The Home Affordable Refinance Program (HARP) is a government initiative created in 2009 to assist homeowners who are unable to refinance their homes due to a decrease in home value. The program is designed to provide eligible homeowners with the opportunity to refinance their mortgages to obtain lower interest rates, reduced monthly payments, or a more stable mortgage product. The purpose of the HARP program is to help homeowners who are current on their mortgage payments but unable to refinance due to their homes being worth less than what they owe. The program provides relief to borrowers who are unable to obtain traditional refinancing options and helps them avoid foreclosure. By providing a more affordable mortgage payment, HARP allows homeowners to remain in their homes and avoid the financial strain of defaulting on their mortgages. To qualify for HARP, homeowners needed to meet specific requirements: 1. Loan Ownership by Fannie Mae or Freddie Mac: The mortgage must have been owned or guaranteed by Fannie Mae or Freddie Mac 2. Loan Origination Date: The mortgage must have originated on or before May 31, 2009. 3. Current Loan-To-Value (LTV) Ratio: The LTV ratio must have been greater than 80%, meaning that the homeowner owed more than 80% of the home's value on their mortgage. 4. Payment History: Homeowners must have been current on their mortgage payments, with no late payments in the past six months and no more than one late payment in the past 12 months. 5. Minimum Credit Score: Although HARP did not impose a minimum credit score, lenders might have required a specific credit score for approval. Homeowners could determine if their loan was owned by Fannie Mae or Freddie Mac using the respective online lookup tools or by contacting their mortgage servicer. Applicants needed to collect documents for income verification, tax returns, bank statements, and credit reports. Homeowners had to work with a lender approved to offer HARP loans to submit their applications. Homeowners should have compared various HARP loan offers and selected the most suitable option based on interest rates, loan terms, and fees. For homeowners seeking mortgage assistance or refinancing options after the conclusion of the HARP program, there are several alternatives available: This program is designed for homeowners with existing FHA-insured mortgages to refinance with reduced paperwork and underwriting requirements. The VA IRRRL program allows eligible veterans and military service members with existing VA loans to refinance at a lower interest rate with minimal documentation requirements. Homeowners with USDA-backed mortgages can take advantage of the USDA streamline refinance program, which simplifies the refinancing process and often does not require a new appraisal. For homeowners with conventional mortgages, refinancing through a traditional loan product might be a viable option depending on their credit score, LTV ratio, and financial situation. Some lenders and government-sponsored programs offer loan modification options to help struggling homeowners by adjusting their interest rates, extending loan terms, or providing other assistance. The HARP program provided several advantages for eligible homeowners: Lower Monthly Mortgage Payments: HARP allowed borrowers to refinance their loans, often resulting in reduced monthly payments. Reduced Interest Rates: Refinancing through HARP could lead to lower interest rates, saving homeowners money over the life of their loans. Shorter Loan Terms: HARP provided the option for homeowners to shorten their loan terms, allowing them to pay off their mortgages faster. Fixed-Rate Mortgage Options: Homeowners with adjustable-rate mortgages could switch to fixed-rate mortgages through HARP, providing more predictable monthly payments. No Minimum Credit Score for Some Borrowers: Although lenders might have required a minimum credit score, HARP itself did not impose a credit score requirement. No Appraisal Required in Certain Cases: Some HARP applicants did not need to obtain a new appraisal, potentially saving time and money. Despite its benefits, the HARP program had some limitations: No Principal Reduction: HARP did not offer principal reductions, meaning homeowners still owed the same amount on their mortgage after refinancing. Limited to One HARP Refinance per Property: Homeowners could only use HARP once per property. Potential for Higher Closing Costs: Some borrowers might have faced higher closing costs when refinancing through HARP compared to other options. Stricter Underwriting Guidelines: HARP followed stricter underwriting guidelines, which might have made it more difficult for some borrowers to qualify. End of HARP Program and Transition to New Programs: The HARP program ended in December 2018 and was replaced by new refinancing options like the High LTV Refinance Option and Enhanced Relief Refinance. The HARP program positively affected the housing market in several ways: Since its inception, HARP assisted millions of homeowners in refinancing their mortgages, providing financial relief, and improving their overall financial situation. HARP helped prevent foreclosures and mortgage defaults by enabling homeowners to secure more affordable monthly payments and better loan terms. The program contributed to stabilizing the housing market during a period of economic uncertainty by helping struggling homeowners avoid foreclosure and maintain their properties. HARP's success and challenges provided valuable insights for the development of future housing policies and programs aimed at assisting homeowners in financial distress. The Home Affordable Refinance Program (HARP) was a government initiative designed to assist homeowners in refinancing their mortgages and avoiding foreclosure. The program had eligibility criteria, an application process, benefits, limitations, and alternatives. While HARP had several benefits, including lower monthly mortgage payments, reduced interest rates, and fixed-rate mortgage options, it also had limitations such as the potential for higher closing costs and stricter underwriting guidelines. Despite its limitations, HARP positively impacted the housing market by assisting millions of homeowners in refinancing their mortgages, reducing foreclosures and defaults, and stabilizing the housing market during a period of economic uncertainty. HARP's success and challenges provided valuable lessons for the development of future housing policies and programs aimed at assisting homeowners in financial distress.Definition and Purpose of Home Affordable Refinance Program (HARP)

HARP Eligibility Criteria

HARP Application Process

Researching Eligibility

Gathering Necessary Documents

Working With a HARP-Approved Lender

Loan Comparison and Choosing the Right Refinance Option

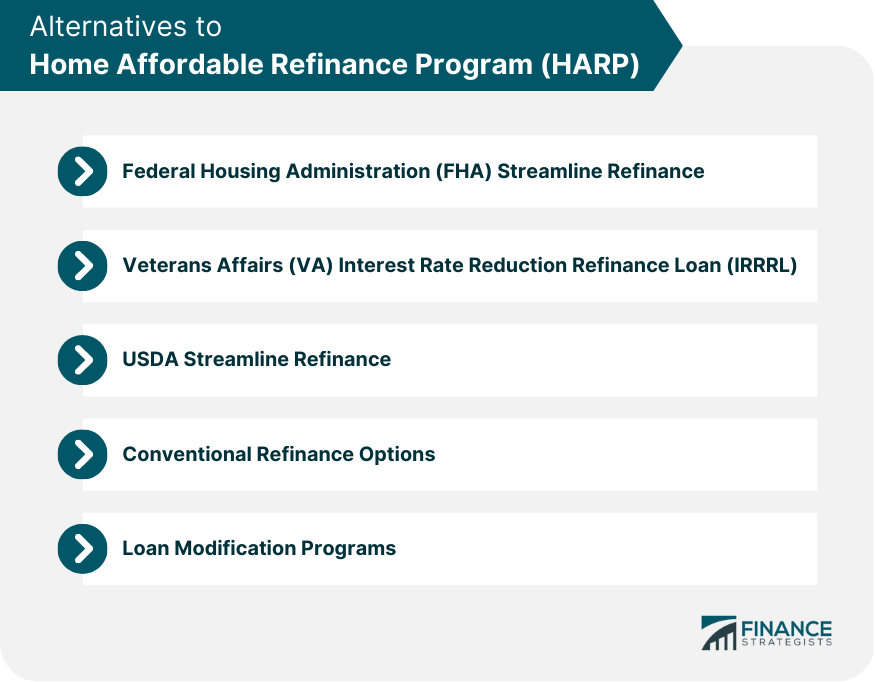

Alternatives to HARP

Federal Housing Administration (FHA) Streamline Refinance

Veterans Affairs (VA) Interest Rate Reduction Refinance Loan (IRRRL)

USDA Streamline Refinance

Conventional Refinance Options

Loan Modification Programs

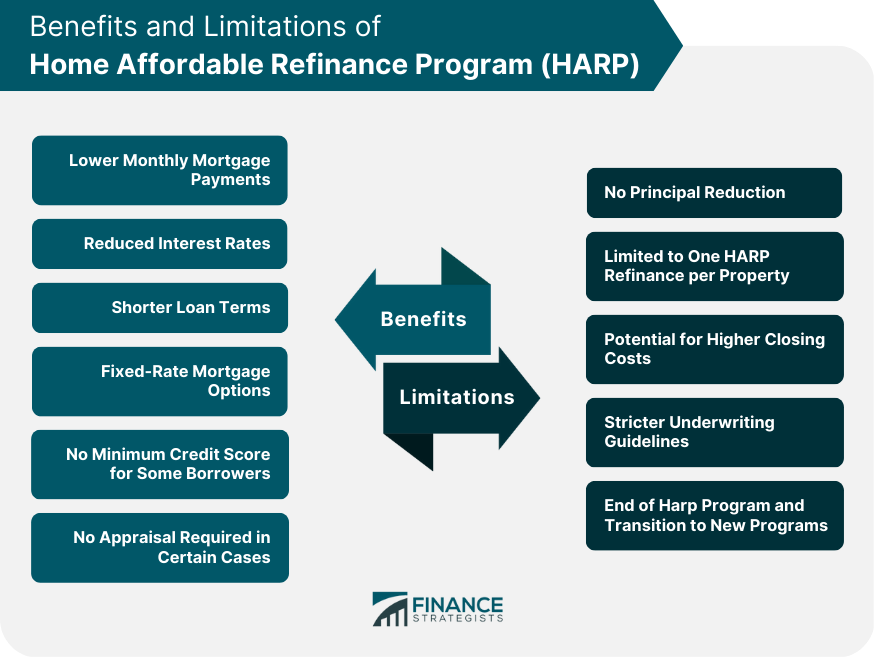

Benefits of HARP

Limitations and Drawbacks of HARP

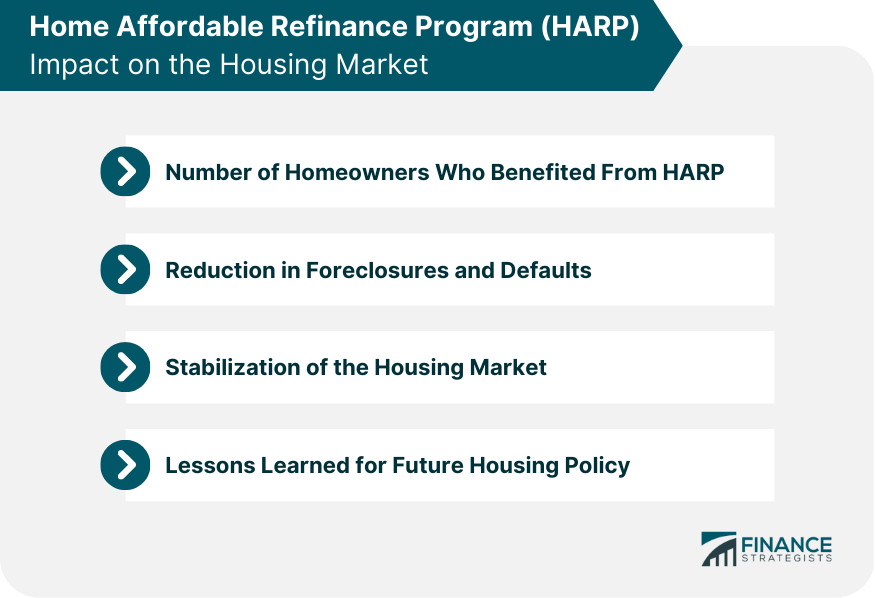

HARP's Impact on the Housing Market

Number of Homeowners Who Benefited From HARP

Reduction in Foreclosures and Defaults

Stabilization of the Housing Market

Lessons Learned for Future Housing Policy

Conclusion

Home Affordable Refinance Program (HARP) FAQs

The Home Affordable Refinance Program (HARP) was a government-sponsored initiative aimed at helping homeowners with little to no equity in their homes refinance their mortgages to secure lower interest rates, more affordable monthly payments, and better loan terms.

To qualify for HARP, homeowners had to meet specific criteria, including having their mortgage owned or guaranteed by Fannie Mae or Freddie Mac, originating the loan on or before May 31, 2009, having a current loan-to-value (LTV) ratio greater than 80%, and having a satisfactory payment history.

HARP provided several benefits to eligible homeowners, such as lowering their monthly mortgage payments, reducing interest rates, offering the option to shorten loan terms, switching to fixed-rate mortgages, and in some cases, not requiring a minimum credit score or a new appraisal.

HARP had some limitations, including no principal reduction, a limit of one HARP refinance per property, the potential for higher closing costs, stricter underwriting guidelines, and the program's eventual end in December 2018.

Alternatives to HARP for homeowners seeking mortgage assistance or refinancing options include the Federal Housing Administration (FHA) streamline refinance, Veterans Affairs (VA) Interest Rate Reduction Refinance Loan (IRRRL), USDA streamline refinance, conventional refinance options, and loan modification programs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.