Loss mitigation refers to strategies employed by mortgage lenders to assist borrowers who have fallen behind on their home loan payments. Rather than proceeding directly to foreclosure, which can be detrimental for both parties, lenders aim to collaborate with borrowers to find alternative solutions. The primary goal is twofold: to provide homeowners an opportunity to avert foreclosure, which can heavily tarnish credit scores and future property purchasing capabilities, and for lenders, to reduce potential financial losses often associated with foreclosure proceedings. Common loss mitigation solutions include forbearance (temporary postponement of payments), loan modification (altering loan terms for affordability), and short sales (selling property for less than the owed balance). Through effective loss mitigation, both lenders and borrowers can navigate financial hardships with increased flexibility and understanding. When a borrower becomes delinquent, the lender typically initiates contact to explore potential remedies. This stage allows both parties to openly assess the borrower's current financial stance, reasons for delinquency, and potential pathways forward, fostering a climate of understanding and collaboration. Eligibility for loss mitigation often hinges on specific criteria such as demonstrated financial hardship, proof of consistent income, and the status of the property as a primary residence. Additionally, a borrower's loan status and history play a critical role, with those who have a good payment track record prior to the financial setback being viewed more favorably. Depending on the results of negotiations and the borrower's situation, an appropriate solution is chosen. Common options include forbearance, loan modification, and short sales. The selected solution largely revolves around the borrower's capacity to meet revised terms and the lender's inclination to compromise. While specific qualifications might vary based on the lender and the type of loan, some general criteria determine a borrower's eligibility for loss mitigation: Financial Hardship: The primary qualification is the borrower's demonstration of financial hardship. This could be due to job loss, medical emergencies, divorce, or other unforeseen financial crises. Proof of Income: Borrowers need to show they have a steady income source, ensuring they can keep up with the adjusted payment plans. Primary Residence: Typically, loss mitigation programs focus on properties that are the borrower's primary residence. Investment properties or vacation homes might not qualify. Delinquent Status: Borrowers who are at least 60 days delinquent on their mortgage payments are often considered first, though some lenders might begin the process even if a borrower is only 30 days behind. Good Payment History: A history of regular, on-time payments before the period of financial hardship can make a borrower more favorable for loss mitigation. To verify the borrower's situation and determine the most suitable loss mitigation option, lenders often require the following documents: Hardship Letter: A detailed explanation of the financial hardship causing the delinquency. Financial Statements: Details of monthly income, expenses, assets, and any other pertinent financial information. Recent Tax Returns: These provide an overview of the borrower's annual financial health. Proof of Current Income: Pay stubs, benefit statements, or other proofs of income to validate the borrower's current financial situation. Lenders might also consider various factors when determining eligibility: Equity in the Home: The amount of equity a borrower has in their home can influence the decision. More equity can offer more flexibility in options. Loan-To-Value Ratio: This ratio, which compares the loan amount to the home's value, can determine the risk factor for the lender. A temporary postponement of mortgage payments, granted by the lender under specific circumstances. A permanent change to the mortgage, where one or more terms of a borrower's loan are changed to provide a more affordable payment. When a borrower sells their property for less than the outstanding mortgage balance, with the lender's permission. A last-resort option is where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. One of the primary benefits of loss mitigation is the chance it offers homeowners to retain their homes. Instead of losing their homes to foreclosure, they get an opportunity to find a middle ground with their lenders. Foreclosing a property isn't just a loss for the homeowner. Lenders can incur considerable costs in the process, from legal fees to property maintenance and eventual selling costs. By opting for loss mitigation, they can avoid these expenses. For borrowers, entering into a loss mitigation agreement can stabilize their financial situation, allowing them to manage their debt better and regain control over their finances. Foreclosed properties can negatively impact the value of neighboring properties. By reducing the number of foreclosures, loss mitigation can help maintain property values in a community. While loss mitigation can be a lifeline, not all borrowers qualify. Lenders might have specific criteria, and some homeowners might not meet the threshold. Some solutions, like forbearance, offer only temporary relief. Once the forbearance period ends, the borrower might find themselves facing the same financial challenges as before. While not as detrimental as foreclosure, some loss mitigation solutions can still negatively impact a borrower's credit score. Solutions like loan modification might involve extending the loan term, meaning the borrower could end up paying more over the life of the loan. When consumers find themselves unable to manage their rising credit card balances, it becomes essential to seek strategies to minimize the negative impact on both their financial health and the lender's bottom line. This is where loss mitigation steps in, aiming to find a middle ground between the borrower and the creditor. Negotiating Lower Interest Rates: One of the primary steps a cardholder can take is to negotiate a lower interest rate with their credit card provider. A reduced rate can help minimize the speed at which the debt grows, making it more manageable. Payment Plans: Some creditors offer structured payment plans. These plans can consolidate the owed amount into fixed monthly payments, often with reduced interest or waived fees. Debt Settlement: This involves negotiating with the creditor to pay a lump sum, which is usually less than what's owed, settling the debt. While this can reduce the debt considerably, it might negatively impact the consumer's credit score. Debt Management Plans: Offered by credit counseling agencies, these plans consolidate debts into one monthly payment. The agency might negotiate lower interest rates or fees, helping the consumer repay the debt more efficiently. Governments often set standards and regulations to ensure that loss mitigation is conducted fairly and transparently. Certain government programs, like the Home Affordable Modification Program (HAMP), offer assistance to borrowers in modifying their mortgages. To prevent foreclosures and promote understanding of loss mitigation options, governments often back educational initiatives and counseling services for homeowners. Loss mitigation serves as a vital bridge between mortgage lenders and borrowers facing loan delinquency, offering alternative solutions to foreclosure. It not only aids homeowners in retaining their properties but also helps lenders avoid the financial repercussions of property foreclosure. The process involves open negotiations, assessing the borrower's financial health, and subsequently providing tailored solutions such as forbearance, loan modification, or even short sales. While it boasts benefits like maintaining community property values and ensuring borrower's financial stability, challenges like temporary relief and potential credit score impacts persist. The strategy extends to credit card debts, emphasizing negotiations for lower interest rates or structured payment plans. Moreover, the government plays an instrumental role in overseeing loss mitigation through regulations, offering modification programs, and endorsing homeowner education. In essence, loss mitigation is a comprehensive approach to financial challenges, underpinned by collaboration, understanding, and the shared goal of financial stability.What Is Loss Mitigation?

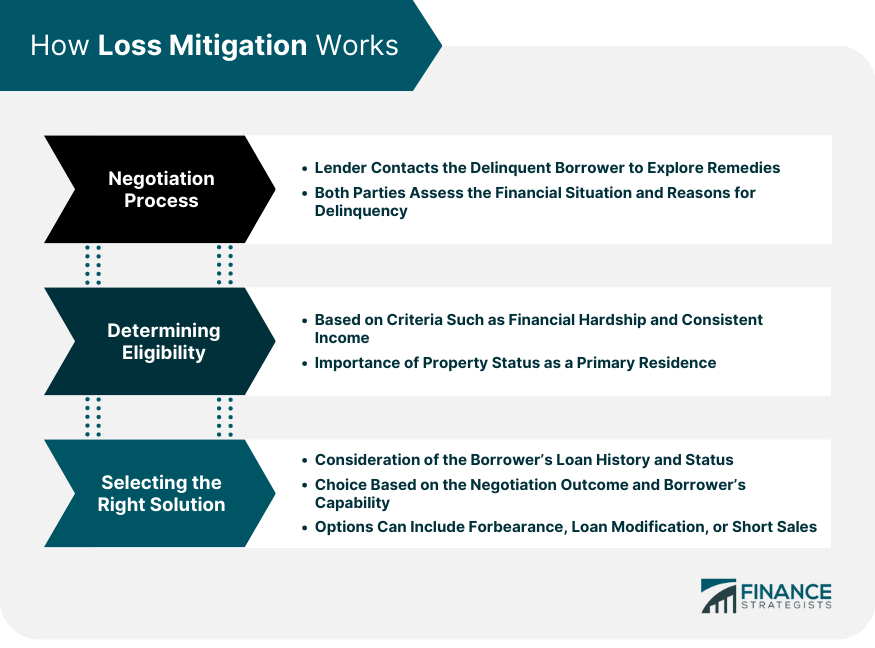

How Loss Mitigation Works

Negotiation Process

Determining Eligibility

Selecting the Right Solution

Qualifications for Loss Mitigation

Basic Eligibility Criteria

Loan Status and History

Documentation Requirements

Consideration Factors

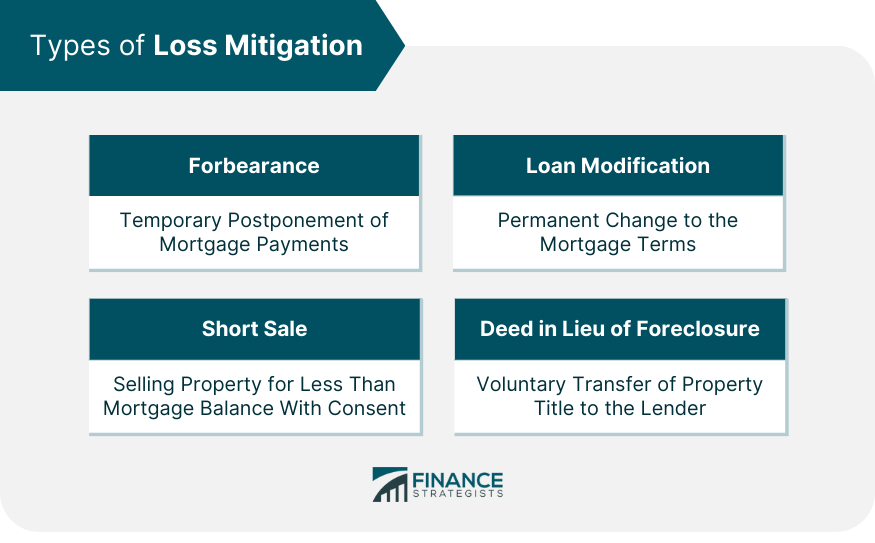

Types of Loss Mitigation

Forbearance

Loan Modification

Short Sale

Deed in Lieu of Foreclosure

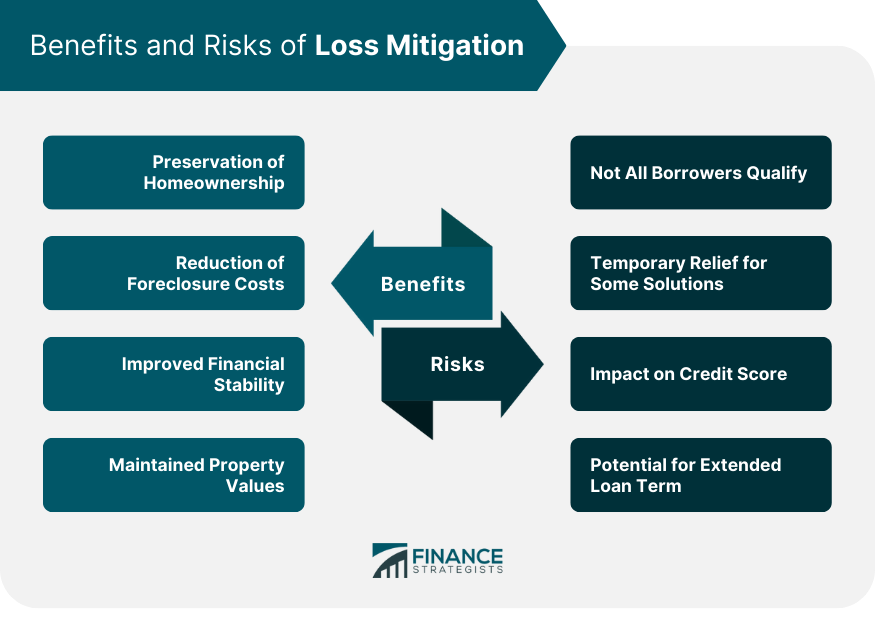

Benefits of Loss Mitigation

Preservation of Homeownership

Reduction of Foreclosure Costs

Improved Financial Stability

Maintained Property Values

Risks of Loss Mitigation

Not All Borrowers Qualify

Temporary Relief for Some Solutions

Impact on Credit Score

Potential for Extended Loan Term

Loss Mitigation in Credit Card Debt

Need for Loss Mitigation

Key Loss Mitigation Strategies for Credit Card Debt

Role of the Government in Loss Mitigation

Regulatory Oversight and Standards

Government-Backed Modification Programs

Promotion of Homeowner Education and Counseling

Conclusion

Loss Mitigation FAQs

Loss mitigation refers to strategies used by mortgage lenders to assist borrowers who are delinquent on their home loans, aiming to find alternatives to foreclosure and minimize potential losses.

While foreclosure is the legal process where lenders take over a property due to missed mortgage payments, loss mitigation involves working collaboratively with the borrower to find alternative solutions that could prevent foreclosure.

Yes, some loss mitigation options, like certain loan modifications or short sales, can have an effect on your credit score. However, the impact is often less detrimental than a foreclosure.

Common solutions include forbearance (temporary postponement of payments), loan modification (changing loan terms for more affordable payments), short sale (selling property for less than the outstanding balance with lender's consent), and deed in lieu of foreclosure (voluntarily transferring property title to the lender).

Not all borrowers qualify. Eligibility often depends on the lender's criteria, the borrower's financial situation, the specific cause of delinquency, and the type of loss mitigation option being considered.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.