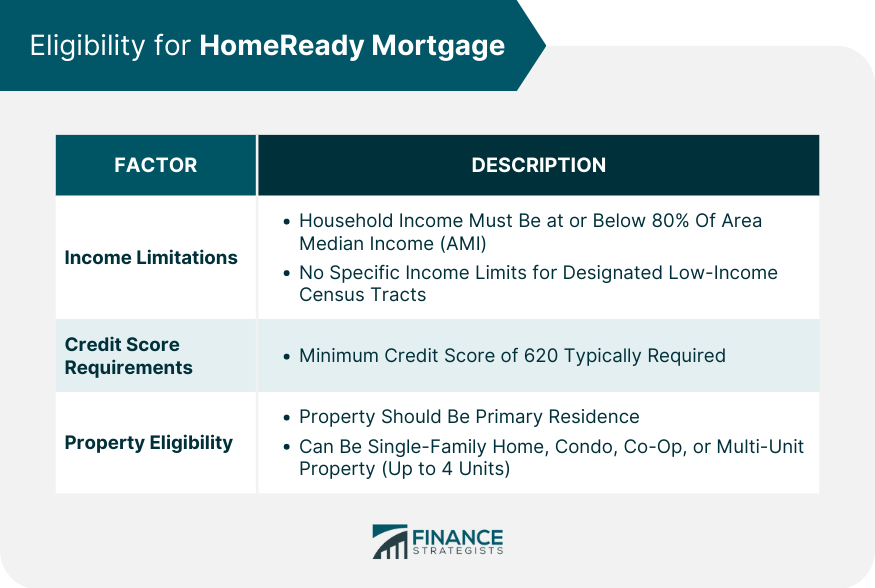

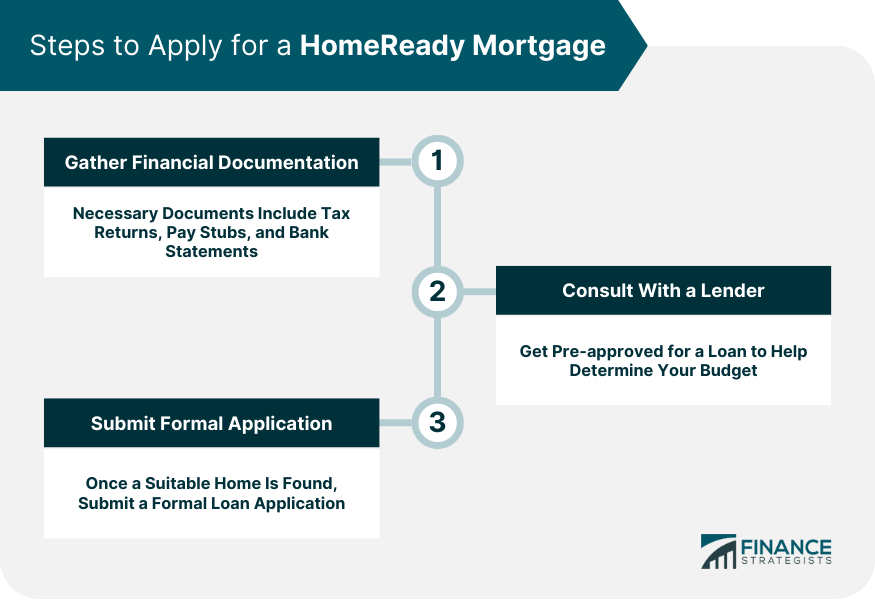

HomeReady Mortgage is a program offered by Fannie Mae designed to support creditworthy low- to moderate-income borrowers. It offers several key benefits, including a lower down payment requirement—potentially as low as 3%—and lower private mortgage insurance premiums. One of the defining characteristics of the HomeReady Mortgage is its flexible underwriting standards. The program considers income from non-borrower household members, potentially increasing qualifying income. Furthermore, rental income from a border or an accessory dwelling unit (like a basement apartment) can also be considered. Borrowers are required to complete an online homeowner education course to help them understand the home-buying process and their responsibilities as homeowners. This mortgage program aims to make homeownership more accessible to those who might find it challenging to qualify for a traditional mortgage. The HomeReady Mortgage program, sponsored by Fannie Mae, is designed to serve low- to moderate-income borrowers. As such, income limits are an essential eligibility criterion. To qualify, your household income must be at or below 80% of the area median income (AMI) in the location of the property you intend to buy. However, in designated low-income census tracts, there are no specific income limits. Creditworthiness is another key determinant for HomeReady Mortgage eligibility. Typically, the program requires a minimum credit score of 620. However, if you're able to make a larger down payment, some lenders might be willing to consider a lower score. It's important to note that a higher credit score could lead to more favorable loan terms, including a lower interest rate. The HomeReady Mortgage program can be used for the purchase of a primary residence, which could be a single-family home, a condo, a co-op, or a multi-unit property of up to four units. The program can also be utilized for limited cash-out refinances of existing Fannie Mae loans. Before starting your mortgage application process, gather the necessary financial documents. These may include: Tax returns Pay stubs This documentation will allow the lender to assess your financial situation accurately, including your income, expenses, and overall financial stability. Consulting with a lender should be your next step. This process involves discussing your financial situation, understanding the specific terms of the HomeReady Mortgage, and getting pre-approved for a loan. The pre-approval process can help you determine your budget for buying a home. Once you have your pre-approval, you can start searching for a home within your price range. Keep in mind that the property must meet specific eligibility requirements for the HomeReady program. For instance, the property should be your primary residence, and it can be a single-family home, a condo, a co-op, or a multi-unit property with up to four units. After finding a suitable home, the final step is to submit a formal application for the HomeReady Mortgage. Your lender will guide you through the process, which includes filling out the application form, submitting the necessary documentation, and waiting for approval. The interest rates for HomeReady Mortgages are typically competitive, often lower than conventional loan rates. The loan term options are flexible, with 15-, 20-, and 30-year fixed-rate terms available. There's also an adjustable-rate mortgage (ARM) option, which could be advantageous for those planning to move before the fixed-rate period ends. One of the primary benefits of the HomeReady Mortgage program is the low down payment requirement. Borrowers can pay as little as 3% down. Furthermore, this down payment can come from various sources, such as personal savings, gifts, or grants, providing greater flexibility for borrowers. While both HomeReady and FHA loans aim to facilitate homeownership for lower-income buyers, there are key differences. HomeReady often provides lower mortgage insurance premiums than FHA loans, potentially reducing the monthly payment. However, FHA loans are more lenient on credit scores, making them a better option for borrowers with lower credit. Compared to conventional loans, HomeReady loans allow lower down payments (as low as 3%) and consider non-traditional income sources. However, conventional loans might be a better choice for borrowers with higher credit scores or those who can afford larger down payments, as they might offer more competitive interest rates in these cases. Fannie Mae requires all HomeReady borrowers to complete an online homeownership education course. This course helps borrowers understand the home-buying process and the responsibilities of owning a home. It's designed to prepare borrowers for successful homeownership and reduce the risk of default and foreclosure. The homeownership course required for HomeReady Mortgage borrowers is available online through Framework, an online education resource. It's designed to be convenient and accessible, providing potential homeowners with critical knowledge and resources. HomeReady Mortgage program, facilitated by Fannie Mae, provides a comprehensive solution for creditworthy low- to moderate-income borrowers aspiring to homeownership. Its distinguishing attributes include low down payment options, reduced private mortgage insurance premiums, and flexible underwriting standards that accommodate non-borrower household income. Notable, too, is its application to various property types, competitive interest rates, and diverse loan term options. While similar in goal to FHA and conventional loans, HomeReady has distinct advantages like lower mortgage insurance premiums and recognition of non-traditional income sources. The program underscores the importance of homeownership education by requiring an online course for borrowers. As we compare various mortgage programs, it becomes clear that HomeReady offers a unique blend of features designed to make homeownership more accessible and sustainable for a wider range of potential homeowners.HomeReady Mortgage Overview

Requirements for HomeReady Mortgage

Income Limitations for HomeReady Mortgage

Credit Score Requirements for HomeReady Mortgage

Property Eligibility for HomeReady Mortgage

Steps to Apply for a HomeReady Mortgage

Gather Your Financial Documentation

Consult With a Lender

Search for a Home Within Your Budget

Submit a Formal Loan Application

HomeReady Mortgage Loan Terms

Interest Rates and Loan Term Options for HomeReady Mortgage

Down Payment Requirements for HomeReady Mortgage

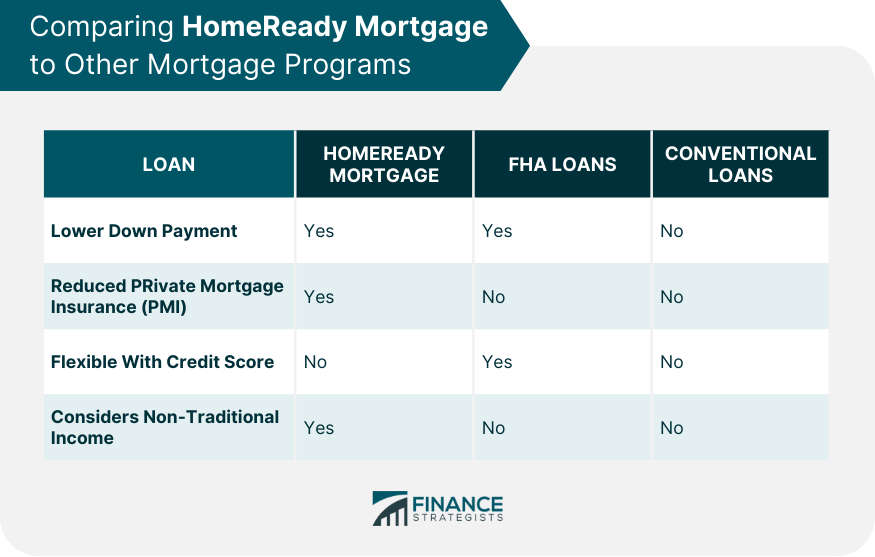

Comparing HomeReady Mortgage to Other Mortgage Programs

HomeReady Mortgage vs FHA Loans

HomeReady Mortgage vs Conventional Loans

Homeownership Education With HomeReady Mortgage

Conclusion

HomeReady Mortgage FAQs

To qualify for a HomeReady Mortgage, you must meet several requirements. Your household income must not exceed 80% of the area median income unless the property is in a designated low-income census tract. A minimum credit score of 620 is typically required, though this may vary among lenders. The property to be purchased must be your primary residence and can be a single-family home, a condo, a co-op, or a multi-unit property with up to four units.

The HomeReady Mortgage program offers several benefits over conventional mortgages. These include a lower down payment requirement (as low as 3% of the home price), the ability to consider income from non-borrower household members in the approval process, and reduced Private Mortgage Insurance coverage, which can lead to lower monthly payments.

No, the HomeReady Mortgage program is only for the purchase of a primary residence. It cannot be used for the purchase of second homes or investment properties. If you're interested in purchasing an investment property, other mortgage options may be more suitable.

Fannie Mae requires all HomeReady Mortgage borrowers to complete an online homeownership education course before the loan closes. This course, available through Framework, covers the home buying process and the responsibilities of homeownership. It's designed to prepare borrowers for successful, sustainable homeownership.

Yes, the HomeReady Mortgage program includes unique underwriting guidelines. Notably, it considers income from non-borrower household members, allowing potential homebuyers to count the income of other individuals living in the household towards the qualifying income for the mortgage. This can increase the borrowing capacity of many families.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.