Overview of Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac are big names in the US mortgage scene. Both were made to help keep the US mortgage market stable and help people get loans.

Fannie Mae is short for the Federal National Mortgage Association, and Freddie Mac is short for the Federal Home Loan Mortgage Corporation. Since they started, they have helped many Americans buy homes.

However, these two groups do more than just that. They also deal with mortgage fees, which may seem small but are very important.

If you look closely at the housing market, you'll see that mortgage fees play a big role. These fees help shape how the housing market works.

These fees also change how loans are given out. They can also affect home prices, how many people own homes, and the larger economy.

Understanding the Fees of Fannie Mae and Freddie Mac

Definition and Purpose of These Fees

The mortgage industry, in its complexity, uses fees to maintain equilibrium. These charges, meticulously crafted, are Fannie and Freddie's way of covering potential risks.

Each time they acquire, securitize, or guarantee a mortgage, they're stepping into a realm of uncertainty. Fees serve as their armor, shielding them from unexpected financial blows.

But, why charge these fees? Beyond risk mitigation, they ensure the long-term financial health of these institutions.

In essence, they are the steady revenue streams that keep Fannie and Freddie robust, ensuring they can weather economic downturns and continue their mission.

How These Fees Impact Borrowers

To the average homeowner or aspiring buyer, mortgage fees may seem abstract, almost distant. But they're closer to home than one might imagine.

Each fee incrementally increases the cost of a loan. It's a delicate dance of numbers, where even a slight uptick can translate into thousands of dollars over the lifespan of a mortgage.

And while on one hand, these fees protect the broader market, they do have tangible implications for borrowers. They could mean the difference between a loan approval or denial, between a manageable monthly payment or a burdensome one.

Specific Mortgage Fees Associated With Fannie Mae and Freddie Mac

Loan-Level Price Adjustments (LLPAs)

Definition and Purpose

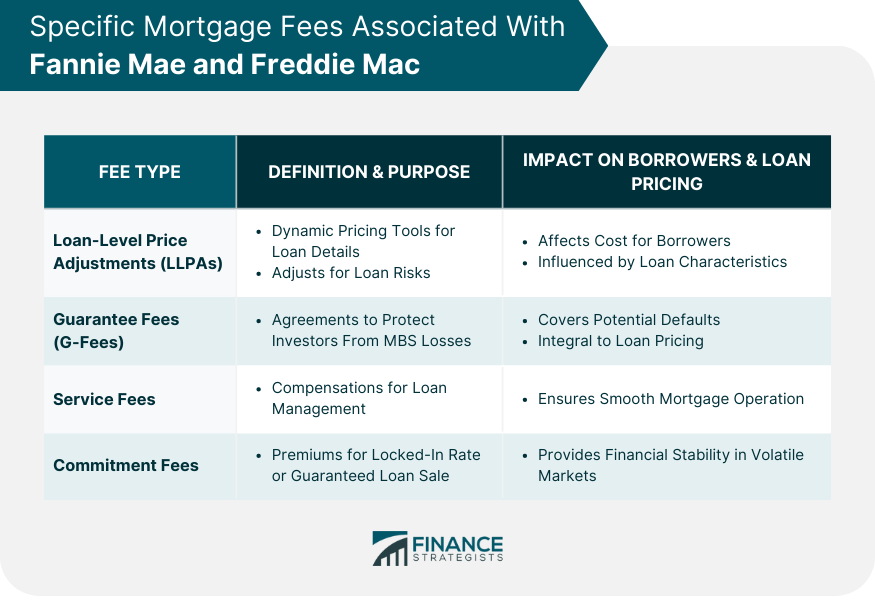

LLPAs are more than just financial jargon; they are Fannie and Freddie's microscopic lenses, adjusting mortgage prices based on the granular details of loans.

Think of them as dynamic pricing tools, ones that ensure that each loan's price is commensurate with its risk.

LLPAs are, in essence, a reflection of the mortgage landscape's diversity. They recognize that no two loans are the same and that each carries a unique risk fingerprint.

How LLPAs Affect Borrowers

It's fascinating, the world of LLPAs. For some borrowers, they might mean a favorable wind, leading to cost savings. But for others, they could signify headwinds, adding to their borrowing costs.

How one's loan characteristics—like credit score or down payment size—align with LLPAs can dictate the loan's final price.

Guarantee Fees (G-Fees)

Understanding the Fee Structure

Peeling back the layers of the mortgage world reveals the critical role of G-Fees. At their core, these fees are contractual agreements, where Fannie and Freddie promise to protect investors from potential losses on Mortgage-Backed Securities (MBS).

It's a symbiotic relationship: lenders get the assurance of timely payments, and in return, Fannie and Freddie earn their revenue.

Purpose and Impact on Loan Pricing

G-Fees aren't whimsical numbers plucked from thin air; they're carefully calculated metrics designed to cover credit losses stemming from potential borrower defaults.

And when it comes to the broader mortgage market, G-Fees cast a long shadow. They're integral to loan pricing, and even minute fluctuations can recalibrate the cost of borrowing.

Other Relevant Fees and Charges

Service Fees

Navigating the intricate corridors of the mortgage world demands expertise, and that's where service fees come into play. They're compensations for managing loans.

Every mortgage is a living entity, needing regular attention, from payment collection to default management.

Service fees ensure that this ecosystem runs seamlessly, catering to both lenders' and borrowers' needs.

Commitment Fees

In a volatile market, commitment is gold. Commitment fees are essentially premiums paid for this golden promise. They're the cost borrowers or lenders pay for the certainty of a locked-in rate or a guaranteed loan sale.

In a sense, they're anchors, providing stability amidst financial storms.

Factors Influencing Fee Variations Between Fannie Mae and Freddie Mac

Loan-To-Value Ratios (LTV)

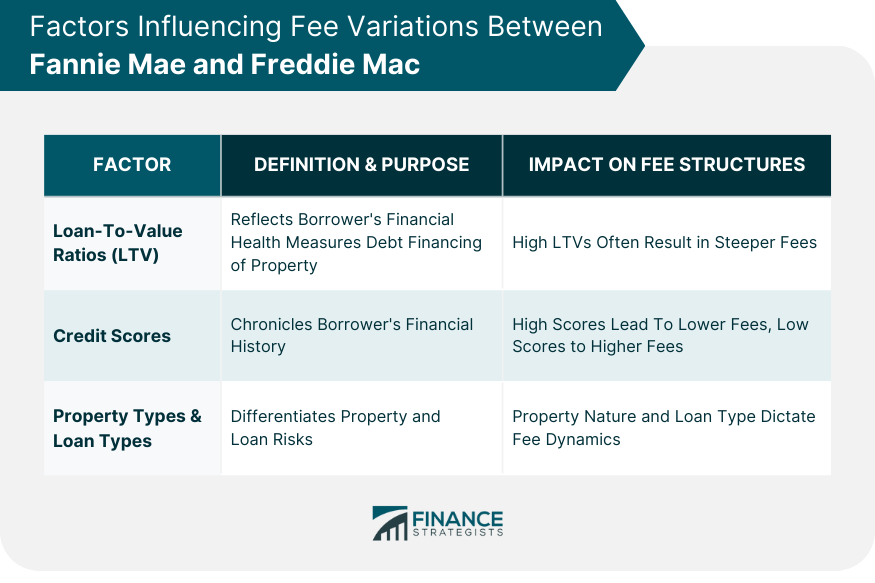

LTV isn't just a ratio—it's a mirror reflecting a borrower's financial health. It gauges how much of the property's total value is financed through debt.

A high LTV, indicating a smaller down payment, often raises eyebrows, signaling potential risk. Such risk perceptions invariably influence fee structures, with higher LTVs generally ushering in steeper fees.

Credit Scores

In the grand tapestry of finance, credit scores are vibrant threads telling individual stories. They chronicle a borrower's financial journey, capturing their discipline, reliability, and trustworthiness.

High scores often herald lower fees, signaling a lower risk to lenders. Conversely, lower scores might hint at potential financial turbulence, leading to higher fee assessments.

Property Types & Loan Types (Fixed vs Adjustable)

Every property tells a tale, and each type—be it a cozy single-family home or a sprawling multi-unit complex—brings its own set of risks and rewards.

Similarly, the choice between fixed and adjustable-rate mortgages dictates fee dynamics. While fixed-rate loans offer a predictable path, adjustable-rate mortgages, with their fluctuating interest, come with a distinct risk-reward profile.

Both these factors—the property's nature and the loan type—play pivotal roles in shaping fees.

Comparison Between Fannie Mae and Freddie Mac Fees

Similarities in Fee Structure

Purpose of Fees

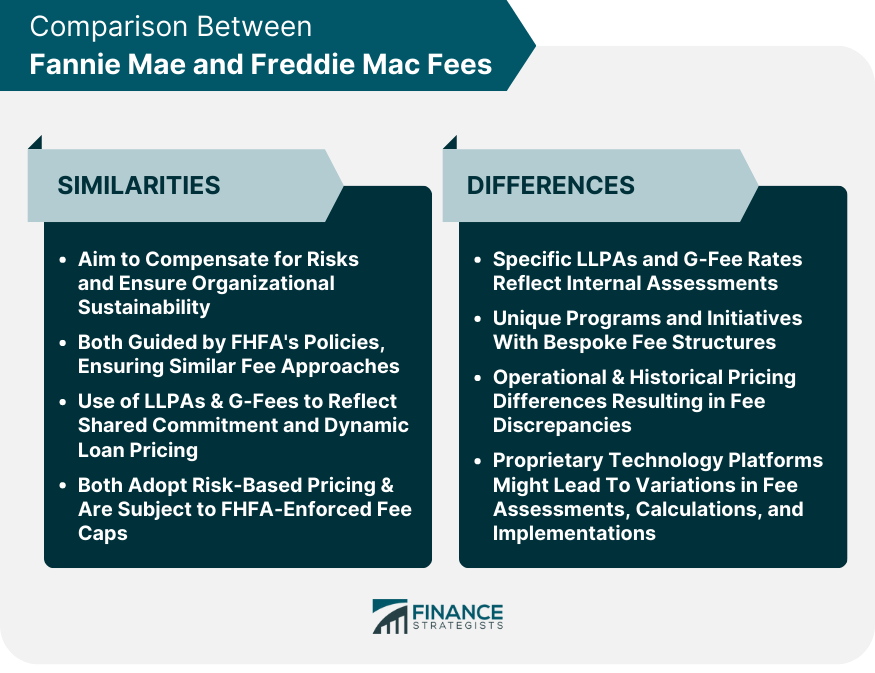

At their heart, both Fannie and Freddie have a shared mission: to stabilize and democratize the U.S. mortgage market. This shared vision is reflected in their fee structures, which fundamentally aim at compensating for risks and ensuring organizational sustainability.

While they might differ in nuances, the core rationale behind their fees remains aligned.

Influence of Federal Housing Finance Agency (FHFA)

The FHFA, as the regulator and conservator, casts its shadow over both entities. Its guidelines, directives, and policies resonate within the fee structures of both Fannie and Freddie.

In many ways, the FHFA ensures that these giants don't diverge drastically in their fee approaches, ensuring a level playing field.

Loan-Level Price Adjustments (LLPAs) & Guarantee Fees (G-Fees)

Both Fannie and Freddie recognize the importance of dynamic loan pricing. Hence, LLPAs find a place in both their toolkits, adjusting loan prices based on specific characteristics.

Similarly, G-Fees, central to their business models, reflect a shared commitment to safeguarding MBS investors.

Risk-Based Pricing & Fee Caps

Risk-based pricing is a common thread weaving through both institutions. They tailor fees based on the perceived risk each loan brings, ensuring a balanced portfolio.

And while they might be free to set their fee structures, the FHFA often establishes fee caps, ensuring neither goes on a fee spree, protecting borrowers in the process.

Differences and Unique Attributes

Specific LLPAs and G-Fee Rates

While the overarching principles are shared, the devil, as they say, is in the details. Both institutions might have slightly varying LLPAs and G-Fee rates, reflecting their internal risk assessments, historical data, and strategic directions.

Special Programs and Initiatives

In their journey, both Fannie and Freddie have launched unique programs targeting specific borrower segments or addressing particular market needs. Such initiatives might come with their bespoke fee structures, diverging from regular practices.

Operational Differences & Historical Pricing Differences

Centuries-old institutions develop their quirks and operational styles. Such operational nuances can influence fee decisions. Furthermore, historical pricing data, reflecting past market behaviors and institutional responses, can lead to subtle fee discrepancies.

Proprietary Technology Platforms

In this digital age, technology platforms play a pivotal role in fee management. Both entities might embrace different technologies, leading to variations in fee assessments, calculations, and implementations.

How Mortgage Fees Affect Loan Rates

Direct Influence on Interest Rates

Mortgage fees can change interest rates. When Fannie and Freddie change their fees, it can make loan prices go up or down. So, borrowers might see their interest rates change because of these fees.

Role of Lenders in Adjusting Rates Based on These Fees

It's not only Fannie and Freddie that make these changes. Lenders, who give out loans, also play a big role.

When the fees change, lenders take note and adjust their loan prices. This means the interest rates they offer can change based on the fees, what the market is like, and what borrowers need.

Evolution of Mortgage Fees Over Time

Historical Perspective on Fannie Mae and Freddie Mac Fee Changes

Mortgage fees have changed a lot over the years. Since they began, Fannie Mae and Freddie Mac have changed their fees because of things like economic problems, more people buying homes, or new laws.

Sometimes they raised fees when things were uncertain. Other times, they lowered fees when things looked good. By looking at these changes, we can learn about the economy and what was happening at the time.

Fannie and Freddie have faced many challenges. Their fees show how they changed and adapted over time. Every time they changed a fee, it was like a mark on a timeline of history. It showed how they stayed strong, changed, and planned for the future.

Factors That Have Led to Adjustments in These Fees

There are many reasons why fees change. The economy, like when many people have jobs or when businesses are doing well, affects fees. But there's more to it.

New rules, technology, and things happening in other countries can also make fees go up or down.

Fannie and Freddie also look at things like how many people can't pay back their loans or how much it costs to run their business.

Another thing that affects fees is what people want. If more people want certain kinds of loans, fees might change. And when other companies come and offer loans, Fannie and Freddie might change their fees to stay in the game.

Bottom Line

Mortgage fees, particularly those managed by Fannie Mae and Freddie Mac, play an essential role in the U.S. housing market. These institutions, pivotal in the mortgage landscape, use fees to balance risks and maintain their financial health.

As a protective measure, these fees impact borrowers, influencing loan costs and affordability. These charges, which include LLPAs and G-Fees, vary based on loan specifics like credit scores and down payments.

Factors such as economic conditions, technological advances, and international events influence these fees' adjustments. Furthermore, lenders also adapt their loan prices in response to changes in these fees.

Over time, the evolution of fees provides a lens into broader economic shifts and challenges faced by Fannie and Freddie.

In essence, understanding these fees is vital not just for potential homeowners but for anyone keen on deciphering the intricacies of the U.S. economy.

Fannie Mae and Freddie Mac Mortgage Fees FAQs

They are charges used by these institutions to cover potential risks and ensure their long-term financial health when acquiring, securitizing, or guaranteeing a mortgage.

Fees can directly influence the cost of a loan, potentially affecting loan approval, monthly payments, and overall borrowing costs.

LLPAs are dynamic pricing tools adjusting mortgage prices based on specific loan characteristics, ensuring each loan's price aligns with its risk.

Mortgage fees, especially those from Fannie Mae and Freddie Mac, can subtly influence interest rates, shaping the final loan pricing for borrowers.

While both have overarching similarities, they exhibit nuances in LLPAs, G-Fee rates, special programs, and operational practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.