A Home Equity Conversion Mortgage is a type of reverse mortgage loan that allows homeowners who are at least 62 years old to access a portion of their home equity. Unlike traditional mortgages, HECM loans do not require borrowers to make monthly mortgage payments. Instead, the loan balance is deferred until the borrower passes away, sells the home, or no longer resides in the home as their primary residence. HECM loans were created by the U.S. Department of Housing and Urban Development (HUD) in 1987. The purpose of HECM loans was to provide retirees with an additional source of retirement income, allowing them to access the equity in their homes without having to sell their homes. HECM loans work by converting the borrower's home equity into cash. The loan amount is based on the appraised value of the home, the borrower's age, and current interest rates. The loan balance is deferred until the borrower passes away, sells the home, or no longer resides in the home as their primary residence. HECM loans do not require borrowers to make monthly mortgage payments. Instead, the loan balance is deferred until the borrower passes away, sells the home, or no longer resides in the home as their primary residence. The loan balance is repaid by selling the home, using other assets, or refinancing the loan. HECM loans have several fees, including upfront mortgage insurance premiums, origination fees, and servicing fees. These fees can be rolled into the loan balance, reducing the out-of-pocket costs for the borrower. HECM loans have adjustable interest rates, which are tied to the London Interbank Offered Rate (LIBOR) or the Constant Maturity Treasury (CMT) rate. The interest rate on a HECM loan can change over time, depending on market conditions. Borrowers must be at least 62 years old, and the loan amount is based on the borrower's age, the appraised value of the home, and current interest rates. The older the borrower, the more they can borrow, as they have a shorter life expectancy and a greater likelihood of passing away or moving out of the home. The home must be the borrower's primary residence and meet certain eligibility requirements. The home must be a single-family home, a multi-family home with up to four units, or an FHA-approved condominium or townhome. Manufactured homes may also be eligible if they meet certain requirements. The lender will review the borrower's credit history, income, and expenses to ensure they have the ability to pay property taxes, insurance, and maintenance expenses. The lender will also consider any outstanding liens on the property and the borrower's ability to pay them off. Borrowers must attend counseling sessions with a HUD-approved counselor to learn about the terms and conditions of the loan, including the repayment requirements, interest rates, and fees. The counselor will also discuss other options for accessing home equity, such as traditional home equity loans or the sale of the home. HECM loans provide retirees with an additional source of retirement income, allowing them to access the equity in their homes without having to sell their homes. HECM loans do not require borrowers to make monthly mortgage payments, providing borrowers with more financial flexibility in retirement. HECM loans are non-recourse loans, which means that the borrower or their heirs will never owe more than the value of the home at the time of repayment. HECM loans allow borrowers to retain ownership of their homes, providing them with the peace of mind of knowing that they can stay in their homes for as long as they wish. HECM loans have high closing costs, including upfront mortgage insurance premiums, origination fees, and servicing fees. These costs can be rolled into the loan balance, but they can significantly reduce the amount of equity that the borrower can access. HECM loans reduce the equity in the borrower's home, which may impact the amount of inheritance that the borrower's heirs receive. HECM loans have a complicated loan structure, which can make it difficult for borrowers to understand the loan terms and conditions. If the loan balance on a HECM loan exceeds the value of the home at the time of repayment, the borrower or their heirs will not receive any equity from the sale of the home. A traditional home equity loan is a type of loan that allows homeowners to borrow against the equity in their homes. Unlike a HECM loan, a traditional home equity loan requires monthly payments and has a shorter repayment period. Borrowers can choose between a fixed interest rate and a variable interest rate, depending on their financial needs. Selling the home is another option for accessing home equity. By selling the home, borrowers can receive a lump sum payment that they can use to supplement their retirement income. However, selling the home may not be feasible for all retirees, especially those who wish to age in place. Private reverse mortgages or jumbo reverse mortgages are alternative options to HECM loans. These types of loans are not backed by the government, but they may have more flexible eligibility requirements and repayment options than HECM loans. However, they may also have higher fees and interest rates. Refinancing is another option for accessing home equity. Borrowers can refinance their existing mortgage to a lower interest rate, which can reduce their monthly mortgage payments and free up cash for other expenses. However, refinancing may not be feasible for all borrowers, especially those with poor credit or limited income. Home Equity Conversion Mortgage is a viable option for retirees looking to supplement their retirement income. HECM loans allow borrowers to access the equity in their homes without having to sell their homes, providing them with financial flexibility in retirement. While HECM loans have several advantages, such as no monthly payments, non-recourse loans, and retaining home ownership, they also have some disadvantages, including high closing costs, reduced equity, complicated loan structure, and loan balance exceeding the home value. Borrowers should carefully consider the pros and cons of HECM loans and seek professional advice before making any decisions.What Is a Home Equity Conversion Mortgage (HECM)?

How Does a Home Equity Conversion Mortgage Work?

Loan Structure

Repayment Options

Loan Fees

Interest Rates

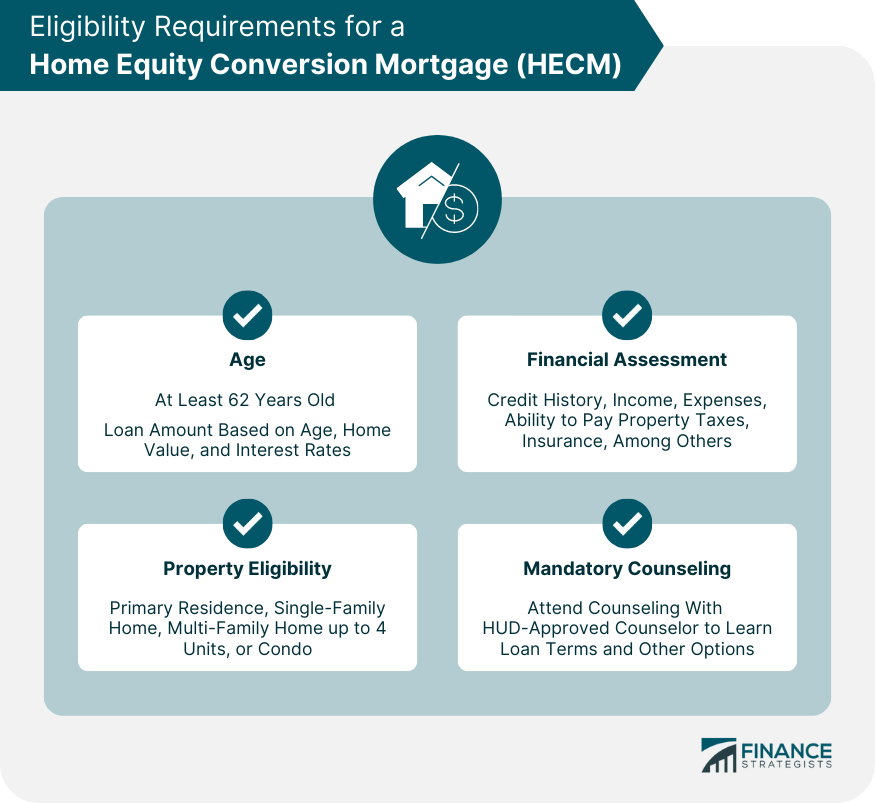

Eligibility Requirements for a Home Equity Conversion Mortgage

Age

Property Eligibility

Financial Assessment

Mandatory Counseling

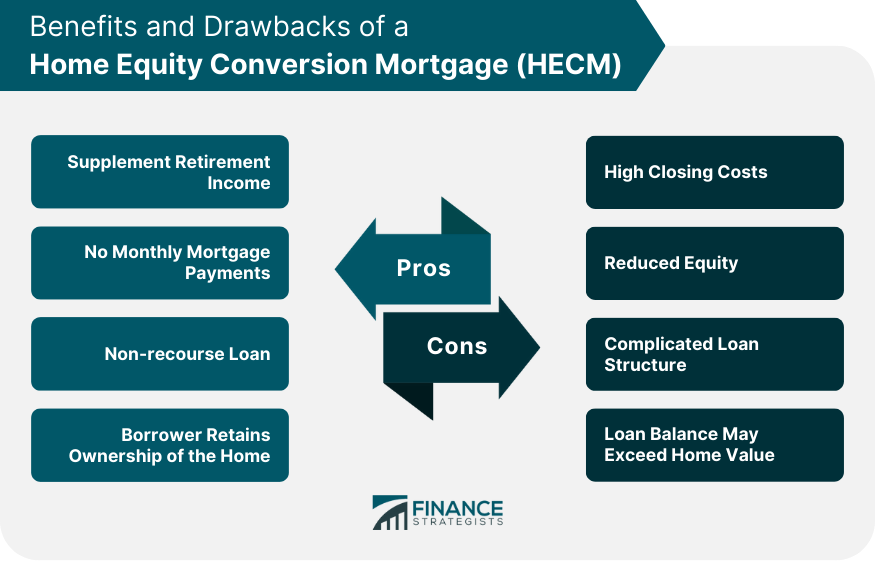

Advantages of a Home Equity Conversion Mortgage

Supplement Retirement Income

No Monthly Mortgage Payments

Non-recourse Loan

Borrower Retains Ownership of the Home

Disadvantages of a Home Equity Conversion Mortgage

High Closing Costs

Reduced Equity

Complicated Loan Structure

Loan Balance May Exceed Home Value

Alternatives to a Home Equity Conversion Mortgage

Traditional Home Equity Loan

Sale of the Home

Reverse Mortgage Alternatives

Refinancing

Final Thoughts

Home Equity Conversion Mortgage (HECM) FAQs

A Home Equity Conversion Mortgage is a type of reverse mortgage loan that allows homeowners who are at least 62 years old to access a portion of their home equity without having to sell their homes. The loan balance is deferred until the borrower passes away, sells the home, or no longer resides in the home as their primary residence.

To qualify for a HECM loan, borrowers must be at least 62 years old, have a primary residence that meets certain eligibility requirements, meet certain financial qualifications, and attend mandatory counseling sessions with a HUD-approved counselor.

HECM loans provide retirees with an additional source of retirement income, allow borrowers to access their home equity without having to sell their homes, do not require borrowers to make monthly mortgage payments, are non-recourse loans, and allow borrowers to retain ownership of their homes.

HECM loans have high closing costs, reduce the equity in the borrower's home, have a complicated loan structure, and may result in a loan balance that exceeds the value of the home at the time of repayment.

Alternatives to a HECM loan include traditional home equity loans, the sale of the home, private reverse mortgages or jumbo reverse mortgages, and refinancing. It is important for borrowers to consider the advantages and disadvantages of each option and to seek professional advice before making any decisions about their retirement finances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.