Overview of Fannie Mae

The Federal National Mortgage Association, colloquially known as Fannie Mae, stands as an eminent pillar in the United States mortgage market.

Established during the Great Depression, it has since been a beacon for aspiring homeowners, especially those navigating the complex maze of the American real estate arena.

Over the decades, its role has expanded and adapted, continuously meeting the evolving housing needs of the nation.

Its stability and outreach have become foundational for many looking to cement their place in the American dream.

Every lending institution maintains its set of borrower eligibility criteria, setting the groundwork for risk management.

For Fannie Mae, these guidelines ensure both lender protection and equitable access to loans, fostering a balanced ecosystem where dreams of homeownership are attainable.

Ensuring that borrowers meet these criteria creates confidence in the lending system, reducing the risk of default and maintaining the health of the broader housing market.

Fannie Mae’s Policies on Non-Citizen Borrower Eligibility

Definition of a Non-Citizen Borrower

A non-citizen borrower isn't inherently a foreign concept. Simply put, it's someone who seeks a mortgage in the U.S. but isn't a U.S. citizen. This distinction encompasses various statuses, each with its nuances.

Recognizing the diverse backgrounds and needs of these individuals is crucial for lenders, as they often bring unique financial profiles to the table.

Overview of Fannie Mae’s Guidelines Regarding Non-Citizens

Diverse and dynamic, Fannie Mae’s guidelines for non-citizens are sculpted to ensure fairness while upholding the sanctity of the lending process. They provide clear directives on eligibility, ensuring transparency and inclusivity.

As the demographics of the U.S. shift, it’s vital for institutions like Fannie Mae to be ahead of the curve, providing policies that cater to the modern borrower.

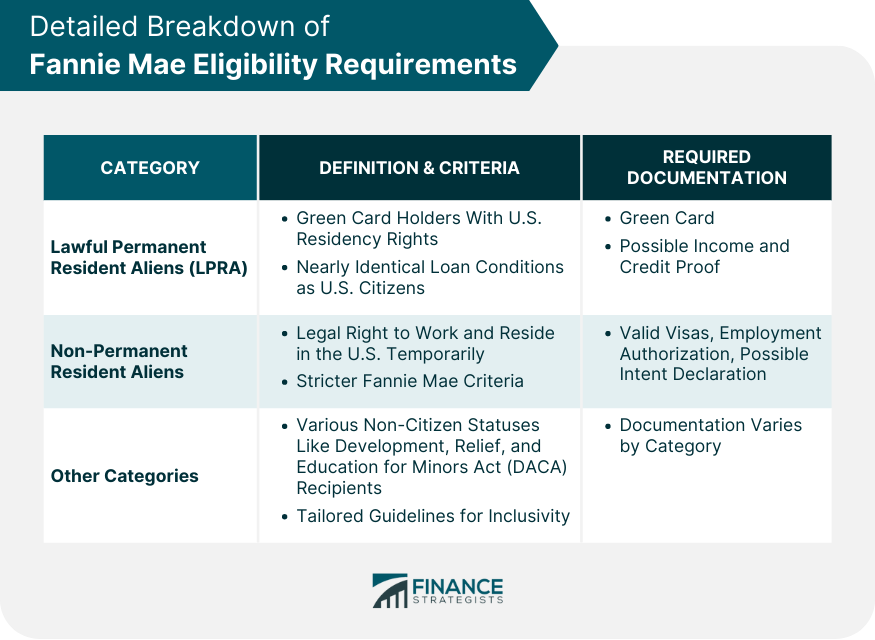

Detailed Breakdown of Fannie Mae Eligibility Requirements

Lawful Permanent Resident Aliens

Definition and Criteria

Being a Lawful Permanent Resident Alien (LPRA) means you hold a Green Card, granting you the privilege to live and work in the U.S. indefinitely.

Fannie Mae recognizes LPRAs, allowing them to access mortgage loans under conditions almost identical to U.S. citizens.

This inclusivity emphasizes the institution's commitment to treating all residents fairly and acknowledges the substantial economic contributions of LPRAs.

Required Documentation

While LPRAs have an easier path, documentation is pivotal. The key piece? The Green Card, proving both identity and lawful residency, ensuring a smoother journey in the loan application journey.

Additionally, lenders might also require proof of stable income and creditworthiness, much like they would for a U.S. citizen.

Non-Permanent Resident Aliens

Definition and Criteria

Falling under the vast umbrella of non-citizens are Non-Permanent Resident Aliens. Though they possess a legal right to work and reside in the U.S., their stay isn't indefinite.

Fannie Mae, however, remains committed to facilitating their homeownership aspirations, albeit with slightly more stringent criteria.

Recognizing their temporary status, Fannie Mae tailors its requirements to safeguard both the lender and the borrower.

Required Documentation

Documentation is paramount, especially for Non-Permanent Resident Aliens.

Fannie Mae typically requires valid visas, employment authorization documents, and sometimes even an additional declaration of intent to reside in the property being financed.

Keeping these documents up to date is crucial, as their temporary nature means they often have expiration dates that lenders will scrutinize.

Other Categories

The realm of non-citizenship is vast. Whether it's a Development, Relief, and Education for Minors Act (DACA) recipient dreaming of a home or an asylum seeker awaiting refuge, Fannie Mae provides specific guidelines tailored to each category, ensuring no group remains marginalized.

Recognizing the unique circumstances and challenges faced by these groups, Fannie Mae strives to provide pathways that are both compassionate and financially sound.

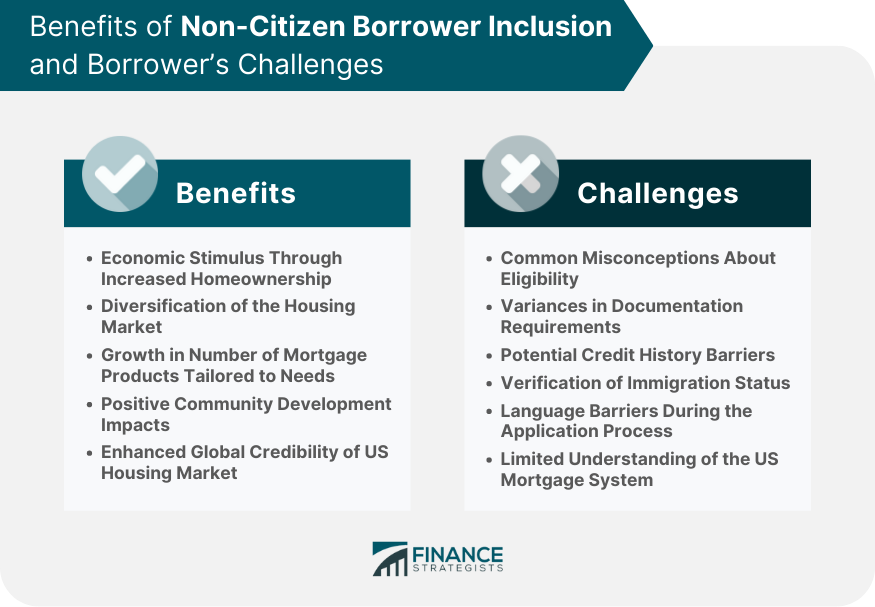

Benefits of Non-Citizen Borrower Inclusion

Economic Stimulus Through Increased Homeownership

Including non-citizen borrowers isn't just a matter of equity; it's an economic catalyst. Their inclusion stimulates the housing market, generating robust growth and weaving a stronger financial tapestry for the nation.

As more non-citizens invest in homes, local economies benefit from increased spending in construction, home improvement, and related sectors.

Diversification of the Housing Market

A diversified housing market is a resilient one. With non-citizens participating, the market not only grows in volume but also in diversity, reflecting the rich tapestry of America's global connections.

This diversification enhances stability, as economic downturns in one segment might be offset by growth in another.

Growth in the Number of Mortgage Products Tailored to Varied Needs

With diversified borrowers come diversified needs. This has ushered in a surge of mortgage products, each tailored to address the unique requirements of non-citizen groups, showcasing the market's adaptability.

Lenders, in turn, innovate to cater to these unique needs, fostering a competitive and customer-centric market.

Positive Community Development Impacts

Communities thrive when inclusivity is the norm. By embracing non-citizens, neighborhoods experience enriched cultural exchanges, fostering unity, and communal growth.

This inclusive approach promotes understanding, collaboration, and shared growth, fostering neighborhoods that are vibrant and cohesive.

Enhanced Global Credibility and Attraction of the US Housing Market

America's housing market stands tall on the global stage. By embracing non-citizen borrowers, it not only showcases inclusivity but also solidifies its reputation as a global investment haven.

This attraction draws international investments, further buoying the market and reinforcing its status as a global leader.

Challenges Faced by Non-Citizen Borrowers

Common Misconceptions About Eligibility

Misinformation can often cloud reality. Non-citizen borrowers frequently grapple with misconceptions about their eligibility, leading to hesitancy or misguided decisions.

It's crucial to dispel these myths, ensuring clarity and empowering these borrowers to make informed decisions.

Variances in Documentation Requirements

Documentation can be a maze, with every turn presenting a new requirement. For non-citizens, this maze often feels more intricate due to variances in documentation needs. From visas to work permits, the range is vast, requiring meticulous attention to detail.

Potential Credit History Barriers

Establishing a robust credit history is a cornerstone of the American lending system. However, non-citizens, especially recent arrivals, may lack this, creating potential barriers.

While some might have stellar credit histories in their home countries, transferring that credibility can be a challenge.

Verification of Immigration Status

Status verification is non-negotiable. However, for non-citizen borrowers, this can sometimes be a complex process, especially given the evolving nature of immigration laws and regulations. This step, while crucial, can introduce delays and require additional diligence.

Language Barriers During the Application Process

Language can either be a bridge or a barrier. For many non-citizen borrowers, navigating the mortgage process in English can be daunting, leading to misunderstandings or errors.

Ensuring clear communication is vital, perhaps through multilingual resources or interpreters.

Limited Understanding of the US Mortgage System

The U.S. mortgage system, with its intricacies, can confound even seasoned professionals. For non-citizens unfamiliar with the landscape, this complexity can be overwhelming, necessitating guidance and comprehensive education resources.

Comparative Analysis With Other Mortgage Institutions

Freddie Mac

While Fannie Mae is prominent, Freddie Mac is its noteworthy counterpart.

Both giants in the secondary mortgage market, they have similarities, yet their policies regarding non-citizen borrowers may differ. Diving into these nuances can help borrowers find the perfect match for their needs.

Federal Housing Administration (FHA)

The FHA, with its hallmark of affordability, offers mortgage insurance on loans. Its approach to non-citizen borrowers emphasizes accessibility, often providing more lenient criteria, making it a viable choice for many who find traditional avenues challenging.

US Department of Veterans Affairs (VA)

The VA home loan program is a testament to America's commitment to its veterans. While primarily designed for U.S. veterans, certain non-citizen categories, like those who've served in the U.S. military, might also be eligible, underscoring the program's inclusivity.

US Department of Agriculture (USDA) Loans

USDA loans, aimed at rural and suburban homebuyers, have their unique set of criteria. While they primarily cater to U.S. citizens, certain non-citizen categories might find a pathway here, especially if they meet the program's specific rural residency requirements.

Private Mortgage Lenders

Beyond government-backed entities, private mortgage lenders are pivotal players. Their flexibility often means they can offer tailored solutions for non-citizens. However, terms might vary, necessitating a deep dive into each lender's offerings and criteria.

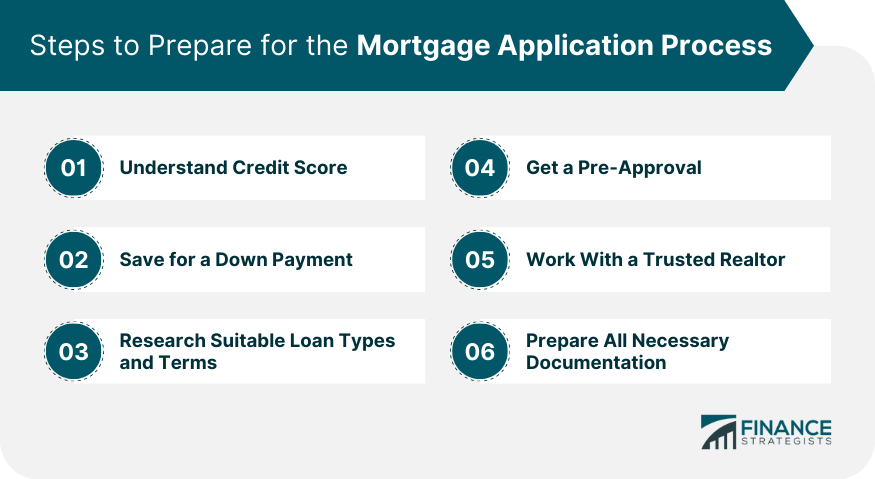

Steps to Prepare for the Mortgage Application Process

Understand Credit Score

Your credit score, like a passport, provides access. For prospective homeowners, it's vital to not only understand but also nurture this score. Regularly reviewing it, correcting discrepancies, and building a strong credit history can significantly ease the mortgage application journey.

Save for a Down Payment

While dreams fuel aspirations, finances cement them. Saving for a down payment is a tangible step towards homeownership. This not only reduces the loan amount but also showcases financial discipline, potentially unlocking better interest rates and terms.

Research Suitable Loan Types and Terms

Knowledge is power. Researching and understanding the plethora of loan types and terms available can empower borrowers to choose wisely. By aligning choices with individual financial profiles and goals, borrowers can optimize their homeownership journey.

Get a Pre-Approval

A pre-approval can be a game-changer. It not only solidifies a borrower's position in the competitive real estate market but also delineates their budget, enabling focused and efficient home searches.

Additionally, sellers often prioritize pre-approved buyers, giving them a competitive edge.

Work With a Trusted Realtor

In the vast and sometimes bewildering world of real estate, a trusted realtor is invaluable. Their expertise and insights can demystify the process, providing guidance at every step.

From identifying potential homes to negotiating prices, their role is pivotal in ensuring a smooth homeownership journey.

Prepare All Necessary Documentation

Efficiency in documentation can be a significant time-saver. Having all required documents at hand, organized, and updated can expedite the approval process. Additionally, it can prevent last-minute scrambles, ensuring a seamless flow from application to approval.

Tips on Gathering Required Documentation for Mortgage Application

Start Collecting Documents Early

The early bird often does get the worm. Initiating the documentation process early can provide ample time for thoroughness, ensuring that no critical document is overlooked.

This forward-thinking approach can significantly streamline the subsequent stages of the mortgage application.

Organize Documents in a Clear and Logical Manner

Organized documentation is akin to a well-told story—it's clear, concise, and compelling. By arranging documents logically, borrowers can facilitate quicker reviews, minimizing queries and back-and-forth exchanges with lenders.

Seek Translations for Non-English Documents

A translation can bridge the gap between confusion and clarity. For non-English documents, an accurate translation is invaluable. It ensures that the lender fully grasps the content, eliminating potential misunderstandings.

Keep Copies of All Submissions

In the digital age, copies are invaluable. Retaining copies of all submitted documents ensures that borrowers are always prepared, whether for reference, verification, or in the rare instance of lost submissions. This small step can be a significant stress-reliever in the longer run.

Regularly Update Time-Sensitive Documents

Relevance is crucial, especially with time-bound documents. By ensuring that such documents are current, borrowers can avoid potential hitches in the verification process. This proactive approach underscores their commitment and can foster confidence in the lender's eyes.

Bottom Line

In the realm of U.S. homeownership, Fannie Mae stands as an integral pillar, extending its reach to include non-citizen borrowers.

Recognizing the significant contributions and diverse backgrounds of non-citizens, Fannie Mae has adapted its guidelines, ensuring both inclusivity and transparency.

By accommodating Lawful Permanent Resident Aliens and Non-Permanent Resident Aliens, the institution acknowledges the evolving demographic landscape of the U.S.

The inclusion of non-citizens not only reflects the spirit of the American dream but also reinforces the nation's economic fabric.

Nevertheless, challenges persist, particularly in documentation, credit history, and misconceptions about eligibility.

Comparatively, while other mortgage institutions offer varying approaches to non-citizens, Fannie Mae's commitment to fairness remains evident.

Ultimately, preparation, understanding, and guidance are essential, making the dream of owning a home accessible and achievable for all.

Fannie Mae Non-Citizen Borrower Eligibility FAQs

Fannie Mae offers clear guidelines ensuring fairness and inclusivity for non-citizen borrowers seeking a U.S. mortgage.

A Lawful Permanent Resident Alien holds a Green Card, allowing them to live and work in the U.S. indefinitely.

They typically require valid visas, employment authorization documents, and possibly a declaration of intent to reside in the financed property.

It stimulates economic growth, diversifies the housing market, and fosters positive community development.

While similar to institutions like Freddie Mac, Fannie Mae has its unique guidelines ensuring transparent and inclusive policies for non-citizens.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.