Fannie Mae, officially the Federal National Mortgage Association, stands as an imperative player in the mortgage market. Their primary mission is to provide liquidity and stability to the U.S housing market by purchasing and guaranteeing mortgages. Thus, it allows lenders to reinvest their assets into more lending and, in turn, enables more borrowers to attain homeownership. At the heart of Fannie Mae's operations lie its underwriting guidelines. These are rules that stipulate the conditions under which it will purchase a loan from a lender. Among these many guidelines, the issue of acreage limit holds a unique place. Understanding these guidelines, particularly around acreage limits, is essential for potential homeowners and mortgage brokers as it can greatly impact property eligibility and the mortgage approval process. "Acreage limit" in mortgage terms typically refers to the maximum lot size a property can have to be eligible for a mortgage loan. It's a common misconception that Fannie Mae sets a strict acreage limit. However, in reality, the situation is more nuanced. The perception of acreage limits comes into play due to the inherent complexities associated with underwriting large properties. While Fannie Mae doesn't explicitly set an acreage limit, it does stress that the property must be residential in nature. As a guideline, Fannie Mae stipulates that the property's value must be primarily attributed to the residential dwelling rather than the land. It implies that properties with excessive acreage might become ineligible if the value of the land surpasses the value of the residential dwelling. Consequently, this residential nature principle may introduce practical acreage limits, as properties with larger land tracts tend to derive more value from the land than the dwelling. This inherent complexity gives birth to the belief that Fannie Mae has an acreage limit. The misunderstood notion of Fannie Mae's acreage limit significantly impacts mortgage approvals. Borrowers with properties on large tracts of land may encounter challenges in obtaining a loan. It is not due to the size of the land, but rather how that size influences the property's value. For instance, a property with vast acreage in a predominantly residential area might be viewed as an anomaly, making it harder to appraise. If most of the property's value lies in its land, the mortgage loan may be denied as it doesn't conform to Fannie Mae's guidelines. Fannie Mae's guidelines extend beyond acreage and delve into the specifics of the dwelling itself. Specifically, Fannie Mae purchases or securitizes first-lien mortgages that are secured by residential properties when the dwelling consists of one to four units. It means that properties with more than four units typically fall outside the realm of Fannie Mae's standard residential mortgage guidelines. However, it's important to note that these rules are not absolute. Under certain circumstances, Fannie Mae may limit the number of dwelling units for specific types of mortgages or transactions. As with acreage, the guidelines concerning dwelling units aim to ensure that the loan is secured against a primarily residential property, keeping in line with Fannie Mae's mandate to facilitate homeownership. This aspect underscores that Fannie Mae's policies are comprehensive, encompassing not just the size of the property's land, but also the nature and size of the dwelling on that land. Therefore, potential homeowners and mortgage brokers must consider all these facets when navigating Fannie Mae's mortgage landscape. Property size plays a crucial role in loan eligibility. This rule applies not just in Fannie Mae's domain, but also in the broader mortgage market. The larger the property, the more complex the underwriting process becomes. Lenders need to ascertain that the primary value resides in the dwelling rather than the land. Moreover, larger properties often come with increased maintenance costs and may also have zoning restrictions or agricultural stipulations. These factors introduce additional risk for the lender, as they may influence the property's marketability and the borrower's ability to maintain the property. Despite the challenges, it's not impossible for properties with larger acreage to secure loans. The approval largely depends on the property's location, its comparability with nearby properties, and its adherence to the residential nature principle. In more rural areas, for example, where larger properties are more common, a property with a larger acreage might not be seen as an anomaly. Additionally, some lenders may be more flexible with acreage limits, as long as the property value is mainly attributed to the dwelling. Therefore, while guidelines provide a framework, there is room for exceptions, underscoring the need for borrowers to explore various lenders and loan options. While acreage can play a role in a property's eligibility for a mortgage, other factors are equally, if not more, important. Fannie Mae's guidelines emphasize that the value of a property should be based on the livable area, including the dwelling and any other improvements, rather than the land. The dwelling must be in good condition and suitable for year-round use to qualify for a loan. It means that the property's value, condition, and use are more significant factors in Fannie Mae's underwriting process than the size of the lot. Location is another significant factor in Fannie Mae's policies. Fannie Mae guidelines state that the property must conform to the neighborhood's characteristics. If a property with substantial acreage is commonplace in a particular region, it may not be considered an anomaly. Hence, the eligibility is likely to be influenced more by regional norms and property comparability than by a hard-and-fast acreage rule. However, if a large property is located in an area where small lots are the norm, it could be viewed as atypical. In such instances, the appraisal might be complicated, and the loan's approval might be challenging. Like Fannie Mae, Freddie Mac does not explicitly impose an acreage limit. However, it places similar emphasis on the residential nature of a property. The property's value should primarily arise from its residential characteristics and suitability for year-round use. Freddie Mac also considers the property's conformity with the neighborhood. Hence, while there isn't a stated acreage limit, the size of the property can indirectly impact the eligibility for a loan due to the same complexities and considerations as Fannie Mae's guidelines. Beyond Fannie Mae and Freddie Mac, individual lenders may have their own policies regarding acreage limits. Some may be more flexible, especially local lenders familiar with the regional property norms. Others may adhere strictly to the guidelines laid out by entities like Fannie Mae and Freddie Mac. It is beneficial to have a knowledgeable team on your side. A local real estate agent, familiar with area norms and intricacies, can help you understand if a property with large acreage aligns with local property characteristics. In addition, a mortgage broker well-versed in navigating Fannie Mae's guidelines can help guide you through the process and ensure you're equipped to address any hurdles that arise. A significant part of Fannie Mae's guidelines revolves around the property's value being attributed primarily to the dwelling rather than the land. Therefore, having a comprehensive understanding of where the property's value lies is crucial. A professional appraisal can provide this insight and help buyers determine if a property aligns with Fannie Mae's guidelines. The property's conformity with its neighborhood is another key aspect that Fannie Mae takes into consideration. Therefore, buyers should assess how well their potential property fits in with its surroundings, especially concerning size and use. A property that is an outlier may face challenges during the mortgage approval process. The condition of the dwelling also plays a role in mortgage approval. It's important for buyers to assess the home's livability and any potential need for repairs, as these factors can influence both the property's value and eligibility for a loan. Having an appraisal contingency in the purchase agreement is a prudent measure. This stipulation can protect buyers if the appraisal does not support the purchase price due to the size of the acreage. It ensures you're not locked into a purchase agreement if the appraisal value comes in lower than expected. Navigating the intricacies of Fannie Mae's acreage limit guidelines requires both knowledge and strategy. While no explicit acreage limit exists, the emphasis on the property's residential nature and value tied to the dwelling can indirectly introduce practical limits. A property's size, value, condition, and conformity with its neighborhood can all impact its eligibility for a mortgage. It's crucial for potential homeowners and mortgage brokers to understand these dynamics. Furthermore, enlisting experienced professionals, securing a professional appraisal, and including an appraisal contingency in the purchase agreement can greatly assist buyers. Individual lenders, including Freddie Mac, may have different acreage policies, further underscoring the need for tailored advice. Overall, a nuanced understanding of these policies can ensure a smoother path towards securing a mortgage for properties with large acreage.Brief Overview of Fannie Mae

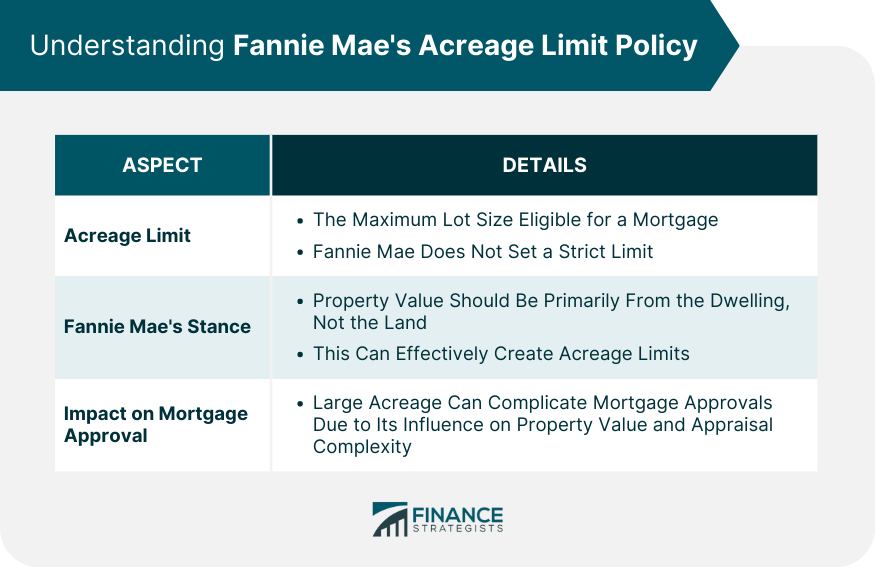

Understanding Fannie Mae's Acreage Limit Policy

Definition of Acreage Limit in Mortgage Terms

Direct Examination of Fannie Mae's Stance on Acreage Limits

Analysis of the Acreage Limit's Impact on Mortgage Approval

Fannie Mae's Policy on Dwelling Units

How Acreage Limitation Influences Property Eligibility

Influence of Property Size on Loan Eligibility

Exceptions and Variances

Other Influencing Factors Beyond Acreage in Fannie Mae Policies

Property Value and Livability

Location

Fannie Mae Comparison to Other Institutions' Policies

How Freddie Mac Addresses Acreage Limits

Acreage Limit Policies of Other Lenders

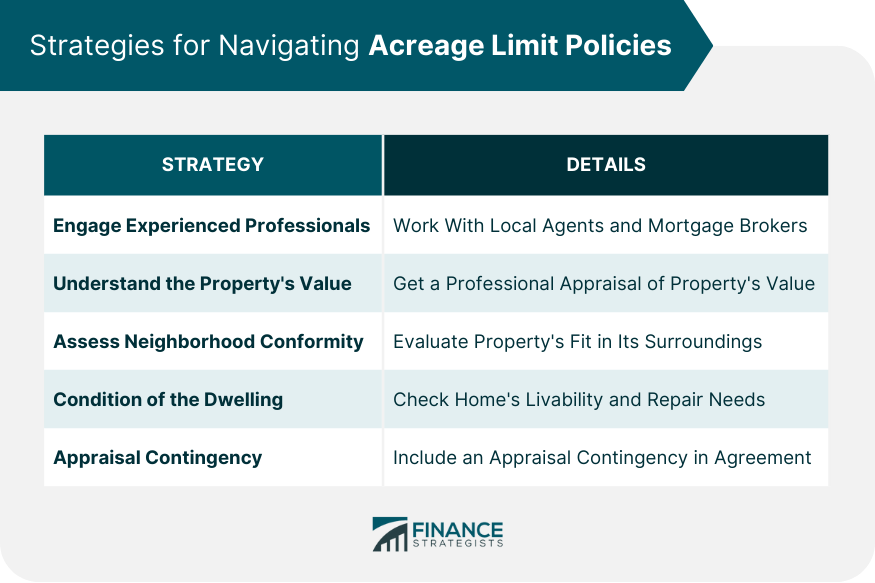

Strategies for Navigating Acreage Limit Policies

Engage Experienced Professionals

Understand the Property's Value

Assess Neighborhood Conformity

Condition of the Dwelling

Appraisal Contingency

Bottom Line

Understanding Fannie Mae Acreage Limit & Its Strategies FAQs

No, Fannie Mae does not have a strict acreage limit. However, it emphasizes that the property's value must be primarily attributed to the residential dwelling rather than the land.

Acreage can indirectly affect mortgage approval as properties with larger land tracts might derive more value from the land than the dwelling, not aligning with Fannie Mae's guidelines.

Yes, properties with large acreage can secure loans depending on factors like the property's location, its comparability with nearby properties, and the value derived from the dwelling.

Fannie Mae considers factors such as the property's value, condition, suitability for year-round use, and conformity with the neighborhood's characteristics.

Mortgage brokers can help buyers understand the complexities of buying large-acreage properties, guide them through the appraisal process, and find lenders willing to underwrite such loans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.