A short sale occurs when a homeowner sells their property for less than the remaining amount of the mortgage. This type of sale typically takes place when the current market value of the home drops significantly. It's a way to avoid foreclosure, a lengthy and costly process for both the homeowner and the bank. Foreclosures can severely impact credit scores, making short sales a more palatable option for many. Short sales become a viable option for homeowners faced with financial distress or sudden life changes. Some may struggle with job loss, medical bills, or divorce which puts pressure on their ability to continue with their mortgage payments. Opting for a short sale can be a strategic decision to prevent more drastic outcomes like foreclosure. Moreover, short sales often lead to a more controlled exit from homeownership, granting sellers some say in the process. The Federal National Mortgage Association, more commonly known as Fannie Mae, is a pivotal player in the U.S. mortgage domain. By purchasing mortgages from primary lenders, consolidating them, and then offering them as mortgage-backed securities, Fannie Mae rejuvenates the liquidity of the mortgage market. This process ensures that lenders have a continual flow of funds to lend out, keeping the housing market dynamic and accessible. Fannie Mae mandates a specific waiting period for borrowers who've undergone a short sale before they can be eligible for a new mortgage. Generally, this waiting period is 4 years. However, if the borrower can validate extenuating circumstances that led to the short sale, this waiting period might be reduced to 2 years. This structure ensures that borrowers have had ample time to regain financial stability and are prepared for a new mortgage commitment. While Fannie Mae has its stipulated waiting period, other lenders and loan types come with their own specifications. Knowing these differences is vital for potential homeowners, as it allows them to evaluate the most suitable path for securing a new mortgage. Each lender or loan type can have unique criteria, so thorough research and consultation are key to finding the best fit. Certain life events or unforeseen hardships like the death of a primary breadwinner or severe illness can be considered extenuating circumstances. These can sometimes lead to a reduced waiting period, as they are events out of the borrower's control. The lending institution recognizes that unpredictable life events can impact anyone, and adjustments can be made accordingly. The amount of down payment can influence the waiting period. A larger down payment can sometimes reduce the waiting period as it indicates a stronger financial position. Additionally, a significant down payment can showcase the borrower's commitment and financial discipline. A borrower's credit history before the short sale can influence the waiting period. Consistent timely payments and a history of responsible credit use can play in the borrower's favor. Establishing a trustworthy credit pattern showcases reliability and can expedite the loan approval process post-short sale. Extenuating circumstances refer to unexpected life events that lead to severe financial strain. Examples include sudden job loss, medical emergencies, or natural disasters. These events are often considered outside the control of the homeowner and can drastically impact their ability to make mortgage payments. Such challenges can take a toll on an individual's or family's financial health, often leading to decisions like short sales. Fannie Mae may consider extenuating circumstances when determining the waiting period post-short sale. By presenting verifiable documentation of these events, homeowners might qualify for a reduced waiting period, ensuring a smoother transition to their next mortgage. This leniency aims to provide some relief to homeowners who've faced unprecedented challenges. Ensure all information on the credit report is accurate. Discrepancies or errors can further lower the score. Regular checks, at least annually, can help in staying on top of your credit health. Additionally, keeping track of changes and updates will make it easier to dispute any inaccuracies. Resolving these issues can lead to quick boosts in your score. Consistent and timely bill payments can gradually rebuild credit standing. Each on-time payment sends a positive signal to credit bureaus, reinforcing trustworthiness. Building a consistent history over time underscores reliability. Automating payments can also be a helpful way to ensure no deadlines are missed. Minimize existing debt to demonstrate fiscal responsibility. By chipping away at debts, you're showing potential lenders your dedication to financial stability. Reducing the credit utilization ratio, which is the balance of your debt relative to your credit limit, can also improve the credit score. Regularly evaluating and consolidating debts might further help in management. This can indicate financial desperation to lenders. Spacing out credit inquiries can prevent sudden dips in your credit score. Too many inquiries in a short span can also be a red flag for potential fraud. A balanced approach to credit management ensures you're not perceived as a high-risk applicant. Professional guidance can provide tailored strategies to rebuild and maintain a healthy credit score. Credit counselors can offer insights and tactics often overlooked by individuals. They bring expertise from working with numerous clients in similar situations, ensuring efficient strategies. Plus, they might have partnerships or programs specifically designed to aid in credit recovery. Offered by the Federal Housing Administration, these loans are popular for their low down payment requirements and leniency in credit score prerequisites. They can be a beacon of hope for those looking for a fresh start in homeownership. Additionally, FHA loans tend to have competitive interest rates, making monthly payments more manageable. Borrowers can also benefit from more forgiving underwriting guidelines, which can ease the application process. FHA-backed loans are a versatile and accessible choice for many potential homeowners, particularly first-time buyers. Designed for veterans, active-duty service members, and certain members of the National Guard and Reserves, VA loans offer competitive interest rates and often require no down payment. They serve as a token of gratitude for those who've served the nation. Moreover, VA loans do not require private mortgage insurance (PMI), which can result in significant savings over the life of the loan. Their underwriting process often looks at the broader financial picture, offering flexibility to applicants. With the support of the Department of Veterans Affairs, these loans bring the dream of homeownership closer to our nation's heroes. Sponsored by the U.S. Department of Agriculture, these loans are designed for rural homebuyers and often come with zero down payment. They're an excellent option for those seeking serene, countryside living. USDA loans are not only limited to farms or large plots of land; they also encompass homes in many smaller towns and suburban areas. The objective is to promote rural development and enhance living standards in these regions. These loans can be particularly appealing to those desiring spacious landscapes without the hustle and bustle of major metropolitan areas. These don't meet the standard criteria set by the Federal Government but can be suitable for those with unconventional income sources or credit histories. They fill the gaps traditional loans might not cover, catering to diverse financial profiles. Non-QM loans might come with varied interest rates and terms, offering flexibility to the borrower. They're especially useful for self-employed individuals, investors, or those with a unique financial landscape. While they might require a deeper look into one's financial life, they open doors that traditional lending methods may keep closed. In today's ever-changing housing market, understanding the intricacies of mortgage regulations is crucial for homeownership success. Fannie Mae, a dominant player in the U.S. mortgage landscape, provides clear guidelines for those navigating the aftermath of a short sale. The waiting period, set at a standard four years, can be reduced to two with valid extenuating circumstances, offering a glimmer of hope to those impacted by unforeseen life events. It's not just about waiting; it's about rebuilding. Strengthening one's credit and exploring alternative mortgage options can be essential steps towards homeownership aspirations. In essence, despite the challenges a short sale presents, avenues are available for individuals to regain financial footing, explore diverse lending options, and work their way back to securing a home.Overview of Short Sales

Fannie Mae and Short Sale Waiting Periods

Overview of Fannie Mae's Role in the Mortgage Market

Specific Waiting Period Requirements After a Short Sale

Comparing Fannie Mae's Waiting Period to Other Mortgage Lenders and Types

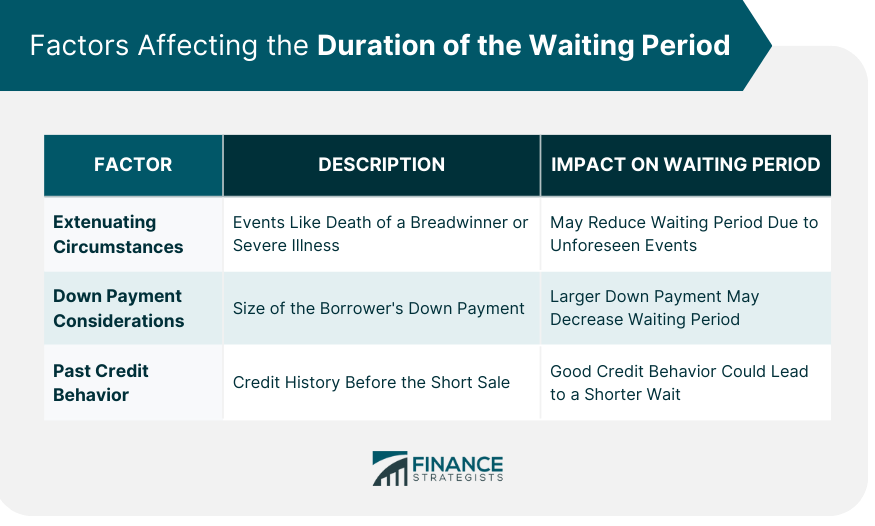

Factors Affecting the Duration of the Waiting Period

Extenuating Circumstances

Down Payment Considerations

Past Credit Behavior

Extenuating Circumstances: A Closer Look

Definition and Examples

Impact on the Waiting Period for Fannie Mae Mortgages

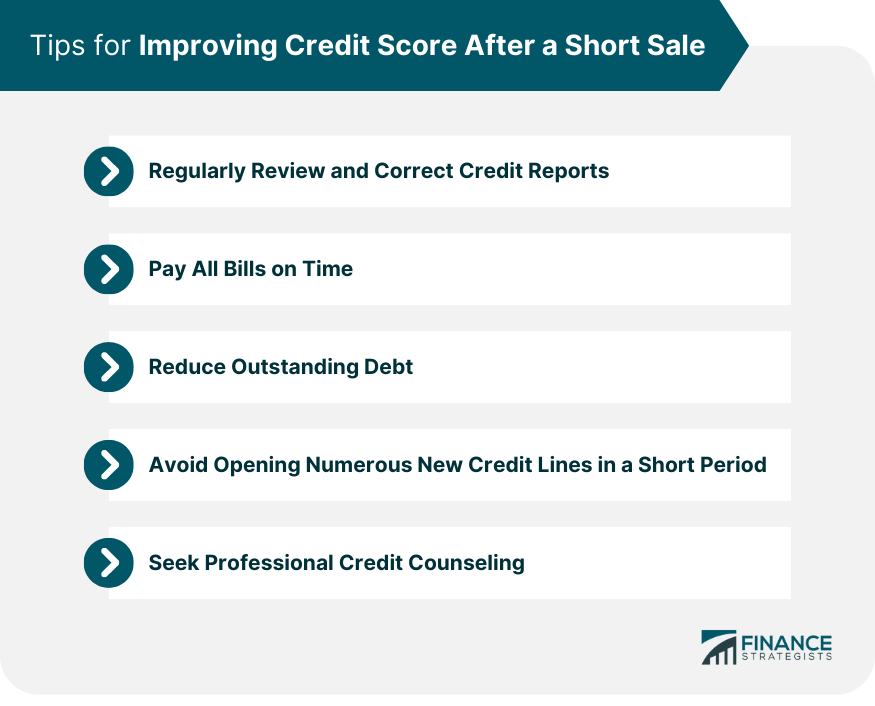

Tips for Improving Credit Score After a Short Sale

Regularly Review and Correct Credit Reports

Pay All Bills on Time

Reduce Outstanding Debt

Avoid Opening Numerous New Credit Lines in a Short Period

Seek Professional Credit Counseling

Alternatives to Fannie Mae Mortgages After a Short Sale

FHA Loans

VA Loans

USDA Loans

Non-Qualifying Mortgages (Non-QM)

Bottom Line

Fannie Mae Waiting Period After Short Sale FAQs

The general waiting period is 4 years, but with proven extenuating circumstances, it can be reduced to 2 years.

Validated extenuating circumstances, like unexpected life events, can decrease the waiting period to 2 years.

Rebuilding credit ensures better loan opportunities, more favorable interest rates, and broader financial prospects in the future.

Yes, alternatives include FHA loans, VA loans, USDA loans, and non-qualifying mortgages (non-QM).

Fannie Mae purchases mortgages from lenders, offering them as securities to rejuvenate the mortgage market's liquidity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.