The Fannie Mae gift of equity is a unique real estate financial tool where a portion of a home's equity is "gifted" by the seller, usually a family member, as a down payment for the buyer. Endorsed by Fannie Mae, a key player in the U.S. mortgage market, this strategy has clear guidelines ensuring transparent and industry-compliant transactions. Its primary advantage is facilitating homeownership, particularly for those challenged by hefty down payments. This approach not only helps potential homeowners achieve their dream but also benefits the seller, aiding a relative or loved one without requiring the buyer to save a large down payment sum. The process is underpinned by the spirit of support, allowing family members to assist in the transition of property ownership. This not only strengthens family bonds but also provides a pragmatic solution in the competitive real estate landscape. Entering the realm of gifts of equity necessitates meticulous documentation. The central piece of this is the gift letter—a written declaration that clarifies the nature of the gift. It states, unequivocally that the money is indeed a gift and not a loan. Thus, it carries no obligation of repayment. This letter should include specific details, such as the amount, the donor's relationship with the recipient, and the house's address. In all dealings, clarity, and forthrightness are paramount. Misrepresentation or omission can lead to serious repercussions. The calculation of an equity gift is pretty straightforward. It's the difference between the market value of the property and the sales price. Here's the formula: For example, let's say the market value of a property is $200,000, and the sales price is $150,000. The gift of equity would be $50,000. In this case, the buyer would have to come up with a down payment of $50,000 in addition to the $150,000 sales price. However, the buyer could use the gift of equity to help cover the down payment. Begin by applying for a mortgage, where you'll introduce the concept of the gift of equity. Instead of the traditional down payment, the equity from the home will be incorporated as a significant part of the financial considerations. As a core requirement, lenders will ask for a gift letter. This document serves as a written declaration that verifies the nature of the gift. It should clearly state that the equity being transferred is genuinely a gift and not a loan, thereby carrying no repayment obligations. Beyond the gift letter, lenders might request further proof to confirm the legitimacy of the transaction. This can include bank statements reflecting the transfer or even direct communication with the person gifting the equity. Once all documents are in place and verifications are done, the loan application moves to the underwriting stage. Here, the lender will assess the risk, review all submitted materials, and decide on the mortgage terms. One of the standout benefits of the gift of equity is the reduction or even elimination of the need for a cash down payment. By utilizing the home's equity, buyers can significantly reduce their upfront costs. This is especially beneficial for those who haven't accumulated vast savings, as it enables them to move forward with a purchase that might have otherwise been out of reach. Financial transactions often bring with them tax considerations. Thankfully, with the gift of equity, there are potential tax benefits for both parties. Under certain conditions, the equity gift can be excluded from gift tax, leading to financial savings. Both the giver and the receiver should consult with tax professionals to understand these advantages in detail. Family homes often carry sentimental value. The gift of equity allows for a seamless transition of such properties between family members. Rather than venturing into the traditional selling process, families can opt for this method, ensuring the home remains within the family, preserving memories and history. While the gift of equity can be a boon, it's not without its challenges. Some lenders may be unfamiliar with the concept, leading to misconceptions or a lack of understanding. Additionally, complications may arise during the underwriting process, requiring further documentation or clarification. Buyers should be prepared for these potential obstacles. Even with its potential tax benefits, the gift of equity might also present some complications. There are specific gift tax considerations, reporting requirements, and potential liabilities that both the giver and the receiver should be aware of. Engaging with a tax professional can help in navigating these waters. Blending finances and family can be a delicate dance. Gifts of equity might open doors to family disagreements or misunderstandings. It's vital for both parties to communicate their intentions and expectations clearly, ensuring that the gift strengthens the bond rather than creating friction. A widespread misconception revolves around the valuation of equity. Some believe that appraisals are arbitrary or can be easily manipulated. However, appraisals are systematic evaluations that consider various factors, including recent sales of comparable homes. Also, the fluctuating real estate market can significantly impact equity value. Distinguishing between Fannie Mae guidelines and federal gift tax limits can be confusing. While Fannie Mae may have specific directives regarding the gift of equity, federal gift tax limits operate under a different purview. It's crucial to understand both, and when in doubt, consult with a tax professional. Open and transparent communication lies at the heart of a successful gift of equity transaction. Both parties should understand the process, the implications, and each other's expectations. Clear dialogue can preempt misunderstandings and set the stage for a smooth transaction. The gift of equity landscape is intricate, and navigating it solo can be daunting. It's wise to engage with knowledgeable real estate agents who are familiar with the concept. Additionally, seeking advice from mortgage brokers and tax professionals can provide valuable insights and guidance. In all financial transactions, especially one as unique as the gift of equity, documentation is paramount. Parties should maintain records of all communications, transactions, appraisals, gift letters, and related documents. This ensures transparency and can be crucial in case of any future discrepancies or queries. The world of finance and real estate is ever-evolving. Staying updated on changes to Fannie Mae guidelines and federal tax laws related to gifts of equity ensures that one is always in compliance and can make the most of the benefits on offer. The Fannie Mae gift of equity, a hallmark in the real estate financial landscape, provides an innovative pathway to homeownership, especially for those navigating the challenges of hefty down payments. Its design encourages family bonds, emphasizing seamless home transitions while navigating potential tax benefits. Yet, like all financial tools, it demands careful attention to detail – be it through meticulous documentation, professional consultations, or clear communication. As lenders and tax professionals may have varied experiences with this concept, it's vital to be prepared, ensuring transparent transactions while keeping abreast of evolving regulations. Ultimately, the gift of equity, when utilized judiciously, can be a boon, bridging the gap between dreams and reality, memories and futures, and between one generation and the next.What Is Fannie Mae's Gift of Equity?

How Fannie Mae Gift of Equity Works

Gift Letter Requirements

Calculation of the Equity Gift

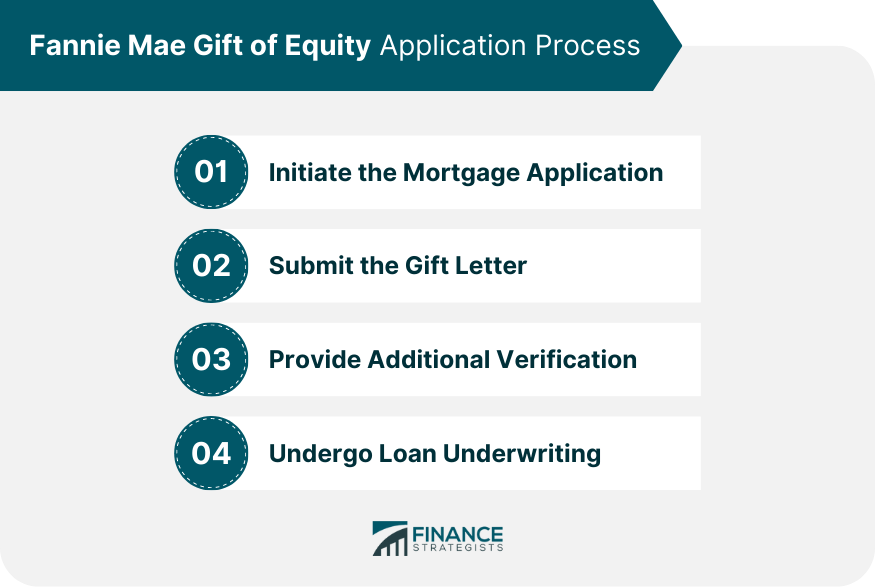

Application Process

Initiate the Mortgage Application

Submit the Gift Letter

Provide Additional Verification

Undergo Loan Underwriting

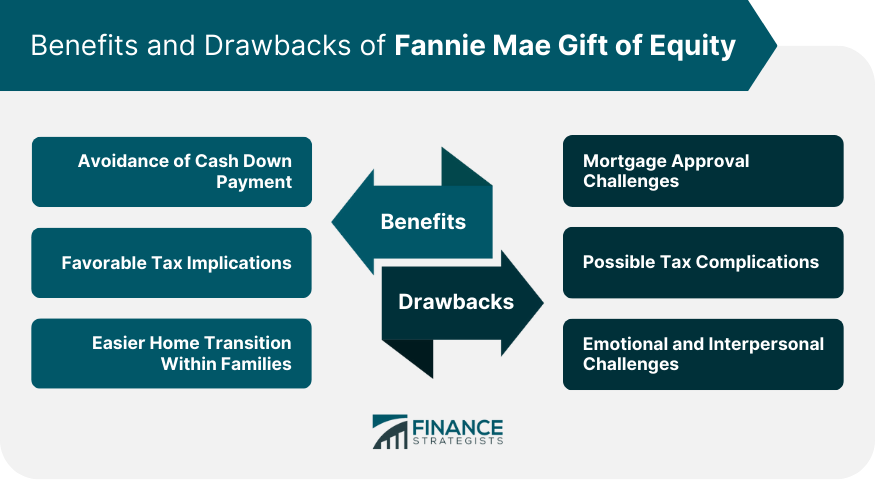

Benefits of Fannie Mae Gift of Equity

Avoidance of Cash Down Payment

Favorable Tax Implications

Easier Home Transition Within Families

Drawbacks of Fannie Mae Gift of Equity

Mortgage Approval Challenges

Possible Tax Complications

Emotional and Interpersonal Challenges

Common Misconceptions About Fannie Mae's Gift of Equity

Misunderstanding of Equity Valuation

Confusion Over Gift Limits

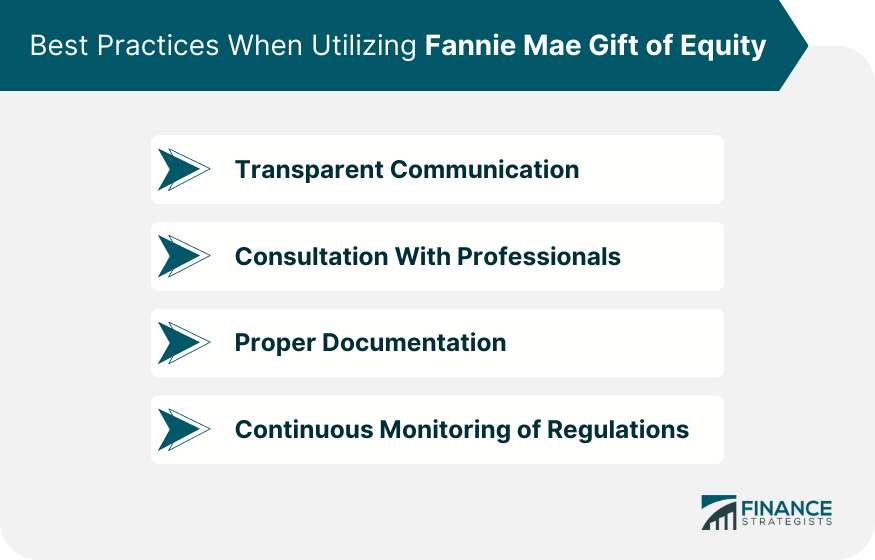

Best Practices When Utilizing Fannie Mae Gift of Equity

Transparent Communication

Consultation With Professionals

Proper Documentation

Continuous Monitoring of Regulations

Bottom Line

Fannie Mae Gift of Equity FAQs

It's a type of down payment where the home's equity is "gifted" by the seller, usually a family member, to the buyer as per Fannie Mae's guidelines.

It reduces or eliminates the need for a cash down payment, offers potential tax advantages, and eases home transitions within families.

Yes, potential challenges include mortgage approval difficulties, possible tax complications, and emotional or interpersonal issues within families.

A gift letter detailing the nature and amount of the gift is essential, along with possible verification through bank statements or donor contact.

Professionals provide valuable insights on the process, tax implications and ensure you stay updated with changing regulations and guidelines.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.