HomeReady mortgage program, an initiative by Fannie Mae, is tailored to assist low to moderate-income families in achieving homeownership. The HomeReady income limits for 2024 are set by Fannie Mae, a government-sponsored enterprise that buys and guarantees mortgages. To qualify for a HomeReady mortgage, you can’t make more than 80% of your area’s median income (AMI). The AMI is the average income of all households in a given geographic area. You can use the Area Median Income Lookup Tool to find out the AMI and HomeReady income limit for your location. A HomeReady mortgage is designed to help low-income borrowers buy or refinance a home with a low down payment, flexible funding sources, and reduced mortgage insurance requirements. These limits ensure that the program remains both accessible to its target demographic and sustainable over time. Depending on the area's cost of living and AMI, these limits can vary. High-cost areas might see elevated income thresholds, while regions with lower average incomes might have more conservative limits. The foundation stone of the HomeReady income limits is the Area Median Income. This metric offers a snapshot of the median household income in a particular region or community. It's imperative to adjust the income limits based on the AMI to ensure they mirror the economic realities of the area they serve. Different regions come with their unique housing market dynamics. Some areas might experience a surge in property values, while others might witness stagnation or even depreciation. These market movements significantly influence the HomeReady income limits. Adjusting the limits ensures that they remain relevant and that homeownership remains accessible, irrespective of local market conditions. The broader economic landscape, encompassing aspects like employment rates, wage growth, and economic policy, plays a significant role in determining the HomeReady income limits. An economy on an upswing might result in elevated income limits, whereas a sluggish economy might temper them. Certain areas are notoriously expensive to live in, with costs of living substantially above the national average. Recognizing the challenges posed by these high-cost locales, the HomeReady program often incorporates higher income limits. This approach ensures that residents in such areas aren't unduly disadvantaged. For 2024, the HomeReady income limits have been fine-tuned based on household size. For instance, a family of four might have a different income threshold compared to a single individual or a couple. This tiered system ensures that larger families, which naturally have higher expenses, aren't at a disadvantage. Just as real estate underscores the importance of "location, location, location," the HomeReady program emphasizes the significance of geography. Income limits in bustling urban hubs differ from those in rural retreats. These distinctions are crucial in maintaining the program's relevance across diverse landscapes. While the 2024 limits reflect the current state of the housing and economic markets, it's intriguing to juxtapose them against previous benchmarks. Such a comparison reveals broader trends, provides insights into the program's adaptability, and offers a trajectory of its evolution. The calibrated income limits for 2024 present a spectrum of opportunities. Prospective buyers who previously teetered on the brink of eligibility might now find themselves within the threshold, making them viable candidates for the HomeReady program. On the flip side, there's a cohort that sits just a notch above the defined limits. These individuals face the conundrum of not qualifying for HomeReady benefits while grappling with the challenges posed by conventional loan systems. It's crucial to understand that while income limits dictate eligibility, they aren't the sole determinants of the loan amount. Other factors, including credit score, debt-to-income ratio, and property type, converge to influence the final loan approval. For properties situated in designated low-income regions, the HomeReady program extends additional leniencies. Such zones might not be tethered to the same strict income limits, ensuring communities in these areas benefit from the program's offerings. The beauty of the HomeReady initiative lies in its compatibility. Borrowers can often couple their HomeReady loans with other assistance or subsidy programs, amplifying their benefits and making homeownership even more accessible. Every rule has its exceptions, and the HomeReady income parameters are no different. There are instances, albeit rare, where exemptions or special considerations come into play, offering a nuanced approach to individual circumstances. Eligibility verification necessitates meticulous documentation. Potential borrowers must furnish proof of income, typically in the form of pay stubs, tax returns, and employment verification letters, ensuring complete transparency and veracity. To streamline the process, Fannie Mae and affiliated lenders often provide online tools and calculators. By inputting relevant data, prospective homeowners can ascertain their eligibility vis-à-vis the 2024 income limits, fostering a more informed approach. The maze of homeownership is intricate, with twists and turns at every juncture. Mortgage professionals, with their expertise and experience, can guide aspirants, ensuring they navigate the HomeReady income intricacies with finesse. HomeReady mortgage program, spearheaded by Fannie Mae for 2024, is a testament to the institution's commitment to facilitating homeownership for low to moderate-income families. The program's income limits, intricately calibrated based on diverse factors like the Area Median Income, local housing dynamics, and broader economic conditions, reflect its adaptability. While high-cost areas see elevated thresholds, other regions with modest incomes have proportionately set limits. The program's design, emphasizing geography, household size, and evolving economic markers, ensures a fair playing field for all aspiring homeowners. Prospective buyers should remain cognizant of these nuances and leverage the resources, including online tools and mortgage professionals, to navigate their homeownership journey effectively. In a nutshell, the HomeReady program's intricate structure for 2024 underscores its goal: making the dream of owning a home achievable for many.HomeReady Income Limits 2024

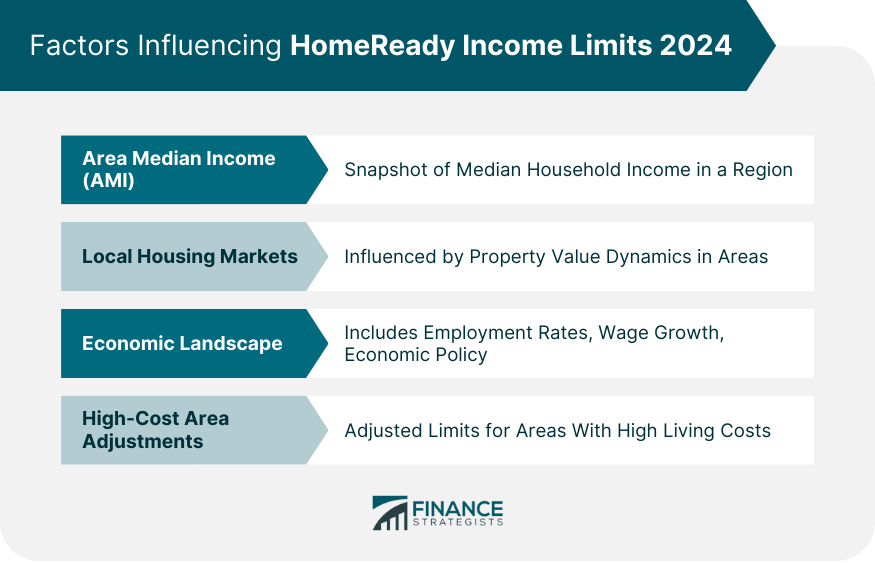

Factors Influencing HomeReady Income Limits 2024

Area Median Income (AMI)

Local Housing Markets

Economic Landscape

High-Cost Area Adjustments

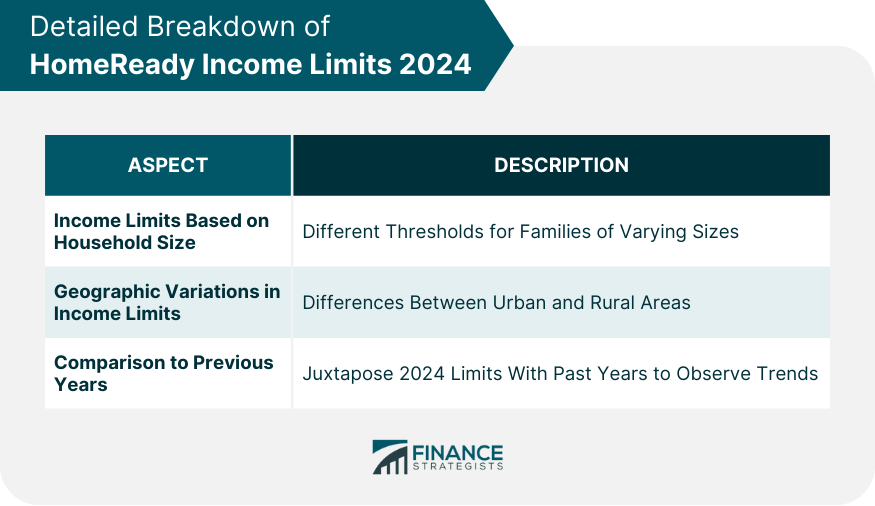

Detailed Breakdown of HomeReady Income Limits 2024

Specific Income Limits Based on Household Size

Geographic Variations in Income Limits

Comparison to HomeReady Income Limits From Previous Years

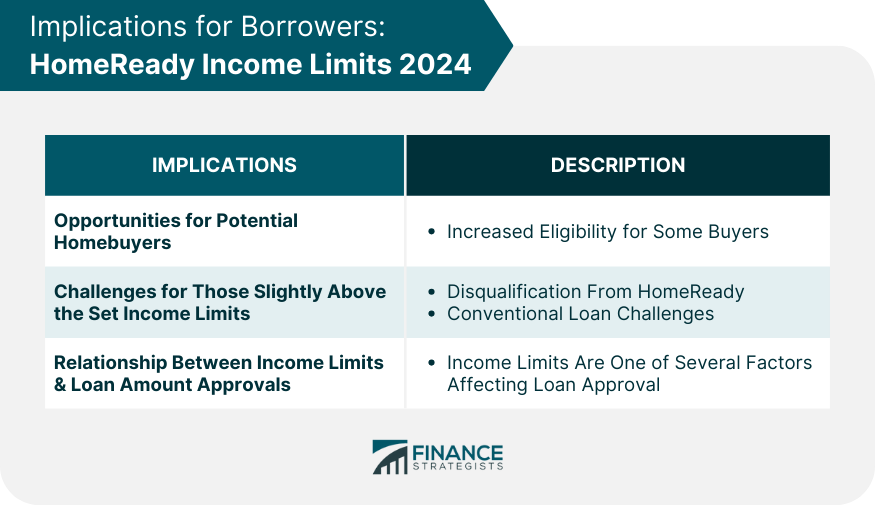

Implications for Borrowers

Opportunities for Potential Homebuyers

Challenges for Those Slightly Above the Set Income Limits

Relationship Between Income Limits and Loan Amount Approvals

Additional Features and Flexibilities

Provisions for Properties in Designated Low-Income Areas

Combination With Other Assistance or Subsidy Programs

Possible Exemptions or Special Cases

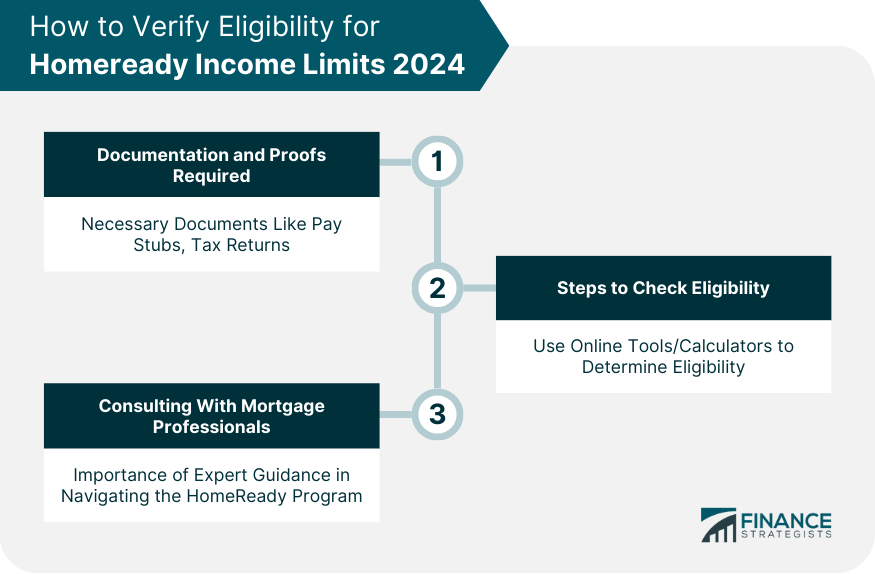

How to Verify Eligibility for HomeReady Income Limits 2024

Documentation and Proofs Required

Steps to Check Your Eligibility

Importance of Consulting With Mortgage Professionals

Conclusion

HomeReady Income Limits FAQs

The HomeReady Income Limits for 2024 are specific financial thresholds set by Fannie Mae to determine eligibility for the HomeReady mortgage program. These limits vary based on geographic location and household size.

The HomeReady Income Limits 2024 have been adjusted to reflect the current economic landscape and housing market conditions. The exact differences depend on the area and household size in comparison to prior years.

Geographic variations in the HomeReady Income Limits 2024 are in place to account for differences in living costs and average incomes in different regions. This ensures the program remains relevant and accessible across diverse areas.

Yes, properties in designated low-income areas might have different income limit considerations. Additionally, there can be exemptions or special cases based on individual circumstances and the HomeReady program's overarching goals.

To verify eligibility based on the HomeReady Income Limits 2024, you can utilize online tools provided by Fannie Mae or affiliated lenders or consult with mortgage professionals for detailed guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.