory body, based on factors such as the asset's credit rating and maturity.

Risk-based capital ratios are used to compare a financial institution's level of capital to its level of risk. These ratios help regulators to determine whether a financial institution is holding sufficient capital to cover the risks associated with its assets. Financial institutions with higher levels of risk are required to hold more capital, as a percentage of their total assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.