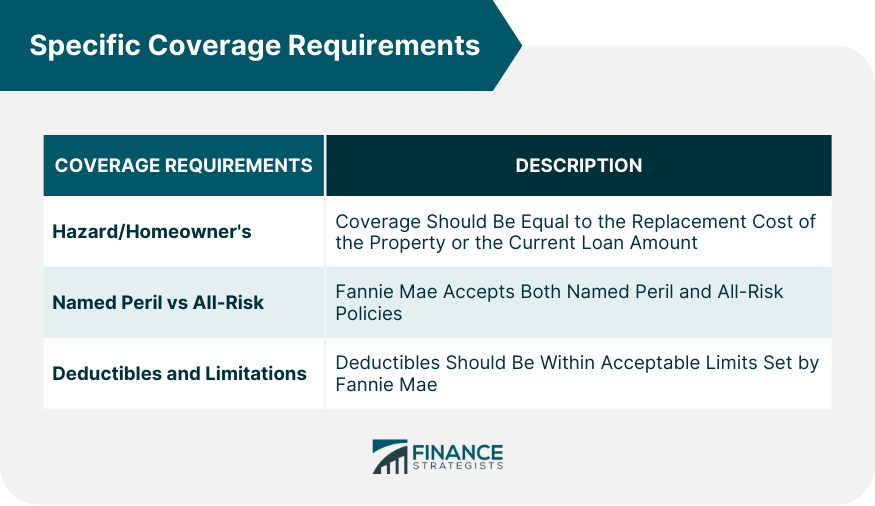

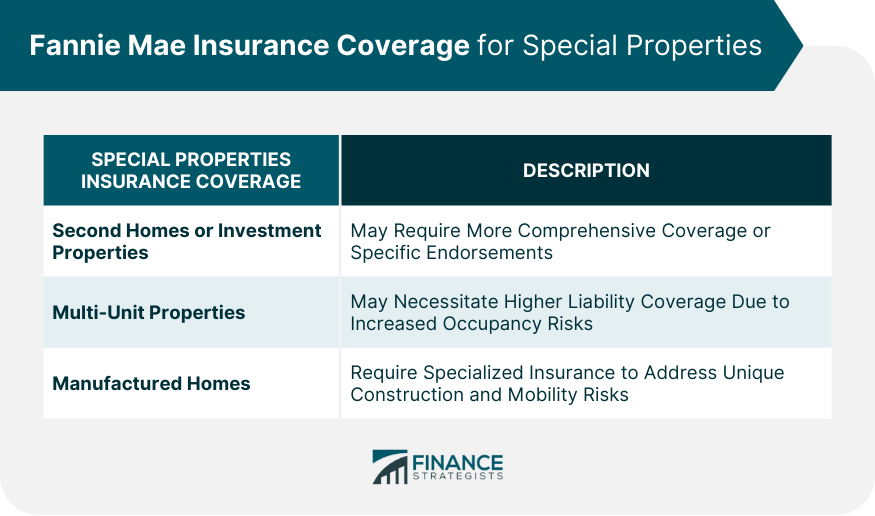

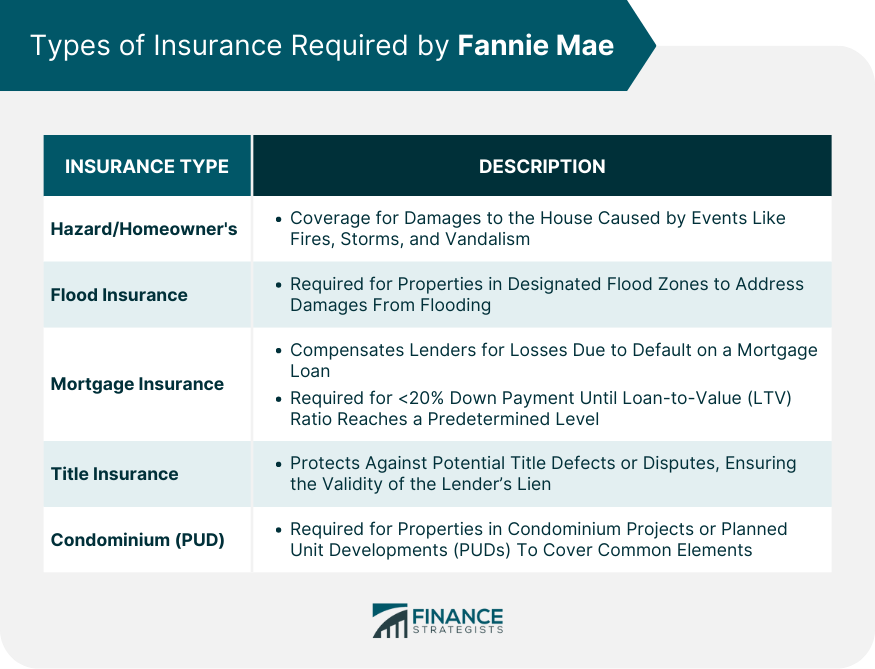

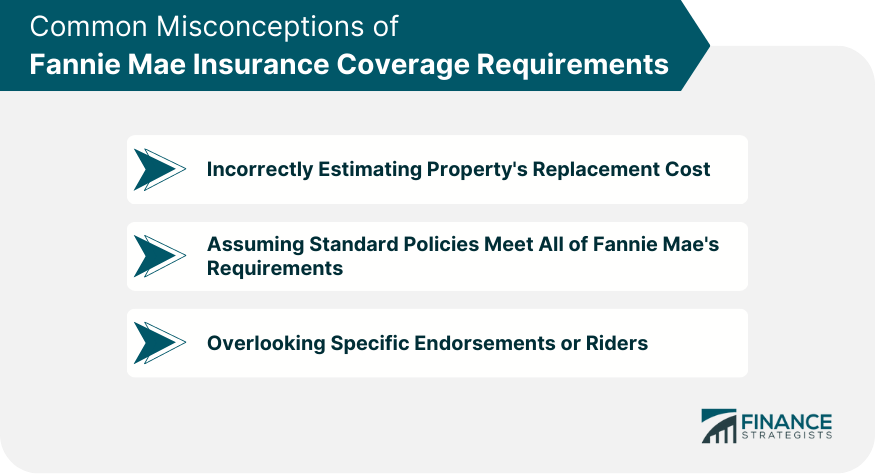

Established to boost the housing market for low- to middle-income Americans, Fannie Mae has a pivotal role in the mortgage industry. Central to its mission is ensuring properties financed through it have sufficient insurance coverage. Those opting for Fannie Mae mortgages must adhere to specific insurance criteria. These stipulations ensure not just the lender's and Fannie Mae's interests, but also shield borrowers from potential financial disasters. Insurance in mortgage transactions is crucial, protecting both parties from unpredicted damages or devaluation. Fannie Mae's insurance guidelines aim for uniform protection, clarity for all involved, and bolstering trust in the mortgage-backed securities sector. It's not just about having insurance; it's about having the right amount and type of insurance. For hazard and homeowner's insurance, the coverage should typically be equal to the replacement cost of the property or the current loan amount. It ensures that in the event of a total loss, there are adequate funds to rebuild. Fannie Mae accepts both named peril and all-risk policies. While named peril policies cover only those risks specified in the policy, all-risk policies provide broader coverage, encompassing all risks except those explicitly excluded. Deductibles should be clearly stated and within acceptable limits set by Fannie Mae. Some policies may have limitations or exclusions, which borrowers should be aware of to ensure compliance with Fannie Mae's guidelines. Certain properties, due to their unique nature, have special insurance requirements. Second Homes or Investment Properties: Such properties might be vacant for extended periods, presenting different risks. Thus, they might necessitate more comprehensive coverage or specific endorsements. Multi-Unit Properties: Properties with more than one dwelling unit, like duplexes or triplexes, may require higher liability coverage, given the increased occupancy and associated risks. Manufactured Homes: Given their construction and potential mobility, manufactured homes have distinct risks, necessitating specialized insurance policies to address those unique challenges. Ensuring that a property is comprehensively protected requires various types of insurance coverages, each addressing different risks. This is a non-negotiable for most homeowners. It provides coverage against damages to the physical structure of the house caused by events like fires, storms, and vandalism. For those with a Fannie Mae-backed mortgage, there are specific guidelines about the minimum coverage limits and the types of risks covered. For properties located in designated flood zones, flood insurance is a must. This coverage is separate from the standard homeowner's insurance and addresses damages caused by flooding. The Federal Emergency Management Agency (FEMA) delineates flood zones. Properties situated in high-risk flood areas, such as those labeled as 'A' or 'V' zones, are mandatorily required to have flood insurance when financed through Fannie Mae. The insurance should cover either the outstanding balance of the mortgage or the maximum insurance available from the National Flood Insurance Program (NFIP) – whichever is less. This is a type of insurance that compensates lenders or investors for losses due to the default of a mortgage loan. Mortgage insurance is typically required when a borrower makes a down payment of less than 20% of the home's purchase price. It remains in place until the loan-to-value (LTV) ratio reaches a predetermined level. There are two primary types: Borrower-Paid Mortgage Insurance (BPMI) and Lender-Paid Mortgage Insurance (LPMI). BPMI is when borrowers pay the insurance premium directly, while in LPMI, the lender pays the premium but might charge a higher interest rate. To protect against potential title defects or disputes, Fannie Mae requires borrowers to obtain title insurance. This ensures the lender's lien is valid and in the correct lien position. For properties within condominium projects or Planned Unit Developments (PUDs), Fannie Mae requires specific insurance that covers common elements and shared spaces. Insurance isn't a one-time event; it's a continuous obligation. Borrowers must ensure their insurance policies remain active and provide adequate coverage for the duration of their loan. They must also provide their lender with proof of insurance. If a borrower's insurance coverage lapses or falls below the required standards, Fannie Mae might force-place an insurance policy. While this ensures the property remains covered, it might be more expensive than a policy the borrower could obtain independently. Navigating the intricacies of insurance requirements can be challenging, leading to errors or misconceptions. • Incorrectly Estimating Property's Replacement Cost: A common mistake is underestimating a property's replacement cost, leading to inadequate insurance coverage. It's crucial to obtain accurate estimates to ensure complete coverage. • Assuming Standard Policies Meet All of Fannie Mae's Requirements: Not all standard insurance policies meet Fannie Mae's guidelines. Borrowers should carefully review their policies and, if necessary, obtain additional endorsements or riders to meet requirements. • Overlooking Specific Endorsements or Riders: Special properties or unique risks might necessitate specific endorsements or riders. Overlooking these can result in non-compliance with Fannie Mae's requirements. Fannie Mae's role in promoting home ownership in the U.S. cannot be understated, and a significant part of this mandate lies in ensuring properties under its purview are aptly protected against potential losses. Insurance, as a tool, doesn't merely guard against unforeseen calamities but also serves to safeguard the interests of lenders and borrowers alike. The varied insurance types, be it Hazard/Homeowner's, Flood, or Mortgage Insurance, all cater to specific risk profiles associated with properties. Furthermore, recognizing the uniqueness of certain properties, Fannie Mae's guidelines emphasize tailored coverage for second homes, multi-unit properties, and manufactured homes. However, navigating these requirements can be intricate, warranting borrowers to be vigilant, ensuring continuous coverage, and avoiding common pitfalls. Ultimately, abiding by these requirements is not just a mandate but a prudent step towards securing one's most valuable asset: their home.Fannie Mae's Essential Insurance Protocols

Fannie Mae Specific Coverage Requirements

Amount of Coverage Necessary

Named Peril vs All-Risk Policies

Requirements for Deductibles and Limitations

Fannie Mae Insurance Coverage for Special Properties

Types of Insurance Required by Fannie Mae

Hazard/Homeowner's Insurance

Flood Insurance

Mortgage Insurance

Title Insurance

Condominium (or PUD) Insurance

Fannie Mae Ensuring Continuous Coverage

Common Misconceptions of Fannie Mae Insurance Coverage Requirements

Bottom Line

Fannie Mae Insurance Coverage Requirements FAQs

Fannie Mae commonly requires Hazard/Homeowner's Insurance, Flood Insurance (for properties in designated flood zones), Mortgage Insurance (especially when the down payment is less than 20%), Title Insurance, and, for properties within condominium projects or Planned Units Developments (PUDs), specific insurance for shared spaces.

The amount of flood insurance should cover either the outstanding balance of the mortgage or the maximum insurance available from the National Flood Insurance Program (NFIP), choosing the lesser of the two.

BPMI means the borrower directly pays the mortgage insurance premium. In contrast, with LPMI, the lender pays the premium but might adjust the loan terms, often charging a higher interest rate to the borrower.

If a borrower's insurance coverage lapses or if it doesn't meet the required standards set by Fannie Mae to protect its interests, Fannie Mae might force-place an insurance policy. This ensures the property remains covered, though it might be costlier than a policy the borrower could obtain independently.

Some frequent errors include underestimating a property's replacement cost, assuming standard insurance policies automatically meet Fannie Mae's guidelines, and overlooking the need for specific endorsements or riders for unique properties or risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.