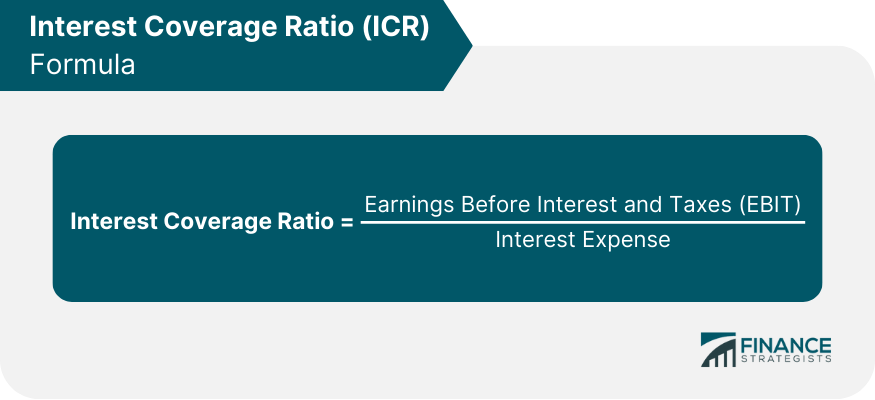

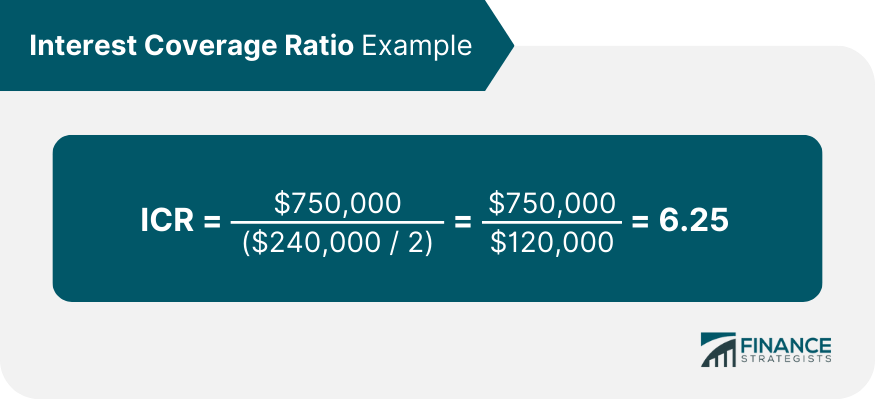

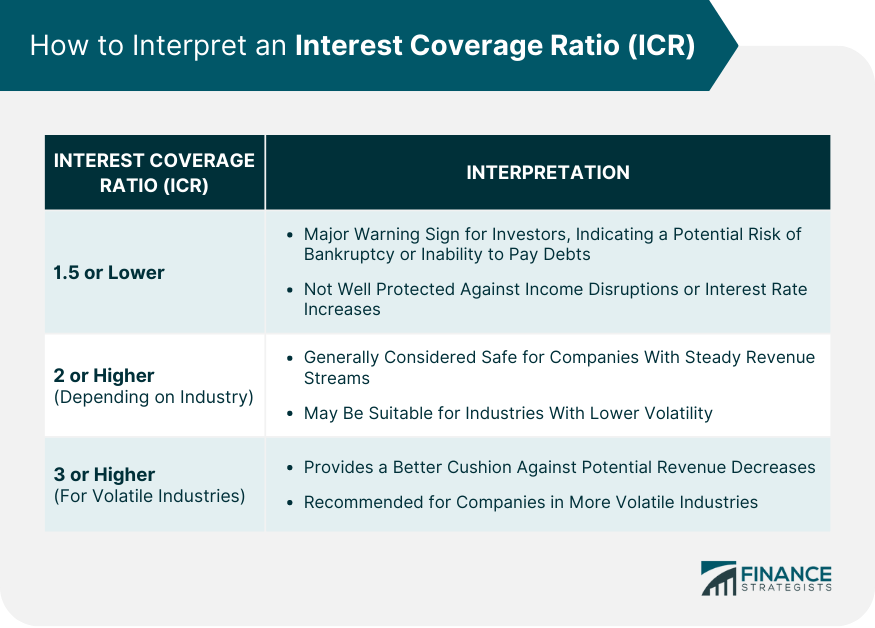

The Interest Coverage Ratio, or ICR, is a financial ratio used to determine how well a company can pay its outstanding debts. Also called the "times interest earned ratio," it is used in order to evaluate the risk in investing capital in that company--and how close that company is to debt insolvency. The ICR is calculated using the Earnings Before Interest and Taxes, or EBIT, and the company's interest payments due. Both measurements should be taken for the same set period of time, such as the trailing twelve months (TTM). The Interest Coverage Ratio formula is a simple division, taking the Earnings Before Interest and Taxes (EBIT) and dividing it by the interest expense. The EBIT is also referred to as the operating profit and is calculated by subtracting total revenue from the money a company owes in interest and taxes. The interest expense is the money due for borrowings such as bonds, loans, and lines of credit. In order to assess a company's financial health and ability to meet its interest obligations, the ICR can be calculated in three straightforward steps 1. Identify EBIT from the income statement. 2. Identify the interest expense, also found on the income statement. 3. Divide the EBIT by the interest expense. The result is your Interest Coverage Ratio. A higher ratio indicates better financial health as it implies that the company can easily meet its interest obligations from operating profit. Conversely, a lower ratio can indicate financial risk. Always compare ICR among similar companies for a comprehensive analysis, as industry standards can significantly influence the ratio's acceptable values. If a company is making $750,000 per quarter in earnings before interest and taxes and owes $240,000 in debt every six months, the company's interest coverage ratio would have to be calculated by dividing the debt figure by two (since six months equals two quarters) and then dividing the EBIT by the new amount. So $750,000 / ($240,000 / 2) = $750,000 / $120,000 = an ICR of 6.25. This is a solid interest coverage ratio figure for a decently sized corporation. The Interest Coverage Ratio shows how many times over a company can pay its current interest on its debts with its cash and assets on hand. Investors are almost always looking for companies that can do so at least more than one time in order to be able to address any crises that may arise in the financial world. In other words, Interest Coverage meaning is how much of a safety net a company has to pay its debts regardless of how much income it is currently generating. Like many other financial metrics, the Interest Coverage Ratio is best used by looking at rolling ICRs for the same company over a long period of time to see which way the company is trending. A trend toward insolvency would be a major red flag for potential investors. The lower a company's interest coverage ratio, the closer it is to being unable to pay its debts and risking bankruptcy. The lowest an interest coverage ratio can get while staying above insolvency is 1, so a good rule of thumb is that an ICR of 1.5 or lower should be a major warning sign for investors. If a company has an interest coverage ratio in that range, it is not well protected against a potential disruption in income flow or an increase in interest rates. What makes up a good interest coverage ratio depends on the industry. If a company has a steady revenue stream less likely to be interrupted by extenuating circumstances, an ICR of at least 2 could be safe enough. For companies in more volatile industries, an investor may want to hold off until he or she sees an ICR at 3 or more, providing a better cushion against a possible decrease in revenue. Investors should also take a look at which direction a company's ICR is trending over a period of time. If the interest coverage ratio is increasing, the company is increasingly able to cover itself in the event of a revenue disruption. If the interest coverage ratio is decreasing, the company may be on a slide to insolvency. The Interest Coverage Ratio serves as an important financial tool, measuring a company's capacity to meet its debt obligations using EBIT. Its formula, EBIT divided by interest expense, reveals whether a firm can comfortably service its debt or face potential financial risk. A high ICR implies robust financial health, while low ICR signals potential insolvency. The ICR isn't just a number but a financial barometer, providing insights into a company's sustainability in periods of financial uncertainty. It's crucial for investors to assess the ICR trend over time and in comparison to industry counterparts. A declining ICR might suggest looming insolvency, making it a red flag for investors. Conversely, an improving ICR indicates a firm's strengthening ability to address debt, making it a potentially lucrative investment. In essence, understanding and correctly interpreting the ICR helps in making informed financial decisions and managing investment risk.What Is Interest Coverage Ratio (ICR)?

Interest Coverage Ratio Formula

Interest Coverage Ratio Calculation

Interest Coverage Ratio Example

What Does Interest Coverage Ratio Mean?

Interest Coverage Meaning

Determining Bad ICR Ratios

Determining Good ICR Ratios

What Investors Look For

Final Thoughts

Interest Coverage Ratio (ICR) Formula FAQs

The acronym ICR stands for Interest Coverage Ratio.

The ICR is a financial ratio used to determine how well a company can pay its outstanding debts.

The ICR is calculated using the Earnings Before Interest and Taxes, or EBIT, and the company’s interest payments due.

Investors are almost always looking for companies that can pay interest on outstanding debts with currents cash and assets in order to be able to address any crises that may arise in the financial world.

The lowest an interest coverage ratio can get while staying above insolvency is 1, so a good rule of thumb is that an ICR of 1.5 or lower should be a major warning sign for investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.