The Fannie Mae Home Price Index is a crucial instrument in the U.S. real estate arena, providing a monthly snapshot of national and regional home prices. Unlike many indices, it derives its data strictly from home purchase transactions, ensuring specificity in its insights. This tool is designed to offer transparency into housing market trends, acting as a benchmark for professionals to gauge the health of the housing sector. By aggregating data on both a national and regional scale, the index captures a broad spectrum of market dynamics. Seasonal adjustments further refine its accuracy, making it a reliable and indispensable resource for economists, policymakers, and real estate enthusiasts. In essence, the Fannie Mae Home Price Index offers a clear lens into the ever-evolving landscape of American housing prices. At its core, the index is fueled by data. Primary sources include home purchase transactions and detailed mortgage data. This ensures that the index’s findings are rooted in real-world market activity. Once the data is in, the magic begins. Fannie Mae utilizes proprietary algorithms, adjusting for a slew of factors. One major adjustment is for seasonal effects, which ensures the data remains relevant year-round. The end result is a meticulously crafted representation of the housing market at both a national and regional level. The foundation of the index lies in its data sources. Predominantly, it relies on home purchase transactions and intricate details from mortgages. This approach ensures that the index captures genuine market activity and remains rooted in real-world occurrences. Beyond mere data collection, the real prowess of the index shines in its calculation. Fannie Mae employs proprietary algorithms to make sense of the vast swathes of data. This ensures an accurate, consistent, and holistic view of the housing market. One standout feature of the methodology is its adjustments for various factors, notably seasonal effects. By accounting for seasonal housing market fluctuations, the index provides readings that mirror the true state of the market, irrespective of the time of year. Ask any real estate aficionado, and they’ll tell you: that an index is only as good as its data. The Fannie Mae Home Price Index's robust foundation in real-world transaction data grants it unparalleled reliability. Beyond mere reliability, its coverage is expansive. Offering both national and regional insights, it paints a picture of the U.S. housing market that few other tools can. Housing markets ebb and flow with the seasons. By adjusting for these seasonal market fluctuations, the index ensures it remains accurate, relevant, and dependable throughout the calendar year. Data compilation and processing aren't instantaneous. There's an inevitable delay, which means the index might not capture real-time market conditions. While the focus on purchase transactions adds a layer of specificity, it's also a limitation. The exclusion of other real estate transaction types, particularly refinancing, means the index isn't exhaustive. No index is perfect. With its wide scope, there might be variations in regional data. Some regions may, unfortunately, find themselves less accurately represented than others. Housing prices don’t exist in a vacuum. They're swayed by broader economic indicators. Employment rates, GDP growth, and other macroeconomic factors play a role in shaping the index’s readings. The Intricacies of the housing market itself also weigh in. From the tug of war-between supply and demand to fluctuating mortgage rates and the spiraling costs of construction, these internal dynamics leave an imprint on the index. Governments and their policies can make or break markets. Changes in housing regulations, tax policies, or lending criteria, for instance, can ripple through the housing market, finding their echo in the index's readings. Each index has its own flavor. While the Fannie Mae Home Price Index emphasizes purchase transactions, others, like the S&P/Case-Shiller Home Price Index, may incorporate varied data points, leading to unique readings and interpretations. Yet, the unique lens of Fannie Mae’s index offers strengths others might not possess. Its reliability, comprehensive coverage, and seasonal adjustments stand out in a crowded market of indices. Every rose has its thorns. When stacked against other indices, certain areas—such as real-time data capturing—might seem where competitors have an edge. The Fannie Mae Home Price Index remains a cornerstone in the U.S. real estate landscape, offering unparalleled insights derived strictly from home purchase transactions. This meticulous focus ensures the index delivers a precise pulse on housing market dynamics. Enhanced by proprietary algorithms and seasonal adjustments, the Fannie Mae Home Price Index provides both national and regional perspectives. While it boasts vast benefits, including comprehensive coverage and year-round relevance, potential limitations, such as a time lag in data representation, are noteworthy. Nevertheless, when juxtaposed with other indices, it holds its own, showcasing both strengths and areas of improvement. For professionals, policymakers, and real estate enthusiasts, this index remains an invaluable tool to navigate the intricacies of the housing market, reflecting broader economic indicators, housing dynamics, and policy impacts.What Is Fannie Mae Home Price Index?

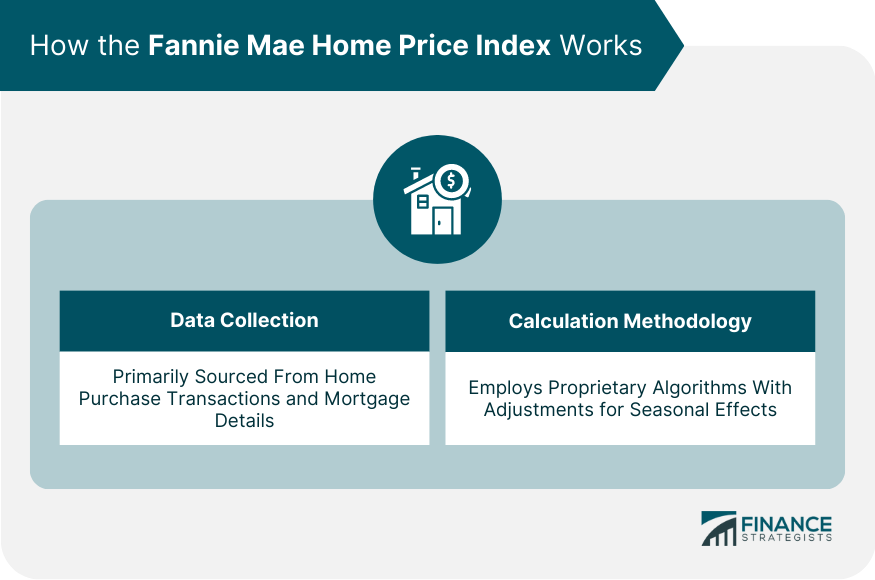

How the Fannie Mae Home Price Index Works

Data Collection

Calculation Methodology

Methodology Behind Fannie Mae Home Price Index

Data Collection

Calculation Techniques

Adjustments for Real-world Scenarios

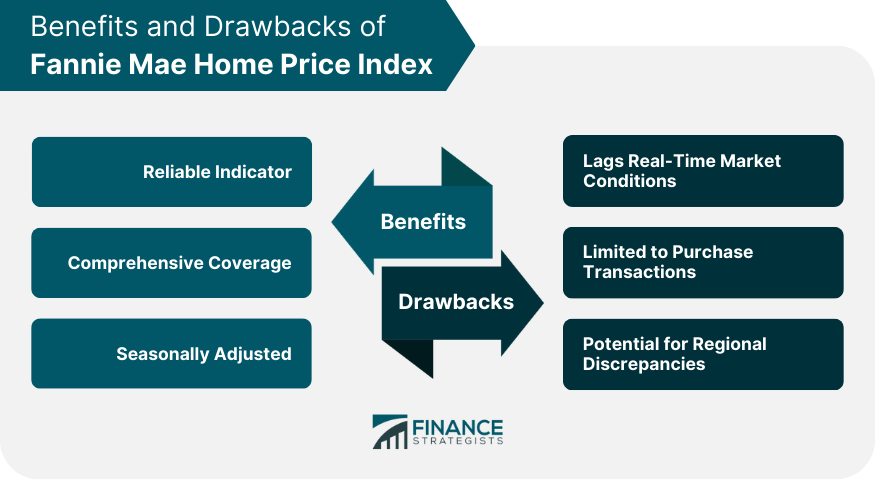

Benefits of Fannie Mae Home Price Index

Reliable Indicator

Comprehensive Coverage

Seasonally Adjusted

Drawbacks of Fannie Mae Home Price Index

Lags Real-Time Market Conditions

Limited to Purchase Transactions

Potential for Regional Discrepancies

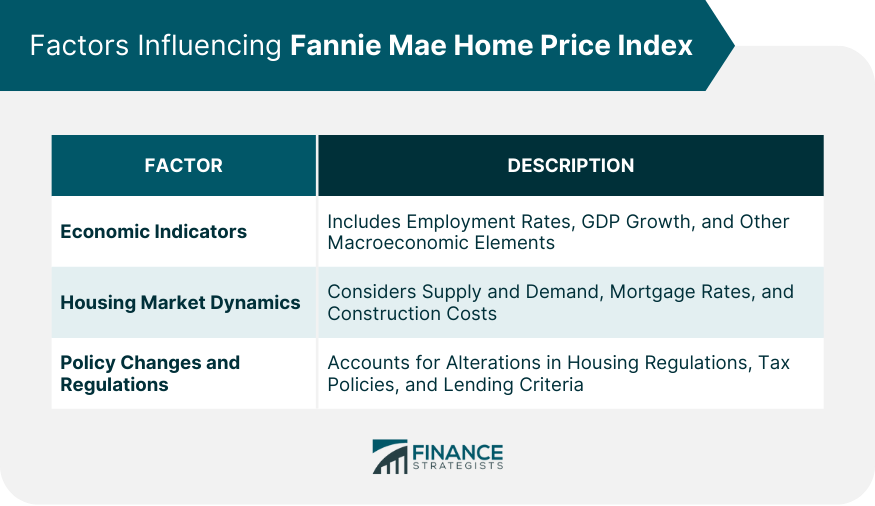

Factors Influencing Fannie Mae Home Price Index

Economic Indicators

Housing Market Dynamics

Policy Changes and Regulations

Comparison With Other Home Price Indices

Differences Between the Fannie Mae Home Price Index and Other Major Indices

Advantages Over Other Indices

Limitations in Comparison

Conclusion

Fannie Mae Home Price Index FAQs

The Fannie Mae Home Price Index is used to provide a monthly assessment of national and regional home prices in the U.S. based on purchase transactions, helping professionals gauge housing market health.

The Fannie Mae Home Price Index is distinct in its focus on home purchase transactions and its proprietary algorithms that adjust for factors like seasonal effects, offering unique insights compared to other indices.

Yes, the Fannie Mae Home Price Index can lag behind real-time market conditions due to the time it takes to compile and process the data it uses.

The Fannie Mae Home Price Index is seasonally adjusted to provide a more accurate representation of housing market trends by factoring in the usual seasonal fluctuations in the housing market.

Yes, the Fannie Mae Home Price Index is based primarily on home purchase transactions, excluding other types of real estate transactions like refinancing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.