The 2008 financial crisis stands as one of the most significant economic downturns in modern history. Triggered by a collapse in the US housing market, it soon spiraled into a global recession, impacting nations, businesses, and individuals worldwide. Derivatives like mortgage-backed securities were at the heart of the meltdown, exposing fragility within the global financial system. Financial institutions, once seen as impregnable, found themselves on shaky ground, calling for unprecedented government interventions. Fannie Mae and Freddie Mac, government-sponsored entities (GSEs), were pivotal in the American housing sector. Responsible for purchasing mortgages from lenders, they ensured liquidity in the market, enabling banks to issue more loans. However, the role they played in the crisis was multifaceted and has been a subject of intense scrutiny and debate. Their influence, due to their sheer size and pivotal role, often dictated the dynamics of the housing market. Created as part of the New Deal in the 1930s, Fannie Mae's mission was to provide local banks with federal money to finance home mortgages. This not only bolstered the housing market but also made home ownership accessible to more Americans. Freddie Mac was later established in 1970 to serve a similar purpose, but with a focus on thrift banks. Their collective mandate was to keep the American dream of homeownership alive and thriving. Over time, these GSEs became significant players in the American housing landscape. Their function evolved from merely funding mortgages to buying them, bundling them into securities, and selling those to investors. This secondary mortgage market flourished, with the GSEs at its helm, but it also planted the seeds for future vulnerabilities. Their actions influenced broader market practices, setting standards that others often followed. The secondary mortgage market witnessed exponential growth in the decades leading up to the crisis. Fannie and Freddie, with their vast financial resources, were at the forefront of this expansion. The process of securitizing mortgages and selling them to investors not only proliferated mortgage lending but also spread associated risks. These developments, while fostering home ownership, also masked underlying vulnerabilities, creating an illusion of endless prosperity. The insatiable appetite for higher yields led the GSEs into riskier territories. Subprime and Alt-A mortgages, which catered to borrowers with less-than-stellar credit histories, became a significant part of their portfolio. This shift was, in many ways, a ticking time bomb that would later detonate with devastating consequences. By venturing into these waters, the GSEs inadvertently legitimized them, drawing in other players and amplifying risks. The GSEs, in their pursuit of profitability and market share, bought and guaranteed a slew of risky loans. This influx of capital into the housing market inflated property prices, creating an unsustainable bubble. When these high-risk borrowers began to default, it spelled doom for the housing sector. As foreclosures surged, communities across the country were devastated, with ripple effects extending far beyond housing. With Fannie and Freddie readily purchasing high-risk loans, lending standards across the industry plummeted. Mortgages were being approved without due diligence, a phenomenon aptly termed "NINJA" loans - No Income, No Job, and No Assets. This reckless lending was a primary factor behind the subsequent cascade of defaults. The trust, once implicit in the lending process, was severely compromised, leading to tightened credit markets. As the bubble burst, home values plummeted. This devaluation meant that many of the assets held by the GSEs were now worth far less than what they had paid for. This created solvency concerns, as their liabilities far outstripped their assets. The monumental scale of this mismatch threatened not just the GSEs, but the very fabric of the global financial system. As homeowners began defaulting, Fannie and Freddie faced unparalleled financial stress. Their vast holdings of high-risk mortgages were now a liability. Default rates skyrocketed, and the GSEs found themselves on the brink of collapse. Questions about their survival and the potential repercussions of their failure dominated headlines and policy discussions. In response to the looming crisis, the US government enacted the Emergency Economic Stabilization Act of 2008. A significant component of this was the conservatorship of Fannie Mae and Freddie Mac. This move aimed to stabilize the erratic housing market by ensuring the continued operation of these entities, now under government control. The sheer scale of this intervention underscored the depth of the crisis and the lengths required to combat it. Shareholders of Fannie and Freddie bore the brunt of the conservatorship. Stock prices tanked, and dividends were suspended. Many shareholders saw their investments evaporate, raising questions about the ethics and long-term repercussions of such government intervention. Legal battles and discussions about compensation and rights ensued, adding another layer of complexity to the situation. The conservatorship, while controversial, played a crucial role in stabilizing the housing market. With Fannie and Freddie operational, liquidity was maintained, ensuring that mortgages remained available. This averted a complete collapse and paved the way for eventual recovery. Their central role during this period cemented their position as pillars of the American housing market, albeit ones requiring careful oversight. The crisis was a wake-up call, prompting a slew of reforms. Both entities underwent massive overhauls in their operational models, focusing on risk management and oversight. These changes aimed to ensure that the mistakes leading up to 2008 would not be repeated. As they moved forward, these GSEs operated under heightened scrutiny, with an emphasis on sustainability over rapid growth. The role of Fannie Mae and Freddie Mac post-crisis has been hotly debated. While they remain integral to the housing market, questions about their long-term viability, structure, and necessity persist. Some argue for a return to privatization, while others believe a continued government role is crucial. The balance between ensuring stability, fostering innovation, and minimizing systemic risk remains an ongoing challenge. The 2008 financial crisis highlighted the intricacies and vulnerabilities interwoven in the global financial system. Central to this narrative were Fannie Mae and Freddie Mac, whose actions in the housing sector bore far-reaching consequences. Born from noble intentions of promoting homeownership, their evolution into mortgage behemoths eventually magnified systemic risks. As their practices influenced market standards, they inadvertently sowed the seeds of the crisis. Their entanglement in risky ventures and subsequent near-collapse necessitated unprecedented government intervention, reflecting their indispensable position in the housing ecosystem. Post-crisis reforms sought to rectify past missteps, leading to rigorous oversight and strategic recalibrations. Yet, the debate around their future underscores a broader contemplation about the balance between market dynamics and regulatory prudence. Their saga serves as a cautionary tale, emphasizing the need for vigilance, adaptability, and discernment in navigating complex financial landscapes.Overview of the 2008 Financial Crisis

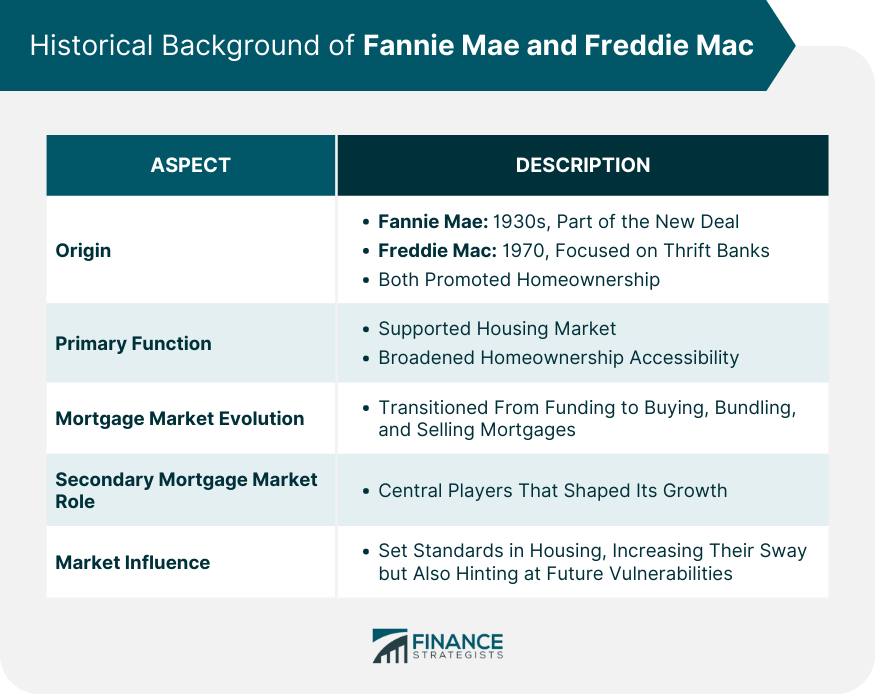

Historical Background of Fannie Mae and Freddie Mac

Establishment and Primary Function of Fannie Mae and Freddie Mac

Evolution of Their Role in the Mortgage Market

Pre-Crisis Operations and Business Model

Growth of the Secondary Mortgage Market

Expansion Into Subprime and Alt-A Mortgages

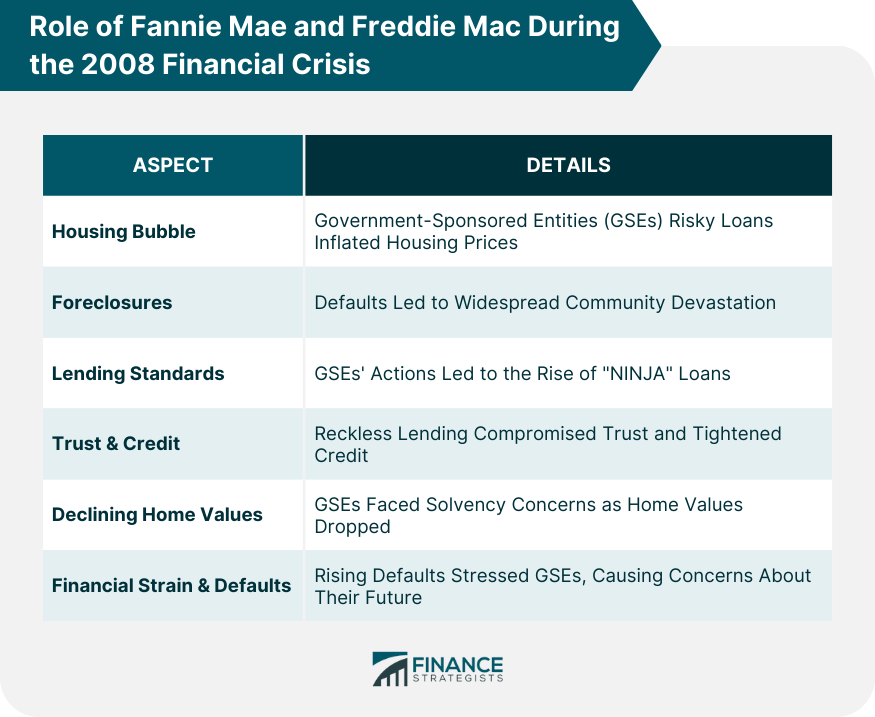

Role of Fannie Mae and Freddie Mac During the 2008 Financial Crisis

Contribution to the Housing Bubble

Buying and Guaranteeing Risky Loans

Impact on Lending Standards

Financial Challenges and Insolvency Risks

Declining Home Values and Their Impact on Assets

Rising Default Rates and Financial Strain

Government Intervention and Conservatorship

Emergency Economic Stabilization Act of 2008

Implications of the Government Takeover

Impact on Shareholders

Implications for the Broader Housing Market

Post-Crisis Landscape

Reforms and Changes to Fannie Mae and Freddie Mac's Business Model

Debate on Their Future Role in the Mortgage Market

Bottom Line

Role of Fannie Mae and Freddie Mac in the 2008 Financial Crisis FAQs

They contributed to the housing bubble by buying and guaranteeing risky loans and influenced lending standards, leading to an unsustainable bubble.

They provided liquidity by purchasing mortgages from lenders and fostered growth in the secondary mortgage market.

Due to rising default rates and financial strain, the government intervened to stabilize the housing market and prevent a broader financial collapse.

They underwent reforms focusing on risk management and oversight, ensuring more sustainable operations and heightened scrutiny.

Yes, there's ongoing debate about their long-term viability, structure, and the balance between stability, innovation, and minimizing systemic risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.