Fannie Mae, officially known as the Federal National Mortgage Association, began its journey in the late 1930s. Born from the Great Depression's economic chaos, its main objective was to stabilize the housing market by ensuring a constant supply of mortgage funds. Over the years, Fannie Mae's role expanded, making it a pivotal player in the U.S. housing finance ecosystem. Today, Fannie Mae serves as a bridge, connecting lenders and borrowers, ensuring that the American Dream remains accessible to many. Its evolution reflects the changing needs of homeowners and the broader economic environment. The U.S. mortgage market's vibrancy is largely attributed to Fannie Mae's robust and consistent presence. By buying and securitizing mortgages, Fannie Mae facilitates a flow of capital, allowing lenders to issue more loans and homebuyers to find more accessible financing. Without such intermediaries, lenders might be more hesitant, potentially constricting the supply of housing loans. Cash-out refinancing is a tantalizing concept, especially within Fannie Mae's framework. At its core, this refinancing allows homeowners to replace their current mortgage with a new, often larger one, and pocket the difference in cash. Fannie Mae's cash-out refinancing provides homeowners with the flexibility to tap into their home equity, which could be used for a plethora of purposes from debt consolidation to major purchases. This financial tool not only offers immediate benefits but also can strategically position homeowners for future financial endeavors. While refinancing generally aims to benefit homeowners, not all refinancing options are created equal. Traditional refinancing, for instance, usually aims to secure a lower interest rate or reduce the loan term. Cash-out refinancing, on the other hand, seeks to transform equity into liquid assets. With Fannie Mae’s version, specific criteria and guidelines ensure a structured, risk-adjusted approach, distinguishing it from other available refinancing pathways. Such precision is vital for homeowners to make informed decisions that resonate with their financial goals. Criteria act as gatekeepers, ensuring that only qualified homeowners embark on this financial journey. For borrowers, Fannie Mae examines credit scores, debt-to-income ratios, and employment stability. But it’s not just about the borrower. The property itself undergoes scrutiny. It must fall within approved types, and its value often determines the refinance amount, necessitating precise loan-to-value ratio calculations. It's a comprehensive system, designed to minimize risks and maximize the potential for sustainable lending. Mortgage size isn’t a free-for-all. For primary residences, Fannie Mae often has higher limits compared to second homes or investment properties. It's a dynamic landscape, with loan limits reviewed annually. These changes are influenced by various factors, from housing price fluctuations to economic indicators, ensuring the limits remain relevant in ever-evolving markets. Keeping abreast of these changes can offer homeowners timely opportunities to leverage their property's value. An application demands evidence. Proof of income and employment showcases a borrower's ability to honor loan commitments. Credit scores are windows into past financial behaviors, and property appraisal assesses the home's current market value. These components work in tandem, painting a detailed picture of both the borrower and the property in question. Through meticulous documentation and verification, both lenders and borrowers achieve clarity, reducing uncertainties in the process. Tapping into equity transforms a static asset into dynamic possibilities. Whether it's for immediate expenses or emergency funds, the liquidity boost empowers homeowners to navigate financial waters with an added sense of security and opportunity. This flexibility is particularly vital in uncertain times, giving homeowners an extra layer of financial cushion. A refinance isn’t just about cash; it’s a chance to renegotiate. With changing market conditions or improved credit scores, homeowners might find themselves eligible for better mortgage terms, from lower interest rates to more favorable durations. Such tweaks can translate to significant long-term savings, making the refinancing endeavor even more rewarding. High-interest debts can be a relentless drain. Using the cash from refinancing to pay off such debts might offer relief. It's a strategic move, turning multiple payments into a singular, often-lower monthly commitment. By centralizing debts, homeowners can streamline their finances and potentially enhance their financial health. Sometimes, the best investment is one's own abode. Be it a kitchen remodel or a new patio, the funds can breathe life into home improvement dreams, potentially increasing the property’s value. Beyond aesthetics, these improvements can enhance the functionality and comfort of the home, enriching daily living experiences. Knowledge is power, and investment is growth. Some homeowners see beyond immediate needs, channeling their funds into education or diverse investment portfolios, sowing seeds for future returns. Investing in oneself or the broader market can pave the way for compounded benefits down the road. Equity is a cushion, a safeguard. Tapping too much of it might leave homeowners vulnerable, especially if property values dip. It's a balancing act, where caution must dance with ambition. Being aware of market trends and having a long-term perspective can help in making judicious decisions. Market conditions are mercurial. While one might enter a cash-out refinance hoping for better terms, rising interest rates could offset potential benefits, increasing long-term costs. Monitoring rate trends and understanding their implications can provide a clearer picture when weighing the pros and cons. More money now might mean more commitment later. Extending a loan's life or increasing its amount could mean higher overall interest, stretching the financial tether. It's essential to consider the long-game, understanding the implications of an extended mortgage timeline on one's broader financial landscape. Housing markets aren’t always buoyant. Should property values fall post-refinancing, homeowners could owe more than their homes are worth, a precarious position. Staying informed about local housing market trends and seeking expert advice can help mitigate such risks. Every financial decision ripples through a person's fiscal landscape. Refinancing requires recalibration, adjusting plans, and perhaps, redefining financial goals. Engaging with financial planners or counselors can ensure that the refinancing decision aligns well with overarching financial objectives. Freddie Mac, Fannie Mae's sibling enterprise, also offers cash-out refinances. While they share common ground, differences in guidelines, loan limits, and borrower requirements can sway homeowners' choices. Navigating both landscapes offers a broader perspective, illuminating the best path forward based on individual circumstances. Beyond Fannie Mae and Freddie Mac lie other enticing refinancing avenues. The Federal Housing Administration (FHA) and the Veterans Affairs (VA) have their own sets of rules, benefits, and constraints. These programs cater to specific borrower segments, like veterans or those with lower credit scores. By juxtaposing Fannie Mae's offerings with these, homeowners can find the most synergistic fit. Outside the realm of government-backed entities, private lenders have their own cash-out refinancing flavors. Often more flexible, they cater to non-conforming loans that don’t fit the mold of Fannie Mae or Freddie Mac. However, flexibility might come at a cost, often in the form of higher interest rates. It's a diverse playground, and understanding each option's nuances can be instrumental in making informed decisions. This step is the inception of the refinancing process. Homeowners initiate a dialogue with a lender or financial consultant to gain insights into the benefits, potential drawbacks, and feasibility of a cash-out refinance. This session provides clarity, helping homeowners gauge if this option aligns with their financial goals and current standing. Armed with the insights from the initial consultation, homeowners should introspect on their current financial and equity positions. This involves examining current mortgage terms, assessing home equity, and understanding how much cash can be accessed through refinancing. It sets the foundation for the decisions ahead. This phase involves collecting all the pertinent information and paperwork required by Fannie Mae. Typical documents include proof of income, current mortgage statements, property tax assessments, credit history, and home appraisals. Ensuring that all documents are accurate and up-to-date is crucial, as this data serves as the backbone for the refinancing assessment. Once all documents are in order, homeowners can officially apply for the cash-out refinance. The application process might vary slightly between lenders, but it usually involves filling out detailed forms, attaching the gathered documentation, and submitting them either online or in person. After submission, the lender or financial institution reviews the application in detail. They assess the homeowner's creditworthiness, the value of the property, and other pertinent details. This review ensures that the proposed refinancing aligns with Fannie Mae's guidelines and that the homeowner meets all the criteria for approval. It's a comprehensive evaluation that determines the success or failure of the refinancing endeavor. Underwriting is the crucible, the test of an application's mettle. Assessors meticulously comb through credit histories, appraisals, and more, ensuring that the loan is a sound venture for both parties. Beyond just numbers, underwriting seeks to understand the story — the context behind credit scores, the rationale behind appraisals. It's a comprehensive evaluation, culminating in loan terms and conditions that resonate with both borrower and lender. The finale is in sight, but it comes with its own set of intricacies. Costs associated with refinancing can vary, influenced by multiple factors from loan size to third-party fees. The timeline, too, isn't static, often contingent on underwriting complexities and other logistical nuances. And as the curtain falls, finalizing loan agreements becomes paramount, setting the stage for the next financial chapter. In the complex landscape of housing finance, Fannie Mae stands as an emblem of stability and opportunity, bridging lenders and borrowers to fulfill the quintessential American Dream. Cash-out refinancing under Fannie Mae's umbrella offers homeowners a chance to strategically harness their home's equity, balancing immediate liquidity needs with long-term financial planning. As enticing as it sounds, this option comes with its nuances, from the meticulous documentation to potential equity dilution risks. Furthermore, while Fannie Mae's refinancing stands out, other options, like those offered by Freddie Mac or private lenders, provide a broader spectrum for homeowners to consider. Therefore, understanding, comparing, and consulting are crucial before embarking on this financial voyage. Ultimately, the success of a cash-out refinance hinges on aligning with one's financial goals, being informed, and navigating the process with precision and foresight.Overview of Fannie Mae

Understanding Fannie Mae Cash-Out Refinance

Definition and Basic Mechanics

Fannie Mae Cash-Out Refinance vs Other Refinancing Options

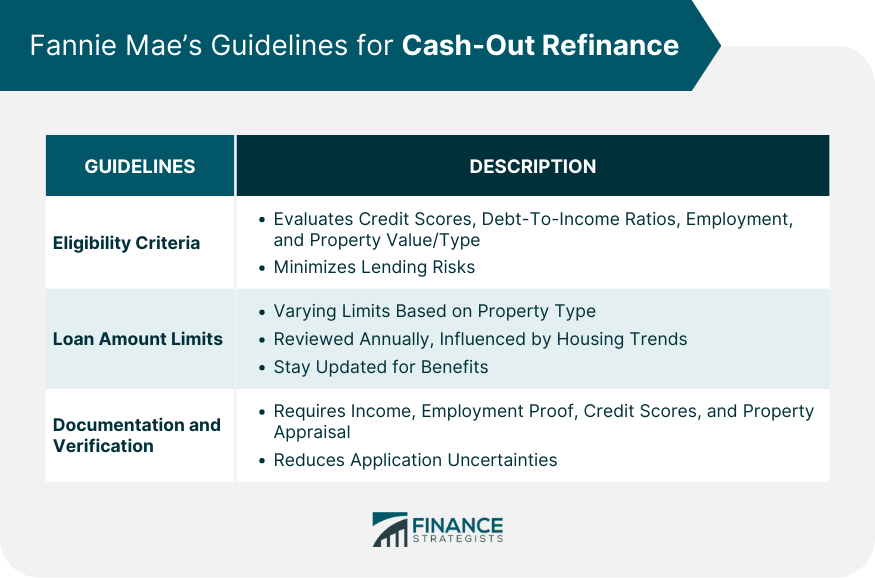

Fannie Mae’s Guidelines for Cash-Out Refinance

Eligibility Criteria

Loan Amount Limits

Documentation and Verification

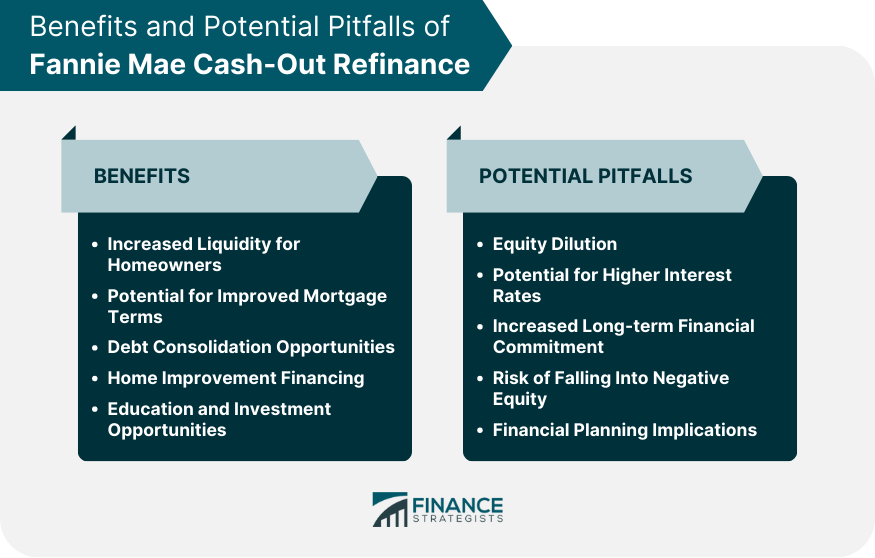

Benefits of Fannie Mae Cash-Out Refinance

Increased Liquidity for Homeowners

Potential for Improved Mortgage Terms

Debt Consolidation Opportunities

Home Improvement Financing

Education and Investment Opportunities

Potential Pitfalls of Fannie Mae Cash-Out Refinance

Equity Dilution

Potential for Higher Interest Rates

Increased Long-term Financial Commitment

Risk of Falling Into Negative Equity

Financial Planning Implications

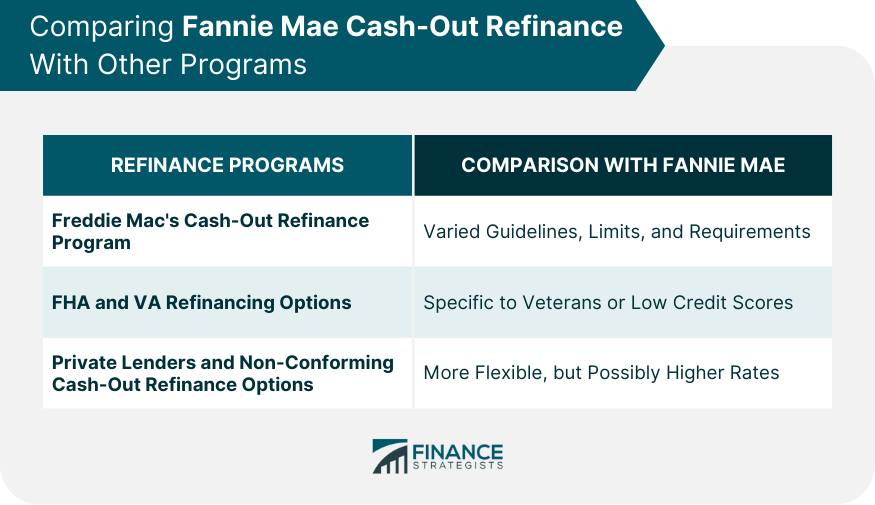

Comparing Fannie Mae Cash-Out Refinance With Other Programs

Freddie Mac's Cash-Out Refinance Program

FHA and VA Refinancing Options

Private Lenders and Non-Conforming Cash-Out Refinance Options

Application and Approval Process of Fannie Mae Cash-Out Refinance

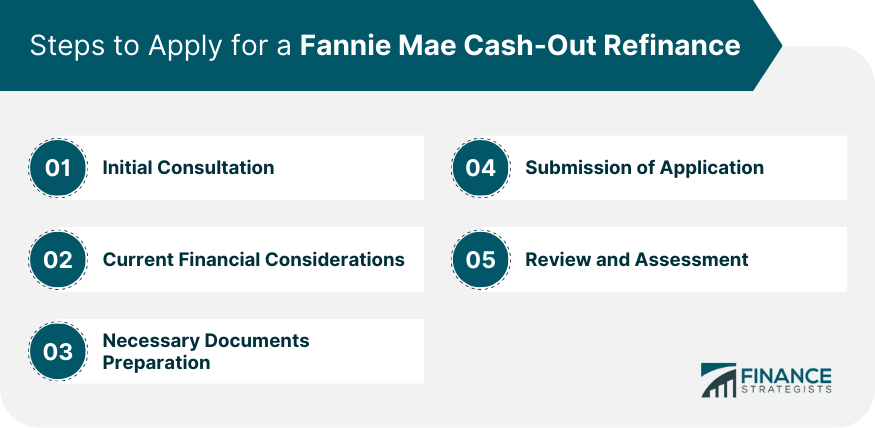

Steps to Apply for a Fannie Mae Cash-Out Refinance

Initial Consultation

Current Financial Considerations

Necessary Documents Preparation

Submission of Application

Review and Assessment

What to Expect During Underwriting

Closing the Refinance

Bottom Line

Fannie Mae Cash-Out Refinance FAQs

It's a refinancing option allowing homeowners to tap into their home equity by replacing their current mortgage with a larger one.

It has specific guidelines and criteria distinct from traditional refinancing and offers structured, risk-adjusted benefits.

Benefits include increased liquidity, improved mortgage terms, debt consolidation, home improvement financing, and investment opportunities.

Yes, potential pitfalls include equity dilution, higher interest rates, extended financial commitments, risk of negative equity, and financial planning implications.

It involves initial consultation, gathering documentation, submitting the application for review, underwriting assessment, and finalizing loan terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.