Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) are pivotal institutions in the U.S. housing market, both established as government-sponsored entities (GSEs). Their primary purpose is to bolster homeownership and housing affordability by ensuring a consistent supply of mortgage capital. They achieve this by purchasing mortgages from lenders, transforming them into securities, and selling them to investors, thereby introducing liquidity to the market. While their missions are parallel, distinguishing features arise from their historical contexts, organizational structures, and product offerings. Fannie Mae, founded in 1938, was initially a government agency, while Freddie Mac emerged in 1970 to cultivate competition in the secondary mortgage market. Both have faced challenges, such as the 2008 financial crisis, but their combined presence remains foundational to the stability and accessibility of the U.S. mortgage landscape. Delving into the depths of the 1930s, America faced a banking crisis that threatened homeownership. Fannie Mae was born out of this necessity. It began as a government agency tasked with injecting funds into the housing market. The goal was straightforward: stimulate homeownership by making mortgages more accessible. As time progressed, Fannie Mae’s influence and reach expanded, playing an instrumental role in shaping the nation's housing finance framework. When Fannie Mae entered the scene, its primary role was to purchase Federal Housing Administration (FHA) insured loans, replenishing lenders' funds. It was a beacon of hope for a struggling housing market. By the 1960s, Fannie Mae transitioned to a mixed ownership corporation but remained under the government's auspices, continuing its pursuit to ease homeownership for many. Over the years, its strategies and operations were refined, making it more responsive to market dynamics and emerging challenges. Fast forward to 1970, the birth year of Freddie Mac. While Fannie Mae already existed, there was a need for more players to boost the secondary mortgage market. Freddie Mac's arrival wasn't just about competition but about diversification and offering more avenues for mortgage financing. Its inception was a testament to the nation’s evolving mortgage landscape, addressing market gaps and ensuring that a broader spectrum of consumers had access to home financing. Freddie Mac hit the ground running, providing a secondary market for conventional mortgages not covered by Fannie Mae. Its presence led to innovations in mortgage products and an increase in available funds for home loans. The two institutions, though different, became stalwarts in the U.S. housing finance landscape. Their complementary roles fostered a more robust, resilient, and inclusive housing market. Fannie Mae's mantra resonates with homeownership. By purchasing mortgages from lenders, it provides them with the necessary capital to lend again. Beyond this, its role extends to setting underwriting standards, ensuring the mortgage market's vitality, and tackling housing challenges head-on. The breadth of its operations has made it integral to the housing ecosystem, from influencing mortgage rates to shaping lender practices. From mortgage-backed securities to trust services, Fannie Mae's offerings are diverse. Their products have continuously evolved, reflecting the dynamic needs of the housing market. This adaptability is a testament to Fannie Mae's commitment to serving lenders and ultimately, homeowners. By being at the forefront of financial product innovation, Fannie Mae has consistently addressed the nuanced demands of a diverse population of homebuyers. Yet, the journey hasn't been without hiccups. Fannie Mae has faced criticisms, from accounting scandals to debates about its actual impact on homeownership. These challenges, while significant, have also propelled the entity to introspect, reform, and emerge stronger. It's a testament to Fannie Mae's resilience that it has consistently recalibrated and realigned its strategies to remain a cornerstone of the U.S. housing finance sector. Fannie Mae's footprint in the housing market is undeniable. Through its operations, the institution has facilitated homeownership for countless Americans, shaping the socio-economic fabric of the nation. Its influence extends beyond mere numbers; by fostering home ownership, it has contributed to community development, wealth accumulation, and economic stability for families across the nation. Parallel to Fannie Mae, Freddie Mac's mission orbits around the housing market's stability. Its modus operandi involves purchasing mortgages, pooling them, and then selling them as mortgage-backed securities. This process ensures a liquid market, making funds readily available for lenders and borrowers. As it carved out its niche, Freddie Mac continually evolved its strategies to resonate with the changing needs of both lenders and consumers. Freddie Mac's repertoire includes a variety of mortgage products tailored to different demographics. Their innovations have often set the pace, leading the market towards more inclusive and diverse home loan offerings. From first-time homebuyer programs to refinancing options, Freddie Mac's initiatives have often been a response to societal needs, ensuring that more individuals find a pathway to homeownership. Freddie Mac too has navigated turbulent waters, especially during economic downturns. Criticisms about its risk management and the overall role of GSEs have often been points of contention. Yet, these challenges also underscore the institution's resilience. Through each trial, Freddie Mac has demonstrated a commitment to its mission, making necessary changes to its operational strategies and maintaining its pivotal role in housing finance. Freddie Mac's legacy is interwoven with the U.S. housing narrative. Its efforts have consistently propelled the housing market forward, ensuring that homeownership remains within reach for many. Beyond its primary operations, Freddie Mac has played a role in shaping housing policies, advocating for affordable housing, and ensuring that the dream of homeownership remains attainable for future generations. At their core, both Fannie Mae and Freddie Mac have overlapping missions—promoting homeownership, ensuring liquidity, and stabilizing the U.S. housing market. While their methodologies might differ, their foundational principles are in tandem. Their shared objectives underscore the broader vision of a robust and inclusive housing market that serves the needs of all Americans. Both institutions operate under the watchful eye of the Federal Housing Finance Agency (FHFA). This oversight ensures that their operations align with broader national housing goals and that they remain accountable to the public. The symbiotic relationship between the GSEs and regulatory bodies has often been a balancing act, ensuring that while innovation thrives, systemic risks are mitigated. A pivotal role for both is their presence in the secondary mortgage market. By buying mortgages, transforming them into securities, and selling them to investors, they inject liquidity into the mortgage ecosystem. Their collective operations in this space have not only bolstered the housing market but have also contributed to the depth and sophistication of U.S. capital markets. The robustness of these GSEs is evident in their response to financial crises. Time and again, they've acted as pillars, ensuring that the housing market doesn't crumble, even when economic landscapes shift. Their ability to navigate these challenging terrains has reinforced the importance of their roles, highlighting their significance in underpinning economic stability. While both serve similar market segments, their organizational structures vary. Differences in leadership approaches, corporate strategies, and stakeholder interactions mark their distinct identities. Over the decades, both entities have cultivated unique corporate cultures, informed by their histories, challenges, and visions for the future. Dive deeper, and you'll find a plethora of unique offerings. Each institution has its signature products, tailored to address specific market needs, niches, or challenges. Their innovative streaks have often been the catalyst for change in the broader housing market, pushing boundaries and introducing products that resonate with shifting demographics and economic realities. Both GSEs have a nationwide presence, but their market penetration varies. Regional preferences, partnerships, and historical operations contribute to their distinct footprints. While their missions overlap, their on-ground strategies often differ, reflecting their understanding of regional nuances and local market dynamics. Their legacies are punctuated by a series of decisions, some controversial, others visionary. These strategic choices have shaped their paths, carved their niches, and underscored their impact. Through triumphs and tribulations, Fannie Mae and Freddie Mac have displayed a knack for evolution, adapting their strategies to the ever-changing contours of the housing market. The 2008 financial meltdown is a grim chapter in global economic history. A complex web of factors, including aggressive lending practices, inflated housing prices, and financial innovations like mortgage-backed securities, set the stage. The intertwined nature of global financial systems meant that a ripple in one segment could cascade into a tidal wave, threatening the very foundations of the world economy. The crisis saw Fannie Mae and Freddie Mac teetering on the brink. The federal government intervened, placing both under conservatorship. This move was pivotal, ensuring the continued functioning of the U.S. mortgage market. By stepping in, the government underscored the systemic importance of these GSEs, not just for housing, but for the broader health of the national economy. Post-2008, the landscape changed. Both GSEs underwent restructuring, bolstering their financial health and redefining their roles. Conservatorship heralded a new era, emphasizing prudence, accountability, and a renewed commitment to the American homeowner. As they rebuilt, both institutions placed a greater emphasis on risk management, transparency, and stakeholder engagement, ensuring that lessons from the past informed their future trajectories. Fannie Mae and Freddie Mac, as government-sponsored entities, serve as the linchpins of the U.S. housing finance ecosystem. Their intertwined histories and shared missions underscore the importance of fostering homeownership, maintaining market liquidity, and ensuring housing affordability for all. While they share core principles, their distinct organizational structures, innovative financial products, and strategic decisions highlight their unique contributions to the mortgage landscape. Their resilience, especially during tumultuous times like the 2008 financial crisis, speaks to their systemic significance. Both have adeptly navigated challenges, evolved with changing market dynamics, and consistently championed the dream of homeownership. In understanding their roles, histories, and impacts, we gain a deeper appreciation of the intricacies of the U.S. housing market and the foundational roles these entities play in shaping it.Fannie Mae vs Freddie Mac: Overview

Early Beginnings: How Fannie Mae and Freddie Mac Came to Be

Establishment of Fannie Mae

Purpose and Initial Operation

Birth of Freddie Mac

Initial Years and Growth

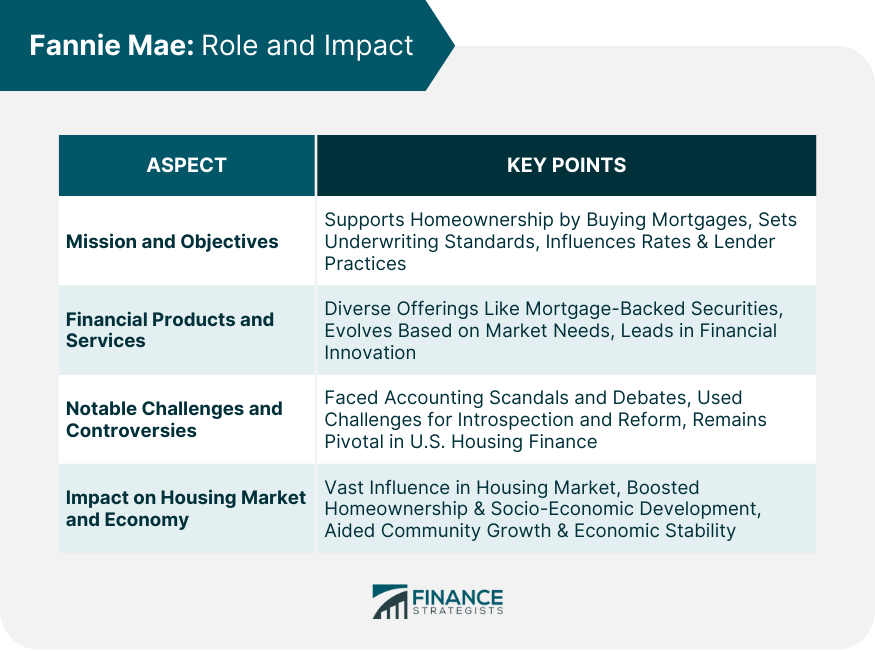

Fannie Mae: Role and Impact

Mission and Objectives

Financial Products and Services

Notable Challenges and Controversies

Impact on the Housing Market and Economy

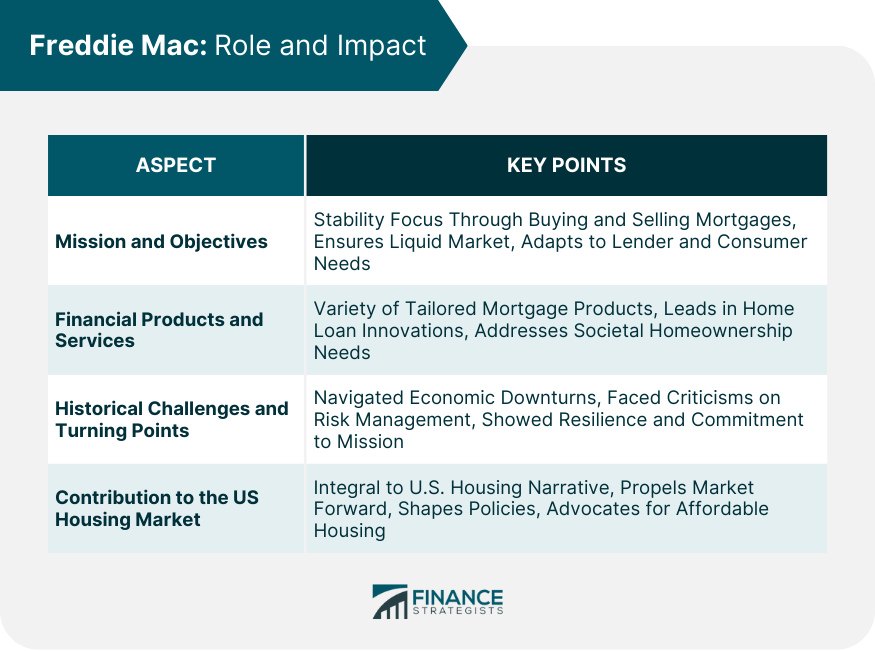

Freddie Mac: Role and Impact

Mission and Objectives

Financial Products and Services

Historical Challenges and Turning Points

Contribution to the US Housing Market

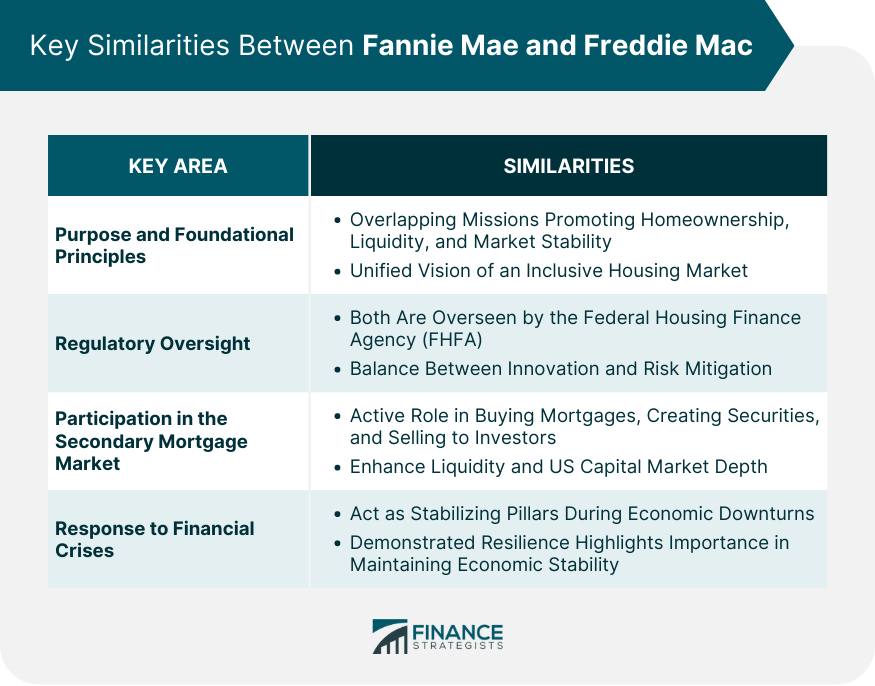

Key Similarities Between Fannie Mae and Freddie Mac

Purpose and Foundational Principles

Regulatory Oversight

Participation in the Secondary Mortgage Market

Response to Financial Crises

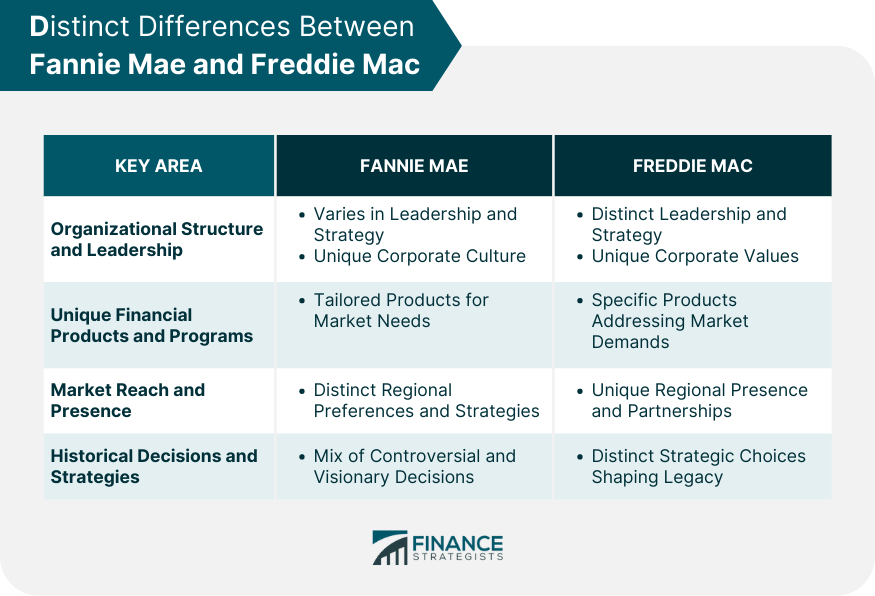

Distinct Differences Between Fannie Mae and Freddie Mac

Organizational Structure and Leadership

Unique Financial Products and Programs

Market Reach and Presence

Historical Decisions and Strategies

The 2008 Financial Crisis: How Both GSEs Were Affected

Causes Leading up to the Crisis

Federal Government's Intervention

Post-Crisis Restructuring and Conservatorship

Bottom Line

Fannie Mae vs Freddie Mac FAQs

Both aim to promote homeownership, ensure liquidity, and stabilize the U.S. housing market.

Both GSEs were placed under federal conservatorship, underwent restructuring, and emphasized risk management in their post-crisis operations.

They purchase mortgages, convert them into securities, and then sell them to investors, infusing liquidity into the mortgage ecosystem.

Yes, each institution has unique offerings tailored to address specific market needs, niches, and challenges.

Both GSEs operate under the oversight of the Federal Housing Finance Agency (FHFA).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.